News Corp: Undervalued Business Units And Investment Potential

Table of Contents

The Undervalued Powerhouse: Dow Jones & The Wall Street Journal

The cornerstone of News Corp's value proposition is undoubtedly Dow Jones and its flagship publication, The Wall Street Journal (WSJ). These assets represent a significant source of strength, providing a robust foundation for future growth and investment returns. The keywords here are Dow Jones, Wall Street Journal, subscription model, financial news, digital subscriptions, and market dominance.

-

The Wall Street Journal's enduring brand recognition and strong digital subscriber base provide a stable revenue stream. The WSJ enjoys unparalleled brand loyalty amongst high-net-worth individuals and professionals who rely on its in-depth financial news and analysis. This translates into a predictable and resilient revenue stream, less susceptible to the volatility often seen in advertising-driven media models.

-

Successful Transition to a Subscription-Based Model: The WSJ's strategic shift towards a subscription-based model has proven remarkably successful. This move has insulated it from the challenges facing other media outlets heavily reliant on advertising revenue, ensuring a more stable and predictable income flow. This successful digital transition highlights News Corp's adaptability and forward-thinking approach.

-

Competitive Advantages: The WSJ maintains a significant competitive advantage in the financial news market. Its high-quality journalism, rigorous fact-checking, and established network of sources are difficult for competitors to replicate. This creates a substantial barrier to entry and protects its market share.

-

Future Growth Potential: The WSJ's expansion of digital offerings and international reach presents significant opportunities for future growth. New digital products, targeted content, and international expansion can unlock further revenue streams and solidify its position as a market leader.

Bullet Points:

- High barrier to entry for competitors.

- Strong brand loyalty amongst high-net-worth individuals.

- Potential for further premium content monetization.

- Expanding international reach and digital product offerings.

Reap the Rewards: News Corp's Diversified Portfolio

Beyond Dow Jones, News Corp boasts a diversified portfolio of assets that contribute to its overall value and mitigate risk for investors. This diversification is a key factor in evaluating News Corp's investment potential. We'll look at the News Corp portfolio, diversification, real estate, book publishing, digital real estate, and News Corp subsidiaries.

-

Beyond Dow Jones: News Corp's holdings extend beyond financial news, encompassing book publishing, digital real estate, and other media properties. This diversification provides resilience against fluctuations in any single sector.

-

Diversification Benefits: The diversified nature of the News Corp portfolio mitigates investment risk. If one segment underperforms, others can offset the losses, providing stability and reducing the overall volatility of the investment.

-

Growth Opportunities: Each business unit within the News Corp portfolio offers unique growth opportunities. For example, the book publishing arm can capitalize on evolving digital distribution channels, while the real estate holdings can benefit from strategic acquisitions and development.

Bullet Points:

- Stable revenue streams from diverse sources.

- Opportunities for synergies between different business units.

- Potential for strategic acquisitions or divestitures to maximize value.

Navigating the Challenges: Risks and Considerations

While News Corp presents compelling investment opportunities, it's crucial to acknowledge the challenges and risks inherent in the media industry. Understanding these factors is key to making an informed investment decision. Keywords to consider here are News Corp risks, market volatility, competition, regulatory changes, and media industry challenges.

-

Industry Challenges: The media industry faces significant challenges, including intense competition, evolving advertising models, and the impact of disruptive technologies. News Corp is not immune to these challenges.

-

Potential Risks: News Corp's investments and operations carry inherent risks, including market volatility, regulatory changes, and geopolitical uncertainties impacting specific markets.

-

Balanced Perspective: It's essential to maintain a balanced perspective, weighing both the opportunities and risks associated with investing in News Corp.

Bullet Points:

- Impact of changing advertising revenue models.

- Potential for disruption from emerging technologies.

- Geopolitical risks affecting certain markets.

Assessing the Valuation: Is News Corp Truly Undervalued?

A key question for potential investors is whether News Corp's current market capitalization accurately reflects its intrinsic value. Analyzing News Corp valuation, stock price analysis, financial performance, market capitalization, and intrinsic value is crucial.

-

Valuation Analysis: A thorough analysis of News Corp's current market capitalization compared to its historical performance and the valuations of its competitors is necessary to determine if it is truly undervalued.

-

Growth Catalysts: Identifying potential catalysts that could drive future growth and increase the stock price, such as successful product launches or strategic acquisitions, is vital.

-

Valuation Techniques: Employing valuation techniques like discounted cash flow (DCF) analysis can provide a more robust assessment of News Corp's intrinsic value and help determine if the current stock price represents a compelling investment opportunity.

Conclusion

News Corp, despite often being overlooked, presents a compelling investment case due to its strong core assets, particularly Dow Jones and The Wall Street Journal, and a diversified portfolio capable of generating stable returns. While risks exist within the media industry, the potential for significant upside, driven by the undervaluation of its business units, makes News Corp worthy of serious consideration. The News Corp stock presents a potentially lucrative opportunity for long-term investors.

Call to Action: Explore the investment potential of News Corp further. Conduct thorough due diligence, including a detailed analysis of its financial statements and future prospects, and consider adding News Corp stock to your diversified portfolio. Don't miss out on this potentially undervalued media conglomerate and its impressive investment opportunities. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

10 Fastest Standard Production Ferraris Official Track Performance Data

May 24, 2025

10 Fastest Standard Production Ferraris Official Track Performance Data

May 24, 2025 -

8 Stock Market Surge On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Surge On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Daxs Rise Potential For A Wall Street Comeback And Market Impact

May 24, 2025

Daxs Rise Potential For A Wall Street Comeback And Market Impact

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025 -

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

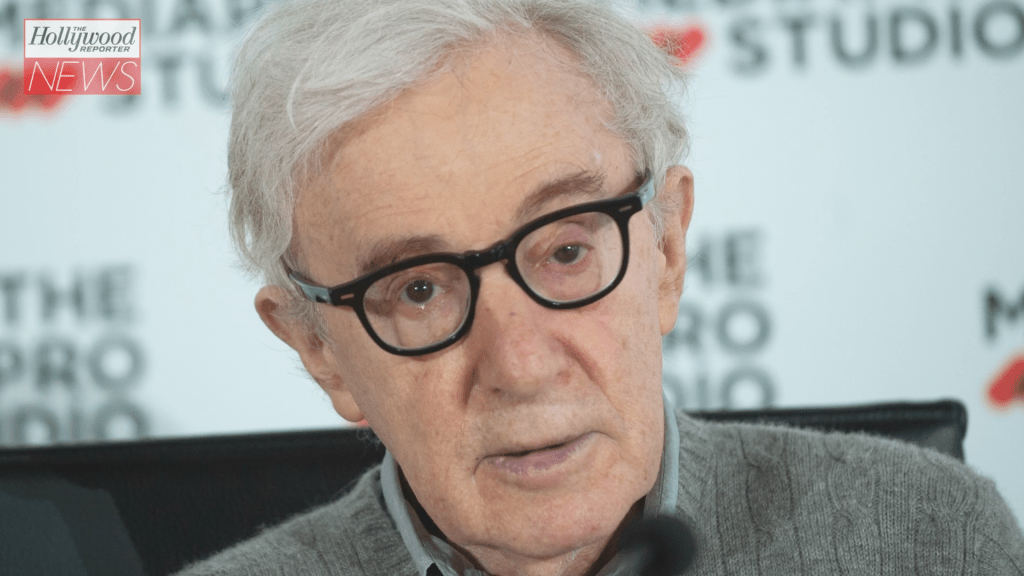

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025