A Beginner's Guide To XRP (Ripple) Investment: Risks And Opportunities

Table of Contents

Understanding XRP and Ripple

XRP is a cryptocurrency designed to facilitate fast and low-cost cross-border payments. It's the native token of the Ripple network, a technology designed to improve the efficiency of global financial transactions. Unlike cryptocurrencies like Bitcoin, which rely on blockchain technology, Ripple uses a unique consensus mechanism. Ripple's target audience is primarily banks and other financial institutions looking to streamline their payment processes. The RippleNet, Ripple's payment network, utilizes XRP to enable near real-time transfers across borders.

- XRP's role: XRP acts as a bridge currency, facilitating faster and cheaper cross-border payments between different financial institutions.

- Ripple vs. XRP: Ripple is the company behind the technology and network, while XRP is the cryptocurrency that powers the network's transactions. It's crucial to understand this distinction.

- Unique features: XRP boasts significantly faster transaction speeds and lower fees compared to many other cryptocurrencies, making it attractive for large-scale financial transactions.

Potential Benefits of XRP Investment

While XRP investment carries significant risks (discussed below), the potential for high returns is a key attraction for many investors. The growing adoption of Ripple's technology by financial institutions globally fuels this potential.

- XRP price performance: Historical XRP price data shows periods of significant gains and losses, highlighting the inherent volatility of the cryptocurrency market. Past performance, however, is not indicative of future results.

- Future price appreciation: Increased adoption of RippleNet by banks and financial institutions could drive future price appreciation. Technological advancements and partnerships could also positively impact XRP's value.

- Portfolio diversification: Including XRP in a diversified investment portfolio can help reduce overall risk, provided the investor understands and accepts the risks associated with XRP's volatility.

Risks Associated with XRP Investment

The cryptocurrency market, including XRP, is extremely volatile. Investing in XRP involves significant risk, and investors could experience substantial losses.

- Price fluctuations: The XRP price is highly susceptible to market speculation, news events, and regulatory changes, leading to dramatic price swings.

- Regulatory risks: The ongoing legal battles faced by Ripple have created significant regulatory uncertainty, impacting investor confidence and XRP's price. The outcome of these legal challenges remains uncertain.

- Security risks: As with all cryptocurrencies, there are security risks associated with storing and trading XRP. Investors need to take precautions to secure their digital wallets and protect against hacking and theft.

- Counterparty risk: Ripple's partnerships with financial institutions introduce counterparty risk. If a major partner encounters financial difficulties, it could negatively affect XRP's value.

How to Invest in XRP

Investing in XRP typically involves purchasing it on a cryptocurrency exchange and storing it in a secure digital wallet.

- Choosing an exchange: Select a reputable and secure cryptocurrency exchange with a proven track record and robust security measures.

- Setting up a wallet: Utilize a secure hardware or software wallet to store your XRP securely, minimizing the risk of theft or loss.

- Trading fees: Understand the fees associated with buying, selling, and transferring XRP. These fees can vary across different exchanges.

- Diversification: Avoid putting all your investment eggs in one basket. Diversify your holdings across other assets to mitigate risk.

Due Diligence and Research before XRP Investment

Before investing in XRP, thorough research and due diligence are paramount. Understanding the risks and potential rewards is crucial before committing any capital.

- Market analysis: Analyze XRP's market capitalization, trading volume, and overall market sentiment.

- Competitive landscape: Understand the competitive landscape within the cryptocurrency market and XRP's position relative to other cryptocurrencies.

- Ripple's financials: Evaluate Ripple's financial health, technological advancements, and overall business strategy.

- Risk tolerance: Assess your personal risk tolerance and ensure that XRP investment aligns with your broader financial goals. Consult with a financial advisor before making any decisions.

Conclusion

Investing in XRP offers the potential for significant returns but carries substantial risks. This beginner's guide to XRP investment has highlighted the key aspects to consider before allocating capital to this volatile asset. Remember that thorough research and understanding the inherent risks are crucial for any XRP investment strategy. Before making any investment decisions, always conduct your own due diligence and consult with a qualified financial advisor. Start your journey into the world of XRP investment wisely and cautiously. Learn more about effective XRP investment strategies and manage your risks responsibly.

Featured Posts

-

Najnovejse Novice O Papezevem Zdravstvenem Stanju

May 07, 2025

Najnovejse Novice O Papezevem Zdravstvenem Stanju

May 07, 2025 -

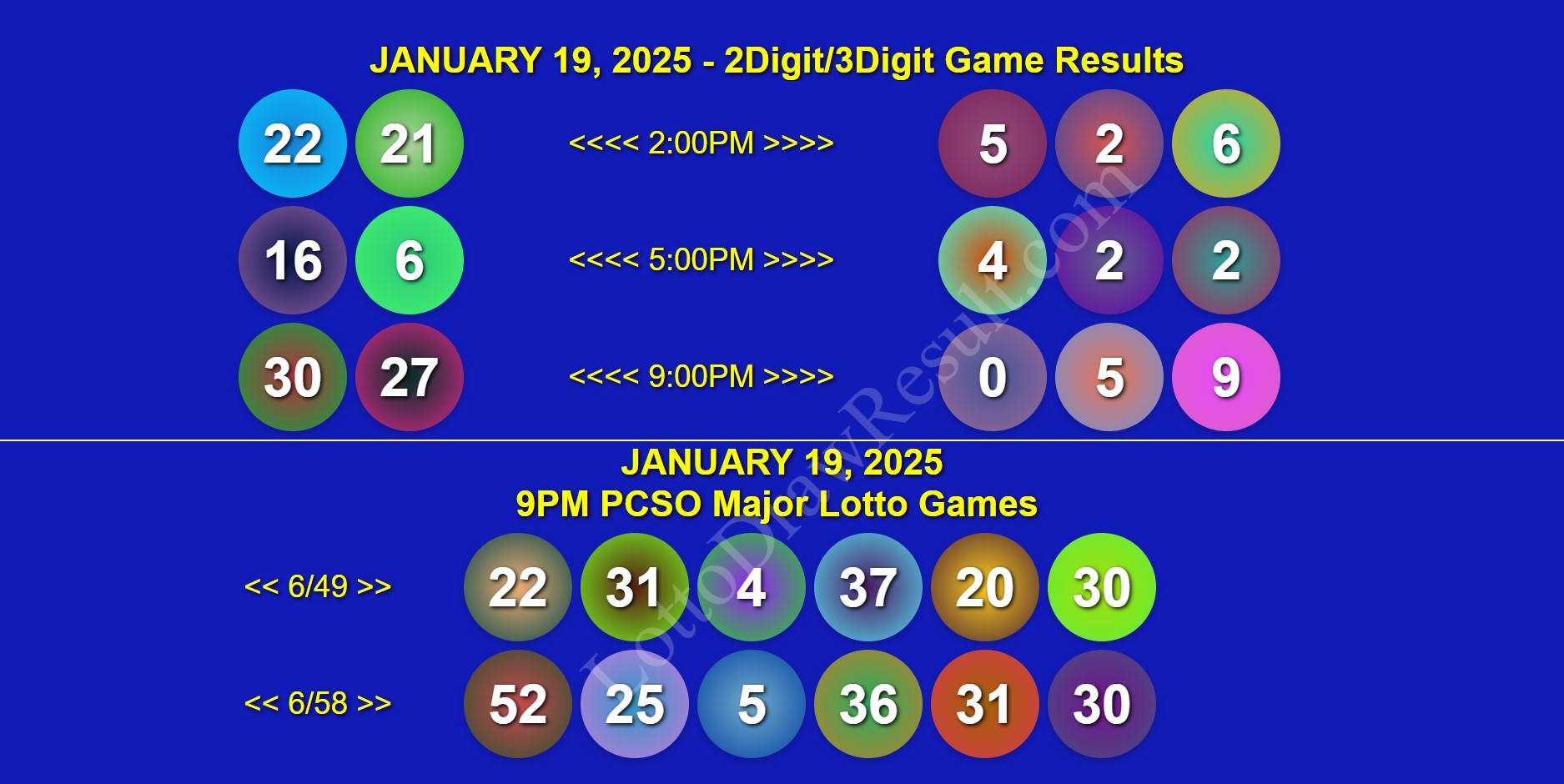

April 18 2025 Daily Lotto Results

May 07, 2025

April 18 2025 Daily Lotto Results

May 07, 2025 -

Isabela Merced On Playing Hawkgirl An Improvement Over Madame Web

May 07, 2025

Isabela Merced On Playing Hawkgirl An Improvement Over Madame Web

May 07, 2025 -

Become Baba Yaga Your John Wick Experience In Las Vegas

May 07, 2025

Become Baba Yaga Your John Wick Experience In Las Vegas

May 07, 2025 -

Przejazd Kolejowy Smierci Piecioosobowa Rodzina I Bezkarnosc Sprawcow

May 07, 2025

Przejazd Kolejowy Smierci Piecioosobowa Rodzina I Bezkarnosc Sprawcow

May 07, 2025

Latest Posts

-

Xrp Rising The Impact Of Recent Trump News

May 08, 2025

Xrp Rising The Impact Of Recent Trump News

May 08, 2025 -

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025 -

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025