Apple Stock Analysis: Q2 Results And Future Outlook

Table of Contents

Q2 Earnings Report: Key Highlights and Analysis

Apple's Q2 2024 earnings report revealed a complex picture, reflecting both strengths and challenges in the current market environment. Let's analyze the key elements.

Revenue and Earnings Growth

Apple's revenue growth in Q2 showed a mixed performance compared to the previous quarter and the same period last year. While some segments exceeded expectations, others faced headwinds.

- Revenue: [Insert actual Q2 revenue figures here]. This represents a [Insert percentage]% increase/decrease compared to Q1 2024 and a [Insert percentage]% increase/decrease compared to Q2 2023.

- Earnings Per Share (EPS): [Insert actual EPS figures here]. This reflects a [Insert percentage]% increase/decrease compared to Q1 2024 and a [Insert percentage]% increase/decrease compared to Q2 2023.

- Analyst Expectations: The reported figures were [above/below/in line with] analyst expectations. This deviation can be attributed to [explain reasons, e.g., stronger than expected iPhone sales, weaker than anticipated Mac sales].

- Impact of Macroeconomic Factors: The global economic slowdown, characterized by high inflation and rising interest rates, impacted consumer spending and consequently affected Apple's overall revenue growth. Supply chain disruptions also played a role in impacting production and sales during the quarter.

Product Performance and Market Share

Analyzing individual product performance provides a more granular understanding of Apple's Q2 results.

- iPhone: iPhone sales constituted [Insert percentage]% of total revenue, showing [Insert percentage]% growth/decline compared to Q2 2023. This performance reflects [discuss market trends and factors influencing sales].

- iPad: iPad sales contributed [Insert percentage]% to total revenue with a [Insert percentage]% growth/decline. [Discuss factors influencing iPad sales].

- Mac: Mac sales represented [Insert percentage]% of total revenue, showing a [Insert percentage]% growth/decline. [Discuss factors influencing Mac sales, including potential competition from Windows-based PCs].

- Wearables, Home, and Accessories: This segment contributed [Insert percentage]% to revenue, experiencing [Insert percentage]% growth/decline. [Discuss the performance of Apple Watch, AirPods, etc.].

- Market Share: Apple maintains a leading market share in the [smartphone/tablet/etc.] market, but faces increasing competition from [mention key competitors like Samsung, Google, etc.]. The competitive landscape remains dynamic and requires continuous innovation.

Services Revenue Growth and Future Potential

Apple's services segment continues to be a key driver of growth and profitability.

- Revenue: Services revenue reached [Insert figures] in Q2 2024, exhibiting a [Insert percentage]% growth rate compared to the previous year.

- Key Drivers: The growth is primarily driven by the increasing adoption of subscription services like Apple Music, iCloud+, and Apple TV+. The App Store also remains a significant contributor to this segment’s revenue.

- Future Potential: The services segment offers considerable potential for future growth through expansion into new areas like augmented reality applications, fitness services, and financial services. The increasing user base within the Apple ecosystem strengthens this growth potential.

Factors Influencing Apple Stock Price

Several factors beyond the Q2 earnings report influence Apple stock price.

Macroeconomic Factors

Global economic conditions significantly impact Apple's stock price.

- Inflation and Interest Rates: High inflation and rising interest rates impact consumer spending and investor sentiment, creating uncertainty in the market and potentially affecting Apple stock price negatively.

- Recessionary Fears: Concerns about a potential recession can lead to decreased investor confidence and increased volatility in the stock market, including Apple stock.

- Geopolitical Events: Global geopolitical instability can also affect investor sentiment and impact Apple's stock price.

Competitive Landscape

Apple faces competition from various players in different market segments.

- Smartphone Market: Samsung, Google (Pixel), and other Chinese manufacturers pose significant competition in the smartphone market. Innovation and pricing strategies are key to maintaining market share.

- Tablet Market: Android-based tablets are increasing competition in the tablet segment.

- Wearables Market: Companies like Fitbit and Samsung continue to expand in the wearables market, influencing Apple's market share.

- Services Market: Streaming services and cloud storage providers are key competitors in the services sector.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings play a crucial role in shaping Apple's stock price.

- Analyst Ratings: [Summarize the average analyst rating – buy, hold, or sell – and the average price target]. Analyst opinions often reflect expectations for future performance.

- Investor Sentiment: News articles, social media sentiment, and general market mood contribute significantly to investor confidence, impacting the trading volume and price fluctuations.

- News and Events: Major news events concerning Apple, such as product launches or legal challenges, influence investor sentiment.

Apple Stock Future Outlook and Investment Strategies

Based on our analysis, let's explore the future outlook and investment strategies for Apple stock.

Long-Term Growth Potential

Apple has considerable long-term growth potential, driven by various factors:

- Product Innovation: Continued innovation in existing product lines (iPhone, Mac, iPad) and expansion into new areas like augmented reality (AR), virtual reality (VR), and potentially autonomous vehicles provide significant growth opportunities.

- Services Revenue: The services segment's growth potential is substantial, offering recurring revenue streams and high profitability.

- International Expansion: Opportunities for growth exist in emerging markets, where Apple's brand and products are gaining popularity.

- Technological Advancements: Investments in research and development ensure Apple remains at the forefront of technological advancements.

Investment Strategies

Investment decisions should consider various factors:

- Risk Tolerance: Investors with a higher risk tolerance might consider buying Apple stock, while those with lower risk tolerance may opt for a "hold" strategy or diversify their portfolio.

- Investment Horizon: Long-term investors benefit from Apple's long-term growth potential, while short-term investors are susceptible to market volatility.

- Diversification: Diversification is essential to mitigate risk. Don't put all your eggs in one basket.

- Buy, Hold, or Sell?: The decision to buy, hold, or sell Apple stock depends on individual circumstances, risk tolerance, and investment goals. Thorough research and financial advice are crucial.

Conclusion

Apple's Q2 results provide a mixed bag, showing continued strength in some areas while facing headwinds from others. While macroeconomic factors present challenges, Apple's strong brand, loyal customer base, and innovative product pipeline offer substantial long-term growth potential. Investors should carefully consider the factors discussed above when formulating their Apple stock investment strategy. Conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions related to Apple stock or any other security. Remember to regularly analyze the Apple stock market performance for updated insights and to adapt your strategy accordingly. Understanding the nuances of Apple stock analysis is crucial for making informed investment decisions.

Featured Posts

-

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025 -

Princess Road Accident Latest Updates And Emergency Response

May 24, 2025

Princess Road Accident Latest Updates And Emergency Response

May 24, 2025 -

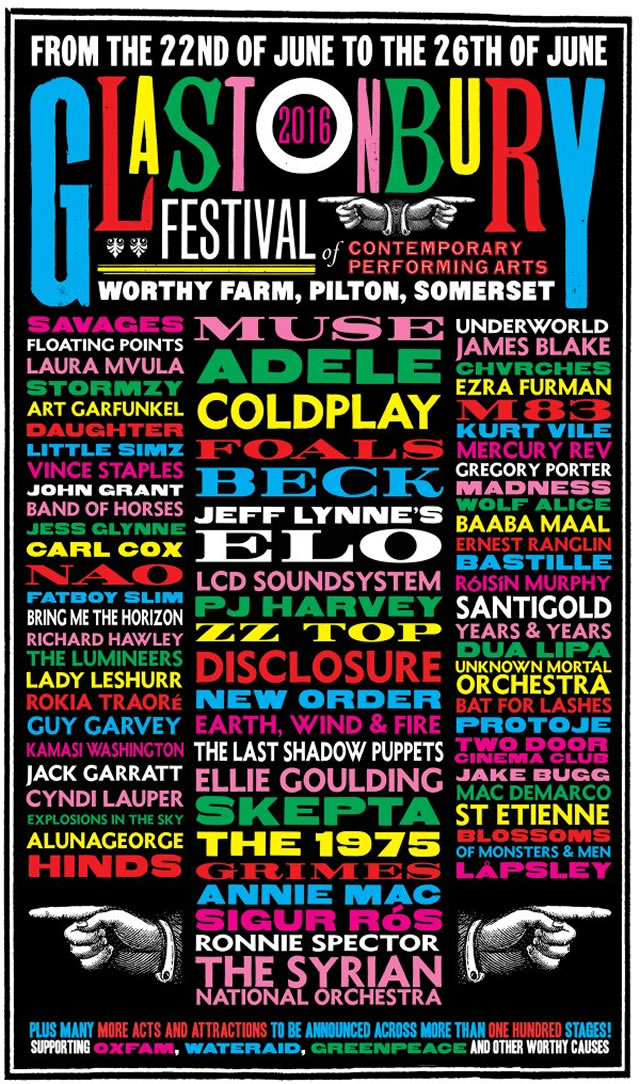

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025 -

Debate Reignites Macrons Party Pushes For Under 15s Hijab Ban

May 24, 2025

Debate Reignites Macrons Party Pushes For Under 15s Hijab Ban

May 24, 2025 -

Silence Impose La Chine Muselle Les Dissidents En France

May 24, 2025

Silence Impose La Chine Muselle Les Dissidents En France

May 24, 2025

Latest Posts

-

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025 -

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025 -

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025