Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value (NAV)

Table of Contents

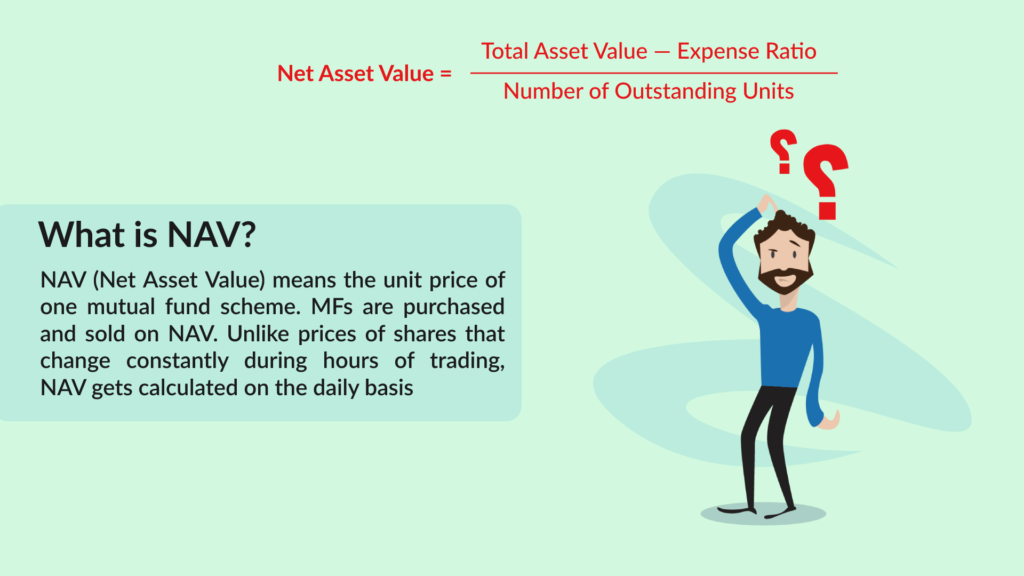

What is Net Asset Value (NAV) and How is it Calculated?

Definition and Importance

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. It's calculated by taking the total market value of all the securities held within the ETF, subtracting any liabilities (including management fees and expenses), and then dividing by the total number of outstanding shares. Understanding the NAV is critical for several reasons: it allows you to track the ETF's performance, compare it to other investments, and make informed decisions about buying or selling. A rising NAV generally indicates a positive performance, while a falling NAV suggests the opposite. This is a fundamental metric for evaluating any ETF, including the Amundi MSCI All Country World UCITS ETF USD Acc.

Calculation Method

The NAV calculation process is relatively straightforward:

- Sum the market value of all holdings: This involves adding up the current market prices of all the stocks, bonds, and other assets within the ETF's portfolio.

- Subtract liabilities: Deduct any expenses, fees, and other liabilities associated with managing the ETF. This includes the expense ratio, which is a recurring cost.

- Divide by outstanding shares: Divide the resulting net asset value by the total number of ETF shares currently in circulation.

This calculation provides a precise figure representing the per-share value of the ETF. Keywords: Net Asset Value, NAV calculation, ETF valuation, daily NAV, market value, liabilities, share price, currency risk.

Daily NAV Updates and Influencing Factors

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is typically updated daily, reflecting the closing market prices of its underlying assets. You can usually find this information on the Amundi website, major financial news sources, or through your brokerage account. Several factors can influence daily NAV fluctuations:

- Market price changes: The most significant factor is the movement of the market prices of the underlying assets within the ETF. If the market goes up, the NAV generally rises; if it goes down, the NAV typically falls.

- Currency fluctuations: Because this is a USD Acc ETF, fluctuations in exchange rates between the US dollar and other currencies significantly impact the NAV. A strengthening dollar will generally increase the NAV, while a weakening dollar will have the opposite effect.

- Dividend distributions: When the underlying companies in the ETF pay dividends, this affects the NAV, although it's usually a relatively small impact.

Understanding NAV in the Context of Amundi MSCI All Country World UCITS ETF USD Acc

Specific Considerations for Global Diversification

Calculating the NAV for the Amundi MSCI All Country World UCITS ETF USD Acc involves unique considerations due to its global diversification. Valuing numerous international holdings across various markets and currencies adds complexity. The ETF tracks the MSCI All Country World Index, which represents a vast number of companies across different sectors and geographies. This broad diversification spreads risk but also complicates the NAV calculation due to the need to consider multiple exchange rates.

Impact of Currency Fluctuations

Currency exchange rate movements significantly affect the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc. If the US dollar strengthens against other currencies, the value of the non-USD holdings, when converted to USD, will increase, thus raising the NAV. Conversely, a weakening dollar will generally lower the NAV. Investors should be aware of this inherent currency risk.

Expense Ratio's Effect on NAV

The ETF's expense ratio, though small, subtly impacts the NAV over time. The expense ratio represents the annual fee charged for managing the ETF. This fee is deducted from the overall asset value, slightly reducing the NAV over the long term. It's crucial to consider this factor when evaluating the ETF's overall return.

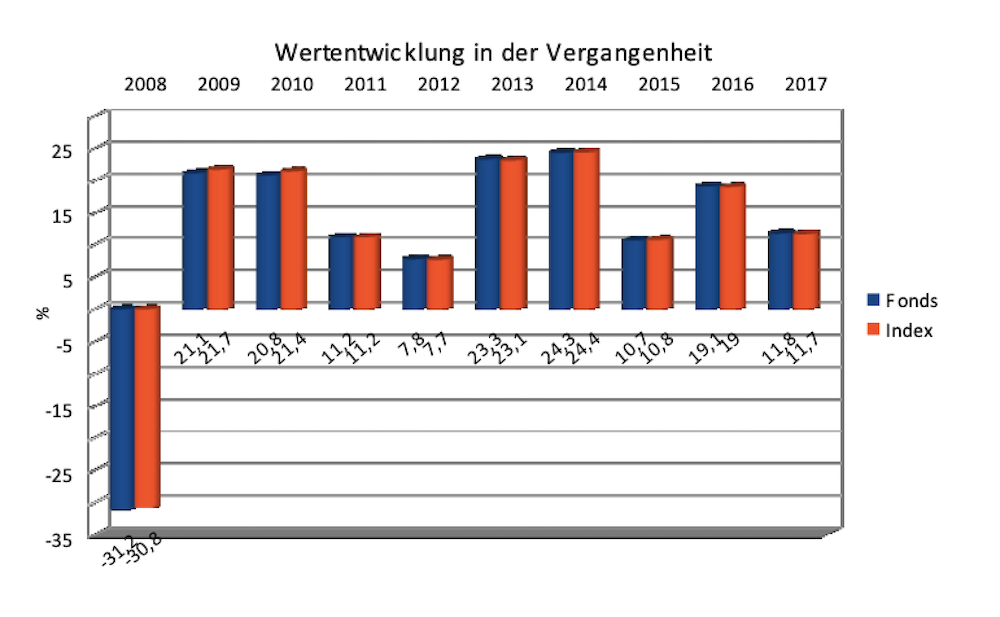

Interpreting NAV Changes

Small daily changes in the NAV are often insignificant and are often simply the result of daily market fluctuations. It's more important to observe longer-term trends in the NAV to assess the ETF's performance. Focus on consistent, long-term growth rather than reacting to short-term volatility. Keywords: Amundi MSCI All Country World UCITS ETF NAV, global diversification, currency exchange rates, expense ratio, investment performance.

How to Use NAV Information for Investment Decisions

Comparing Performance

Use NAV data to compare the Amundi MSCI All Country World UCITS ETF USD Acc's performance against other ETFs or investment options. Compare percentage changes in NAV over specific periods to assess relative performance. However, remember to also account for differences in expense ratios.

Timing Purchases and Sales

While tempting, trying to time the market based solely on short-term NAV fluctuations is generally discouraged. A long-term investment strategy focused on regular investing, rather than market timing, is usually more successful.

Evaluating Investment Returns

Calculate your investment returns by comparing the change in NAV since your initial purchase, considering any reinvested dividends. This will provide a clear picture of your investment's growth.

Using NAV for Portfolio Allocation

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc helps you make informed decisions about the appropriate allocation of this ETF within your broader investment portfolio. It helps determine the right balance of risk and diversification within your overall strategy. Keywords: Investment strategy, ETF performance comparison, buy and sell signals, investment returns, portfolio allocation, risk management.

Conclusion: Mastering the Amundi MSCI All Country World UCITS ETF USD Acc's NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for making informed investment decisions. This guide has explained how NAV is calculated, the factors influencing it, and how to use this information for performance comparison, investment timing (though cautioning against market timing), and portfolio allocation. Remember to regularly monitor the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc investments and continue researching the ETF to gain a deeper understanding of its performance and associated risks. By understanding the NAV, you can confidently manage your investment in this globally diversified fund. For further information, consult the Amundi website or your financial advisor. Keywords: Amundi MSCI All Country World UCITS ETF NAV, investment knowledge, informed decisions, ETF investment, portfolio management.

Featured Posts

-

Pletojamas Porsche Elektromobiliu Ikrovimo Tinklas Europoje

May 24, 2025

Pletojamas Porsche Elektromobiliu Ikrovimo Tinklas Europoje

May 24, 2025 -

Your Dream Country Escape Making The Move A Reality

May 24, 2025

Your Dream Country Escape Making The Move A Reality

May 24, 2025 -

Hvad Gerir Nyja Porsche Macan Rafmagnsbilinn Einstakan

May 24, 2025

Hvad Gerir Nyja Porsche Macan Rafmagnsbilinn Einstakan

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025 -

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Latest Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Dist Daily Nav Updates And Their Significance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Daily Nav Updates And Their Significance

May 24, 2025 -

News Corp Undervalued Business Units And Investment Potential

May 24, 2025

News Corp Undervalued Business Units And Investment Potential

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav And Investment Strategies

May 24, 2025

The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav And Investment Strategies

May 24, 2025