Ethereum Price Surge: Bullish Momentum And Future Price Predictions

Table of Contents

Factors Contributing to the Ethereum Price Surge

Several key factors have converged to propel the recent Ethereum price surge. Understanding these drivers is crucial for predicting future price movements and assessing the long-term viability of Ethereum as an investment.

Increased Network Activity and DeFi Growth

The explosive growth of Decentralized Finance (DeFi) applications built on the Ethereum network is a primary driver of the recent price surge. DeFi protocols offer a wide range of financial services, from lending and borrowing to decentralized exchanges (DEXs) and yield farming. The increased usage of these platforms directly translates into higher transaction volume on the Ethereum blockchain, driving up demand for ETH, Ethereum's native cryptocurrency.

- Growing number of decentralized applications (dApps) on the Ethereum network: The Ethereum ecosystem boasts a thriving dApp landscape, offering users diverse functionalities and increasing network engagement.

- Rising Total Value Locked (TVL) in DeFi protocols: A substantial increase in TVL indicates growing confidence and investment in DeFi applications built on Ethereum, bolstering demand for ETH.

- Increased user adoption and engagement with DeFi services: More users adopting and engaging with DeFi services translates directly into higher transaction fees and network activity, further fueling the Ethereum price surge. Specific protocols like Aave, Uniswap, and Compound have significantly contributed to this increased activity.

The Merge and its Impact on Ethereum's Value

The Ethereum Merge, a significant upgrade transitioning the network from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism, has had a profound impact on Ethereum's value and the Ethereum price surge. This transition dramatically reduced energy consumption and lowered transaction fees, making Ethereum a more environmentally friendly and cost-effective platform.

- Reduced energy consumption leading to increased environmental friendliness: The shift to PoS drastically lowered Ethereum's carbon footprint, addressing a major criticism of PoW blockchains and attracting environmentally conscious investors.

- Lower transaction fees making Ethereum more accessible: Reduced gas fees have made it more affordable for users to interact with the Ethereum network, fueling further adoption and network activity.

- Enhanced scalability and efficiency of the network: The Merge improved the network's overall scalability and efficiency, paving the way for greater adoption and further price appreciation.

Institutional Investment and Growing Adoption

The growing acceptance of Ethereum by institutional investors and large corporations is another significant factor driving the Ethereum price surge. Hedge funds, investment firms, and even corporations are increasingly incorporating Ethereum into their investment portfolios, recognizing its potential as a store of value and a key player in the evolving digital economy.

- Increased investment from hedge funds and other institutional investors: Large-scale institutional investment injects significant capital into the market, increasing demand and pushing prices higher.

- Growing acceptance of Ethereum as a store of value and investment asset: Ethereum is increasingly viewed as a valuable asset, similar to gold or other precious metals, driving demand from long-term investors.

- Strategic partnerships with major corporations: Partnerships between Ethereum and major corporations lend credibility and legitimacy, boosting market confidence and attracting further investment.

Analyzing the Bullish Momentum

The current bullish momentum in the Ethereum market is supported by various technical indicators and positive market sentiment. This section analyzes these factors to further understand the current trend and its potential implications for the future.

Technical Indicators

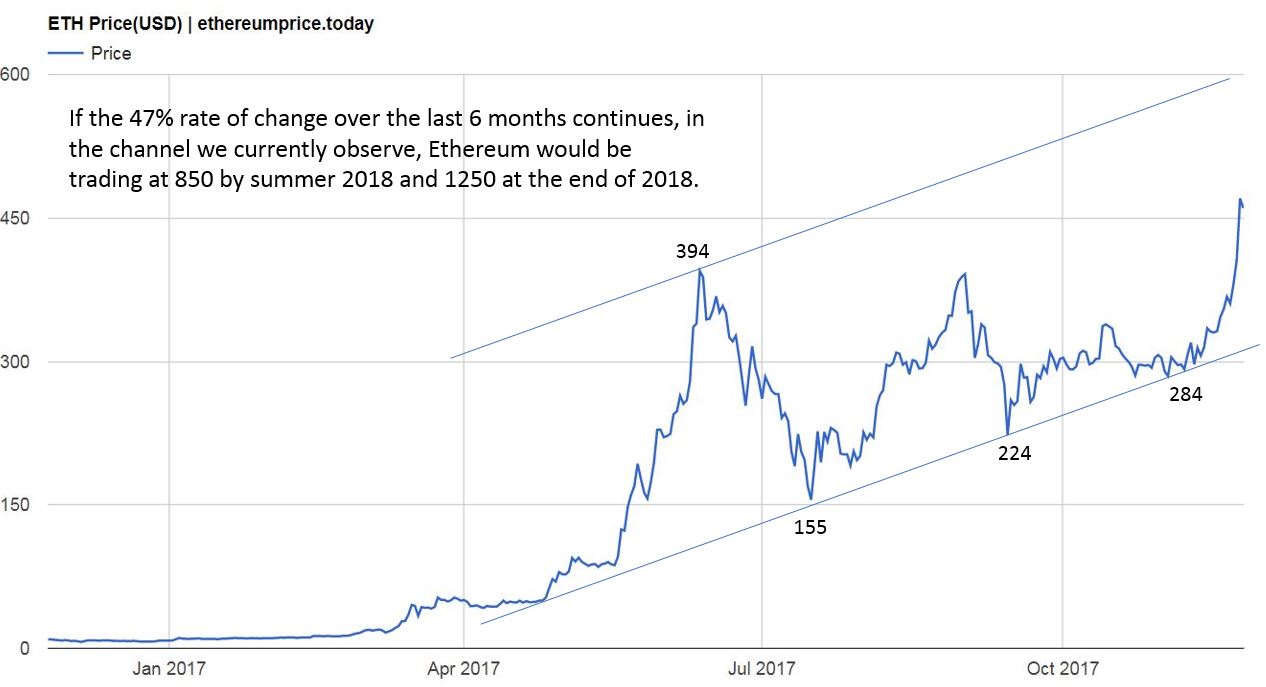

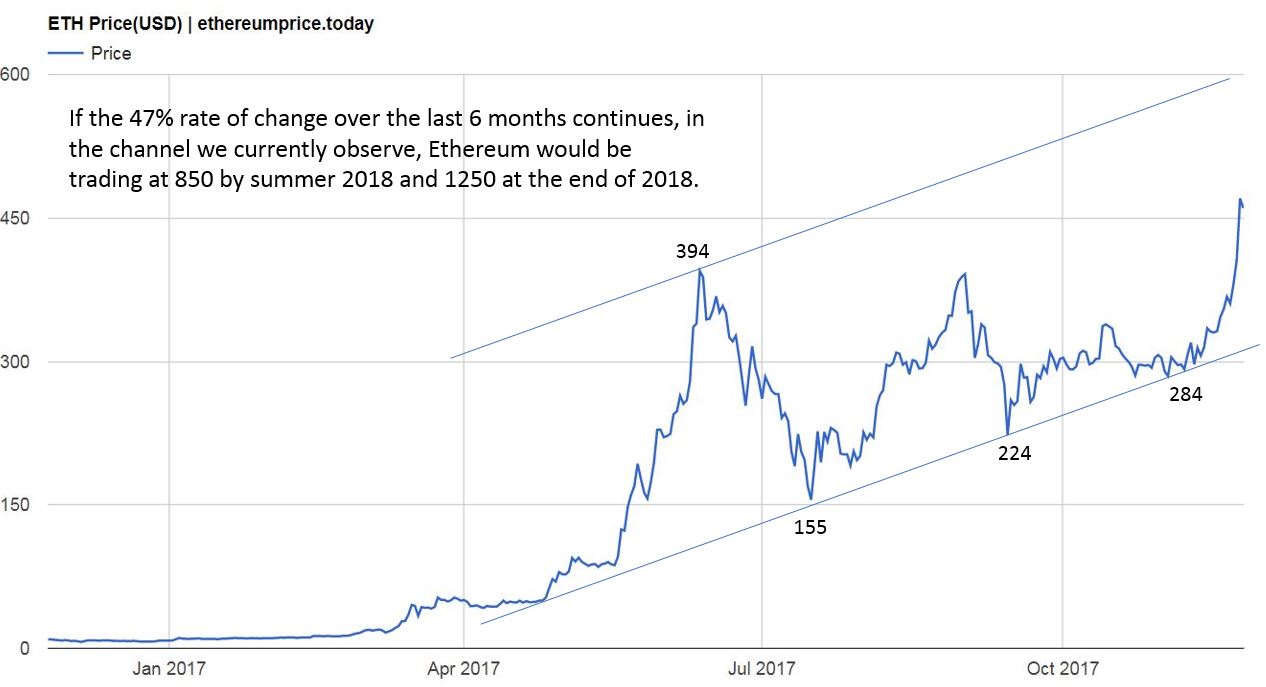

Technical analysis provides valuable insights into short-term and medium-term price movements. Several key indicators suggest a continuation of the bullish trend for Ethereum.

- Positive trends in key technical indicators: Moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) show positive trends, suggesting further price increases are likely.

- Strong support levels preventing significant price drops: The price of Ethereum has shown strong resistance to significant drops, indicating a robust underlying support base.

- Potential breakout patterns indicating further price increases: Certain chart patterns suggest a potential breakout, leading to even higher price targets in the near future.

Market Sentiment and Social Media Analysis

Social media sentiment and overall market sentiment towards Ethereum remain overwhelmingly positive, bolstering the bullish momentum.

- Positive sentiment expressed on social media platforms: Social media platforms like Twitter and Reddit show predominantly positive sentiment towards Ethereum, indicating strong community support.

- Increasing media coverage highlighting Ethereum's potential: Increased media coverage focuses on Ethereum's potential as a leading blockchain platform, further enhancing its market appeal.

- Strong community support and engagement: A vibrant and engaged community surrounding Ethereum continues to fuel innovation and adoption, driving further price appreciation.

Future Price Predictions and Potential Risks

Predicting future prices with certainty is impossible; however, analyzing various price prediction models and expert opinions, along with acknowledging potential risks, provides a more informed perspective.

Price Prediction Models and Expert Opinions

Various price prediction models, ranging from technical analysis to fundamental valuation, offer a range of potential price targets.

- Price predictions from various analytical sources: Reputable analysts offer diverse price predictions, ranging from conservative estimates to more optimistic forecasts.

- Factors influencing the range of potential price targets: Factors such as overall market conditions, regulatory developments, and technological advancements significantly influence price predictions.

- Considerations for short-term, medium-term, and long-term price movements: Short-term price movements are more volatile, while medium-term and long-term predictions tend to be more stable, reflecting the underlying value proposition of Ethereum.

Potential Risks and Challenges

While the outlook for Ethereum is largely positive, several risks and challenges could negatively impact its price.

- Regulatory uncertainty and potential government interventions: Unclear regulatory frameworks and potential government interventions could stifle innovation and negatively impact the price.

- Competition from other blockchain platforms and cryptocurrencies: Competition from other blockchain platforms with similar functionalities could impact Ethereum's market share and price.

- Potential for market corrections and price volatility: The cryptocurrency market is inherently volatile, and sudden market corrections or price crashes are possible.

Conclusion

The recent Ethereum price surge is fueled by a confluence of factors, including increased DeFi activity, the successful Merge, and growing institutional adoption. While bullish momentum is strong, it's crucial to acknowledge potential risks. Analyzing technical indicators and market sentiment alongside expert predictions provides a comprehensive outlook. Staying informed about the developments surrounding Ethereum and understanding its potential risks is vital for any investor considering involvement in this dynamic market. Continue to follow the latest news and analysis on the Ethereum price surge to make informed decisions about your investment strategy and potential profits from this dynamic cryptocurrency.

Featured Posts

-

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

May 08, 2025

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

May 08, 2025 -

Expert Prediction Hargreaves On Arsenal Vs Psg Champions League Final

May 08, 2025

Expert Prediction Hargreaves On Arsenal Vs Psg Champions League Final

May 08, 2025 -

Bitcoin Madenciliginin Sonu Yaklasirken Gelecegi Degerlendirmek

May 08, 2025

Bitcoin Madenciliginin Sonu Yaklasirken Gelecegi Degerlendirmek

May 08, 2025 -

Tri Poljupca Deandre Dzordan Otkriva Zasto On I Nikola Jokic Tako Cine

May 08, 2025

Tri Poljupca Deandre Dzordan Otkriva Zasto On I Nikola Jokic Tako Cine

May 08, 2025 -

Dembele Injury Update Arsenal Face Major Setback

May 08, 2025

Dembele Injury Update Arsenal Face Major Setback

May 08, 2025

Latest Posts

-

Navigating The Great Decoupling Challenges And Opportunities

May 08, 2025

Navigating The Great Decoupling Challenges And Opportunities

May 08, 2025 -

Navigating The Trade War Identifying A Successful Cryptocurrency

May 08, 2025

Navigating The Trade War Identifying A Successful Cryptocurrency

May 08, 2025 -

The Great Decoupling Implications For Global Economies

May 08, 2025

The Great Decoupling Implications For Global Economies

May 08, 2025 -

Trade War Fallout Which Cryptocurrency Will Prevail

May 08, 2025

Trade War Fallout Which Cryptocurrency Will Prevail

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Kw Tby Anshwrns Ky Shwlt Frahm

May 08, 2025

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Kw Tby Anshwrns Ky Shwlt Frahm

May 08, 2025