April 24 Oil Market: News, Prices, And Analysis

Table of Contents

Crude Oil Price Movements on April 24th

Benchmark Prices (WTI & Brent):

The April 24th oil market opened with Brent crude at $85.50 per barrel and West Texas Intermediate (WTI) at $82.00. Throughout the day, prices fluctuated considerably. Brent crude reached a high of $86.75 and a low of $84.20, finally closing at $85.90. WTI saw a similar pattern, peaking at $83.25, dipping to $80.80, and eventually closing at $82.30. The following chart illustrates the price movements throughout the day:

[Insert Chart/Graph here showing WTI and Brent price movements throughout April 24th. Clearly label axes and legend.]

Percentage Changes and Volatility:

Brent crude experienced a 0.47% increase compared to the previous day's close, while WTI saw a 0.36% rise. However, the intraday volatility was noteworthy. Both benchmarks experienced several significant price swings, reflecting the market's sensitivity to incoming news and fluctuating investor sentiment. This volatility was primarily fueled by the unexpected news regarding potential OPEC+ production cuts, creating uncertainty and prompting significant trading activity.

- WTI: Opened at $82.00, High: $83.25, Low: $80.80, Close: $82.30 (+0.36% change from previous day).

- Brent: Opened at $85.50, High: $86.75, Low: $84.20, Close: $85.90 (+0.47% change from previous day).

- Significant price dips were observed around midday, likely triggered by initial market reactions to the news.

- Prices recovered some of their losses later in the day, indicating a degree of market resilience.

Key News and Events Impacting the April 24th Oil Market

Geopolitical Factors:

While no major geopolitical events directly triggered the April 24th price swings, ongoing tensions in Eastern Europe continued to serve as a backdrop for market anxieties. Concerns about potential disruptions to oil supplies from the region remained a significant underlying factor influencing investor behavior and price sensitivity.

OPEC+ Decisions and Statements:

The most significant event impacting the April 24 Oil Market was an unscheduled announcement by a key OPEC+ member regarding a potential voluntary production cut. While the details weren't immediately clear, the mere suggestion of reduced supply immediately sent ripples through the market, leading to increased price volatility. The announcement sparked uncertainty about the future direction of global oil supplies and OPEC+ strategy.

Economic Data Releases:

The release of unexpectedly strong manufacturing data from a major oil-consuming nation earlier that day initially boosted investor optimism. However, this positive sentiment was quickly overshadowed by the subsequent OPEC+ news. This highlights the complex interplay of economic data and geopolitical events in shaping oil market dynamics.

- Headline 1: "OPEC+ Member Announces Potential Production Cut" (link to news source)

- Headline 2: "Strong Manufacturing Data Fuels Early Market Optimism" (link to news source)

- Impact Analysis: The OPEC+ news had a more significant impact than the positive economic data, overriding the initial bullish sentiment.

Market Sentiment and Analyst Forecasts

Trader Sentiment:

Early morning sentiment was cautiously optimistic, reflecting positive economic data. However, the unexpected OPEC+ announcement shifted the sentiment to a mix of uncertainty and cautious bullishness. Traders remained hesitant to make significant bets given the unclear implications of the production cut announcement.

Analyst Predictions:

Analyst reactions were diverse. Some highlighted the potential for higher prices due to tighter supply, while others expressed concerns about the long-term impact of such cuts on demand and economic growth. Forecasts varied considerably, with price predictions ranging from a modest increase to a more substantial surge in the coming weeks.

- Analyst Quote 1: "[Quote from an analyst emphasizing the impact of reduced supply]."

- Analyst Quote 2: "[Quote from an analyst expressing concern about demand and economic implications]."

- Sentiment Shift: The overall market sentiment changed from cautious optimism to cautious bullishness, driven by the OPEC+ announcement.

Conclusion: Understanding the April 24 Oil Market and Looking Ahead

The April 24th oil market was characterized by significant price volatility driven primarily by an unexpected announcement of potential production cuts from an OPEC+ member. While positive economic data initially fueled optimism, this was quickly overshadowed by the uncertainty surrounding the production cut. Analyst predictions remain varied, reflecting a complex interplay of supply, demand, and geopolitical factors. Looking ahead, close monitoring of OPEC+ actions, geopolitical developments, and economic indicators will be crucial to forecasting future oil price movements. For continued in-depth analysis of the oil market, check back regularly for updates and future analyses like "Oil Market Analysis: April 25th" and consider subscribing to receive our expert insights delivered directly to your inbox.

Featured Posts

-

Premios Caonabo De Oro 2025 Conoce A Los Ganadores

Apr 25, 2025

Premios Caonabo De Oro 2025 Conoce A Los Ganadores

Apr 25, 2025 -

Bears 2025 Nfl Draft Strategy Focusing On An Electrifying Playmaker

Apr 25, 2025

Bears 2025 Nfl Draft Strategy Focusing On An Electrifying Playmaker

Apr 25, 2025 -

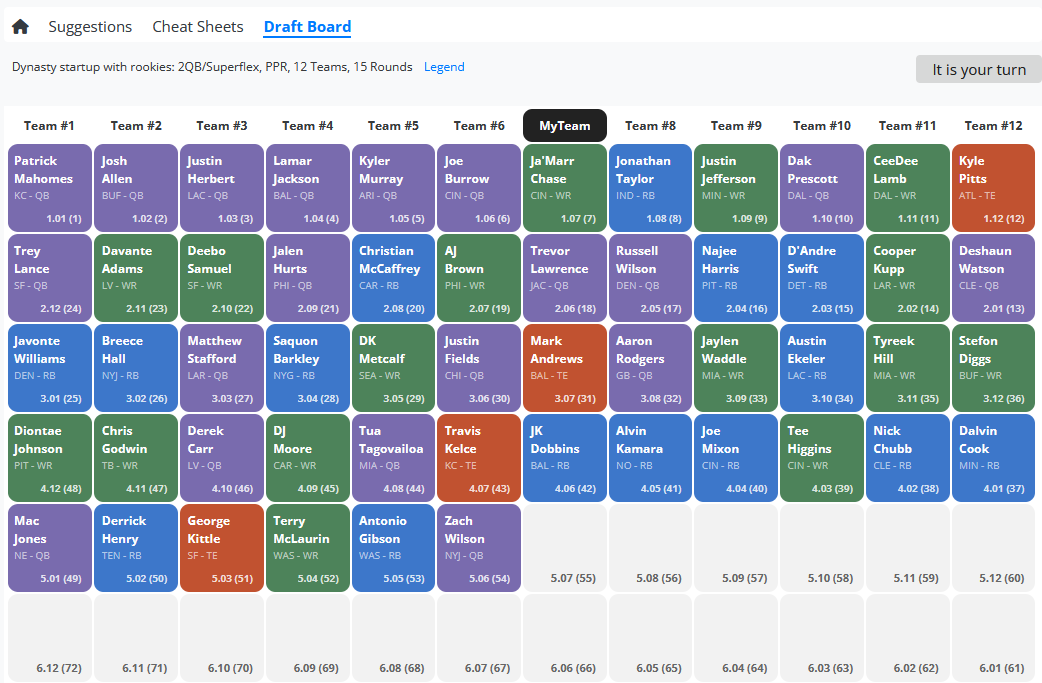

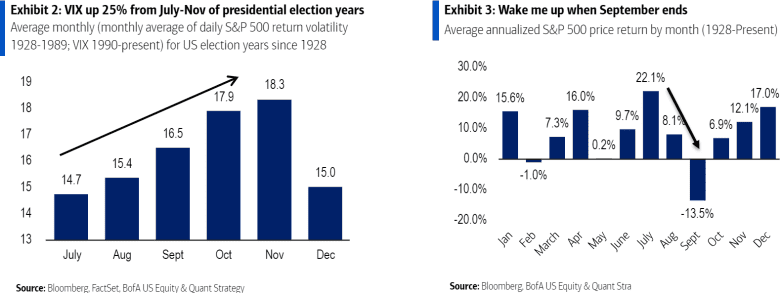

Are Stretched Stock Market Valuations Justified Bof As View

Apr 25, 2025

Are Stretched Stock Market Valuations Justified Bof As View

Apr 25, 2025 -

Ryujinx Emulators Development Ceases After Nintendo Intervention

Apr 25, 2025

Ryujinx Emulators Development Ceases After Nintendo Intervention

Apr 25, 2025 -

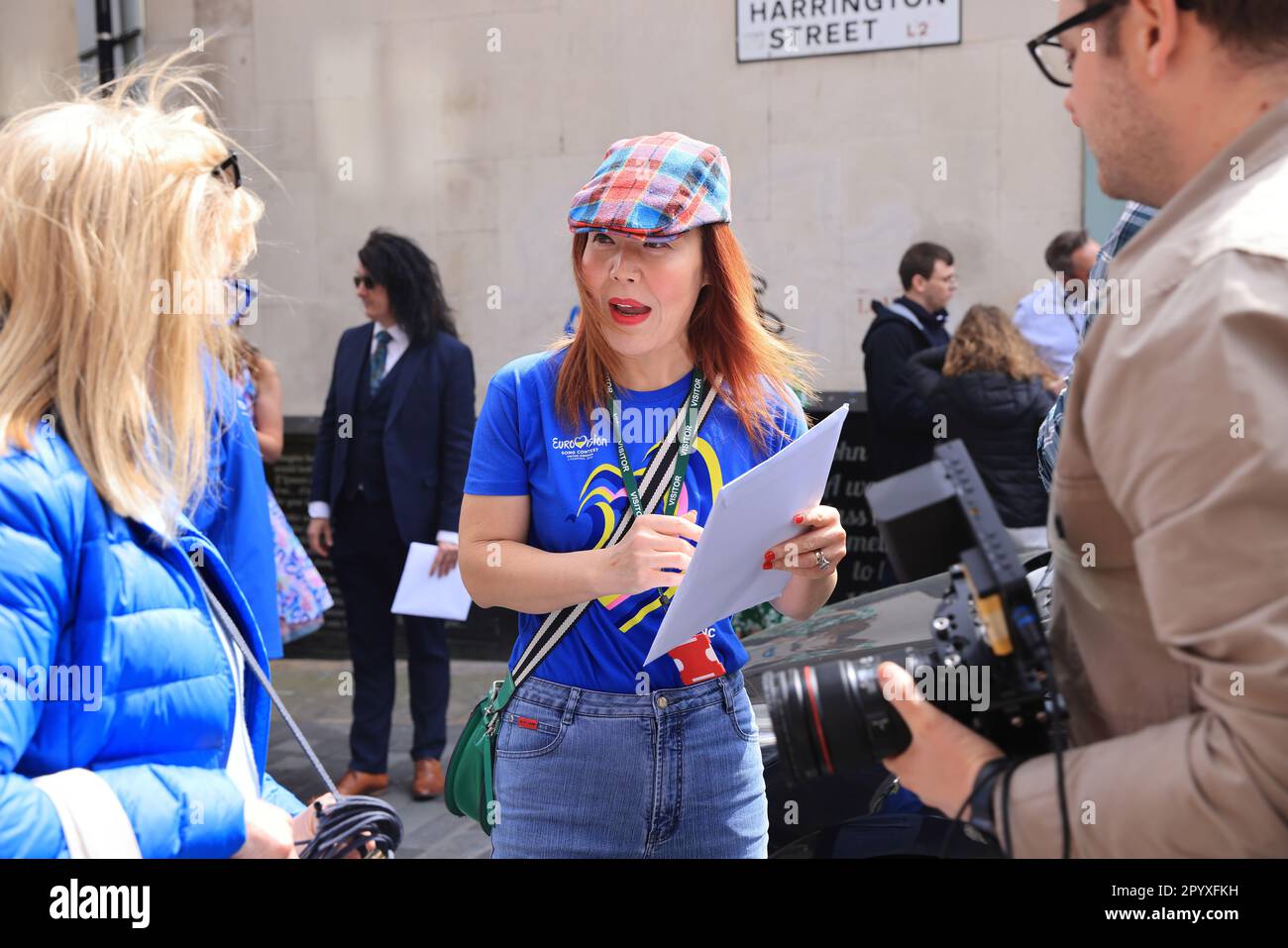

Honest Admission From Uks Eurovision Representative

Apr 25, 2025

Honest Admission From Uks Eurovision Representative

Apr 25, 2025

Latest Posts

-

Politicheskaya Izolyatsiya Zelenskogo Analiz Sobytiy 9 Maya

May 10, 2025

Politicheskaya Izolyatsiya Zelenskogo Analiz Sobytiy 9 Maya

May 10, 2025 -

First Up Imf To Review Pakistans 1 3 Billion Loan Package And Other Top News

May 10, 2025

First Up Imf To Review Pakistans 1 3 Billion Loan Package And Other Top News

May 10, 2025 -

Germaniya Ugroza Novogo Potoka Bezhentsev Iz Ukrainy Rol S Sh A

May 10, 2025

Germaniya Ugroza Novogo Potoka Bezhentsev Iz Ukrainy Rol S Sh A

May 10, 2025 -

Den Pobedy Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 10, 2025

Den Pobedy Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 10, 2025 -

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025