Palantir Stock Investment: Weighing The Risks And Rewards For 2025

Table of Contents

Palantir's Business Model and Growth Potential

Palantir's business model centers around its Gotham and Foundry platforms, providing powerful data integration and analytics solutions. Its success hinges on both its government and commercial market performance.

Government Contracts and Revenue Stability

Palantir's revenue significantly relies on government contracts, particularly within the US defense sector. This reliance provides a degree of revenue stability due to the long-term nature of these contracts. However, it also introduces potential risks.

- Long-term contracts: These contracts offer predictable revenue streams for several years, reducing short-term volatility.

- Contract renewals: The success of future revenue depends heavily on the ability to secure contract renewals. Any failure to do so could significantly impact revenue.

- Government budget fluctuations: Changes in government spending, particularly defense spending, directly affect Palantir's revenue. Budget cuts or shifts in priorities could negatively influence future contracts.

- Diversification efforts: Palantir is actively working to diversify its revenue streams beyond government contracts, expanding its commercial offerings to mitigate this risk.

Keywords: Palantir government contracts, defense spending, revenue stability, contract renewals, government budget, Palantir revenue.

Commercial Market Expansion and Future Growth Drivers

Palantir's commercial market expansion is a crucial driver of future growth. The company is actively targeting various industries, leveraging its platform's capabilities to address diverse data analytics needs.

- Industry verticals: Key growth areas include financial services, healthcare, and energy, where large datasets and advanced analytics are highly valuable.

- Key partnerships and acquisitions: Strategic partnerships and acquisitions can accelerate market penetration and enhance Palantir's technological capabilities.

- AI integration: Integrating AI and machine learning into its platforms strengthens Palantir's offerings and positions it for growth in the rapidly evolving AI-driven data analytics market.

- Competitive landscape: Palantir faces competition from established players like Microsoft and smaller specialized firms. Its competitive advantages lie in its proprietary technology and strong relationships with key government and commercial clients.

Keywords: Palantir commercial contracts, data analytics, AI integration, market expansion, commercial growth, competition, Palantir Foundry, Palantir Gotham.

Assessing the Risks of Palantir Stock

While Palantir offers significant growth potential, investors must carefully consider the associated risks.

Valuation and Stock Price Volatility

Palantir's stock price has historically demonstrated considerable volatility. This volatility stems from various factors, including its relatively new public listing, its dependence on large contracts, and the overall market sentiment towards technology stocks.

- Valuation compared to competitors: Analyzing Palantir's valuation relative to its competitors is crucial to gauge its potential for future growth. Is it overvalued or undervalued based on its projected future earnings?

- Reasons for price volatility: Price swings are often influenced by news related to contract wins or losses, changes in government policy, and broader market trends.

- Factors affecting future stock price: Future stock performance will depend on revenue growth, profitability, successful market expansion, and investor confidence.

Keywords: Palantir stock price, stock volatility, market capitalization, valuation, stock price prediction, PLTR stock.

Financial Performance and Profitability

Evaluating Palantir's financial performance is essential to assess its long-term sustainability. While revenue growth has been impressive, profitability remains a key focus.

- Key financial metrics: Analyzing revenue growth, net income, free cash flow, and debt levels provides insights into the company's financial health.

- Industry benchmarks: Comparing Palantir's financial performance to industry benchmarks helps identify its strengths and weaknesses.

- Potential financial risks: Risks include potential contract losses, increased competition, and the need for continued investment in research and development.

Keywords: Palantir financials, revenue growth, profitability, cash flow, financial performance, debt levels, Palantir profitability.

Investment Strategies for Palantir Stock

The suitability of Palantir stock depends largely on the investor's investment horizon and risk tolerance.

Long-Term vs. Short-Term Investment Horizons

Palantir's long-term growth prospects are attractive for patient investors. However, its volatility makes it less suitable for short-term traders.

- Risk tolerance: Investors need to carefully assess their risk tolerance before investing in Palantir. Its volatility requires a higher risk tolerance compared to more stable investments.

- Long-term benefits: Long-term investors can potentially benefit from significant price appreciation if Palantir achieves its growth targets.

- Short-term drawbacks: Short-term trading in Palantir can be highly risky due to its price fluctuations.

Keywords: Palantir long-term investment, Palantir short-term investment, investment strategy, risk tolerance, investment horizon.

Diversification and Portfolio Management

Proper portfolio diversification is crucial when investing in Palantir. Its volatility necessitates balancing it with less risky assets.

- Incorporating Palantir into a diversified portfolio: Allocate a portion of your investment portfolio to Palantir, depending on your risk tolerance and overall investment strategy.

- Balancing risk: Combine Palantir with other investments, such as bonds or established blue-chip stocks, to reduce overall portfolio risk.

- Rebalancing strategies: Regularly rebalance your portfolio to maintain your desired asset allocation and risk level.

Keywords: Portfolio diversification, risk management, investment portfolio, asset allocation, rebalancing.

Conclusion

Investing in Palantir stock presents significant potential rewards, driven by its innovative technology and expanding market opportunities. However, investors must carefully weigh the inherent risks associated with its valuation, volatility, and reliance on government contracts. A thorough understanding of Palantir's business model, financial performance, and the broader market landscape is crucial before making any investment decisions. By carefully considering the risks and rewards and developing a well-defined investment strategy, investors can make an informed choice about whether a Palantir stock investment is right for their portfolio in 2025 and beyond. Conduct your own thorough due diligence before investing in Palantir or any other stock. Remember, this is not financial advice. Learn more about Palantir stock investment opportunities and make a smart decision for your portfolio.

Featured Posts

-

Snls Poor Harry Styles Impression His Honest Reaction

May 10, 2025

Snls Poor Harry Styles Impression His Honest Reaction

May 10, 2025 -

Hart Trophy Finalist Leon Draisaitls Outstanding Season With The Oilers

May 10, 2025

Hart Trophy Finalist Leon Draisaitls Outstanding Season With The Oilers

May 10, 2025 -

Strands Nyt Crossword Hints And Answers Tuesday March 4th Game 366

May 10, 2025

Strands Nyt Crossword Hints And Answers Tuesday March 4th Game 366

May 10, 2025 -

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025 -

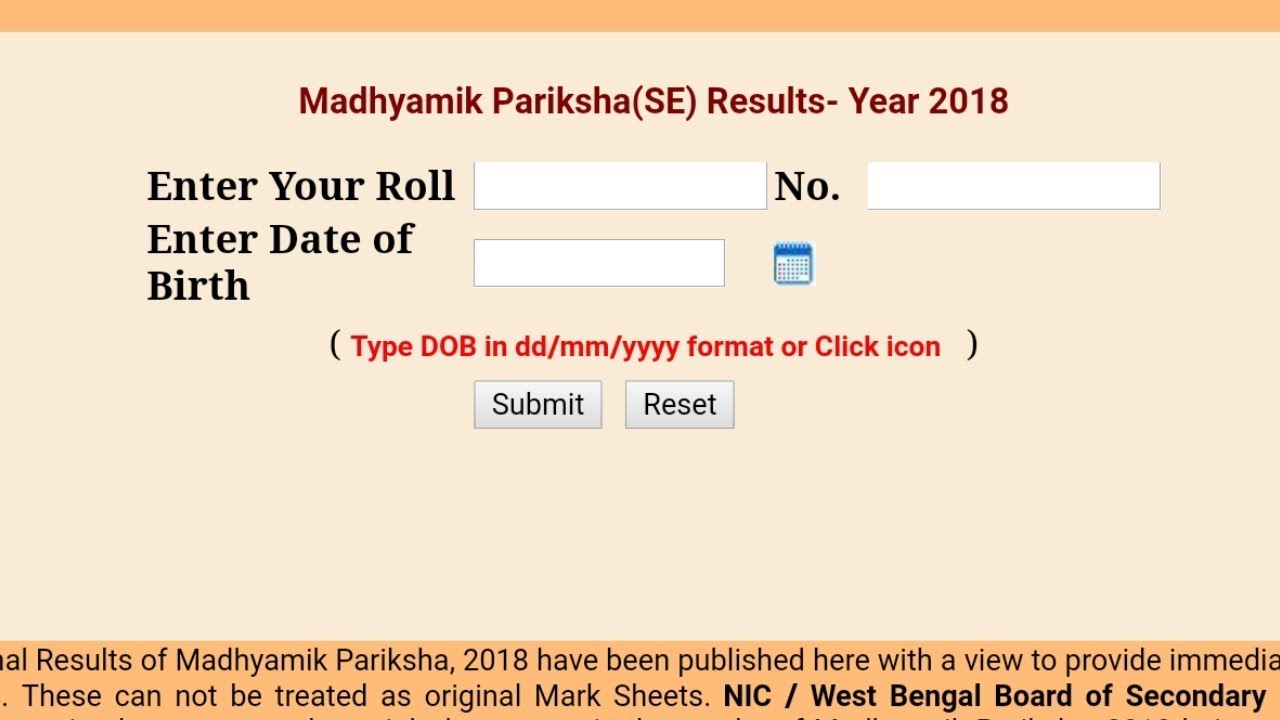

Madhyamik Pariksha Result 2025 Merit List And District Wise Results

May 10, 2025

Madhyamik Pariksha Result 2025 Merit List And District Wise Results

May 10, 2025

Latest Posts

-

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025 -

Uk To Tighten Visa Rules For Nigerians And Pakistanis What You Need To Know

May 10, 2025

Uk To Tighten Visa Rules For Nigerians And Pakistanis What You Need To Know

May 10, 2025 -

New Report Potential Changes To Uk Visa Application Process For Selected Nationalities

May 10, 2025

New Report Potential Changes To Uk Visa Application Process For Selected Nationalities

May 10, 2025 -

Updated Uk Immigration Policy English Language Requirements Strengthened

May 10, 2025

Updated Uk Immigration Policy English Language Requirements Strengthened

May 10, 2025 -

Changes To Uk Visa Regulations Addressing Work And Student Visa Abuse

May 10, 2025

Changes To Uk Visa Regulations Addressing Work And Student Visa Abuse

May 10, 2025