Bitcoin Price Surge: Positive US Regulations Drive Record High

Table of Contents

Positive Regulatory Developments Fueling the Bitcoin Price Surge

Recent positive regulatory developments in the US concerning Bitcoin and cryptocurrencies are significantly fueling the current price surge. The increased clarity and favorable stance from regulators are creating a more stable and attractive environment for both individual and institutional investors.

-

Specific examples of new bills or proposed legislation: Several states have introduced bills clarifying the legal status of Bitcoin and other cryptocurrencies, reducing the regulatory grey areas that previously hindered wider adoption. For instance, the [insert example of specific legislation, e.g., "New York's BitLicense framework"] has provided a clearer path for cryptocurrency businesses to operate legally. Furthermore, discussions at the federal level regarding a comprehensive regulatory framework for digital assets are signaling a more proactive and less antagonistic approach.

-

Clarification of regulatory grey areas: The reduction in regulatory uncertainty is a key factor. Previously, the lack of clear guidelines created a climate of fear and uncertainty, deterring many potential investors. The ongoing efforts to define and regulate the cryptocurrency market are now fostering a more predictable environment.

-

Increased regulatory clarity leading to greater institutional investment: Institutional investors, with their large capital reserves, are notoriously risk-averse. The increased regulatory clarity is reducing this risk, paving the way for significant institutional investment in Bitcoin. This influx of capital is directly contributing to the price surge.

Impact of Clarity on Institutional Investment

Reduced regulatory uncertainty is encouraging large-scale investments from institutional players like hedge funds, asset management firms, and even publicly traded companies. These entities require a level of legal certainty before committing significant capital, and the recent positive regulatory developments are providing just that. This institutional buying pressure is a significant driver of the current Bitcoin price surge.

The Role of Regulatory Sandboxes in Bitcoin Adoption

Regulatory sandboxes, where companies can test new technologies and business models under controlled regulatory supervision, are accelerating Bitcoin adoption. These initiatives allow businesses to innovate within a defined framework, minimizing risks and fostering a culture of responsible experimentation. This approach helps in identifying potential issues and allows regulators to adjust their guidelines, further strengthening the Bitcoin ecosystem.

Increased Investor Confidence and Market Sentiment

Positive regulations directly translate to increased investor confidence and a more positive market sentiment. The perception of reduced risk, coupled with positive media coverage and favorable analyst predictions, is creating a self-reinforcing cycle of investment.

-

Data showing increased trading volume and market capitalization: Data clearly shows a significant rise in Bitcoin trading volume and market capitalization coinciding with the positive regulatory news. [Insert relevant data/charts showing this correlation].

-

Positive media coverage and analyst predictions driving further investment: The positive regulatory shifts have garnered significant media attention, further bolstering investor confidence. Many analysts now predict continued Bitcoin price growth, creating a positive feedback loop.

-

Impact of reduced fear of regulatory crackdowns on investor psychology: The lessening fear of harsh regulatory crackdowns has a considerable psychological impact on investors. Reduced uncertainty leads to greater willingness to invest, driving up demand and price.

The Psychology of Bitcoin Investment

Bitcoin investment is significantly influenced by investor psychology. Factors like fear of missing out (FOMO), herd mentality, and risk tolerance all play a role in price fluctuations. Positive regulatory news significantly mitigates the fear element, encouraging broader participation.

Correlation between Regulatory News and Bitcoin Price Fluctuations

Analysis shows a strong positive correlation between positive regulatory news and Bitcoin price increases. As regulatory clarity improves, investor confidence rises, leading to increased demand and consequently, higher prices. [Insert relevant data/charts supporting this correlation].

Future Outlook: Sustained Growth or Short-Lived Rally?

The question remains: will this Bitcoin price surge continue, or is it a short-lived rally? While positive US regulations provide a strong foundation for sustained growth, several factors could influence future price movements.

-

Potential challenges and risks: Despite the positive regulatory developments, challenges remain. Volatility is inherent to cryptocurrencies, and external factors like macroeconomic conditions and geopolitical events can significantly impact Bitcoin's price.

-

Expert opinions and predictions for Bitcoin's price: Expert opinions are varied, with some predicting continued growth while others caution against over-optimism. It's crucial to consider a range of perspectives and avoid relying solely on bullish predictions.

-

The importance of diversification and risk management: For Bitcoin investors, diversification and risk management remain crucial. Investing only in Bitcoin carries significant risk, and a well-diversified portfolio can mitigate potential losses.

Geopolitical Factors Influencing Bitcoin's Price

Geopolitical events, such as international conflicts or changes in global economic policies, can significantly influence Bitcoin's price. These external factors can create uncertainty and volatility in the market, impacting investor sentiment and price movements.

Technological Advancements and Their Impact on Bitcoin's Value

Technological advancements within the Bitcoin ecosystem, such as improved scalability solutions and advancements in blockchain technology, can positively impact Bitcoin's long-term value proposition. Increased adoption and efficiency can drive further price appreciation.

Conclusion

The recent Bitcoin price surge is significantly linked to positive US regulatory developments. Increased regulatory clarity, reduced uncertainty, and a more favorable regulatory environment have fueled investor confidence, leading to increased institutional investment and a rising price. The connection between regulatory clarity and market growth is undeniable.

Stay updated on the latest developments influencing the Bitcoin price surge and make informed investment decisions. Learn more about Bitcoin investment strategies and subscribe to our newsletter for the latest updates.

Featured Posts

-

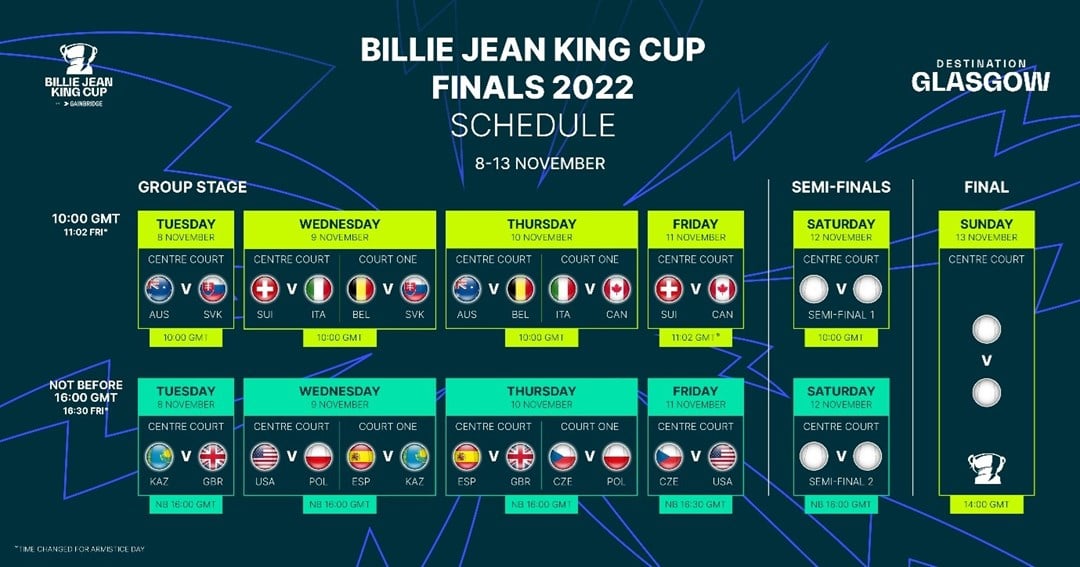

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Power Performance

May 24, 2025

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Power Performance

May 24, 2025 -

Glastonbury 2025 Full Lineup Announcement Olivia Rodrigo And The 1975 Headline

May 24, 2025

Glastonbury 2025 Full Lineup Announcement Olivia Rodrigo And The 1975 Headline

May 24, 2025 -

Porsche Macan Ev Eiginleikar Og Verdlagning

May 24, 2025

Porsche Macan Ev Eiginleikar Og Verdlagning

May 24, 2025 -

Bianca Andreescus Straight Sets Victory Sends Her To Italian Open Fourth Round

May 24, 2025

Bianca Andreescus Straight Sets Victory Sends Her To Italian Open Fourth Round

May 24, 2025 -

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025

Latest Posts

-

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025 -

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025 -

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025 -

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025