Powell's Fed And Interest Rate Cuts: A Risky Gamble Against Time And Trump's Demands

Table of Contents

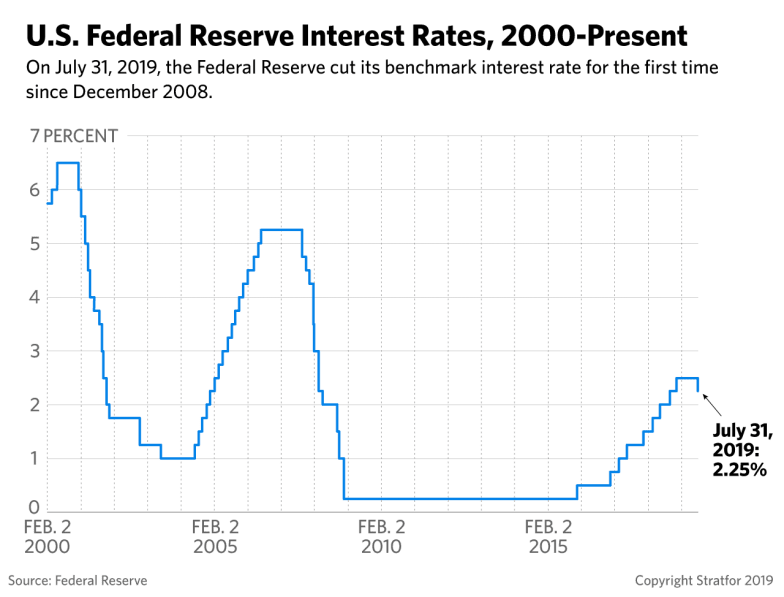

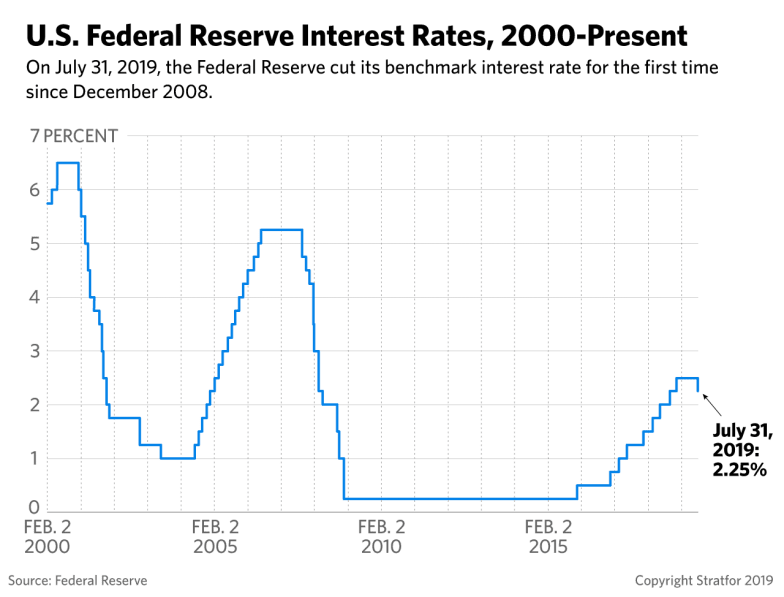

Jerome Powell, as Chairman of the Federal Reserve, holds the immense responsibility of managing the US monetary policy. His decisions directly impact interest rates, inflation, and ultimately, the health of the American economy. The recent series of interest rate cuts by Powell's Fed are a controversial maneuver, undertaken amidst a complex interplay of economic indicators and political pressure.

The Economic Justification (or Lack Thereof) for Rate Cuts

The decision to cut interest rates wasn't made in a vacuum. Several weak economic indicators influenced the Federal Reserve's actions.

Weak Economic Indicators

-

Slowing GDP Growth: Recent GDP growth figures have fallen below expectations, signaling a potential slowdown in economic activity. For example, [cite source for specific GDP figures], indicating a significant deceleration compared to previous quarters. [Cite another source with contrasting data if applicable for balanced perspective].

-

Muted Inflation: Inflation remains stubbornly low, suggesting a lack of robust economic demand. This could indicate a weakening economy, necessitating stimulative measures like interest rate cuts. [Cite source for inflation data].

-

Uncertainty in the Global Economy: Global trade tensions and geopolitical uncertainty are dampening business investment and consumer confidence, further contributing to the slowing economy. [Cite source discussing global economic uncertainty].

-

Criticisms of the Data: It's crucial to acknowledge that economic data can be subject to interpretation. Some economists argue that the current weakness is temporary and doesn't warrant aggressive rate cuts, preferring a "wait-and-see" approach. [Cite source for opposing viewpoints].

The Preemptive Strike Argument

The Fed's strategy can be viewed as a preemptive strike against a potential recession. By lowering interest rates proactively, the hope is to boost borrowing, investment, and consumer spending, preventing a deeper downturn.

- Pros of a Preemptive Strategy: Preventing a recession is a paramount goal. Early intervention can mitigate the severity of an economic contraction.

- Cons of a Preemptive Strategy: Preemptive rate cuts risk fueling inflation if the economy proves more resilient than anticipated. Furthermore, this approach might lead to excessive risk-taking in the financial markets.

- Limitations of Monetary Policy: Interest rate cuts are not a silver bullet. Their effectiveness diminishes when other factors, such as low consumer confidence or high levels of debt, are at play. Fiscal policy (government spending and taxation) may be a more effective tool in certain economic situations.

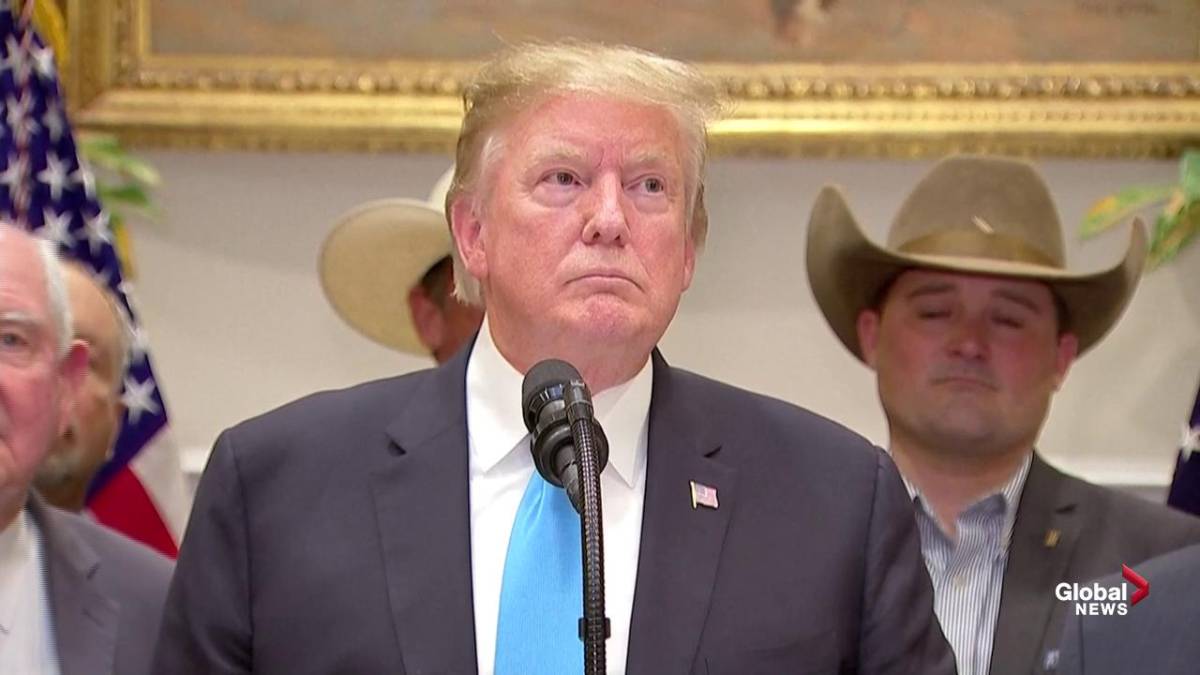

Political Pressure and the Trump Administration's Influence

President Trump's consistent public criticism of the Federal Reserve and its interest rate policies has introduced a significant political dimension to Powell's decisions.

Trump's Public Criticism of the Fed

- Direct Calls for Rate Cuts: President Trump has repeatedly called for lower interest rates, publicly criticizing the Fed for not cutting rates aggressively enough. [Insert links to specific instances of Trump's public statements criticizing the Fed].

- Attacks on Fed Independence: Trump's criticisms raise concerns about the Fed's independence and its ability to make unbiased decisions based solely on economic data. This political pressure can undermine the Fed's credibility and its effectiveness in managing the economy. [Cite articles discussing concerns over Fed independence].

The Political Risks of Rate Cuts

The success or failure of Powell's interest rate cuts carries significant political risk for both the Trump administration and the Fed itself.

- Scenario for Success: If the rate cuts stimulate the economy and prevent a recession, it could boost Trump's chances in the upcoming election.

- Scenario for Failure: If the rate cuts prove ineffective and a recession occurs, it could severely damage Trump's re-election prospects and severely damage the Fed's reputation. [Discuss potential impact on upcoming elections].

- Long-Term Damage to the Fed's Reputation: The perception of the Fed being influenced by political pressure could erode public trust in its ability to manage the economy effectively.

The Long-Term Risks of Interest Rate Cuts

While the immediate goal of Powell's Fed and interest rate cuts might be to stimulate the economy, several long-term risks need consideration.

The Risk of Inflation

Lower interest rates can lead to increased borrowing and spending, potentially igniting inflation.

- Historical Precedents: [Provide examples from economic history where interest rate cuts led to subsequent inflation].

- Alternative Stimuli: Government spending on infrastructure projects or tax cuts could stimulate the economy without the same inflation risk as interest rate cuts.

The Diminishing Returns of Monetary Policy

The effectiveness of monetary policy, especially interest rate cuts, can diminish over time. Continued reliance on this tool may yield minimal impact.

- Examples of Diminishing Returns: [Cite examples where interest rate cuts had limited impact on economic growth].

- Alternative Approaches: The Fed might need to explore alternative strategies such as quantitative easing or other unconventional monetary policies.

Conclusion

Powell's Fed and interest rate cuts represent a high-stakes gamble. Driven by both genuine economic concerns and significant political pressure, these decisions carry the potential for both short-term gains and substantial long-term risks. The possibility of increased inflation and the diminishing returns of continued reliance on monetary policy create serious cause for concern. The interplay of economic data and political influence complicates the situation further, threatening the Fed's independence and long-term credibility. It is crucial to remain informed about the evolving economic situation and the implications of Powell's Fed and interest rate cuts. Continue to research the topic by reading reputable economic news sources and analyzing data from independent research institutions. The future economic health of the nation depends on understanding this complex issue.

Featured Posts

-

The Impact Of Celebrities On Who Wants To Be A Millionaire A Look At The Special Edition

May 07, 2025

The Impact Of Celebrities On Who Wants To Be A Millionaire A Look At The Special Edition

May 07, 2025 -

A Las Vegas John Wick Adventure Play The Part Of Baba Yaga

May 07, 2025

A Las Vegas John Wick Adventure Play The Part Of Baba Yaga

May 07, 2025 -

The Trae Young Travel Debate Were The Refs Too Lenient

May 07, 2025

The Trae Young Travel Debate Were The Refs Too Lenient

May 07, 2025 -

March 14th Cavaliers Grizzlies Game Whos Injured

May 07, 2025

March 14th Cavaliers Grizzlies Game Whos Injured

May 07, 2025 -

Chestit Rozhden Den Dzheki Chan 71 Godini Izplneni S Ekshn

May 07, 2025

Chestit Rozhden Den Dzheki Chan 71 Godini Izplneni S Ekshn

May 07, 2025

Latest Posts

-

Carney Calls Trump Transformational In D C Meeting

May 08, 2025

Carney Calls Trump Transformational In D C Meeting

May 08, 2025 -

Carneys Assessment Trump A Transformational President

May 08, 2025

Carneys Assessment Trump A Transformational President

May 08, 2025 -

Trump On Cusma Positive Assessment But Termination Remains A Possibility

May 08, 2025

Trump On Cusma Positive Assessment But Termination Remains A Possibility

May 08, 2025 -

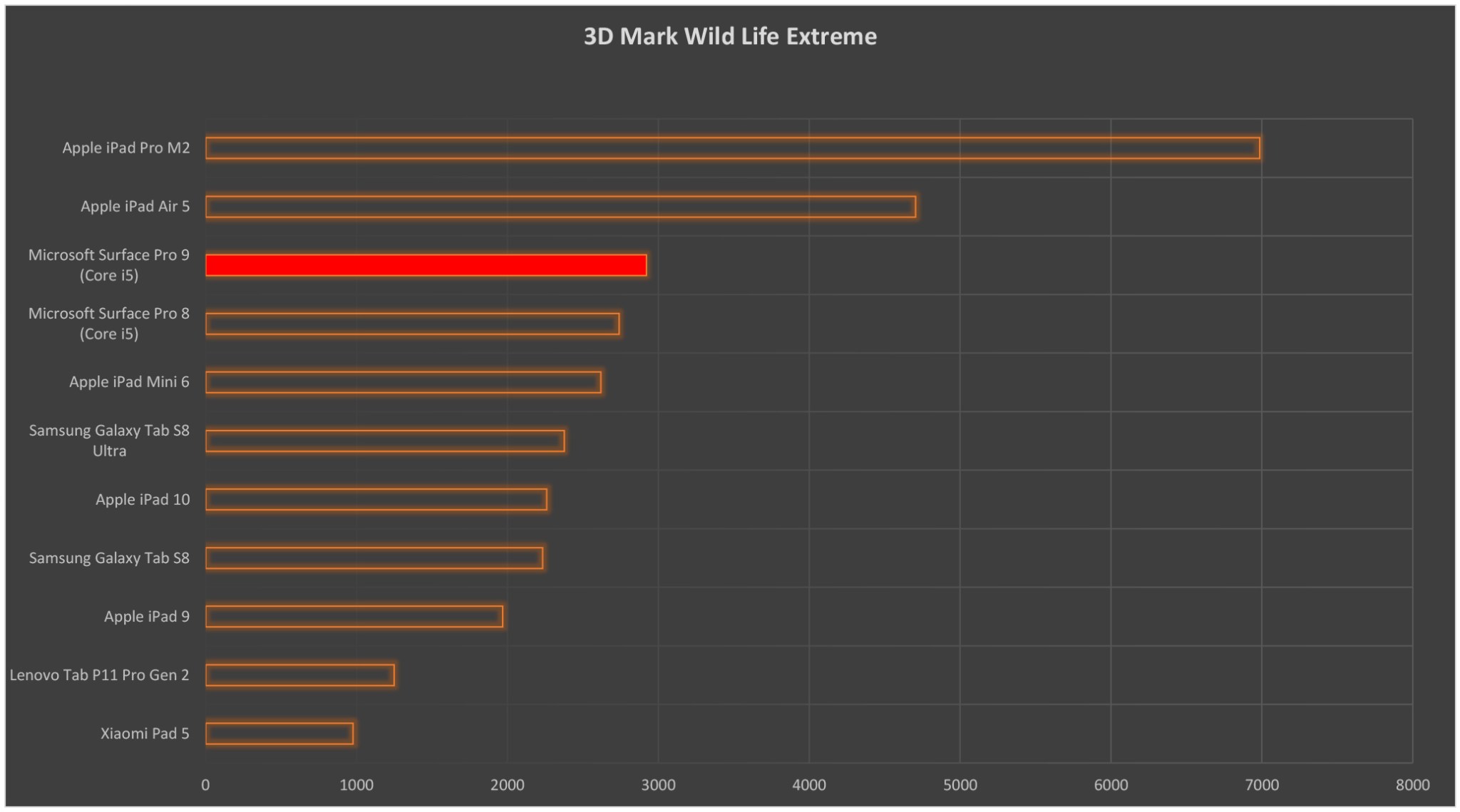

Is The 799 12 Inch Surface Pro Right For You

May 08, 2025

Is The 799 12 Inch Surface Pro Right For You

May 08, 2025 -

Cusma Trump Declares It Beneficial Yet Leaves Open The Possibility Of Termination

May 08, 2025

Cusma Trump Declares It Beneficial Yet Leaves Open The Possibility Of Termination

May 08, 2025