Apple Stock: Long-Term Bullish Despite Price Cut - Wedbush's View

Table of Contents

Wedbush's Bullish Outlook on Apple Stock

Wedbush Securities recently reaffirmed its positive assessment of Apple stock, highlighting several key factors that support their bullish prediction despite the recent price reductions. Their confidence stems from a comprehensive analysis of Apple's financial performance and future growth prospects.

Keywords: Wedbush Apple rating, Apple stock prediction, analyst rating, Apple stock price target

- Strong iPhone Sales and Services Revenue Growth: Wedbush points to consistently strong iPhone sales, even amidst a challenging macroeconomic environment. Furthermore, the continued growth of Apple's Services sector, encompassing Apple Music, iCloud, and the App Store, provides a significant and recurring revenue stream, less susceptible to fluctuations in hardware sales.

- Innovative Product Pipeline: Apple's history of groundbreaking innovation is a key driver of Wedbush's optimism. The anticipation of future product launches and technological advancements contributes to their belief in Apple's continued market leadership and growth.

- Price Target: Wedbush has set a specific price target for Apple stock (the exact figure should be included here, referencing the original Wedbush report). This target reflects their confidence in Apple's long-term potential and profitability.

- Direct Quote: “[Insert a direct quote from the Wedbush report supporting their optimistic view here. Be sure to cite the source appropriately].”

Analyzing the Impact of the Price Cut on Apple's Financials

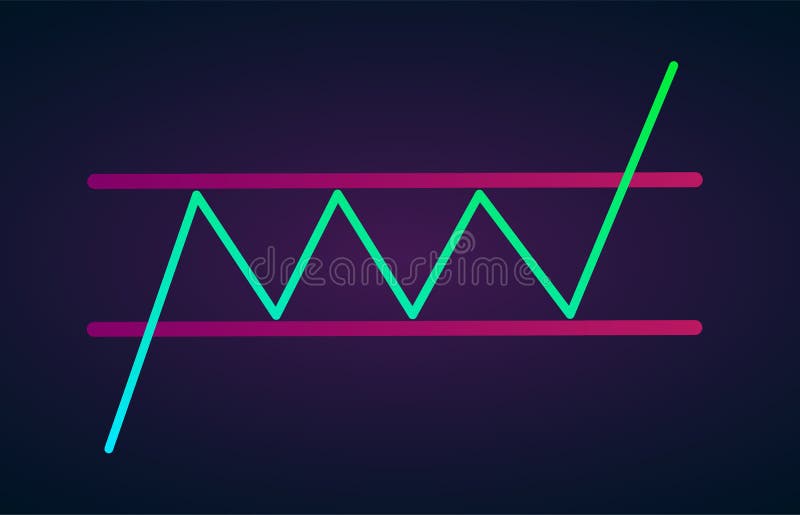

Apple's recent price reductions, particularly affecting certain iPhone models, have naturally raised concerns about their impact on revenue and profit margins. However, Wedbush's analysis suggests that the price cut is a strategic move designed to stimulate sales volume and expand market share.

Keywords: Apple price reduction, Apple sales, Apple revenue, iPhone price cut, impact on margins

- Short-Term Impact: While a short-term dip in profit margins is possible, the increase in sales volume could offset this effect. The actual impact will depend on the elasticity of demand for Apple products.

- Strategic Move to Boost Sales: By making its devices more accessible to a wider customer base, Apple aims to increase its market share and attract new users to its ecosystem. This strategy could lead to long-term gains that outweigh any short-term margin compression.

- Long-Term Profitability: The increased customer acquisition resulting from the price cut could translate into increased revenue from Apple's Services sector and future hardware sales, ultimately enhancing long-term profitability.

Long-Term Growth Drivers for Apple Stock

Beyond the immediate impact of the price cut, several factors contribute to the long-term bullish forecast for Apple stock. These factors represent enduring sources of growth and innovation for the company.

Keywords: Apple services, Apple wearables, Apple growth, future Apple products

- Apple Services' Continued Growth: The Apple Services sector continues to be a significant growth driver, showcasing strong recurring revenue. This segment is less cyclical than hardware sales and demonstrates resilience during economic downturns.

- Expanding Wearables Market: Apple's wearables, including Apple Watch and AirPods, represent a rapidly expanding market segment. Continuous innovation and product development in this area promise considerable future growth.

- Future Product Launches and Innovations: Apple's reputation for innovation remains a cornerstone of its success. Anticipation for future products and technological advancements fuels investor confidence and contributes to the long-term bullish outlook.

Risks and Considerations for Apple Stock Investors

Despite the positive outlook, investors should consider potential risks that could affect Apple's stock performance. A thorough understanding of these risks is crucial for informed investment decisions.

Keywords: Apple stock risk, market volatility, competition, economic downturn, supply chain issues

- Global Economic Uncertainty: Global economic downturns can impact consumer spending, potentially reducing demand for Apple's products.

- Competitive Landscape: The tech industry is highly competitive. The emergence of strong competitors and disruptive technologies poses a risk to Apple's market leadership.

- Supply Chain Disruptions: Global supply chain issues can impact Apple's production and sales, affecting its financial performance.

Conclusion

Wedbush's bullish outlook on Apple stock remains strong despite the recent price cut. The long-term growth prospects, fueled by the continued expansion of Apple Services, the burgeoning wearables market, and the anticipation of future innovations, provide a compelling case for long-term investors. While short-term market fluctuations and economic uncertainties need to be considered, the overall outlook for Apple stock remains positive. Considering Wedbush's positive assessment and the long-term growth potential, now might be a good time to assess your own Apple stock portfolio. Learn more about incorporating Apple stock into your investment strategy and conduct your own thorough research before making any decisions regarding your Apple stock holdings. Remember, this article is not financial advice.

Featured Posts

-

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025 -

China Us Trade Surge Exporters Rush To Meet Trade Deal Deadline

May 24, 2025

China Us Trade Surge Exporters Rush To Meet Trade Deal Deadline

May 24, 2025 -

Complete Bbc Radio 1 Big Weekend Lineup Announced Jorja Smith Biffy Clyro Blossoms And Other Artists

May 24, 2025

Complete Bbc Radio 1 Big Weekend Lineup Announced Jorja Smith Biffy Clyro Blossoms And Other Artists

May 24, 2025 -

Tva Group Restructuring 30 Job Losses Due To Streaming And Regulatory Challenges

May 24, 2025

Tva Group Restructuring 30 Job Losses Due To Streaming And Regulatory Challenges

May 24, 2025 -

Kapitaalmarkt Analyse Van De Stijgende Rentes En De Sterke Euro

May 24, 2025

Kapitaalmarkt Analyse Van De Stijgende Rentes En De Sterke Euro

May 24, 2025

Latest Posts

-

Bitcoin Price Surge Positive Us Regulations Drive Record High

May 24, 2025

Bitcoin Price Surge Positive Us Regulations Drive Record High

May 24, 2025 -

Us Regulatory Developments Boost Bitcoin To Record High

May 24, 2025

Us Regulatory Developments Boost Bitcoin To Record High

May 24, 2025 -

Bitcoin Reaches New Peak Amidst Positive Us Regulatory Outlook

May 24, 2025

Bitcoin Reaches New Peak Amidst Positive Us Regulatory Outlook

May 24, 2025 -

Trumps Threats Prompt Call For Greater Ambition From Canadian Auto Industry

May 24, 2025

Trumps Threats Prompt Call For Greater Ambition From Canadian Auto Industry

May 24, 2025 -

Canadian Automotive Leaders Urge Bold Response To Trump Administration

May 24, 2025

Canadian Automotive Leaders Urge Bold Response To Trump Administration

May 24, 2025