Bitcoin Mining Power Soars: Unpacking This Week's Events

Table of Contents

Factors Contributing to the Surge in Bitcoin Mining Power

Several converging factors have contributed to this dramatic increase in Bitcoin mining power.

Increased Adoption of ASIC Miners

The rise of more efficient and powerful Application-Specific Integrated Circuit (ASIC) miners is a primary driver. These specialized machines are designed solely for Bitcoin mining, offering significantly improved hash rates compared to their predecessors.

- New ASIC Models: Recent releases from leading manufacturers like Bitmain and MicroBT boast substantially higher hash rates and improved energy efficiency. This allows miners to generate more Bitcoin with less energy consumption, increasing profitability.

- Improved Energy Efficiency: Advances in chip design and manufacturing processes have led to a significant reduction in the energy consumed per unit of hashing power. This makes mining more economical, particularly in regions with higher electricity costs.

- Mining Profitability: The combination of higher hash rates and improved energy efficiency directly impacts mining profitability. Increased profitability attracts new miners and encourages existing miners to expand their operations.

Expansion of Mining Farms in Favorable Regions

The geographical distribution of Bitcoin mining farms plays a crucial role in the overall hash rate. Regions offering low electricity costs and favorable regulatory environments are attracting substantial investment in mining infrastructure.

- Low Electricity Costs: Areas like Kazakhstan, Texas, and parts of the Middle East, with access to cheap hydropower or abundant renewable energy sources, are becoming hubs for large-scale Bitcoin mining operations.

- Bitcoin Mining Regulations: Regulatory clarity and supportive policies, or at least the absence of outright bans, encourage investment in Bitcoin mining infrastructure within a given region. Conversely, stricter regulations can stifle growth.

- Geographical Distribution: The decentralized nature of Bitcoin mining is further enhanced by this geographical spread, making the network more resilient to localized disruptions or regulatory crackdowns.

The Impact of Bitcoin's Price

Bitcoin's price acts as a powerful incentive for miners. Higher prices translate directly into increased profitability, attracting new entrants and motivating existing miners to expand their operations.

- Miner Incentives: When the Bitcoin price is high, the rewards for successful mining blocks are significantly more valuable, making the investment in mining hardware and electricity more attractive.

- Price, Profitability, and Hash Rate: A strong positive correlation exists between Bitcoin's price, mining profitability, and the overall hash rate. As the price rises, so does the incentive to mine, resulting in a higher hash rate.

Implications of the Increased Bitcoin Mining Power

The surge in Bitcoin mining power has significant implications across several key areas.

Enhanced Network Security

The increased hash rate significantly strengthens the Bitcoin network's security against attacks, particularly 51% attacks.

- Decentralization and Mining Power: A higher hash rate contributes to the decentralization of the network, distributing mining power across a wider geographic area and making it exponentially more difficult for a single entity to control a majority of the network's computing power.

- 51% Attack Resistance: The cost and difficulty of launching a 51% attack increase dramatically with a higher hash rate, making such attacks practically infeasible. This enhances the overall security and stability of the Bitcoin blockchain.

Potential Impact on Bitcoin's Price

The impact of increased Bitcoin mining power on its price is complex and multifaceted.

- Mining Difficulty: As the hash rate increases, the Bitcoin network automatically adjusts the mining difficulty to maintain a consistent block generation time. This increased difficulty might slightly reduce profitability for some miners in the short term.

- Investor Confidence: A more secure network, bolstered by a higher hash rate, generally increases investor confidence, which can positively impact Bitcoin's price in the long term.

- Market Volatility: While a more secure network is positive, other market factors can still drive significant price volatility.

Environmental Concerns

The significant energy consumption of Bitcoin mining remains a considerable environmental concern.

- Bitcoin Mining Energy Consumption: The vast computational power required for Bitcoin mining consumes substantial amounts of electricity, raising concerns about its carbon footprint.

- Renewable Energy: Initiatives promoting the adoption of renewable energy sources for Bitcoin mining are crucial to mitigate the environmental impact.

- Sustainable Bitcoin Mining: The industry is actively exploring more sustainable mining practices, including the utilization of excess renewable energy and improved energy efficiency technologies.

Conclusion

The recent surge in Bitcoin mining power, driven by factors like the adoption of advanced ASIC miners, expansion of mining farms in favorable regions, and the influence of Bitcoin's price, has profoundly impacted the cryptocurrency landscape. This increase enhances network security, potentially influences Bitcoin's price, and necessitates a focus on sustainable mining practices to address environmental concerns. To stay informed about the evolving dynamics of Bitcoin mining, monitor Bitcoin mining power and track Bitcoin's hash rate, understanding these trends is critical for navigating the future of this crucial aspect of the cryptocurrency ecosystem. For further insights, you can explore resources like [link to a relevant resource, e.g., a mining pool website or news site].

Featured Posts

-

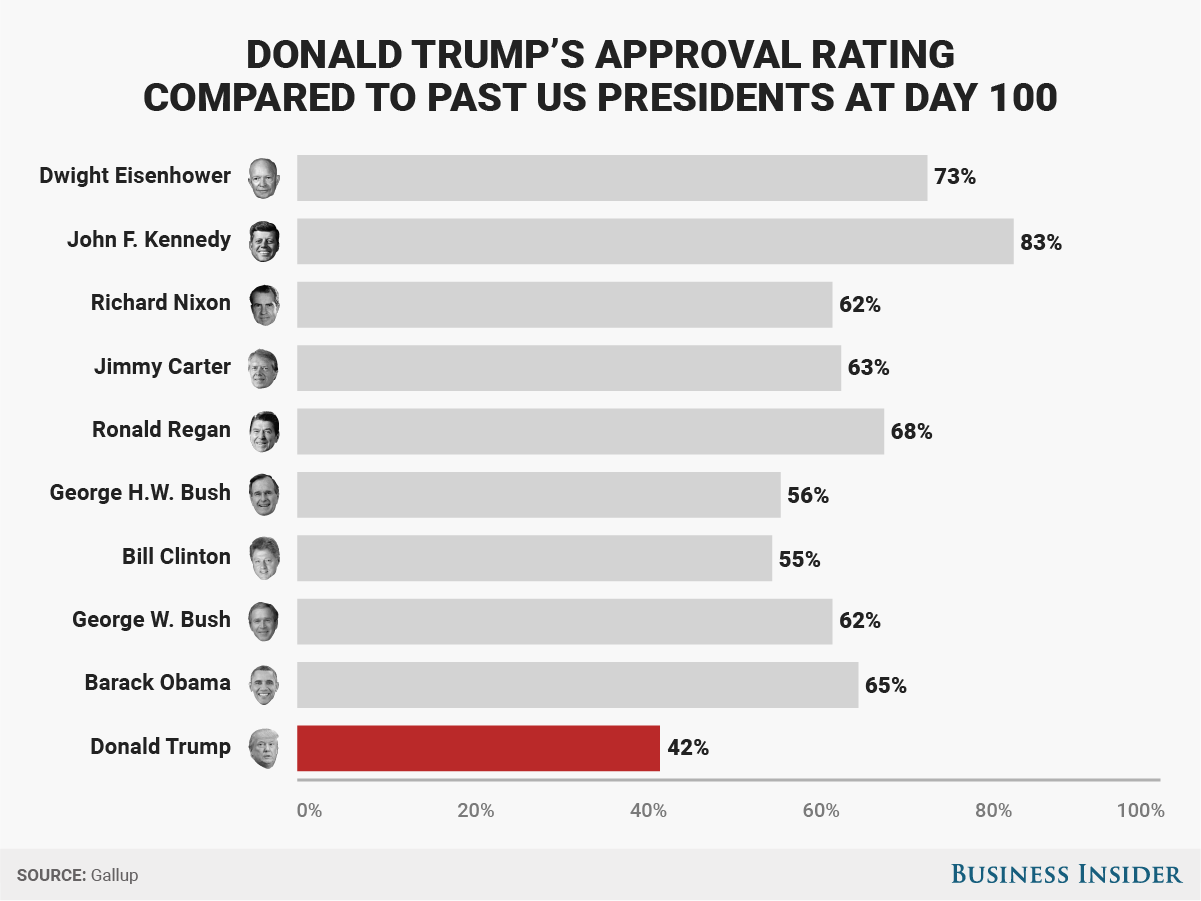

Trumps 100 Day Plan And Bitcoin A 100 000 Price Prediction Analysis

May 08, 2025

Trumps 100 Day Plan And Bitcoin A 100 000 Price Prediction Analysis

May 08, 2025 -

Surface Pro 12 Inch Specs Price And Review

May 08, 2025

Surface Pro 12 Inch Specs Price And Review

May 08, 2025 -

Analyzing The Impact Of Trumps Xrp Endorsement On Institutional Adoption

May 08, 2025

Analyzing The Impact Of Trumps Xrp Endorsement On Institutional Adoption

May 08, 2025 -

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025 -

Micro Strategy Stock And Bitcoin Investment Outlook For 2025

May 08, 2025

Micro Strategy Stock And Bitcoin Investment Outlook For 2025

May 08, 2025

Latest Posts

-

Dwp Home Visit Numbers Double Concerns For Benefit Recipients

May 08, 2025

Dwp Home Visit Numbers Double Concerns For Benefit Recipients

May 08, 2025 -

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

May 08, 2025 -

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025

Dwp 3 Month Benefit Stop Warning For 355 000

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025 -

Six Month Universal Credit Rule Dwp Clarifies New Regulations

May 08, 2025

Six Month Universal Credit Rule Dwp Clarifies New Regulations

May 08, 2025