Canadian Homebuyers Hit Pause Amid Recession Fears: BMO Findings

Table of Contents

Declining Home Sales Across Canada: BMO's Key Observations

The BMO report highlights a substantial drop in Canadian home sales across various regions. Data reveals a [insert percentage]% decrease in national sales compared to the same period last year. This decline isn't uniform; regional variations are significant.

- Toronto: Experienced a [insert percentage]% decrease in sales, reflecting a cooling effect on the historically hot market.

- Vancouver: Saw a similar trend, with sales down by [insert percentage]%, indicating a significant shift in buyer behavior.

- Calgary & Edmonton: These markets, while showing more resilience than Toronto and Vancouver, also experienced a notable slowdown in sales activity. [Insert percentage]% decrease.

(Insert chart/graph illustrating the decline in home sales across different Canadian cities)

These figures clearly illustrate a substantial shift in Canadian housing market trends, confirming a widespread home sales decline impacting major urban centers and beyond. Understanding these regional variations is crucial for navigating the current market.

Rising Interest Rates: A Major Factor in the Housing Market Slowdown

The Bank of Canada's aggressive interest rate hikes are the primary driver behind the current housing market slowdown. These increases directly impact mortgage rates, making it significantly more expensive for Canadians to finance home purchases.

- Increased Mortgage Payments: Even a small increase in interest rates translates to substantially higher monthly mortgage payments, pushing homes further out of reach for many potential buyers.

- Reduced Purchasing Power: Higher interest rates reduce the amount buyers can borrow, effectively shrinking their purchasing power and limiting their options in the market.

- Bank of Canada Projections: The Bank of Canada's future projections regarding interest rates will heavily influence buyer confidence and market activity in the coming months. Any further increases will likely exacerbate the slowdown.

This affordability crisis stemming from interest rate hikes is a key factor contributing to the decline in home sales and decreased activity in the Canadian housing market.

The Impact on First-Time Homebuyers

First-time homebuyers are particularly vulnerable in this challenging market. The increased mortgage stress test and higher borrowing costs create a significant barrier to entry for those already facing affordability challenges.

- Securing Financing: Obtaining mortgage pre-approval is becoming increasingly difficult, with stricter lending criteria and higher down payment requirements.

- Government Interventions: The government may need to implement further supportive measures, such as enhanced first-time homebuyer incentives or adjustments to mortgage stress test requirements, to alleviate the pressure on this crucial segment of the market.

Economic Uncertainty and Recession Fears: Dampening Buyer Confidence

Concerns about a potential recession are significantly impacting consumer sentiment and buyer confidence in the Canadian housing market.

- Inflationary Pressures: High inflation is eroding purchasing power, making it harder for Canadians to afford even moderately priced homes.

- Economic Forecasts: Expert opinions on the likelihood and severity of a potential recession are varied, contributing to market uncertainty. A pessimistic outlook naturally discourages home purchases.

The interplay between economic uncertainty and a potential recession significantly dampens buyer confidence, resulting in decreased demand and further contributing to the housing market slowdown.

What Lies Ahead for the Canadian Housing Market? BMO Predictions

BMO's predictions for the Canadian housing market suggest a period of continued slowdown in the short term. However, the long-term outlook remains uncertain, with potential scenarios ranging from a prolonged slump to a more rapid recovery.

- Market Correction: A price correction is possible, though the extent and duration are difficult to predict. This would represent a significant shift from the sustained price increases seen in previous years.

- Future Outlook: The ultimate trajectory of the Canadian housing market will significantly depend on factors such as the Bank of Canada's interest rate decisions, the overall economic climate, and changes in government policy.

(Insert chart/graph illustrating BMO's predictions for short-term and long-term housing market trends)

Conclusion: Navigating the Pause in the Canadian Housing Market

The BMO report clearly indicates a significant pause in the Canadian housing market, driven largely by rising interest rates and recession fears. Understanding the impact of these factors on affordability and buyer confidence is crucial for anyone considering entering the market. To make informed decisions about Canadian home buying, it's essential to monitor the Canadian housing market closely and stay informed about interest rate changes and economic forecasts from reputable sources. By staying informed about the impact of recession fears on Canadian real estate, you can navigate this challenging period effectively. Continue to follow reputable sources like the BMO reports and other relevant financial news to remain informed and make sound decisions regarding your real estate investments in the evolving Canadian housing market.

Featured Posts

-

New Agreement Deepens Royal Air Maroc And Mauritania Airlines Partnership

May 07, 2025

New Agreement Deepens Royal Air Maroc And Mauritania Airlines Partnership

May 07, 2025 -

Ovechkin V Dinamo Pravda Ili Slukhi

May 07, 2025

Ovechkin V Dinamo Pravda Ili Slukhi

May 07, 2025 -

Has Jenna Ortega Aged A Decade Fans Shocked By Recent Appearance Change

May 07, 2025

Has Jenna Ortega Aged A Decade Fans Shocked By Recent Appearance Change

May 07, 2025 -

Simone Biles Como La Terapia Me Ayuda A Mantenerme Enfocada Y Segura

May 07, 2025

Simone Biles Como La Terapia Me Ayuda A Mantenerme Enfocada Y Segura

May 07, 2025 -

Kyle Harrison And Carson Whisenhunt The Future Of The San Francisco Giants

May 07, 2025

Kyle Harrison And Carson Whisenhunt The Future Of The San Francisco Giants

May 07, 2025

Latest Posts

-

Comparing Micro Strategy And Bitcoin Investments A 2025 Perspective

May 08, 2025

Comparing Micro Strategy And Bitcoin Investments A 2025 Perspective

May 08, 2025 -

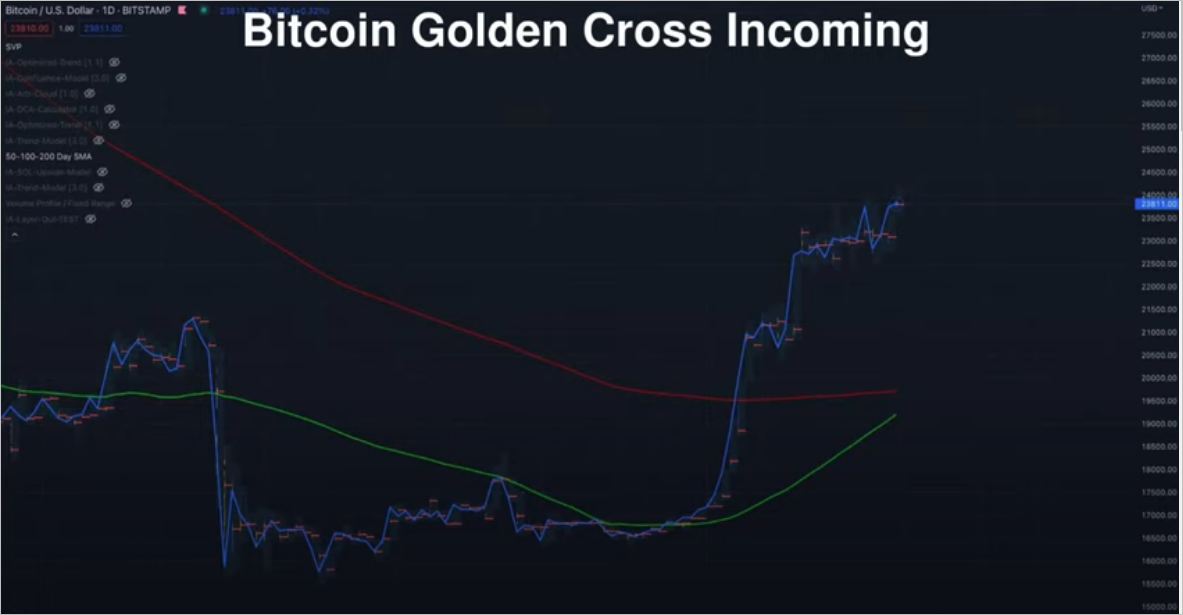

Bitcoins Golden Cross Analyzing The Price Surge And Future Predictions

May 08, 2025

Bitcoins Golden Cross Analyzing The Price Surge And Future Predictions

May 08, 2025 -

Micro Strategy Stock And Bitcoin Investment Outlook For 2025

May 08, 2025

Micro Strategy Stock And Bitcoin Investment Outlook For 2025

May 08, 2025 -

Bitcoin Price Analysis Rally Potential Spotted By Analyst May 6th Chart Included

May 08, 2025

Bitcoin Price Analysis Rally Potential Spotted By Analyst May 6th Chart Included

May 08, 2025 -

Bitcoin Golden Cross A Once In A Cycle Event And Its Implications

May 08, 2025

Bitcoin Golden Cross A Once In A Cycle Event And Its Implications

May 08, 2025