MicroStrategy Stock And Bitcoin: Investment Outlook For 2025

Table of Contents

MicroStrategy's significant Bitcoin holdings have made it a unique player in the intersection of traditional finance and the cryptocurrency market. This bold strategy has created a fascinating investment scenario, intertwining the performance of a publicly traded company with the volatile world of Bitcoin. This article analyzes the investment outlook for both MicroStrategy stock and Bitcoin in 2025, considering various factors influencing their potential performance. We'll explore the risks and rewards associated with investing in these assets, helping you form your own informed opinion.

MicroStrategy's Bitcoin Strategy and its Impact on Stock Performance

Analyzing MicroStrategy's Bitcoin Acquisition History

MicroStrategy's journey into Bitcoin began in August 2020, and since then, the company has made significant purchases, accumulating a substantial Bitcoin treasury.

- August 2020: Initial purchase of 21,454 BTC.

- September 2020 - June 2022: A series of acquisitions significantly increasing their Bitcoin holdings.

- Ongoing: Continued accumulation of Bitcoin, demonstrating a long-term commitment.

The rationale behind MicroStrategy's Bitcoin strategy is multifaceted. Michael Saylor, CEO of MicroStrategy, has publicly stated that Bitcoin is a hedge against inflation and represents a long-term store of value. This strategy positions MicroStrategy as a pioneer in corporate Bitcoin adoption, attracting investors interested in exposure to both traditional business and the cryptocurrency market. However, this strategy also makes MicroStrategy's stock price significantly correlated with Bitcoin's price fluctuations. A substantial increase in Bitcoin's value boosts MicroStrategy's balance sheet and often positively impacts the stock price, and vice versa.

The Correlation Between Bitcoin Price and MicroStrategy Stock Price

Historical data demonstrates a strong correlation between Bitcoin's price and MicroStrategy's stock price. When Bitcoin's value rises, MicroStrategy's stock often follows suit, and the opposite is also true. However, it's crucial to note that factors beyond Bitcoin's price can influence MicroStrategy's stock performance. The company's overall business performance in the business intelligence sector, investor sentiment towards the company's strategic decisions, and broader market conditions all play a role.

- High Bitcoin Price Scenario: A high Bitcoin price in 2025 would likely result in a significant increase in MicroStrategy's market capitalization, leading to higher stock prices.

- Low Bitcoin Price Scenario: Conversely, a substantial drop in Bitcoin's price could negatively impact MicroStrategy's stock, potentially leading to significant losses for investors.

- Decoupling Factors: MicroStrategy's success in its core business and positive news unrelated to Bitcoin could partially decouple the stock price from Bitcoin's performance.

Bitcoin's Potential in 2025: Price Predictions and Market Adoption

Factors Influencing Bitcoin's Price in 2025

Predicting Bitcoin's price in 2025 is inherently speculative, but several factors could significantly influence its value:

- Regulatory Changes: Increased regulatory clarity in major markets could boost institutional adoption and investor confidence. Conversely, overly restrictive regulations could stifle growth.

- Institutional Adoption: Continued institutional investment, including through Bitcoin ETFs (exchange-traded funds), will likely drive demand and price appreciation.

- Technological Advancements: Improvements in Layer-2 scaling solutions will enhance Bitcoin's transaction speed and efficiency, potentially attracting a wider user base.

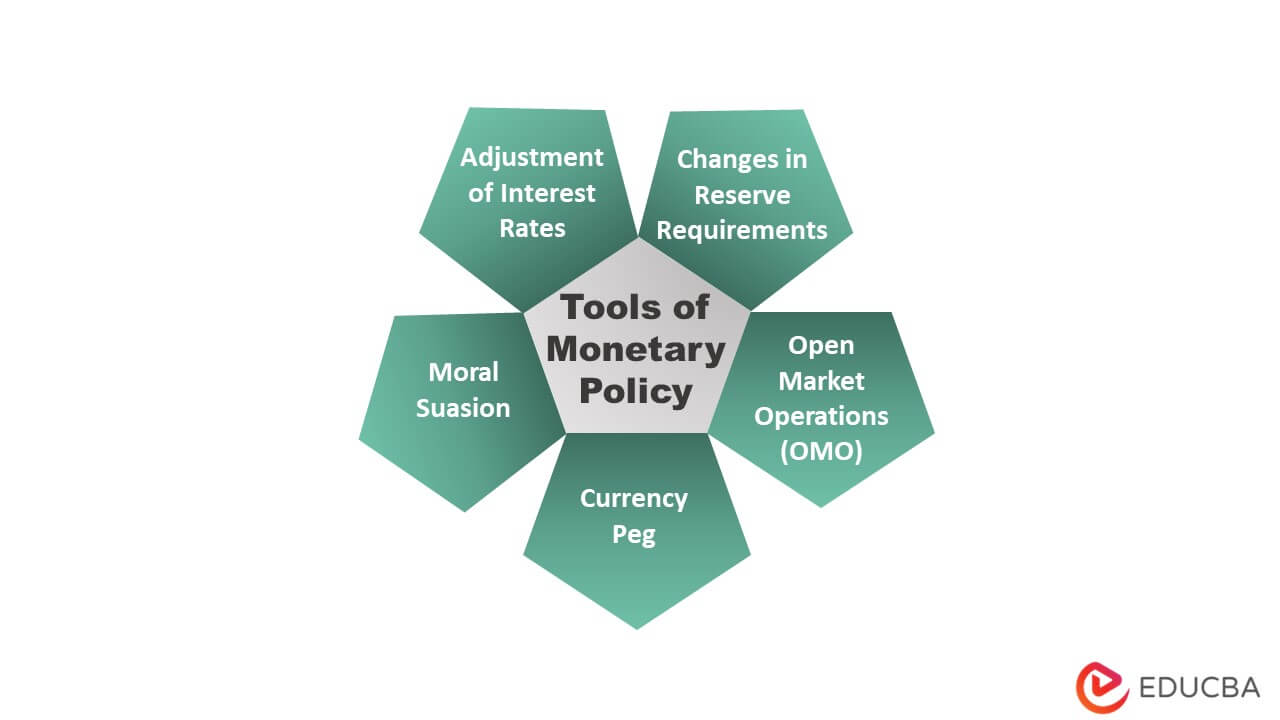

- Macroeconomic Conditions: Global inflation rates and interest rate policies will impact Bitcoin's appeal as a hedge against inflation and a safe-haven asset.

- Competing Cryptocurrencies: The emergence of successful alternative cryptocurrencies could potentially erode Bitcoin's market dominance.

While predicting a precise Bitcoin price is impossible, several scenarios are plausible: a bullish scenario with a significant price increase, a bearish scenario with a price decline, and a neutral scenario with moderate growth or stagnation. The likelihood of each scenario depends on the interplay of the factors mentioned above.

Assessing the Potential for Increased Bitcoin Adoption by Institutions and Individuals

The growing interest of institutional investors in Bitcoin as a store of value and an asset class is undeniable. The approval of Bitcoin ETFs would significantly increase accessibility and potentially lead to a surge in demand. Furthermore, increased regulatory clarity would reduce uncertainty and encourage wider adoption. This combination of factors could drive significant price appreciation in the years leading to 2025.

Risk Assessment: Investing in MicroStrategy Stock and Bitcoin in 2025

Risks Associated with Investing in MicroStrategy Stock

Investing in MicroStrategy stock carries several risks:

- Bitcoin Price Dependence: MicroStrategy's performance is heavily reliant on Bitcoin's price. A significant Bitcoin price decline could severely impact the company's valuation.

- Market Volatility: The stock market is inherently volatile, and MicroStrategy's stock price is subject to fluctuations influenced by both Bitcoin's price and general market conditions.

- Competition: MicroStrategy faces competition in the business intelligence sector, which can impact its overall financial performance.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks:

- Price Volatility: Bitcoin is known for its extreme price volatility, leading to potentially significant gains or losses in short periods.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty about future regulations.

- Security Risks: Bitcoin, like other cryptocurrencies, is susceptible to hacking and scams.

- Technological Risks: Technological vulnerabilities or unforeseen developments could negatively impact Bitcoin's functionality and value.

Diversification Strategies to Mitigate Risks

To mitigate the risks associated with investing in MicroStrategy stock and Bitcoin, diversification is crucial. Investors should consider:

- Holding Other Assets: Diversifying across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of price fluctuations, can reduce the impact of volatility.

Conclusion:

Predicting the future performance of MicroStrategy stock and Bitcoin in 2025 is inherently challenging. However, by analyzing MicroStrategy's Bitcoin strategy, Bitcoin's potential for future growth, and the inherent risks involved, investors can develop a more informed perspective. While MicroStrategy's bold bet on Bitcoin presents significant potential rewards, it also carries considerable risk. Careful consideration of these factors, combined with a diversified investment portfolio, is crucial for navigating the volatile world of cryptocurrency and traditional stock markets. Before making any investment decisions regarding MicroStrategy stock or Bitcoin, conduct thorough research and consider seeking advice from a qualified financial advisor. Remember, investing in MicroStrategy stock and Bitcoin requires a thorough understanding of the inherent risks associated with these assets.

Featured Posts

-

Fetterman Vows To Remain In Senate Despite Health Questions

May 08, 2025

Fetterman Vows To Remain In Senate Despite Health Questions

May 08, 2025 -

Nuggets Player Weighs In On Russell Westbrooks Future

May 08, 2025

Nuggets Player Weighs In On Russell Westbrooks Future

May 08, 2025 -

Rogue Unleashes Cyclops Style Abilities New X Men Reveal

May 08, 2025

Rogue Unleashes Cyclops Style Abilities New X Men Reveal

May 08, 2025 -

Millions Made From Executive Office365 Account Breaches Federal Investigation

May 08, 2025

Millions Made From Executive Office365 Account Breaches Federal Investigation

May 08, 2025 -

Responding To Trade Wars Chinas Monetary Policy Adjustments And Bank Lending

May 08, 2025

Responding To Trade Wars Chinas Monetary Policy Adjustments And Bank Lending

May 08, 2025

Latest Posts

-

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Detayli Analiz

May 08, 2025

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Detayli Analiz

May 08, 2025 -

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Bir Uyari

May 08, 2025 -

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025 -

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025 -

Kripto Para Wall Street Kurumlarinin Degisen Tutumu Ve Gelecegi

May 08, 2025

Kripto Para Wall Street Kurumlarinin Degisen Tutumu Ve Gelecegi

May 08, 2025