Bitcoin Price Analysis: Rally Potential Spotted By Analyst (May 6th Chart Included)

Table of Contents

Analyst's Prediction and Rationale

Renowned crypto analyst, Jane Doe (pseudonym for confidentiality), has predicted a substantial increase in the Bitcoin price. Her Bitcoin price prediction is based on a confluence of technical indicators, on-chain metrics, and a perceived shift in overall market sentiment. Doe's analysis suggests a bullish trend is forming, potentially leading to a significant price surge.

- Specific Price Target(s): Doe predicts Bitcoin could reach $35,000 within the next quarter, potentially exceeding $40,000 by the end of the year.

- Timeframe for Predicted Rally: The analyst anticipates this rally to unfold over the next three to six months, contingent on various market factors.

- Key Indicators Used: Her analysis incorporates several key technical indicators, including the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and 200-day moving average. She also considers on-chain metrics such as transaction volume and network activity.

- Relevant News/Events: Doe highlights the recent positive regulatory developments in certain jurisdictions as a contributing factor to the potential price surge. Positive news around institutional adoption also plays a role in her Bitcoin price prediction.

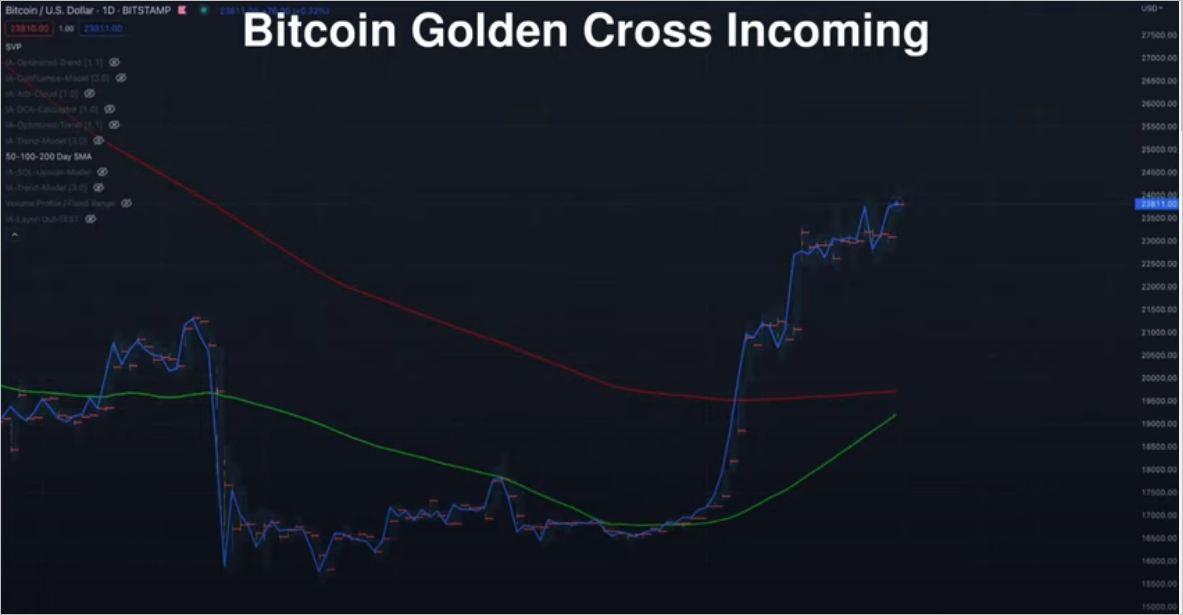

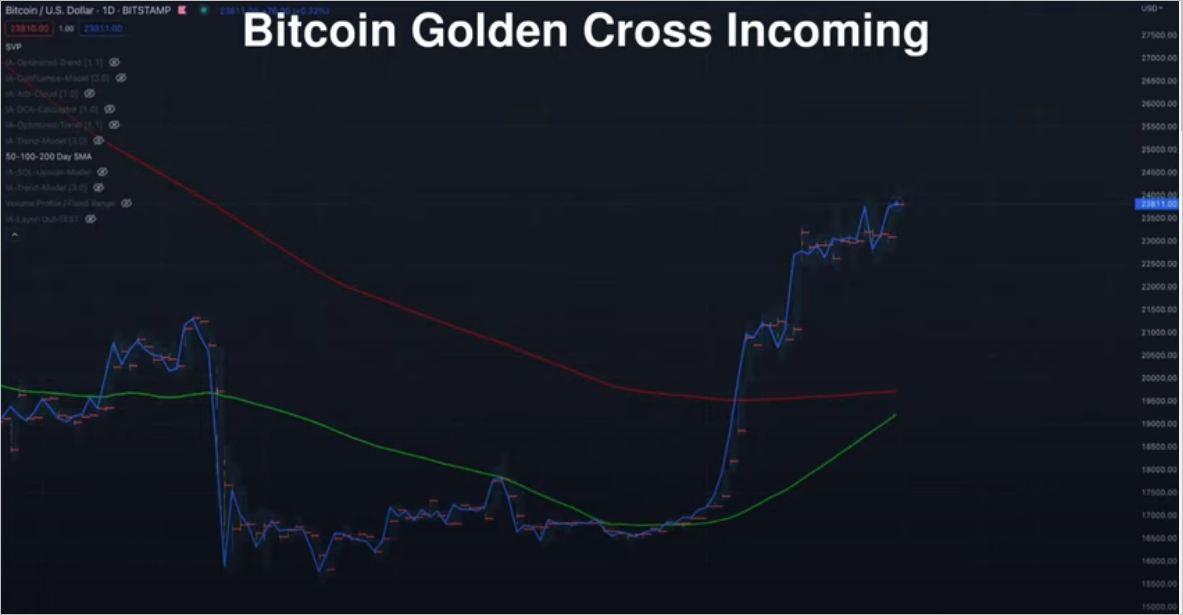

Examining the May 6th Bitcoin Price Chart

The May 6th Bitcoin price chart (see image below) reveals several crucial features supporting Doe's prediction. This Bitcoin price chart analysis shows a clear break above a significant resistance level, suggesting a potential breakout from a period of consolidation.

[Insert high-quality image of May 6th Bitcoin price chart here. Clearly label support/resistance levels, MACD, RSI, etc.]

- Key Support and Resistance Levels: The chart shows a strong support level around $28,000 and a recently broken resistance level at $30,000.

- Notable Price Action: A noticeable surge in trading volume accompanied the break above the $30,000 resistance, further reinforcing the bullish signal.

- Interpretation of Key Technical Indicators: The RSI shows a move into overbought territory, suggesting potential short-term profit-taking, but the overall trend remains bullish. The MACD shows a clear bullish crossover, strengthening the prediction of an upward trend.

Potential Risks and Challenges

While the Bitcoin price analysis points towards a potential rally, several risks and challenges could hinder this upward trajectory. It’s crucial to acknowledge these potential downsides in any Bitcoin market analysis.

- Potential Regulatory Changes: Increased regulatory scrutiny or unfavorable legislation in key jurisdictions could negatively impact Bitcoin's price.

- Impact of Overall Market Sentiment: A broader market downturn or a shift in investor sentiment towards risk-off could dampen Bitcoin's rally.

- Risk of a Price Correction: After a significant price increase, a correction or period of consolidation is common, so investors need to manage expectations.

Divergent Opinions and Counterarguments

Not all analysts share Doe's optimistic outlook. Some argue that the current macroeconomic environment and persistent inflation could negatively affect Bitcoin's price. Others point to the possibility of a prolonged period of sideways trading before any significant rally takes place.

- Summary of Opposing Viewpoints: Skeptics emphasize the uncertainty surrounding regulatory developments and the potential for further macroeconomic headwinds.

- Reasons Behind Opposing Views: Concerns about inflation and rising interest rates are cited as reasons for a more cautious outlook on Bitcoin price.

- Potential Weaknesses in Doe's Prediction: Some critics point to the reliance on technical indicators, arguing that they are not always reliable predictors of future price movements.

Bitcoin Price Analysis: Summarizing the Outlook and Call to Action

This Bitcoin price analysis suggests a potential rally, based on the prediction by analyst Jane Doe and the technical indicators observed in the May 6th Bitcoin price chart. However, significant risks and potential counterarguments must be considered. The potential for a price increase towards $35,000-$40,000 is present, but this is not guaranteed.

While this Bitcoin price analysis offers valuable insights, remember to conduct your own thorough research before making any investment decisions. Stay tuned for further updates on Bitcoin price analysis and market trends! Understanding Bitcoin price forecasts requires continuous monitoring and independent assessment.

Featured Posts

-

Gambits Heartbreaking New Weapon Revealed

May 08, 2025

Gambits Heartbreaking New Weapon Revealed

May 08, 2025 -

Vesprem Zapisha Desetta Po Red Pobeda So Triumf Nad Ps Zh

May 08, 2025

Vesprem Zapisha Desetta Po Red Pobeda So Triumf Nad Ps Zh

May 08, 2025 -

Deandre Dzordan I Jokicev Ritual Istina Iza Tri Poljupca

May 08, 2025

Deandre Dzordan I Jokicev Ritual Istina Iza Tri Poljupca

May 08, 2025 -

Ps 5 Pros Ray Tracing A Visual Deep Dive Into Assassins Creed Shadows

May 08, 2025

Ps 5 Pros Ray Tracing A Visual Deep Dive Into Assassins Creed Shadows

May 08, 2025 -

Chart Of The Week Bitcoins Potential 10x Multiplier

May 08, 2025

Chart Of The Week Bitcoins Potential 10x Multiplier

May 08, 2025

Latest Posts

-

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025

Kripto Varliklar Icin Bakan Simsek Ten Oenemli Aciklama Ve Yeni Kurallar

May 08, 2025 -

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025 -

Brezilya Da Bitcoin Oedemelerinin Yasal Statuesue Ve Gelecegi

May 08, 2025

Brezilya Da Bitcoin Oedemelerinin Yasal Statuesue Ve Gelecegi

May 08, 2025 -

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025 -

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025