Amundi MSCI World Ex-US UCITS ETF Acc: NAV Calculation And Implications

Table of Contents

The Mechanics of Amundi MSCI World ex-US UCITS ETF Acc NAV Calculation

Defining Net Asset Value (NAV)

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. It's essentially the total value of all the securities held within the ETF, minus any liabilities, divided by the total number of outstanding shares. The NAV serves as a benchmark for the ETF's price, ensuring fair trading. It's calculated daily, typically at the close of market trading.

- Simple Definition: NAV = (Total Asset Value - Liabilities) / Number of Outstanding Shares

- Significance: Provides a true reflection of the ETF's intrinsic worth.

- Daily Calculation: Ensures pricing transparency and reflects market movements.

Asset Composition and its Impact on NAV

The Amundi MSCI World ex-US UCITS ETF Acc tracks the MSCI World ex-US Index, meaning its holdings mirror this benchmark index of large and mid-cap companies globally, excluding the United States. Several factors influence the NAV:

- Currency Fluctuations: Changes in exchange rates between the currencies of the underlying assets and the ETF's base currency (likely EUR) directly impact the NAV. A strengthening Euro against other currencies could increase the NAV, and vice versa.

- Dividend Payments: When underlying companies pay dividends, this increases the overall asset value and therefore the NAV, before being distributed to ETF shareholders.

- Management Fees: The ETF's management fees are deducted from the assets, slightly reducing the NAV over time.

The Role of the Custodian Bank

A custodian bank plays a vital role in the NAV calculation process for the Amundi MSCI World ex-US UCITS ETF Acc. Their responsibilities include:

- Asset Verification: Independently verifying the ownership and valuation of all assets held within the ETF.

- NAV Calculation Oversight: Ensuring the accurate calculation of the daily NAV based on the custodian's verified asset data.

Transparency and Data Availability

The Amundi MSCI World ex-US UCITS ETF Acc NAV is readily available to investors. Transparency is key:

- Accessibility: Daily NAV data is usually published on the Amundi website, major financial news sources, and most brokerage platforms where the ETF is traded.

- Real-time Updates: While the official NAV is calculated daily, many platforms provide intraday indicative NAVs.

Implications of NAV Fluctuations for Investors

Understanding Price Volatility

The market price of the Amundi MSCI World ex-US UCITS ETF Acc should closely track its NAV. However, short-term deviations can occur due to supply and demand. Understanding the factors impacting NAV is critical:

- Market Movements: Changes in the overall market (e.g., bull or bear market) directly influence the price of the underlying assets and, consequently, the NAV.

- Currency Swings: Significant currency fluctuations can create short-term NAV volatility.

Investment Strategy and NAV

Using NAV information strategically can enhance investment performance:

- Buy Low, Sell High (In Theory): While not always feasible, aiming to buy when the NAV is relatively low and sell when it's relatively high is a common investment principle.

- Long-Term Perspective: NAV fluctuations are normal, especially in the short term. A long-term investment horizon is generally recommended for ETFs like the Amundi MSCI World ex-US UCITS ETF Acc.

Tax Implications Related to NAV Changes

Capital gains realized from selling shares of the Amundi MSCI World ex-US UCITS ETF Acc are subject to taxes based on the difference between the purchase price and the sale price (which will relate to the NAV). It's essential to:

- Understand Tax Laws: Familiarize yourself with your country's tax laws concerning capital gains on ETF investments.

- Seek Professional Advice: Consult a financial advisor for personalized tax planning related to your investments.

Comparing Amundi MSCI World ex-US UCITS ETF Acc NAV to Competitors

Benchmarking Against Similar ETFs

Comparing the Amundi MSCI World ex-US UCITS ETF Acc's NAV performance against similar ETFs that track the same or similar indices is crucial for evaluating its relative performance. This helps in understanding if it's delivering competitive returns.

- Performance Analysis: Review historical NAV data and compare it to competitors' NAVs to identify areas of relative strength or weakness.

- Methodology Differences: Note any variations in calculation methods between ETFs as this can affect direct comparisons.

Analyzing Expense Ratios and their Effect on NAV

Expense ratios significantly impact long-term NAV growth. A lower expense ratio means more of the investment returns are retained.

- Expense Ratio Comparison: Analyze the Amundi ETF's expense ratio against similar ETFs to assess its cost-effectiveness. Lower expense ratios generally lead to higher long-term NAV growth.

Conclusion: Making Informed Decisions with Amundi MSCI World ex-US UCITS ETF Acc NAV Data

Understanding the Amundi MSCI World ex-US UCITS ETF Acc NAV calculation, the implications of its fluctuations, and how it compares to its competitors is vital for effective investment management. Regular monitoring of the NAV, coupled with a long-term perspective, can contribute to successful investing. Remember to consult a financial advisor for tailored guidance before making any investment decisions. Use the readily available Amundi MSCI World ex-US UCITS ETF Acc NAV data to make informed decisions and optimize your investment strategy.

Featured Posts

-

Severe Delays On M6 Southbound Following Collision

May 24, 2025

Severe Delays On M6 Southbound Following Collision

May 24, 2025 -

Porsche 956 Nin Tavan Sergilemesi Tasarim Ve Muehendislik

May 24, 2025

Porsche 956 Nin Tavan Sergilemesi Tasarim Ve Muehendislik

May 24, 2025 -

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx Europe 600 Ve Dax 40 Taki Gerileme

May 24, 2025

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx Europe 600 Ve Dax 40 Taki Gerileme

May 24, 2025 -

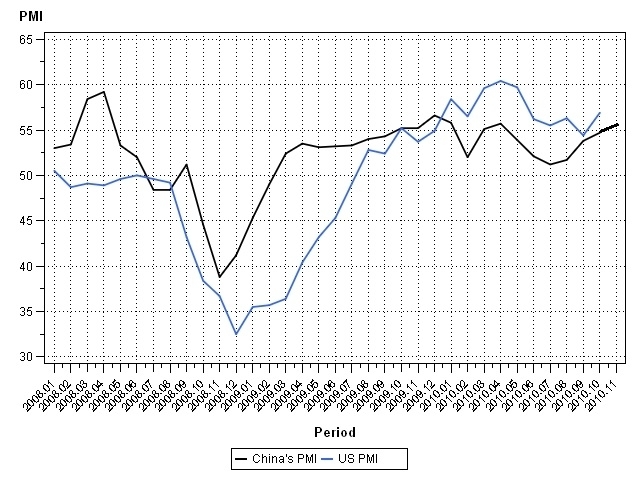

Dow Joness Measured Rise Strong Pmi Bolsters Market Confidence

May 24, 2025

Dow Joness Measured Rise Strong Pmi Bolsters Market Confidence

May 24, 2025 -

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025

Latest Posts

-

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 24, 2025 -

News Corps Hidden Value Underappreciated Business Units And Future Growth

May 24, 2025

News Corps Hidden Value Underappreciated Business Units And Future Growth

May 24, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025 -

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 24, 2025