Apple Stock Suffers Losses Amidst Tariff Announcement

Table of Contents

Rising Production Costs Due to Tariffs

The newly implemented tariffs directly impact Apple's intricate global manufacturing process and extensive supply chain. These tariffs significantly increase the cost of components sourced from affected countries, primarily impacting the production of several key products. The Apple tariff impact is most keenly felt in the manufacturing of iPhones, iPads, and Macs, which rely on components from various global suppliers.

- Estimated Increased Production Costs: According to analysts at [Source 1], the tariff increase could lead to an estimated $X increase in the production cost of an iPhone, while iPads could see a $Y increase per unit. Macs may also experience a similar price surge, depending on the specific components sourced from affected regions. [Source 2] further supports these projections, suggesting that the overall manufacturing costs increase could negatively affect Apple's profit margins.

- Supply Chain Disruption: The Apple supply chain disruption caused by tariffs creates uncertainty and potential delays. This complexity adds further pressure on production costs and delivery timelines. The intricate network of suppliers across multiple countries makes it challenging for Apple to swiftly adapt to these changes. This iPhone production costs escalation is a significant concern.

Impact on Consumer Demand and Sales

The increased production costs due to tariffs will inevitably translate into higher prices for consumers. This raises concerns about the Apple sales forecast and the potential for decreased sales. The question of consumer demand elasticity in the face of these price hikes is crucial.

- Price Sensitivity: Apple products are known for their premium pricing. While loyal customers may absorb some price increases, the iPhone price sensitivity of budget-conscious consumers is a significant factor. A substantial price hike could lead to a decline in sales, directly impacting Apple revenue impact.

- Shifting Consumer Behavior: Consumers may delay purchases, opt for older models, or switch to competing brands offering similar products at lower prices. Analyzing historical data on previous price increases and their impact on Apple's sales figures will provide valuable insights into the potential consequences of this tariff-driven price surge. [Source 3] indicates that previous price increases resulted in a [Percentage]% drop in sales of [Product].

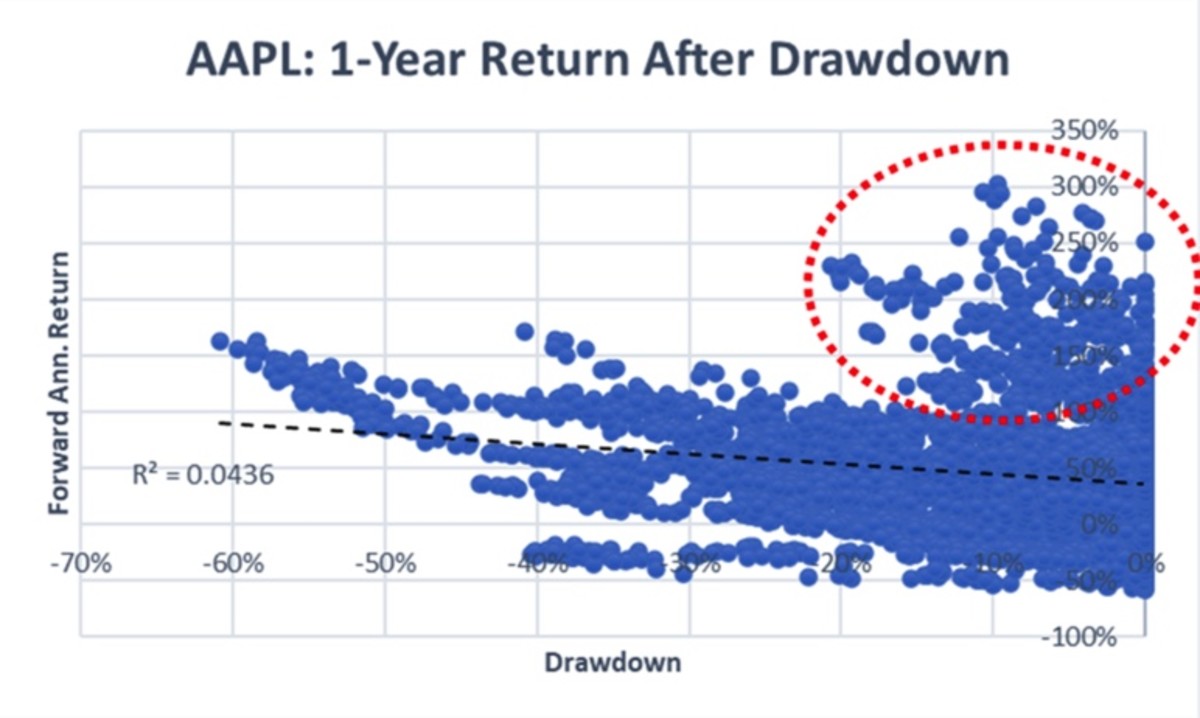

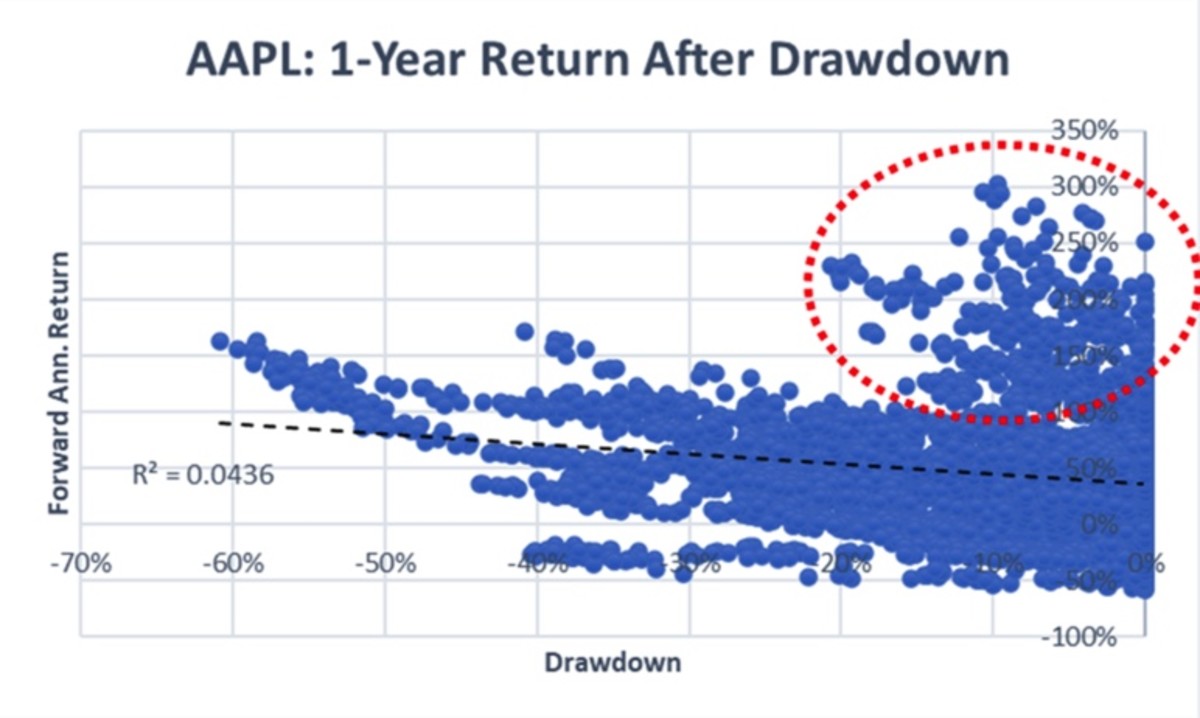

Investor Reaction and Market Analysis

The immediate market volatility following the tariff announcement reflected a significant negative investor sentiment. Apple's stock price experienced a sharp decline, accompanied by increased trading volume, indicating a considerable level of concern among investors.

- Stock Price and Trading Volume: The immediate reaction saw a significant drop in Apple's stock price, illustrating investor concerns about the Apple stock price prediction in the long term. Increased trading volume indicated a large number of investors reacting to the news.

- Analyst Opinions: Financial analysts express varying opinions on the long-term effects. Some predict a temporary dip, while others express concerns about sustained negative impacts on Apple's profitability. “[Quote from a financial expert on the situation],” stated [Source 4]. Understanding the Apple stock forecast requires careful consideration of these diverse perspectives.

Alternative Strategies Apple Might Employ

Faced with these challenges, Apple may explore various strategies to mitigate the negative impacts of the tariffs.

- Production Relocation: Shifting some production to countries not subject to the tariffs is a potential strategy to reduce manufacturing costs increase. However, this involves significant logistical and financial investment.

- Cost-Cutting Measures: Apple may implement cost-cutting measures elsewhere in its operations to offset the increased production costs. This could involve streamlining processes or renegotiating contracts with suppliers. The feasibility and effectiveness of these Apple business strategy adjustments are critical aspects for Apple to consider.

Conclusion: Understanding the Apple Stock Dip

The decline in Apple's stock price following the tariff announcement is a direct consequence of several interconnected factors: rising production costs, potential negative impacts on consumer demand and sales, and the subsequent cautious investor reaction. The severity of the situation demands careful observation of the evolving economic landscape and its impact on Apple’s global operations. The Apple tariff impact on the company’s Apple stock is significant and will continue to shape future strategies and financial performance.

To stay informed about the latest developments concerning Apple stock and tariff implications, subscribe to our newsletter [Link to Newsletter] or follow reputable financial news sources like [Link to Financial News Source 1], and [Link to Financial News Source 2]. Understanding the ongoing impact of these tariffs on Apple stock is crucial for informed investment decisions.

Featured Posts

-

Artfae Daks Alalmany Ma Wrae Tjawz Dhrwt Mars Wmadha Yeny Llmstthmryn

May 24, 2025

Artfae Daks Alalmany Ma Wrae Tjawz Dhrwt Mars Wmadha Yeny Llmstthmryn

May 24, 2025 -

Ricchezza 2025 La Classifica Forbes Degli Uomini Piu Ricchi Al Mondo

May 24, 2025

Ricchezza 2025 La Classifica Forbes Degli Uomini Piu Ricchi Al Mondo

May 24, 2025 -

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025 -

The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav And Investment Strategies

May 24, 2025

The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav And Investment Strategies

May 24, 2025 -

Must Have Gear For Passionate Ferrari Owners

May 24, 2025

Must Have Gear For Passionate Ferrari Owners

May 24, 2025

Latest Posts

-

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 24, 2025

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 24, 2025 -

Londons Odd Burger Vegan Food Arrives At 7 Eleven Locations Across Canada

May 24, 2025

Londons Odd Burger Vegan Food Arrives At 7 Eleven Locations Across Canada

May 24, 2025 -

Mayis Ayinda Askin Kapisini Aralayan 3 Burc

May 24, 2025

Mayis Ayinda Askin Kapisini Aralayan 3 Burc

May 24, 2025 -

Canadas 7 Eleven Stores Now Offer Vegan Options From Odd Burger

May 24, 2025

Canadas 7 Eleven Stores Now Offer Vegan Options From Odd Burger

May 24, 2025 -

Ask Hayatinizda Mayis Ayinda Degisim 3 Sansli Burc

May 24, 2025

Ask Hayatinizda Mayis Ayinda Degisim 3 Sansli Burc

May 24, 2025