Apple Stock Plunges On $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The projected $900 million in tariffs represents a substantial increase in the cost of importing key Apple products. These tariffs, imposed by [Country imposing tariffs], target several crucial product lines, significantly impacting Apple's bottom line.

-

Affected Products: The tariffs specifically affect several key product lines, including:

- iPhones

- iPads

- MacBooks

- Apple Watches

- AirPods

-

Countries Involved: The tariffs primarily impact imports from [List countries involved in the tariff dispute]. This highlights the complex global supply chains involved in Apple's manufacturing.

-

Basis for Tariff Imposition: The tariffs are purportedly based on [State the reason for tariff imposition, e.g., national security concerns, trade imbalances]. (Link to supporting documentation from a reliable source).

-

Percentage Increase: The tariffs represent a [Percentage]% increase in the cost of importing these goods. This directly impacts Apple's manufacturing costs and, subsequently, its profitability.

Market Reaction and Apple Stock Performance

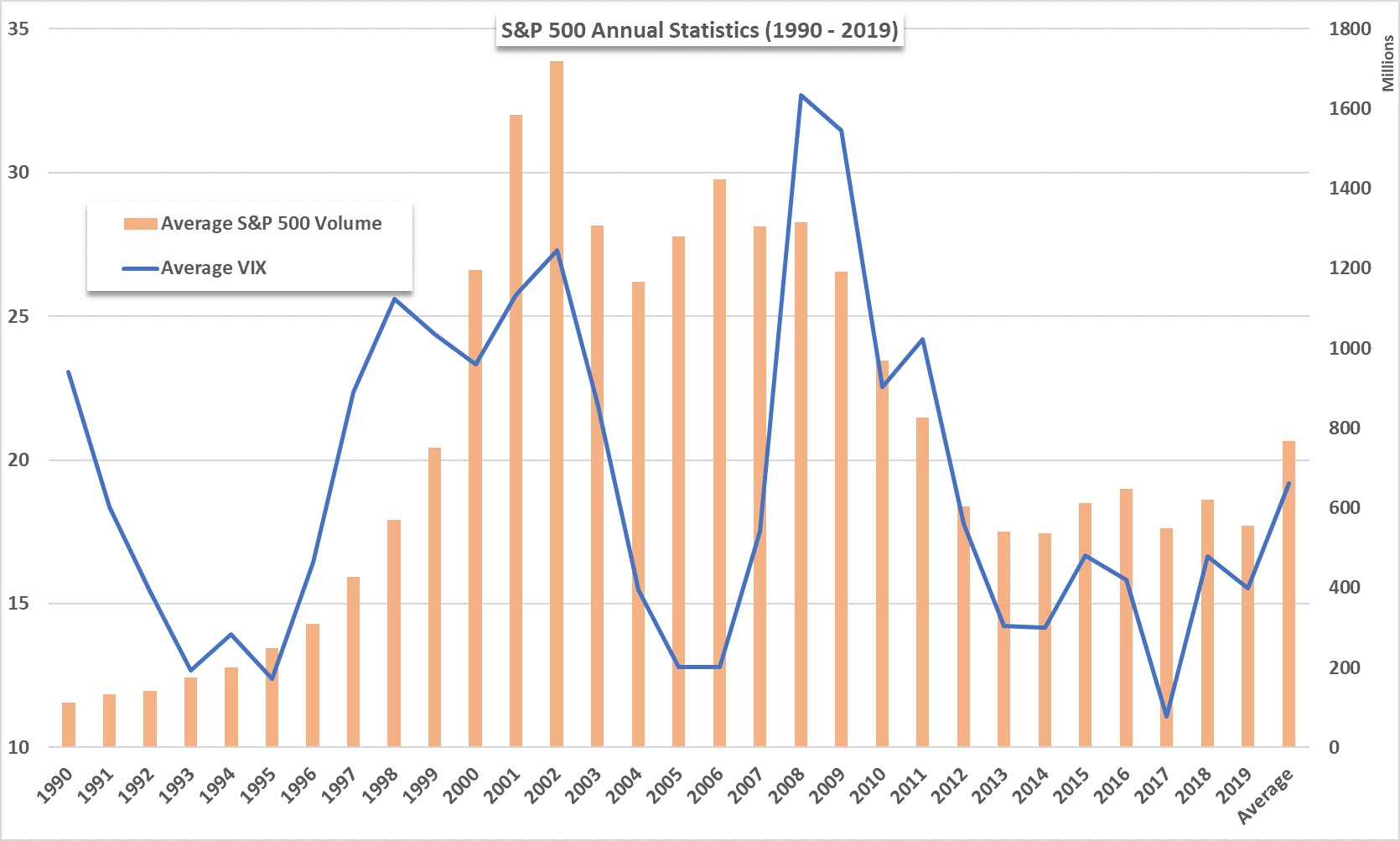

Following the tariff announcement, Apple's stock price experienced a sharp decline. The stock price dropped by [Exact percentage]% to $[Closing price], representing a loss of [Dollar amount] in market capitalization. This plunge occurred within [Timeframe] of the official announcement, indicating a swift and substantial market reaction. Trading volume on the day of the announcement was [Volume data], significantly higher than the average daily volume, reflecting the heightened investor concern. While other tech stocks experienced some downward pressure, the impact on Apple was disproportionately large, reflecting the company's significant reliance on manufacturing and imports from the affected countries.

[Insert a chart or graph here visually representing the stock price fluctuations on the day of the announcement.]

Investor Sentiment and Future Outlook

Investor sentiment regarding Apple stock is currently negative. Many investors are selling off shares, anticipating further negative impact from the tariffs. The long-term effects remain uncertain, but the projected $900 million tariff increase raises concerns about reduced profit margins and potential price increases for consumers. Apple might counter the impact through several strategies:

- Price Increases: Increasing prices on affected products to offset the added tariff costs.

- Shifting Production: Relocating some manufacturing operations to countries outside the scope of these tariffs.

- Negotiations: Engaging in negotiations with the government imposing the tariffs to seek a reduction or exemption.

Analysts' predictions vary, with some suggesting a temporary dip followed by recovery, while others forecast more significant long-term damage.

Geopolitical Implications and Trade Wars

The $900 million tariff projection is not an isolated incident but rather a part of the broader context of ongoing trade tensions between [Mention countries involved in trade war]. These trade wars disrupt global supply chains and create uncertainty for businesses. The tariffs on Apple products may prompt retaliatory measures from other countries, further escalating the trade conflict. This situation highlights the significant geopolitical risks faced by multinational corporations like Apple.

Conclusion: Understanding the Impact of Tariffs on Apple Stock

The Apple stock plunge underscores the significant impact of tariffs on even the most successful companies. The projected $900 million tariff hit represents a major challenge to Apple's profitability and poses considerable uncertainty for its future performance. Both short-term and long-term consequences are substantial, necessitating strategic adjustments by Apple to mitigate the negative impact.

Stay informed about the ongoing impact of tariffs on Apple stock by subscribing to our newsletter for the latest updates. The Apple stock plunge serves as a stark reminder of the significant impact trade policies can have on even the most powerful companies.

Featured Posts

-

Chinas Impact On Bmw And Porsche Are Other Automakers Facing Similar Problems

May 24, 2025

Chinas Impact On Bmw And Porsche Are Other Automakers Facing Similar Problems

May 24, 2025 -

7 Drop In Amsterdam Stock Market Trade War Uncertainty Creates Volatility

May 24, 2025

7 Drop In Amsterdam Stock Market Trade War Uncertainty Creates Volatility

May 24, 2025 -

Escape To The Country Building Your Dream Home In The Countryside

May 24, 2025

Escape To The Country Building Your Dream Home In The Countryside

May 24, 2025 -

Listen Now Joy Crookes Unveils Powerful New Single I Know You D Kill

May 24, 2025

Listen Now Joy Crookes Unveils Powerful New Single I Know You D Kill

May 24, 2025 -

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025

Latest Posts

-

Trumps Threats Prompt Call For Greater Ambition From Canadian Auto Industry

May 24, 2025

Trumps Threats Prompt Call For Greater Ambition From Canadian Auto Industry

May 24, 2025 -

Canadian Automotive Leaders Urge Bold Response To Trump Administration

May 24, 2025

Canadian Automotive Leaders Urge Bold Response To Trump Administration

May 24, 2025 -

Canadian Auto Execs Demand Stronger Action Against Trumps Threats

May 24, 2025

Canadian Auto Execs Demand Stronger Action Against Trumps Threats

May 24, 2025 -

Tva Group Restructuring 30 Job Losses Due To Streaming And Regulatory Challenges

May 24, 2025

Tva Group Restructuring 30 Job Losses Due To Streaming And Regulatory Challenges

May 24, 2025 -

Posthaste Understanding The Implications Of Bond Market Instability

May 24, 2025

Posthaste Understanding The Implications Of Bond Market Instability

May 24, 2025