Bitcoin's Golden Cross: Analyzing The Price Surge And Future Predictions

Table of Contents

Understanding the Recent Bitcoin Golden Cross

The recent Bitcoin Golden Cross occurred on [Insert Date], marking a significant technical event for Bitcoin traders. This crossover was clearly visible on Bitcoin charts, showing the 50-day SMA decisively breaking above the 200-day SMA.

-

Visual Representation: [Insert chart showing the Golden Cross event. Clearly label the 50-day and 200-day SMAs].

-

Trading Volume: The Golden Cross was accompanied by [describe the trading volume – high, low, average compared to previous periods]. This [high/low] volume suggests [interpret the volume's implication – strong/weak bullish sentiment].

-

Market Sentiment: Following the Golden Cross, the overall market sentiment shifted towards [bullish/bearish/neutral], evidenced by [cite examples such as social media sentiment, news articles, analyst reports].

-

Significant News: The Golden Cross coincided with [mention any significant news or regulatory developments, such as institutional adoption announcements, major partnerships, or regulatory changes]. These events likely played a role in influencing the market's reaction to the technical signal.

Analyzing the Price Surge Following the Golden Cross

After the Bitcoin Golden Cross event on [Date], Bitcoin's price experienced a notable increase of approximately [Percentage]%. This price increase can be attributed to several contributing factors:

-

Institutional Investment: Increased institutional adoption of Bitcoin, with larger firms adding the cryptocurrency to their investment portfolios, likely provided significant buying pressure.

-

Regulatory Developments: [Mention any positive regulatory developments that may have influenced the price]. Positive regulatory changes can often boost investor confidence.

-

Increased Adoption Rate: Growing adoption of Bitcoin as a payment method and its integration into various applications contributed to increased demand.

-

Sustainability of the Surge: While the price surge was significant, its sustainability remains uncertain. Several factors could influence its continuation, including [mention potential factors affecting sustainability].

-

Resistance Levels: Potential resistance levels that could hinder further price appreciation include [mention specific price points acting as resistance]. These levels represent previous price highs that could present challenges for further upward movement. Support levels at [mention price points] might provide a cushion against significant downward corrections.

Predicting Bitcoin's Future Trajectory After a Golden Cross

While the Golden Cross is a valuable technical indicator, its predictive power is not foolproof. Historically, the accuracy of Golden Cross signals in predicting Bitcoin's future price has been [describe the historical accuracy – e.g., mixed, sometimes accurate, not always reliable].

-

Limitations of Technical Analysis: It's crucial to acknowledge that technical analysis alone is insufficient for accurate prediction. External factors, such as macroeconomic events, regulatory changes, and unforeseen circumstances, significantly impact Bitcoin's price.

-

Price Prediction Scenarios: Various scenarios are plausible:

- Bullish Scenario: Continued price appreciation based on sustained institutional investment, wider adoption, and positive regulatory developments.

- Bearish Scenario: A price correction due to profit-taking, negative news, or broader market downturns.

- Sideways Scenario: Consolidation in a price range, followed by a future breakout in either direction.

-

Complementary Indicators: Combining the Golden Cross analysis with other technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), can provide a more comprehensive picture. For instance, a high RSI might suggest overbought conditions, warning of a potential price correction.

-

Risk Management: Regardless of the prediction scenario, effective risk management is paramount in Bitcoin trading. Never invest more than you can afford to lose.

Risk Management Strategies for Bitcoin Investors

Bitcoin's inherent volatility demands a robust risk management strategy:

-

Portfolio Diversification: Don't put all your eggs in one basket. Diversify your cryptocurrency portfolio across multiple assets to mitigate risk.

-

Stop-Loss Orders: Use stop-loss orders to automatically sell your Bitcoin if the price drops below a predetermined level, limiting potential losses.

-

Invest Responsibly: Only invest funds you can afford to lose. Bitcoin's price can fluctuate dramatically.

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy mitigates the risk of investing a large sum at a market peak.

Conclusion: Navigating the Bitcoin Market After the Golden Cross

The recent Bitcoin Golden Cross presented a significant technical event, leading to a notable price surge. However, the sustainability of this surge is uncertain. While technical indicators like the Golden Cross offer valuable insights, they should not be considered in isolation. Informed investment decisions require a holistic approach, incorporating both technical and fundamental analysis, alongside a thorough understanding of the inherent risks associated with Bitcoin investment. Conduct thorough research, understand the market dynamics, and carefully manage your risks before engaging with Bitcoin Golden Cross opportunities. For further learning, explore resources on Bitcoin trading strategies and cryptocurrency investment best practices. Remember, responsible investing is key to success in the dynamic world of Bitcoin.

Featured Posts

-

Betts Absence Dodgers Star Sidelined By Illness In Freeway Series

May 08, 2025

Betts Absence Dodgers Star Sidelined By Illness In Freeway Series

May 08, 2025 -

Assassins Creed Shadows Ps 5 Pro Ray Tracing Upgrade Analysis

May 08, 2025

Assassins Creed Shadows Ps 5 Pro Ray Tracing Upgrade Analysis

May 08, 2025 -

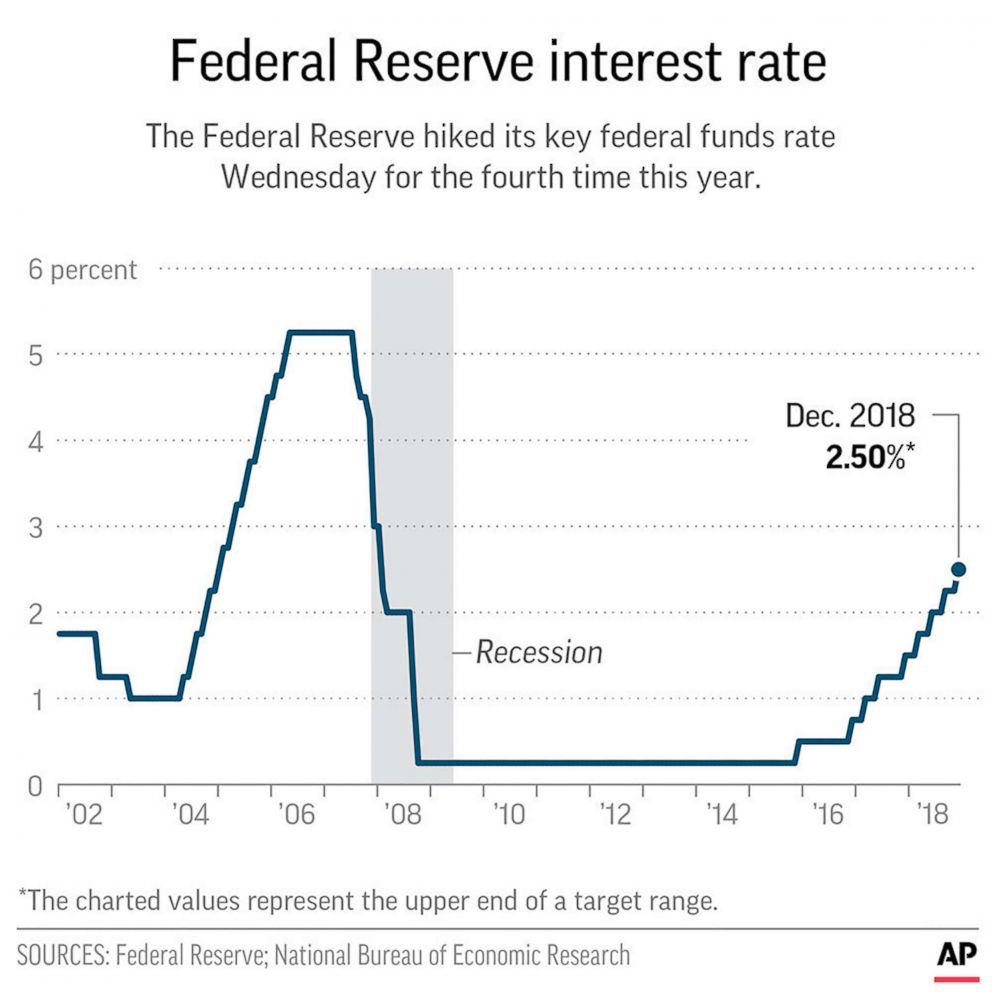

Chinas Economic Stimulus Rate Cuts And Bank Lending In Response To Tariffs

May 08, 2025

Chinas Economic Stimulus Rate Cuts And Bank Lending In Response To Tariffs

May 08, 2025 -

Saturday Night Live A Turning Point For Counting Crows

May 08, 2025

Saturday Night Live A Turning Point For Counting Crows

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025

Latest Posts

-

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025 -

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025 -

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025 -

Kripto Para Yatirimi Kripto Lider I Degerlendirmeniz Icin Kapsamli Bir Rehber

May 08, 2025

Kripto Para Yatirimi Kripto Lider I Degerlendirmeniz Icin Kapsamli Bir Rehber

May 08, 2025