US Regulatory Developments Boost Bitcoin To Record High

Table of Contents

The cryptocurrency market is experiencing a surge, with Bitcoin hitting record highs fueled by recent positive developments in US regulatory frameworks. This unprecedented rise signifies a potential turning point in the acceptance and mainstream adoption of Bitcoin, driven by clearer regulatory guidelines and increased institutional investment. This article explores the key US regulatory developments that have propelled Bitcoin to new heights.

Increased Clarity on Crypto Taxation

The IRS's approach to cryptocurrency taxation has been a major source of uncertainty for investors. However, recent developments have brought increased clarity, reducing ambiguity and encouraging greater compliance.

- IRS Guidance on Crypto Reporting: The IRS has issued clearer guidelines on how to report cryptocurrency transactions, including streamlined tax forms and improved resources for taxpayers. Specific publications, such as IRS Notice 2014-21 and subsequent updates, have provided more detailed explanations of how different types of cryptocurrency transactions are taxed. This includes clarifying the treatment of capital gains and losses for Bitcoin and other cryptocurrencies.

- Impact on Investor Confidence: This increased clarity has significantly improved investor confidence. Knowing precisely how their cryptocurrency transactions will be taxed allows investors to better manage their financial planning and reduces the risk associated with non-compliance. The result has been a greater willingness to participate in the Bitcoin market, contributing to the overall price increase.

Gradual Institutional Adoption Fueled by Regulatory Certainty

Regulatory certainty is a crucial factor driving institutional investment in Bitcoin. The increased clarity around taxation and custody solutions is paving the way for larger players to enter the market.

- SEC Approvals and ETF Applications: The SEC's ongoing review of Bitcoin ETF applications is a key indicator of the evolving regulatory landscape. While approvals haven't been finalized, the very consideration of Bitcoin ETFs by a major regulatory body signals growing acceptance and legitimacy. The potential approval of a Bitcoin ETF could trigger a massive influx of institutional money, significantly impacting the price.

- Bank Involvement in Crypto Custody: Major banks, recognizing the growing demand, are starting to offer cryptocurrency custody services. This provides institutional investors with the security and regulatory compliance they need. The ability to store Bitcoin safely and securely through established financial institutions significantly reduces the risks associated with self-custody, making Bitcoin a more attractive investment for large funds and corporations. Examples include [mention specific banks and their services, if available].

State-Level Regulatory Frameworks

While federal regulations set the overall tone, state-level approaches vary, creating a complex regulatory environment.

- Varying Approaches Across States: Different states have adopted different approaches to regulating cryptocurrencies, leading to a patchwork of regulations across the US. Some states are actively promoting the use of cryptocurrencies, while others have taken a more cautious approach. This regulatory inconsistency poses challenges, but it also fosters innovation and experimentation.

- Challenges and Opportunities: This inconsistency creates uncertainty and challenges for businesses operating nationally. However, it also presents opportunities for state-level innovation and the potential for best practices to emerge, which could later inform federal legislation. The eventual harmonization of state regulations will lead to a more predictable and stable market.

Impact of Regulatory Developments on Bitcoin Price

The correlation between positive regulatory news and Bitcoin's price is undeniable.

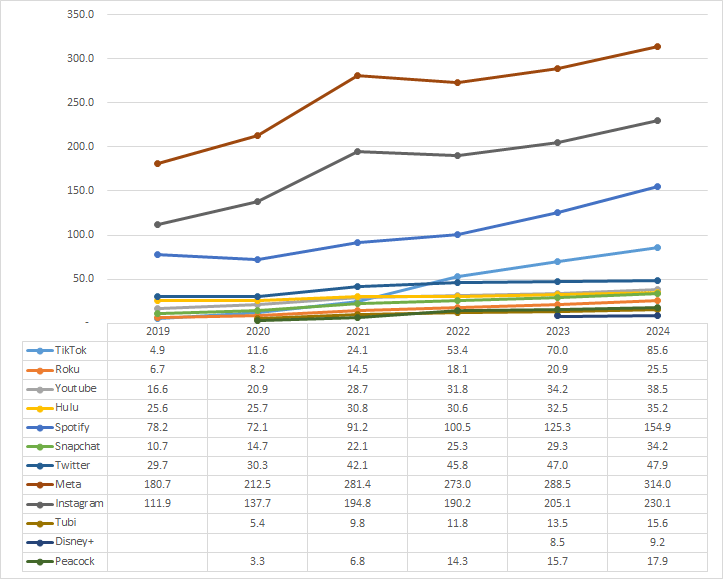

- Correlation between Regulatory Clarity and Market Growth: Positive regulatory announcements, such as clearer tax guidelines or the progress of ETF applications, have consistently been followed by increases in Bitcoin's price. This demonstrates the direct impact of regulatory clarity on investor confidence and market sentiment.

- Impact on Market Sentiment: Reduced uncertainty and increased regulatory clarity directly improve market sentiment. When investors feel more confident, they are more likely to invest, driving up demand and pushing the price higher. This positive feedback loop reinforces the importance of favorable regulatory developments for Bitcoin's price trajectory. [Include charts or graphs, if available, visually demonstrating this correlation].

Conclusion

Recent US regulatory developments have been instrumental in driving Bitcoin to record highs. Increased clarity surrounding taxation, the growing acceptance of Bitcoin by institutional investors, and the gradual evolution of state-level frameworks have all contributed to a more mature and stable cryptocurrency market. While challenges and uncertainties remain, the trend points towards greater acceptance and mainstream adoption of Bitcoin. Staying informed about future US Bitcoin regulation and its impact is vital for making informed investment decisions. Understanding the intricacies of US Bitcoin regulation is key to effectively navigating this dynamic and evolving market.

Featured Posts

-

News Corps Hidden Value Underappreciated Business Units And Future Growth

May 24, 2025

News Corps Hidden Value Underappreciated Business Units And Future Growth

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts Electrifying Ferrari Challenge Racing Days

May 24, 2025 -

Paris In The Red Luxury Goods Slump Hits City Budget March 7 2025

May 24, 2025

Paris In The Red Luxury Goods Slump Hits City Budget March 7 2025

May 24, 2025 -

Washington D C Museum Shooting Israeli Embassy Employees Killed

May 24, 2025

Washington D C Museum Shooting Israeli Embassy Employees Killed

May 24, 2025

Latest Posts

-

The Last Rodeo An Interview With Neal Mc Donough On Bull Riding And Portraying The Pope

May 24, 2025

The Last Rodeo An Interview With Neal Mc Donough On Bull Riding And Portraying The Pope

May 24, 2025 -

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And A New Look

May 24, 2025

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And A New Look

May 24, 2025 -

Neal Mc Donoughs Last Rodeo Discussing Bull Riding And His Role As The Pope

May 24, 2025

Neal Mc Donoughs Last Rodeo Discussing Bull Riding And His Role As The Pope

May 24, 2025 -

Tulsa King Season 3 Is Neal Mc Donough Back Sylvester Stallones New Look And Filming Details

May 24, 2025

Tulsa King Season 3 Is Neal Mc Donough Back Sylvester Stallones New Look And Filming Details

May 24, 2025 -

Neal Mc Donough From Bull Riding To The Pope His Last Rodeo

May 24, 2025

Neal Mc Donough From Bull Riding To The Pope His Last Rodeo

May 24, 2025