Australia's Election: Goldman Sachs Forecasts On Fiscal Policy

Table of Contents

Goldman Sachs' Baseline Scenario for Australia's Fiscal Policy Post-Election

Goldman Sachs' baseline scenario for Australia's fiscal policy post-election paints a picture of moderate growth, albeit with potential challenges. Their projections suggest a continuation of current economic trends, with adjustments based on anticipated government actions.

- Projected GDP growth rate: Goldman Sachs forecasts a GDP growth rate of around 2.5% for the next fiscal year, slightly lower than previous years due to global economic uncertainties. This figure is contingent on the government's fiscal policy decisions.

- Forecasted government debt-to-GDP ratio: The debt-to-GDP ratio is projected to remain relatively stable but with a slight upward trend, dependent on government spending initiatives and tax revenue. This is a key indicator watched closely by investors and credit rating agencies.

- Analysis of potential tax reforms: Goldman Sachs anticipates minor adjustments to tax policy, potentially focusing on streamlining existing systems rather than large-scale reforms. The specifics are largely dependent on the winning party's platform.

- Impact on key economic indicators (inflation, unemployment): Inflation is expected to remain within the Reserve Bank of Australia's target band. Unemployment rates are projected to gradually decline, contingent on sustained economic growth and government stimulus measures, if any. This interplay between fiscal policy and employment is critical for Australia's Election outcome.

Analysis of Potential Policy Changes Under Different Election Outcomes

Goldman Sachs' analysis extends beyond a single baseline scenario, exploring the potential divergence in fiscal policy depending on the election outcome. The projected fiscal policy stances of the major parties differ significantly:

- Coalition's projected fiscal policy stance: Goldman Sachs anticipates a more fiscally conservative approach from the Coalition, prioritizing debt reduction and fiscal sustainability. This might involve controlling government spending and potentially exploring further tax reforms to improve revenue.

- Labor's projected fiscal policy stance: Labor's projected fiscal policy is anticipated to be more expansionary, potentially involving increased government spending on social programs and infrastructure projects. This could lead to higher debt levels but potentially stimulate economic growth in the short term.

- Potential impact of policy differences on specific sectors (e.g., healthcare, education, infrastructure): Depending on the winning party, investment in sectors like healthcare, education, and infrastructure will vary. Labor's projected spending in these areas is anticipated to be considerably higher than the Coalition's.

- Analysis of the potential for fiscal consolidation or expansion under each scenario: Goldman Sachs' report offers a detailed comparison of the potential impact on the national budget under both scenarios – fiscal consolidation under the Coalition and fiscal expansion under Labor. This is a crucial element impacting Australia's Election and its long-term economic outlook.

Goldman Sachs' Assessment of Fiscal Risks and Opportunities

Goldman Sachs acknowledges both the risks and opportunities inherent in Australia's fiscal position:

- Key fiscal risks (e.g., rising debt, inflation): The report highlights the risk of rising government debt if expansionary fiscal policies are implemented without corresponding revenue increases. Inflation remains a concern, influenced by both domestic and global factors.

- Opportunities for economic growth through strategic fiscal investments: Strategic investments in infrastructure and other productive sectors can drive long-term economic growth. This is particularly pertinent to Labor's platform.

- Potential impact of global economic conditions on Australia's fiscal policy: Global economic uncertainty poses a significant risk to Australia’s economy and fiscal policy. The report acknowledges this external influence.

- Goldman Sachs' recommended policy adjustments for the incoming government: Goldman Sachs' recommendations typically emphasize a balanced approach, prioritizing sustainable economic growth while maintaining fiscal responsibility.

Market Reaction and Investor Sentiment Based on Goldman Sachs' Forecasts

Goldman Sachs' forecasts significantly influence market expectations and investor sentiment:

- Expected impact on the Australian dollar: The Australian dollar's value is projected to fluctuate based on investor confidence in the government's fiscal policy approach.

- Potential effects on bond yields and interest rates: Bond yields and interest rates are sensitive to expectations of future inflation and government debt levels.

- Projected impact on the Australian stock market: The Australian stock market’s performance will likely be correlated with the projected economic growth under various fiscal scenarios.

- Analysis of investor confidence levels based on Goldman Sachs' forecasts: Investor confidence is crucial for market stability and economic growth. Goldman Sachs' analysis provides insights into this pivotal factor.

Conclusion: Implications of Goldman Sachs' Forecasts on Australia's Election and Fiscal Policy

Goldman Sachs' analysis of Australia's Election and its projected impact on fiscal policy provides a crucial framework for understanding the potential economic outcomes. The differing fiscal approaches of the major parties significantly impact projected growth, debt levels, and market sentiment. Understanding these implications is crucial for both voters and investors. To stay informed about Australia's Election and its impact on fiscal policy, follow updates from Goldman Sachs and other reputable economic sources. Further reading on Australian economics and election analysis will provide a more comprehensive understanding of this pivotal moment in Australia's economic history.

Featured Posts

-

Eurovision Village 2025 Basel Gives Green Light To Funding

Apr 25, 2025

Eurovision Village 2025 Basel Gives Green Light To Funding

Apr 25, 2025 -

White House Cocaine Incident Secret Service Announces End Of Investigation

Apr 25, 2025

White House Cocaine Incident Secret Service Announces End Of Investigation

Apr 25, 2025 -

Israel Eurovision Controversy Director Responds To Boycott Demands

Apr 25, 2025

Israel Eurovision Controversy Director Responds To Boycott Demands

Apr 25, 2025 -

Securing Makeup Childproof Storage Ideas For Parents

Apr 25, 2025

Securing Makeup Childproof Storage Ideas For Parents

Apr 25, 2025 -

April 24 Oil Market News Prices And Analysis

Apr 25, 2025

April 24 Oil Market News Prices And Analysis

Apr 25, 2025

Latest Posts

-

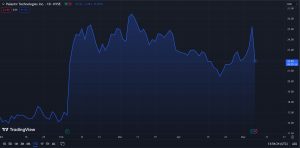

Is A 40 Return On Palantir Stock By 2025 Possible

May 10, 2025

Is A 40 Return On Palantir Stock By 2025 Possible

May 10, 2025 -

Stock Market Gains Sensex Nifty Performance And Top Movers

May 10, 2025

Stock Market Gains Sensex Nifty Performance And Top Movers

May 10, 2025 -

Palantir Stock Investment Weighing The Risks And Rewards For 2025

May 10, 2025

Palantir Stock Investment Weighing The Risks And Rewards For 2025

May 10, 2025 -

Sensex And Nifty Climb Daily Stock Market Report And Analysis

May 10, 2025

Sensex And Nifty Climb Daily Stock Market Report And Analysis

May 10, 2025 -

Analyzing Palantir Stock Is A 40 Gain In 2025 Achievable

May 10, 2025

Analyzing Palantir Stock Is A 40 Gain In 2025 Achievable

May 10, 2025