BSE Shares Poised For Growth: Strong Earnings Forecast

Table of Contents

Strong Corporate Earnings Drive BSE Share Growth

Several major sectors within the BSE are projecting significant increases in both revenue and profit margins. This improved financial health directly translates into higher BSE share prices, creating a positive feedback loop for growth. This robust performance isn't just a flash in the pan; it's driven by fundamental shifts in the Indian economy.

-

Increased consumer spending leading to higher sales for FMCG companies: Rising disposable incomes and a burgeoning middle class are fueling demand for fast-moving consumer goods, leading to impressive profit growth for companies in this sector. This translates directly into higher BSE share prices for these companies.

-

Robust infrastructure development driving growth in construction and related sectors: The Indian government's continued investment in infrastructure projects, including roads, railways, and power generation, is creating significant opportunities for companies in the construction and related sectors. This translates into strong revenue and profit growth, boosting the BSE share prices of these companies.

-

Technological advancements fueling growth in the IT and software sectors: India's burgeoning IT sector continues to attract global attention, driven by innovation and the increasing demand for software solutions. This is a key driver of BSE share price growth in this sector. The adoption of digital technologies across various industries further strengthens this trend.

-

Government initiatives boosting specific industries like renewable energy: Government policies promoting renewable energy sources are creating a surge in investment and growth in this sector. This proactive approach is generating significant opportunities and contributing positively to BSE share valuations.

Positive Economic Indicators Fueling Investor Confidence in BSE Shares

Positive macroeconomic indicators are bolstering investor confidence and fueling investment in BSE shares. A stable and growing economy provides a fertile ground for stock market growth. Several key factors are contributing to this positive sentiment:

-

Stable GDP growth exceeding expectations: India's consistent GDP growth, exceeding many forecasts, demonstrates the resilience and strength of the Indian economy. This steady growth provides a strong foundation for BSE share price appreciation.

-

Controlled inflation within the target range: The Reserve Bank of India's success in keeping inflation under control instills confidence among investors, reducing the risk associated with investments in BSE shares. This stability attracts both domestic and foreign investment.

-

Favorable interest rate environment encouraging borrowing and investment: Lower interest rates make borrowing cheaper for businesses and individuals, encouraging investment and economic activity. This positive environment supports the growth of companies listed on the BSE and boosts investor sentiment.

-

Increased foreign investment flowing into the Indian stock market: Foreign institutional investors (FIIs) are increasingly viewing the Indian stock market as an attractive destination for investment, further boosting the demand for BSE shares and driving up prices.

Sector-Specific Analysis: Identifying High-Growth BSE Shares

Identifying high-growth BSE shares requires a detailed sectoral analysis. While the overall market is showing strength, some sectors are poised for even greater growth. Careful research and understanding of market trends are crucial for successful stock picking.

-

Pharmaceuticals: Strong growth is driven by increasing healthcare expenditure and the rise of generic drug manufacturers. This sector presents attractive investment opportunities within the BSE.

-

Technology: Continued innovation and digital transformation across industries are driving strong demand for technology solutions. This sector remains a key growth driver for the BSE.

-

Financials: Growth is fueled by rising credit demand and financial inclusion initiatives, making this a sector with significant long-term potential for BSE investors.

-

Consumer Discretionary: This sector is benefiting from increasing consumer spending power, providing opportunities for strong returns on BSE shares within this category.

Risk Mitigation Strategies for Investing in BSE Shares

While the outlook for BSE shares is positive, it's vital to implement risk mitigation strategies. Market volatility is inherent, and a well-defined strategy is essential for protecting your investment.

-

Diversify your portfolio across different sectors and asset classes: Don't put all your eggs in one basket. Diversification reduces risk and improves the resilience of your investment portfolio.

-

Conduct thorough due diligence before investing in any specific stock: Research the company's financials, management team, and competitive landscape before making any investment decisions.

-

Set realistic investment goals and manage your risk tolerance: Understand your own risk profile and choose investments that align with your comfort level and financial goals.

-

Consider consulting with a financial advisor: A professional advisor can provide personalized guidance and help you develop a suitable investment strategy.

Conclusion

The strong earnings forecast and positive economic indicators paint a compelling picture for the future of BSE shares. This presents significant investment opportunities, but success requires a strategic approach. Conduct thorough research, diversify your portfolio, and consider professional advice to maximize your returns while mitigating risks. Start exploring the exciting potential of BSE shares today and capitalize on this bullish market! Don't miss out on the growth opportunities available in the thriving Indian stock market – start investing in BSE shares now.

Featured Posts

-

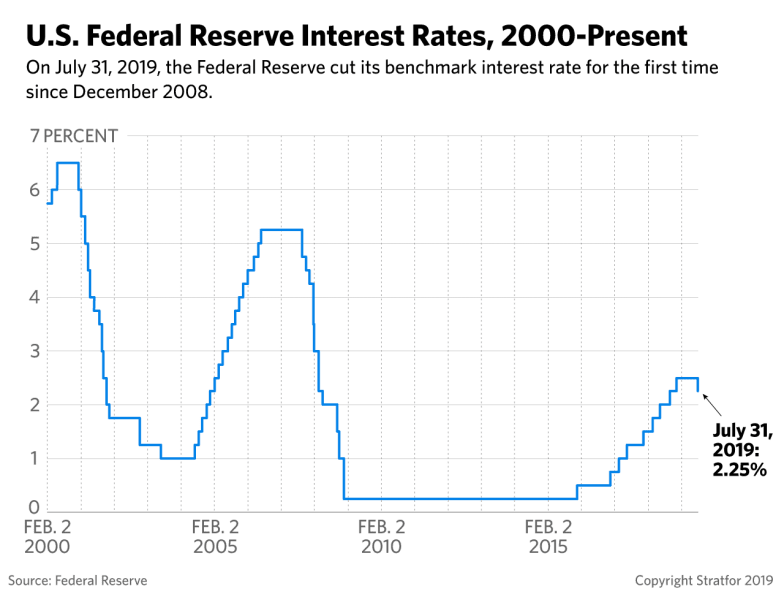

Powells Fed And Interest Rate Cuts A Risky Gamble Against Time And Trumps Demands

May 07, 2025

Powells Fed And Interest Rate Cuts A Risky Gamble Against Time And Trumps Demands

May 07, 2025 -

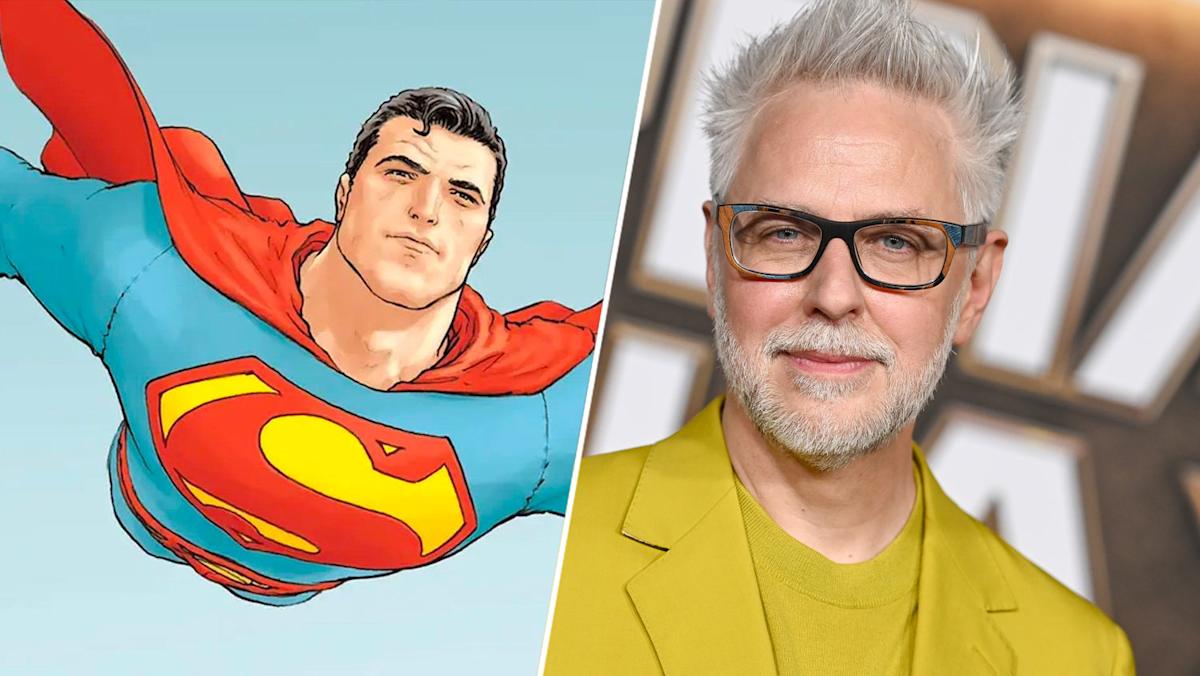

Dcs Superman James Gunn Shares Key Detail About Hawkgirls Wings

May 07, 2025

Dcs Superman James Gunn Shares Key Detail About Hawkgirls Wings

May 07, 2025 -

Vozvraschenie Ovechkina V Moskovskoe Dinamo Podrobnosti

May 07, 2025

Vozvraschenie Ovechkina V Moskovskoe Dinamo Podrobnosti

May 07, 2025 -

Understanding Ontarios Proposed Manufacturing Tax Credit Expansion

May 07, 2025

Understanding Ontarios Proposed Manufacturing Tax Credit Expansion

May 07, 2025 -

Isabela Merced Prefers Hawkgirl To Madame Web Heres Why

May 07, 2025

Isabela Merced Prefers Hawkgirl To Madame Web Heres Why

May 07, 2025

Latest Posts

-

Ke Huy Quans Surprise Voice Cameo In The White Lotus

May 07, 2025

Ke Huy Quans Surprise Voice Cameo In The White Lotus

May 07, 2025 -

Long Term Xrp Ripple Investment Is It A Smart Financial Decision

May 07, 2025

Long Term Xrp Ripple Investment Is It A Smart Financial Decision

May 07, 2025 -

A Beginners Guide To Xrp Ripple Investment Risks And Opportunities

May 07, 2025

A Beginners Guide To Xrp Ripple Investment Risks And Opportunities

May 07, 2025 -

Xrp Ripple Investment Strategy Diversification And Risk Management

May 07, 2025

Xrp Ripple Investment Strategy Diversification And Risk Management

May 07, 2025 -

Evaluating Xrp Ripple Is It A Viable Investment For Retirement Planning

May 07, 2025

Evaluating Xrp Ripple Is It A Viable Investment For Retirement Planning

May 07, 2025