Is A 40% Return On Palantir Stock By 2025 Possible?

Table of Contents

Analyzing Palantir's Current Financial Performance and Growth Potential

To assess the likelihood of a 40% return on Palantir stock by 2025, we must first examine the company's current financial health and growth prospects.

Palantir Revenue and Profitability

Palantir's recent financial reports show consistent revenue growth, though profitability remains a key area of focus. Analyzing key financial metrics like year-over-year growth, gross margin, and operating margin provides a clearer picture.

-

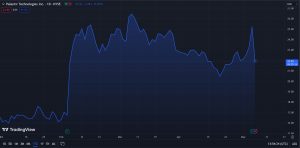

Revenue Growth: Palantir has demonstrated strong revenue growth in recent years, driven by both its government and commercial clients. However, the rate of growth needs to be sustained, and ideally accelerated, to achieve a 40% stock price increase by 2025. (Include a relevant chart or graph illustrating Palantir's revenue growth over time.)

-

Profitability: While revenue is growing, Palantir's profitability is still under development. Analyzing the gross and operating margins reveals the efficiency of their operations and the potential for future profitability improvements. (Include a relevant chart or graph comparing gross and operating margins over time.) Improving profitability is crucial for attracting investors and driving stock price appreciation.

-

Key Financial Indicators: Tracking key performance indicators (KPIs) such as customer acquisition cost (CAC) and customer lifetime value (CLTV) will help assess the long-term financial health and sustainability of the business model.

Palantir Government Contracts and Commercial Growth

Palantir's revenue stream is currently diversified between government contracts and commercial clients. The balance between these two sectors is critical for future growth.

-

Government Contracts: Government contracts have historically been a significant source of revenue for Palantir. The stability and predictability of these contracts provide a solid foundation for the business. However, reliance on government spending can be influenced by geopolitical factors and budget cycles.

-

Commercial Expansion: Palantir's expansion into the commercial sector represents a significant growth opportunity. Success in this area will be crucial for long-term sustainability and reduced dependence on government contracts. The ability to attract and retain a wide range of commercial clients will be a key driver of future growth.

-

Customer Base Diversification: A diversified customer base across various industries reduces risk. Expanding beyond a few key clients will be critical to mitigating potential disruptions from the loss of any single large contract.

Palantir Technological Innovation and Competitive Advantage

Palantir's technological capabilities are central to its success. Continuous innovation and a strong competitive advantage are vital for maintaining market share and driving future growth.

-

Technological Advancements: Palantir continuously invests in research and development to enhance its data analytics platform. Improvements in artificial intelligence (AI), machine learning (ML), and data visualization capabilities are key to staying ahead of competitors.

-

Competitive Landscape: The data analytics market is highly competitive. Palantir must continue to differentiate itself through innovation, superior customer service, and strategic partnerships to maintain its market position and attract new clients.

-

Data Security and Privacy: Given the sensitive nature of the data Palantir handles, maintaining robust data security and privacy protocols is paramount for maintaining customer trust and avoiding regulatory issues.

Factors that Could Influence Palantir's Stock Price by 2025

Predicting stock prices is inherently uncertain. Several macroeconomic, geopolitical, and competitive factors could significantly impact Palantir's stock price by 2025.

Macroeconomic Conditions

Macroeconomic conditions play a crucial role in influencing stock market performance.

-

Economic Downturns: A recession or significant economic slowdown could negatively affect Palantir's performance, particularly in the commercial sector. Companies may reduce spending on data analytics solutions during periods of economic uncertainty.

-

Interest Rates and Inflation: Changes in interest rates and inflation can affect investor sentiment and the overall valuation of stocks. Higher interest rates can make investments in stocks less attractive compared to bonds. High inflation can erode profitability.

Geopolitical Events

Geopolitical instability can create uncertainty and volatility in the stock market.

- Government Spending: Geopolitical events can influence government spending on defense and intelligence, directly impacting Palantir's government contracts. Increased geopolitical tension could lead to increased spending, while reduced tension might have the opposite effect.

Competitive Landscape and Market Share

The data analytics market is fiercely competitive.

- Competitive Threats: Numerous established and emerging companies compete with Palantir. Maintaining and expanding market share will require continued innovation and effective competitive strategies.

Assessing the Probability of a 40% Return on Palantir Stock

Determining the probability of a 40% return on Palantir stock by 2025 requires a thorough risk assessment and scenario analysis.

Risk Assessment

Investing in Palantir stock, like any stock market investment, carries inherent risks.

-

Market Volatility: The stock market is inherently volatile. Unforeseen events can lead to significant price fluctuations, impacting potential returns.

-

Competition: Intense competition in the data analytics market poses a risk to Palantir's market share and profitability.

-

Regulatory Changes: Changes in regulations, particularly concerning data privacy and security, could impact Palantir's operations and profitability.

Scenario Analysis

To assess the likelihood of a 40% return, let's consider three scenarios:

-

Optimistic Scenario: Strong revenue growth, high profitability, successful commercial expansion, and favorable macroeconomic conditions could lead to a significant stock price increase, potentially exceeding 40%.

-

Pessimistic Scenario: Economic downturn, increased competition, regulatory challenges, and reduced government spending could significantly limit growth and potentially lead to a stock price decline.

-

Most Likely Scenario: A moderate growth trajectory, considering the inherent risks and uncertainties, suggests a more modest return, potentially lower than the ambitious 40% target. (Quantify potential returns for each scenario with estimated percentages.)

Conclusion: Is a 40% Return on Palantir Stock by 2025 Realistic?

Whether a 40% return on Palantir stock by 2025 is realistic depends heavily on several interconnected factors. While Palantir demonstrates strong growth potential, significant risks and uncertainties exist. Our analysis suggests that achieving a 40% return is ambitious and hinges on several optimistic factors aligning simultaneously. A more conservative projection might be more realistic.

It is crucial to remember that this analysis is not financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Before making any investment decisions, conduct thorough due diligence, consider a diversified investment portfolio, and seek advice from a qualified financial advisor. Only invest in Palantir stock or any other security if it aligns with your risk tolerance and overall investment strategy.

Featured Posts

-

Wynne Evans Strictly Scandal A Turning Point With Fresh Evidence

May 10, 2025

Wynne Evans Strictly Scandal A Turning Point With Fresh Evidence

May 10, 2025 -

King Protiv Maska Pisatel Vernulsya V X S Rezkoy Kritikoy

May 10, 2025

King Protiv Maska Pisatel Vernulsya V X S Rezkoy Kritikoy

May 10, 2025 -

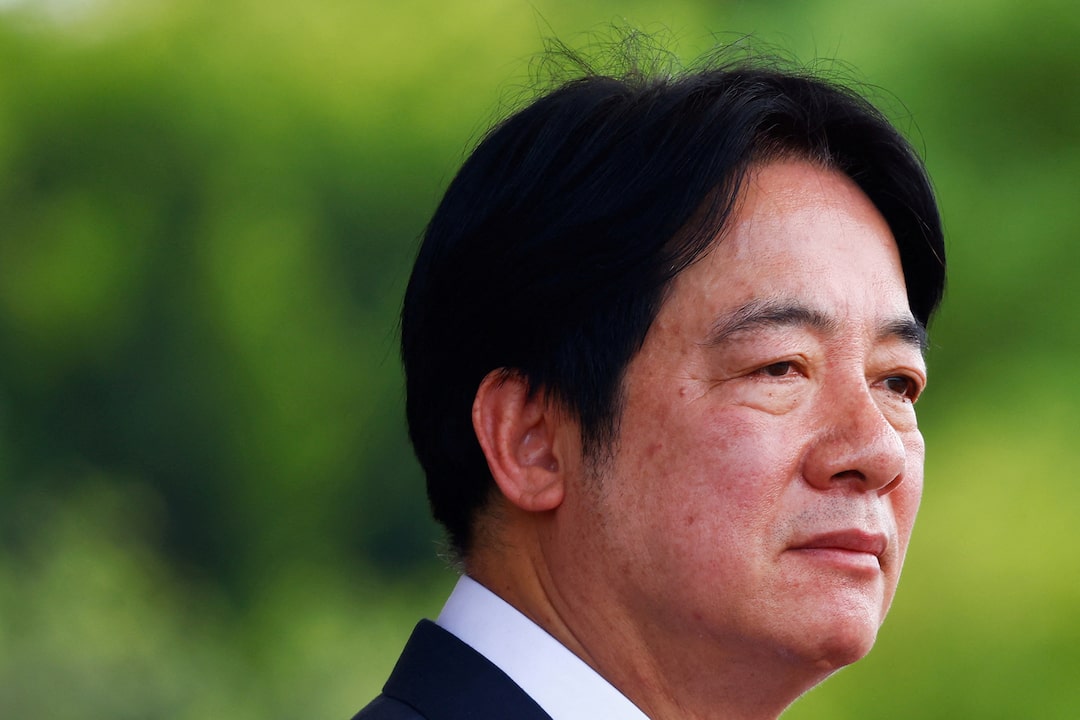

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025 -

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 10, 2025

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 10, 2025 -

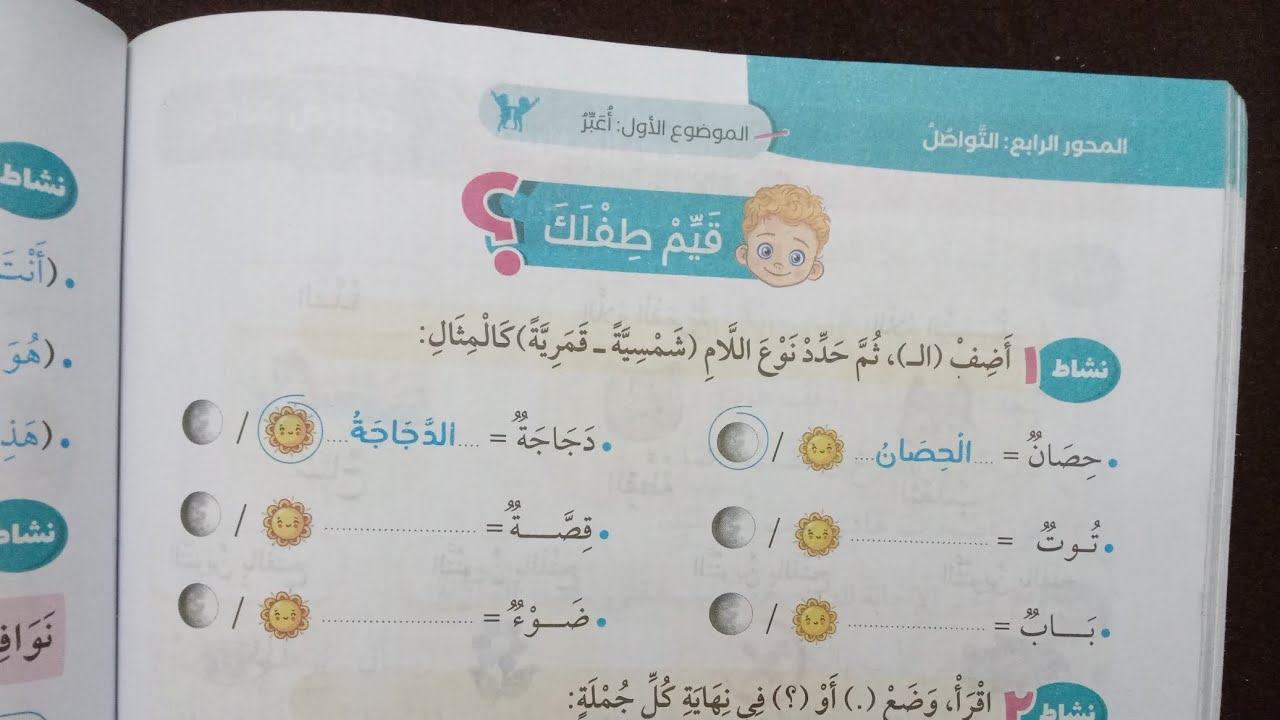

Fyraty Fy Qtr Tqyym Mstwah Me Alerby Bed Rhylh En Alahly

May 10, 2025

Fyraty Fy Qtr Tqyym Mstwah Me Alerby Bed Rhylh En Alahly

May 10, 2025