Binance Sees Bitcoin Buy Volume Dominate Sell Volume After Six-Month Drought

Table of Contents

The Six-Month Drought and its Significance

For six months, a bearish sentiment gripped the Bitcoin market, reflected clearly in Binance's trading data. Sell volume consistently outweighed buy volume, indicating a lack of investor confidence and a prevailing trend of selling pressure. This prolonged period of negative trading momentum can be attributed to several factors.

Potential reasons for this prolonged bearish sentiment include:

- Bear market sentiment and investor hesitancy: The cryptocurrency market experienced a significant downturn, leading to widespread investor hesitancy and a preference for selling rather than buying Bitcoin. Fear, Uncertainty, and Doubt (FUD) played a significant role.

- Impact of macroeconomic conditions on cryptocurrency investment: Global economic uncertainty, rising inflation, and interest rate hikes negatively impacted risk appetite, leading investors to liquidate their crypto holdings, including Bitcoin. This contributed heavily to the sustained sell-off on Binance.

- Regulatory uncertainty affecting Bitcoin trading confidence: Ongoing regulatory scrutiny and uncertainty surrounding cryptocurrency regulations in various jurisdictions created a climate of apprehension, deterring many investors from actively participating in the market. This lack of clarity negatively influenced Bitcoin buy volume.

The Recent Surge in Bitcoin Buy Volume on Binance

The recent shift in trading dynamics on Binance is noteworthy. While precise figures fluctuate constantly, reports indicate a substantial increase in Bitcoin buy volume on Binance, exceeding sell volume for the first time in six months. This change signals a potential shift in market sentiment.

Potential catalysts driving this increased buy volume include:

- Specific dates and volume figures showcasing the increase: [Insert specific dates and percentage increase/volume figures here if available from reliable sources. Cite the source]. This data would significantly strengthen this point.

- Analysis of potential catalysts driving the increased buy volume: Positive news regarding Bitcoin development, potential institutional investment, and a gradual return of retail investor confidence are all possible contributing factors. The emergence of new use cases for Bitcoin could also be a driver.

- Comparison with previous periods of high Bitcoin buy volume on Binance: Comparing the current surge with previous instances of high buy volume can help determine if this is a sustainable trend or a temporary anomaly. Historical data analysis is crucial here.

Implications for Bitcoin Price and Market Sentiment

The increased Bitcoin buy volume on Binance has significant implications for both Bitcoin's price and the overall market sentiment.

- Potential price predictions based on the increased buy volume: While predicting future prices is speculative, increased buy volume generally suggests upward price pressure. However, several factors influence price, so it's not a direct correlation. (Mention any relevant technical analysis indicators here, if applicable)

- Analysis of market sentiment indicators following the shift: Market sentiment indicators, such as social media sentiment, Google Trends searches for "Bitcoin," and on-chain metrics, can be analyzed to gauge the overall feeling amongst investors.

- Discussion on the sustainability of the current trend: The sustainability of the increased buy volume depends on several factors, including the persistence of positive market news, regulatory developments, and macroeconomic conditions. It's crucial to monitor these variables closely.

Binance's Role and the Broader Cryptocurrency Market

Binance, as the leading cryptocurrency exchange by trading volume, plays a significant role in shaping market sentiment and price movements. The observed shift in Bitcoin trading dynamics on Binance could suggest a broader market trend, but it's essential to consider the context.

- Binance's market share and influence on Bitcoin trading: Binance's considerable market share means its trading activity significantly impacts the overall Bitcoin price.

- Comparison with other major cryptocurrency exchanges: Analyzing trading data from other major exchanges like Coinbase, Kraken, and OKX can help determine if this is an isolated phenomenon on Binance or a more widespread trend.

- Analysis of the correlation between Binance's trading volume and Bitcoin price: Historical data analysis can reveal the correlation between Binance's trading volume and Bitcoin's price movements, giving more insight into the significance of this recent surge in Bitcoin buy volume Binance.

Conclusion

The recent dominance of Bitcoin buy volume over sell volume on Binance, after a six-month drought, signals a potentially significant shift in market sentiment. This surge could have considerable implications for Bitcoin's price and the broader cryptocurrency market. The increased buy volume might indicate renewed investor confidence, potentially leading to a sustained price increase. However, it's crucial to remain vigilant and monitor market developments closely.

Call to Action: Stay informed about the evolving dynamics of Bitcoin trading volume on Binance and other major exchanges. Monitor the interplay between Bitcoin buy volume and price fluctuations to make informed investment decisions. Continue to follow our analysis for updates on Bitcoin buy volume Binance and its impact. Understanding the nuances of Binance Bitcoin trading volume is vital for navigating the cryptocurrency market effectively.

Featured Posts

-

Long Term Investment Berkshire Hathaways Impact On Japanese Trading Houses

May 08, 2025

Long Term Investment Berkshire Hathaways Impact On Japanese Trading Houses

May 08, 2025 -

Mike Trouts Power Display Not Enough In Angels Loss To Giants

May 08, 2025

Mike Trouts Power Display Not Enough In Angels Loss To Giants

May 08, 2025 -

The Night Inter Milan Defeated Barcelona To Reach The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona To Reach The Champions League Final

May 08, 2025 -

The Arsenal Debate Collymores Criticism Of Arteta

May 08, 2025

The Arsenal Debate Collymores Criticism Of Arteta

May 08, 2025 -

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025

Latest Posts

-

The Rookies Nathan Fillion An Unforgettable Wwii Performance

May 08, 2025

The Rookies Nathan Fillion An Unforgettable Wwii Performance

May 08, 2025 -

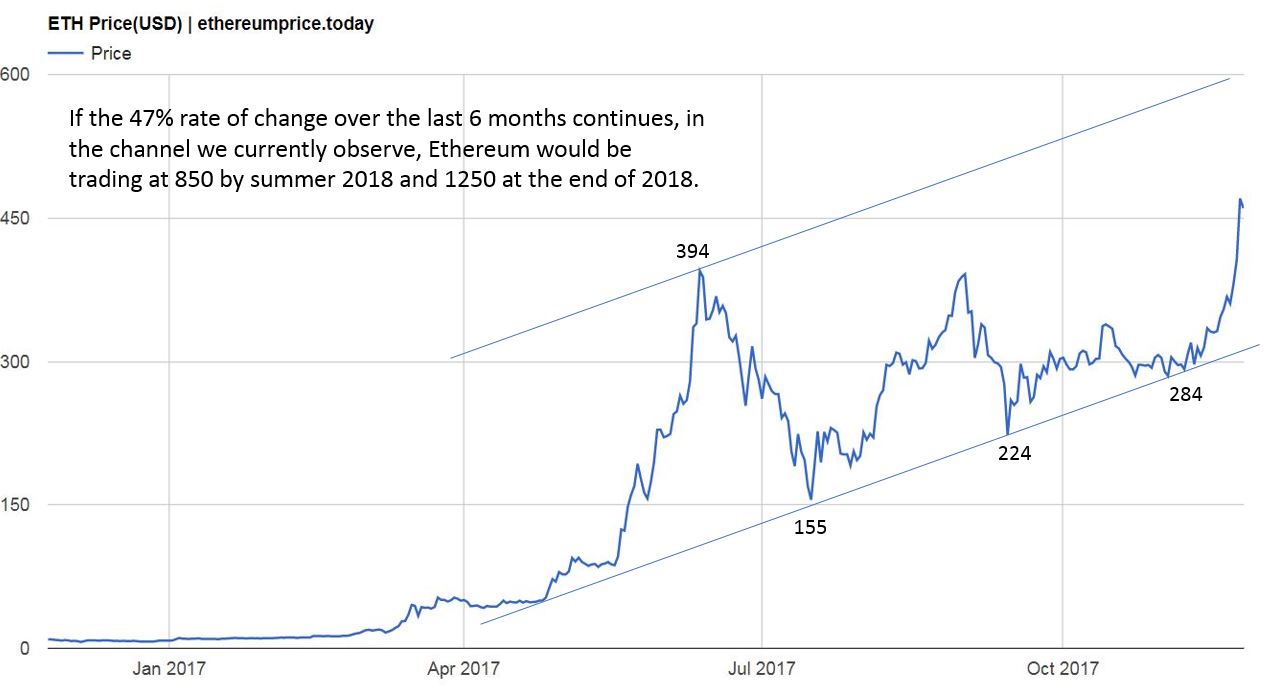

Ethereum Price Surge Bullish Momentum And Future Price Predictions

May 08, 2025

Ethereum Price Surge Bullish Momentum And Future Price Predictions

May 08, 2025 -

The 67 Million Ethereum Liquidation Understanding The Causes And Consequences

May 08, 2025

The 67 Million Ethereum Liquidation Understanding The Causes And Consequences

May 08, 2025 -

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025 -

Is Ethereum Ready To Rebound Weekly Indicator Suggests A Buy Signal

May 08, 2025

Is Ethereum Ready To Rebound Weekly Indicator Suggests A Buy Signal

May 08, 2025