Amundi DJIA UCITS ETF: A Detailed Look At Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and why is it crucial for the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, per share. For the Amundi DJIA UCITS ETF, this means the total value of its holdings in the 30 constituent companies of the Dow Jones Industrial Average, adjusted for any expenses or liabilities. The daily NAV fluctuations directly reflect the market performance of the DJIA. If the DJIA rises, the Amundi DJIA UCITS ETF NAV generally increases, and vice versa.

Understanding the Amundi DJIA UCITS ETF NAV is critical for several reasons:

- NAV reflects the intrinsic value of the ETF. It provides a clear picture of the actual worth of your investment.

- Daily NAV changes are publicly available. You can easily track the performance of your investment.

- Understanding NAV helps compare ETF performance against benchmarks. It allows for accurate assessment against the DJIA itself.

- NAV is crucial for calculating returns on investment. It forms the basis for determining your profit or loss.

The Amundi DJIA UCITS ETF NAV is therefore a key indicator of its performance and a valuable tool for investment analysis.

Factors Affecting the Amundi DJIA UCITS ETF NAV

Several factors influence the daily NAV of the Amundi DJIA UCITS ETF:

- Movement of the Dow Jones Industrial Average (DJIA) components: The primary driver is the performance of the 30 companies within the DJIA. Positive performance in these stocks directly boosts the NAV.

- Currency fluctuations: If the ETF holds assets denominated in currencies other than the base currency of the ETF, exchange rate movements can impact the NAV.

- Dividend payouts from underlying stocks: Dividends received from the underlying companies are added to the NAV, increasing its value.

- Management fees and expenses: These costs are deducted from the ETF's assets, slightly reducing the NAV.

These factors interact dynamically. For example, strong positive market sentiment, reflected in rising DJIA components, can offset the impact of management fees. Conversely, negative geopolitical events or economic downturns can negatively influence the DJIA, resulting in a lower Amundi DJIA UCITS ETF NAV.

- Market sentiment significantly impacts DJIA, hence the ETF's NAV. Bullish markets generally result in higher NAVs.

- Economic indicators affect DJIA performance. Positive economic data often correlates with higher DJIA and NAV.

- Geopolitical events impact the overall market and NAV. Uncertainty can lead to market volatility and NAV fluctuations.

- Understanding these factors helps predict potential NAV changes. While not foolproof, this knowledge aids in risk management.

How to Access and Interpret Amundi DJIA UCITS ETF NAV Data

Daily Amundi DJIA UCITS ETF NAV data is readily accessible from several sources:

- Amundi's official website: The asset manager usually provides up-to-date NAV information.

- Financial news websites and data providers: Reputable financial news sources often publish ETF NAVs.

- Brokerage platforms: If you hold the ETF through a brokerage account, the platform will typically display the NAV.

Interpreting NAV data involves comparing it to historical NAVs to analyze trends. Crucially, you should also compare the NAV with the ETF's market price. A difference between these two reflects the tracking error, indicating how closely the ETF's price tracks its NAV.

- Reliable sources for obtaining accurate NAV information are essential for sound investment decisions.

- Tools and platforms that provide historical NAV data allow for in-depth performance analysis.

- How to use NAV to track long-term performance is vital for assessing investment strategy effectiveness.

- Interpreting NAV alongside other key performance indicators provides a holistic view of ETF performance.

Amundi DJIA UCITS ETF NAV vs. Market Price: Understanding the Difference

While the NAV aims to reflect the intrinsic value of the ETF, the market price at which the ETF trades can sometimes differ. This discrepancy arises due to supply and demand dynamics in the market. The bid-ask spread, the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, also contributes to the price variation.

- Factors leading to divergence between NAV and market price include market liquidity and investor sentiment.

- The role of market liquidity is significant; higher liquidity usually results in smaller discrepancies.

- How to assess the significance of the price difference involves considering the overall market conditions and the ETF's trading volume.

- Understanding premiums and discounts relative to the NAV is essential for making informed trading decisions. A premium indicates the market price is higher than the NAV, and vice versa for a discount.

Conclusion

Understanding Amundi DJIA UCITS ETF NAV is essential for making well-informed investment decisions. We've seen how the NAV reflects the underlying value of the ETF, its daily fluctuations mirroring the performance of the DJIA. Key factors such as DJIA component movements, currency fluctuations, and management fees all impact the NAV. Furthermore, understanding the potential difference between the NAV and market price, along with accessing reliable data sources, empowers investors to effectively track performance and manage risk. By actively monitoring the Amundi DJIA UCITS ETF NAV and considering the factors influencing it, investors can make more confident and strategic investment choices. For more detailed information on Amundi DJIA UCITS ETF NAV and potential investment strategies, we recommend visiting Amundi's website or consulting with a qualified financial advisor.

Featured Posts

-

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025 -

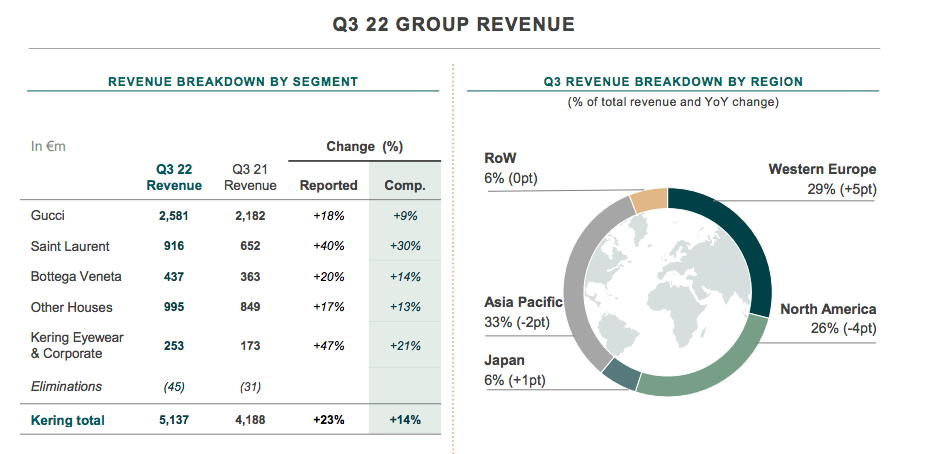

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025 -

The Demna Gvasalia Effect Reshaping Guccis Aesthetic

May 24, 2025

The Demna Gvasalia Effect Reshaping Guccis Aesthetic

May 24, 2025 -

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Latest Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

Demnas Influence Reshaping Guccis Identity And Brand Image

May 24, 2025

Demnas Influence Reshaping Guccis Identity And Brand Image

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025 -

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025