XRP (Ripple) Investment Strategy: Diversification And Risk Management

Table of Contents

Understanding XRP's Volatility and Market Dynamics

XRP's price is influenced by a complex interplay of factors. Understanding these dynamics is crucial for any successful XRP price prediction and effective risk management. XRP volatility is largely driven by:

-

Regulatory uncertainty: The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price. Positive developments can lead to price surges, while negative news can trigger sharp drops. Analyzing regulatory updates is vital for XRP price analysis.

-

Technological advancements: Ripple's ongoing development and adoption of its technology by financial institutions directly influence XRP's value. Improvements to its speed, scalability, and functionality can boost investor confidence and drive up the Ripple market cap.

-

Competition from other cryptocurrencies: The cryptocurrency market is fiercely competitive. The emergence of new cryptocurrencies or increased adoption of existing ones can affect XRP's market share and, consequently, its price.

-

Macroeconomic factors: Broader economic conditions, including inflation, interest rates, and global economic uncertainty, significantly influence the entire cryptocurrency market, including XRP. These macroeconomic factors can impact investor sentiment and XRP price prediction.

Understanding these factors is key to making informed decisions in your XRP investment strategy. Monitoring news, conducting thorough XRP price analysis, and staying abreast of market trends are essential for effective risk management.

Diversification: Spreading Your Investment Risk

Diversification is paramount in minimizing risk within any investment portfolio, and a cryptocurrency portfolio is no exception. Relying solely on a single asset, like XRP, exposes you to significant volatility. A well-diversified portfolio spreads your risk across different asset classes. This approach helps to cushion the impact of potential losses in one area.

-

Allocating a percentage of your investment portfolio to XRP: Determine how much of your overall investment capital you're comfortable allocating to XRP. This percentage will depend on your risk tolerance and investment goals.

-

Investing in a diversified basket of cryptocurrencies: Don't put all your eggs in one basket. Diversify across various cryptocurrencies with different use cases and market caps. This reduces reliance on a single asset's performance.

-

Consider your risk tolerance: A conservative investor might allocate a smaller percentage to XRP and diversify more broadly, while a more aggressive investor might allocate a larger portion but still diversify to mitigate risk.

-

Examples of diversified portfolios incorporating XRP: A sample portfolio might allocate 10% to XRP, 20% to Bitcoin, 20% to Ethereum, and 50% to traditional assets like stocks and bonds. The ideal allocation will vary depending on individual circumstances and risk appetite. This demonstrates a practical application of cryptocurrency portfolio diversification.

Risk Management Techniques for XRP Investments

Effective risk management is crucial for navigating the volatility of the XRP market. Implementing strategies like dollar-cost averaging (DCA) and setting stop-loss orders can significantly reduce your potential losses.

-

Dollar-cost averaging (DCA): Instead of investing a lump sum, DCA involves investing smaller amounts of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a large sum at a market peak.

-

Setting stop-loss orders: A stop-loss order automatically sells your XRP if the price falls to a predetermined level, limiting potential losses. This is a crucial tool in crypto trading strategies.

-

Thorough research and due diligence: Before investing in XRP or any cryptocurrency, conduct thorough research to understand its fundamentals, potential risks, and market dynamics.

-

Understanding your risk tolerance: Invest only the amount you're comfortable losing. Your investment strategy should always align with your risk tolerance.

Long-Term vs. Short-Term XRP Investment Strategies

Your choice between a long-term (HODLing) or short-term trading strategy depends heavily on your risk tolerance and investment goals.

-

Long-term HODLing: This strategy involves buying and holding XRP for an extended period, regardless of short-term price fluctuations. The advantage lies in the potential for significant long-term growth, but it requires patience and tolerance for short-term volatility.

-

Short-term trading: This involves frequent buying and selling of XRP based on short-term price movements. It offers the potential for quick profits but also carries a much higher risk of loss.

-

Choosing the right strategy: Consider your investment timeline and risk appetite. If you're comfortable with risk and have a shorter timeframe, short-term trading might be an option. If you have a longer investment horizon and prioritize capital preservation, HODLing might be a better fit.

-

Tax implications: Remember to factor in the tax implications of short-term versus long-term capital gains. Short-term gains are usually taxed at a higher rate.

Conclusion: Crafting Your XRP (Ripple) Investment Strategy

Developing a successful XRP (Ripple) investment strategy requires a careful balance between aiming for potential gains and effectively managing risk. This involves understanding XRP's volatility, diversifying your portfolio, and employing risk management techniques like DCA and stop-loss orders. Choosing between long-term HODLing and short-term trading should align with your risk tolerance and investment goals. Remember to conduct thorough research, understand your risk tolerance, and tailor your strategy to your individual circumstances. By carefully considering these factors, you can create a comprehensive XRP (Ripple) investment strategy that balances potential rewards with responsible risk management. To further enhance your understanding, consider exploring resources on cryptocurrency investment strategies. Remember, while aiming for potential growth with XRP, responsible risk management is key.

Featured Posts

-

Jenna Ortega And Glen Powell New Fantasy Film To Start Filming In London

May 07, 2025

Jenna Ortega And Glen Powell New Fantasy Film To Start Filming In London

May 07, 2025 -

Wnba Preseason Showdown Notre Dame Stars Return To South Bend

May 07, 2025

Wnba Preseason Showdown Notre Dame Stars Return To South Bend

May 07, 2025 -

E Cj

May 07, 2025

E Cj

May 07, 2025 -

Why Middle Managers Are Essential For Company Success

May 07, 2025

Why Middle Managers Are Essential For Company Success

May 07, 2025 -

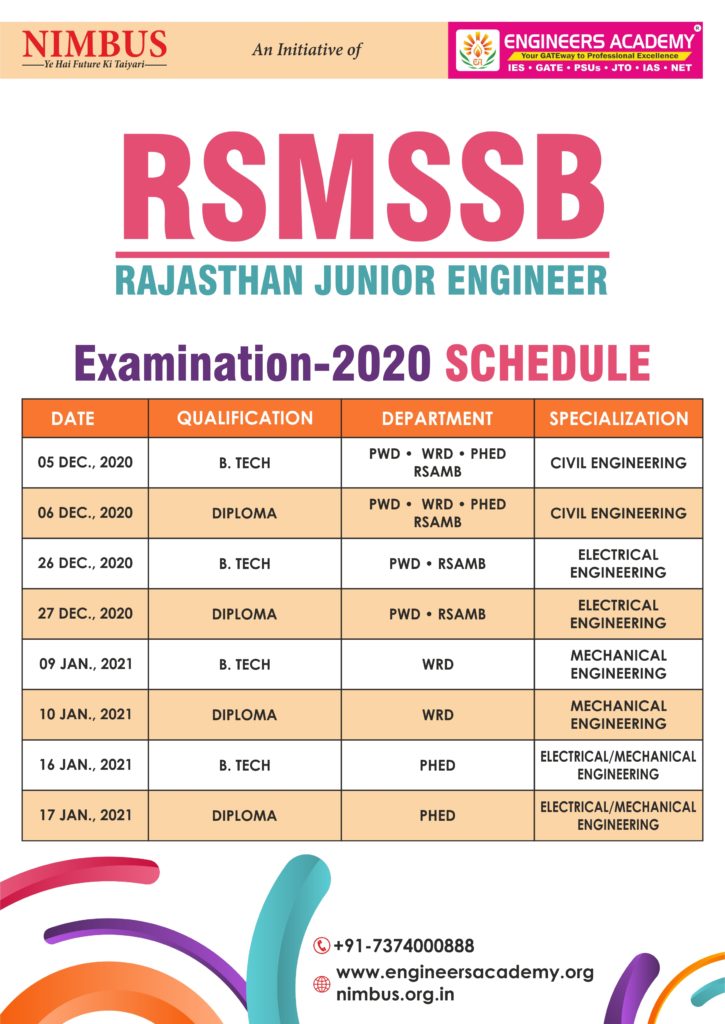

Complete Guide To The Rsmssb Exam Calendar 2025 26

May 07, 2025

Complete Guide To The Rsmssb Exam Calendar 2025 26

May 07, 2025

Latest Posts

-

Thunder Vs Pacers Full Injury Report For March 29th

May 08, 2025

Thunder Vs Pacers Full Injury Report For March 29th

May 08, 2025 -

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025 -

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025 -

Thunder Vs Pacers Injury News Will Key Players Suit Up On March 29

May 08, 2025

Thunder Vs Pacers Injury News Will Key Players Suit Up On March 29

May 08, 2025 -

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025