Bitcoin Reaches New Peak Amidst Positive US Regulatory Outlook

Table of Contents

Main Points:

2.1. Positive Shifts in the US Regulatory Landscape:

Easing Regulatory Uncertainty:

Recent statements and actions from key US regulatory bodies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have significantly reduced uncertainty surrounding Bitcoin and other cryptocurrencies. This easing of regulatory ambiguity is a primary catalyst for the current Bitcoin price surge.

- Example 1: The SEC's recent [insert link to relevant SEC statement or ruling] regarding the classification of certain cryptocurrencies as securities has provided greater clarity for the industry, reducing the fear of an outright ban.

- Example 2: The CFTC's [insert link to relevant CFTC statement or ruling] on Bitcoin futures trading has further legitimized Bitcoin in the eyes of institutional investors, opening the door for more mainstream participation.

- Example 3: Proposed legislation focusing on a comprehensive regulatory framework for cryptocurrencies [insert link to proposed legislation], while still under discussion, signals a proactive approach to regulation rather than outright suppression. This shift towards a more balanced regulatory approach is vital.

Keywords: SEC Bitcoin regulation, CFTC Bitcoin regulation, cryptocurrency regulatory clarity, US crypto policy, regulatory uncertainty, Bitcoin regulatory framework.

Increased Institutional Interest:

The perceived reduced regulatory risk is driving a surge in institutional investment in Bitcoin. Large hedge funds and corporations are increasingly viewing Bitcoin as a viable asset class, contributing significantly to the price increase.

- Example 1: [Insert example of a major institutional investment in Bitcoin, e.g., a specific company's purchase]. This demonstrates the growing confidence in the long-term potential of Bitcoin.

- Example 2: The continued success of the Grayscale Bitcoin Trust [insert link to Grayscale data] highlights the institutional demand for Bitcoin exposure.

- Example 3: Discussions around Bitcoin ETFs [insert link to relevant news articles] are further accelerating institutional adoption and increasing liquidity within the market.

Keywords: Institutional Bitcoin investment, Bitcoin ETF, Grayscale Bitcoin Trust, corporate Bitcoin adoption, institutional investors, Bitcoin investment strategies.

2.2. Impact on Bitcoin Price and Market Sentiment:

Record Bitcoin Price Highs:

The positive regulatory shifts have translated directly into record Bitcoin price highs. [Insert chart or graph showing Bitcoin price increase]. The price has increased by [insert percentage]% in the last [insert timeframe], reaching a new all-time high of [insert price].

- Bitcoin's market capitalization has also seen a substantial increase, reaching [insert current market cap].

- Trading volume has surged, indicating heightened investor activity and market enthusiasm.

Keywords: Bitcoin price chart, Bitcoin market cap, Bitcoin trading volume, Bitcoin all-time high, Bitcoin price prediction, BTC price.

Increased Market Confidence:

The regulatory developments have significantly boosted market confidence in Bitcoin and the broader cryptocurrency market.

- Positive social media sentiment and news coverage reflect a growing belief in Bitcoin's long-term prospects.

- Many analysts now predict continued growth for Bitcoin, based on the improved regulatory outlook.

Keywords: Bitcoin sentiment analysis, cryptocurrency market outlook, Bitcoin price prediction, market confidence, crypto market sentiment.

2.3. Potential Future Implications and Risks:

Continued Regulatory Scrutiny:

While the current outlook is positive, it's crucial to acknowledge that regulatory uncertainty remains a factor. Future regulatory changes could significantly impact Bitcoin's price.

- Further regulatory scrutiny could lead to increased compliance costs for businesses operating in the crypto space.

- Unforeseen legislative hurdles could create volatility in the Bitcoin market.

Keywords: Bitcoin regulation risks, cryptocurrency regulatory uncertainty, future of Bitcoin regulation, regulatory challenges.

Long-Term Bitcoin Growth Potential:

A more positive regulatory environment significantly enhances Bitcoin's long-term growth potential. Increased clarity and reduced risk make Bitcoin a more attractive asset class for a wider range of investors.

- The potential use cases for Bitcoin beyond its role as a store of value, such as microtransactions and decentralized finance (DeFi), remain promising.

- Technological advancements in the Bitcoin network could further enhance its efficiency and scalability.

Keywords: Bitcoin future price, Bitcoin adoption rate, cryptocurrency market growth, Bitcoin use cases, long-term Bitcoin investment.

Conclusion: Navigating the Bitcoin Peak and Future Regulatory Landscape

The recent Bitcoin price peak underscores the significant impact of a positive US regulatory outlook on the cryptocurrency market. Easing regulatory uncertainty and increased institutional interest have combined to fuel this remarkable surge. While future regulatory developments remain a factor, the current trajectory suggests strong growth potential for Bitcoin in the long term. Explore Bitcoin investment opportunities carefully, staying informed on Bitcoin regulation updates and considering its role within a diversified investment portfolio. The evolving landscape of Bitcoin and cryptocurrency necessitates diligent research and informed decision-making. Consider adding Bitcoin to your portfolio as part of a comprehensive investment strategy, but always proceed with caution and seek professional financial advice.

Featured Posts

-

Experience The Usa Film Festival Free Movies In Dallas

May 24, 2025

Experience The Usa Film Festival Free Movies In Dallas

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Jordan Bardella A Contender In The French Presidential Race

May 24, 2025

Jordan Bardella A Contender In The French Presidential Race

May 24, 2025 -

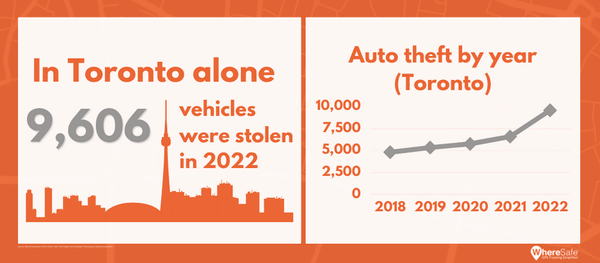

Budget Constraints And The Rise In Canadian Auto Theft

May 24, 2025

Budget Constraints And The Rise In Canadian Auto Theft

May 24, 2025 -

La Repression Chinoise Des Dissidents S Etend En France

May 24, 2025

La Repression Chinoise Des Dissidents S Etend En France

May 24, 2025

Latest Posts

-

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025 -

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025 -

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025 -

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025