CAC 40 Weekly Performance: Mixed Results For March 7, 2025

Table of Contents

The CAC 40, France's benchmark stock index, experienced mixed results during the week ending March 7, 2025. This article delves into the key factors influencing the index's performance, examining individual stock movements, sector trends, and overall market sentiment. We will explore the week's winners and losers, providing insights for investors interested in the French equity market and the CAC 40 index.

Overall CAC 40 Performance

The CAC 40 opened the week at 7,250.35 points and closed at 7,285.10 points, representing a modest 0.48% increase. This is a slight improvement compared to the previous week's performance, which saw a 0.22% decline.

- Market Sentiment: The overall market sentiment can be characterized as cautiously optimistic. While the index showed positive growth, the relatively small percentage increase suggests a degree of uncertainty amongst investors.

- External Factors: Geopolitical tensions in Eastern Europe and ongoing concerns about global inflation continued to exert pressure on the market. However, positive economic data from within the Eurozone helped to offset some of these negative influences. The release of better-than-expected French manufacturing data contributed positively to investor confidence.

Sector-Specific Performance

Top Performing Sectors

The energy and technology sectors were the standout performers during the week.

- Energy: The energy sector experienced a significant boost, with increasing oil prices driving up the share prices of major players. TotalEnergies (TTE) saw a notable increase, climbing by 2.7%, while Engie (ENGI) also showed solid growth, up by 1.5%. This reflects the ongoing global demand for energy and the volatile nature of oil prices.

- Technology: The technology sector benefited from positive news regarding AI advancements, leading to increased investor optimism. STMicroelectronics (STM) rose by 3.1% driven by positive industry forecasts and increased semiconductor demand. Dassault Systèmes (DAST) also performed well, gaining 1.8% following a successful product launch.

Underperforming Sectors

The financial and retail sectors lagged behind, experiencing moderate declines.

- Financial: The financial sector faced headwinds due to rising interest rates impacting lending margins. BNP Paribas (BNP) dipped by 1.2%, reflecting the challenging conditions in the banking sector. Société Générale (GLE) followed a similar trend, experiencing a decline of 0.9%.

- Retail: The retail sector felt the pressure of decreased consumer spending, possibly linked to persistent inflationary pressures. LVMH (MC.PA) experienced a modest dip of 0.5%, and Kering (KER.PA) also showed a decline of 0.8%.

Key Individual Stock Movers

Top Gainers

Several individual stocks significantly outperformed the overall market.

- Hermès International (RMS.PA): A surprise positive earnings report boosted Hermès's share price by 4.2%, showcasing strong resilience amidst global economic uncertainty.

- L'Oréal (OR.PA): Positive market sentiment towards the cosmetics sector and strong sales figures pushed L'Oréal’s stock price up by 3.5%.

Top Losers

Some stocks experienced significant losses during the week.

- Air France-KLM (AF.PA): Concerns about rising fuel costs and the impact of potential strikes caused Air France-KLM's share price to decrease by 2.1%.

- Renault (RNO.PA): Negative news regarding production delays impacted investor confidence, leading to a 1.8% decrease in Renault's stock price.

Implications for Investors

The mixed performance of the CAC 40 this week suggests a market characterized by uncertainty. Long-term investors might consider focusing on fundamentally strong companies within resilient sectors such as energy and technology, while keeping an eye on potential opportunities in underperforming sectors which could bounce back. Short-term traders should exercise caution and monitor market trends closely before making any decisions.

- Long-Term Investors: Continue monitoring the CAC 40 and consider sector diversification to mitigate risks.

- Short-Term Traders: Focus on high-liquidity stocks and be prepared to adapt strategies quickly.

Potential Risks: Geopolitical instability, inflation, and interest rate changes remain significant risks to the market.

Potential Opportunities: Companies showcasing strong earnings and resilience in the face of economic challenges may present favorable investment opportunities.

Conclusion

The CAC 40's performance for the week ending March 7, 2025, showed mixed results, with modest overall gains overshadowed by sector-specific variations. The energy and technology sectors led the advance, while the financial and retail sectors lagged. Individual stock performance varied significantly, influenced by factors such as earnings reports, industry trends, and external events. To make informed investment decisions, it's crucial to regularly track CAC 40 performance and stay updated on market trends. Check back next week for our analysis of the CAC 40's performance, and continue to monitor CAC 40 index movements to stay ahead of the curve. Analyze CAC 40 movements carefully and develop a robust investment strategy.

Featured Posts

-

Debate Reignites Macrons Party Pushes For Under 15s Hijab Ban

May 24, 2025

Debate Reignites Macrons Party Pushes For Under 15s Hijab Ban

May 24, 2025 -

Annie Kilner Shows Off Huge Diamond Ring After Kyle Walker Spotting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Kyle Walker Spotting

May 24, 2025 -

Complete Guide Nyt Mini Crossword Answers April 18 2025

May 24, 2025

Complete Guide Nyt Mini Crossword Answers April 18 2025

May 24, 2025 -

La Mainmise De La Chine Sur Les Dissidents En France

May 24, 2025

La Mainmise De La Chine Sur Les Dissidents En France

May 24, 2025 -

West Hams Transfer Offer For Kyle Walker Peters

May 24, 2025

West Hams Transfer Offer For Kyle Walker Peters

May 24, 2025

Latest Posts

-

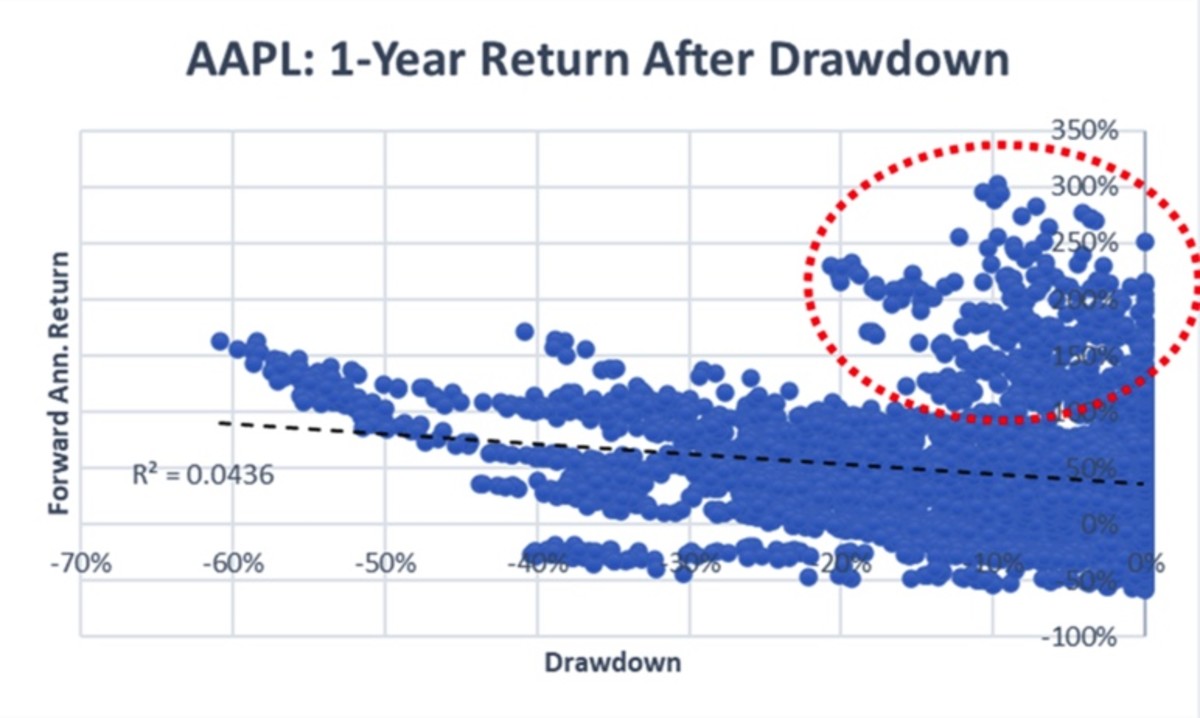

Apple Stock Sell Off 900 Million Tariff Hit

May 24, 2025

Apple Stock Sell Off 900 Million Tariff Hit

May 24, 2025 -

Apple Stock Suffers Losses Amidst Tariff Announcement

May 24, 2025

Apple Stock Suffers Losses Amidst Tariff Announcement

May 24, 2025 -

Apple Stock Plunges On 900 Million Tariff Projection

May 24, 2025

Apple Stock Plunges On 900 Million Tariff Projection

May 24, 2025 -

Investing In Apple Stock Is It A Good Time To Buy

May 24, 2025

Investing In Apple Stock Is It A Good Time To Buy

May 24, 2025 -

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025