Amundi Dow Jones Industrial Average UCITS ETF: Factors Affecting Net Asset Value (NAV)

Table of Contents

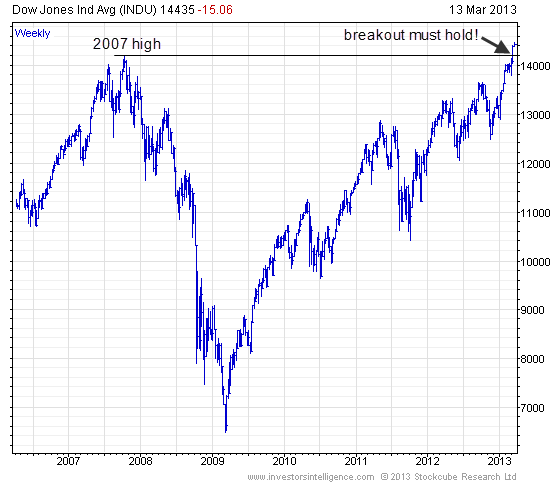

Market Performance of the Dow Jones Industrial Average

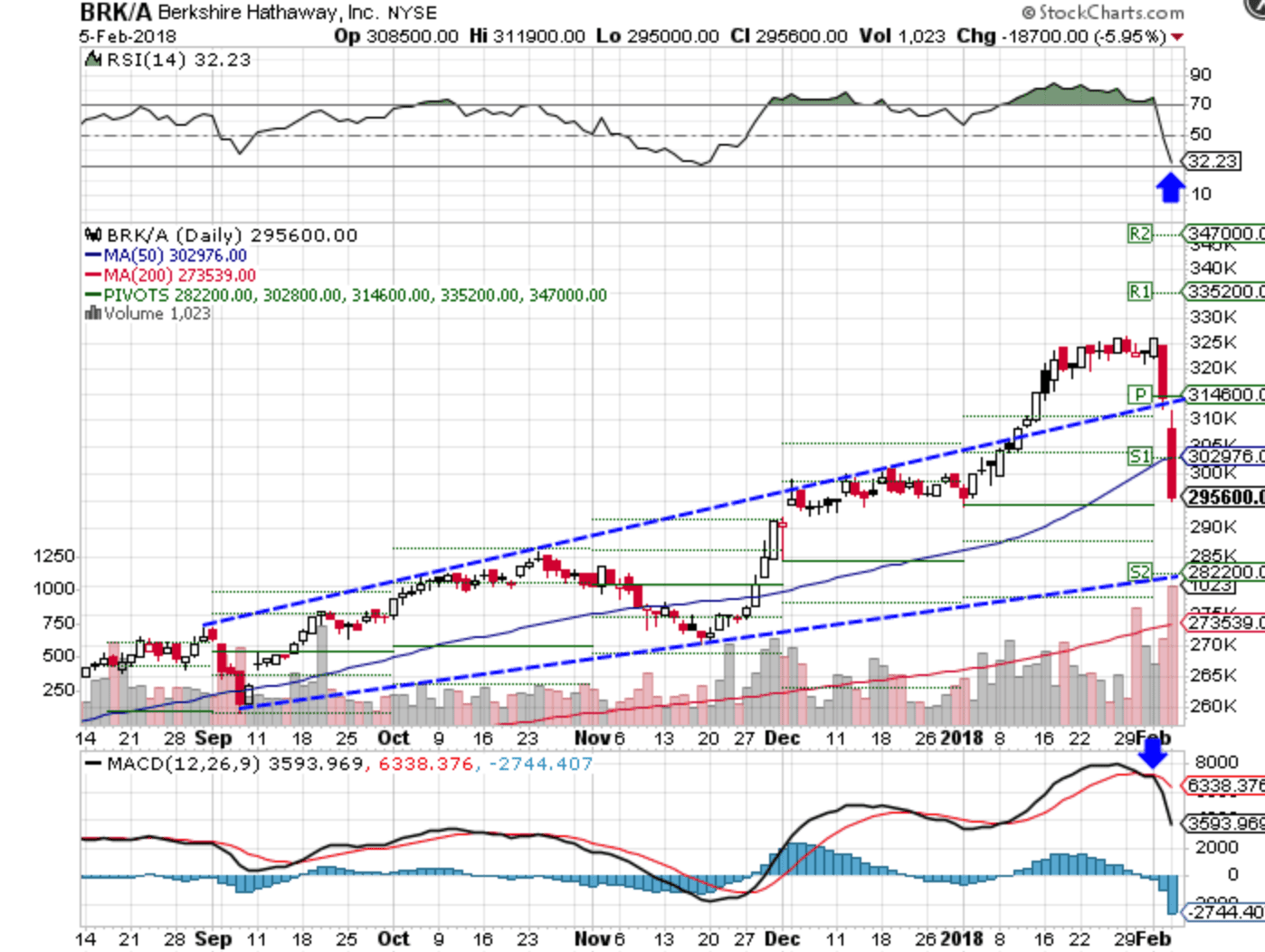

The most significant factor affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV is the performance of the underlying Dow Jones Industrial Average itself. The DJIA's daily movements, driven by the collective performance of its 30 constituent companies, directly translate into changes in the ETF's NAV.

- Daily fluctuations in the DJIA directly affect the ETF's NAV. A positive day for the index generally results in a higher NAV, while a negative day leads to a lower NAV.

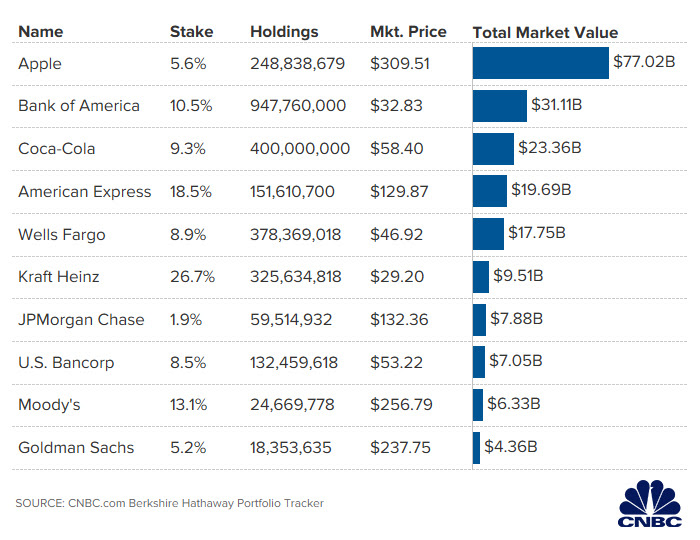

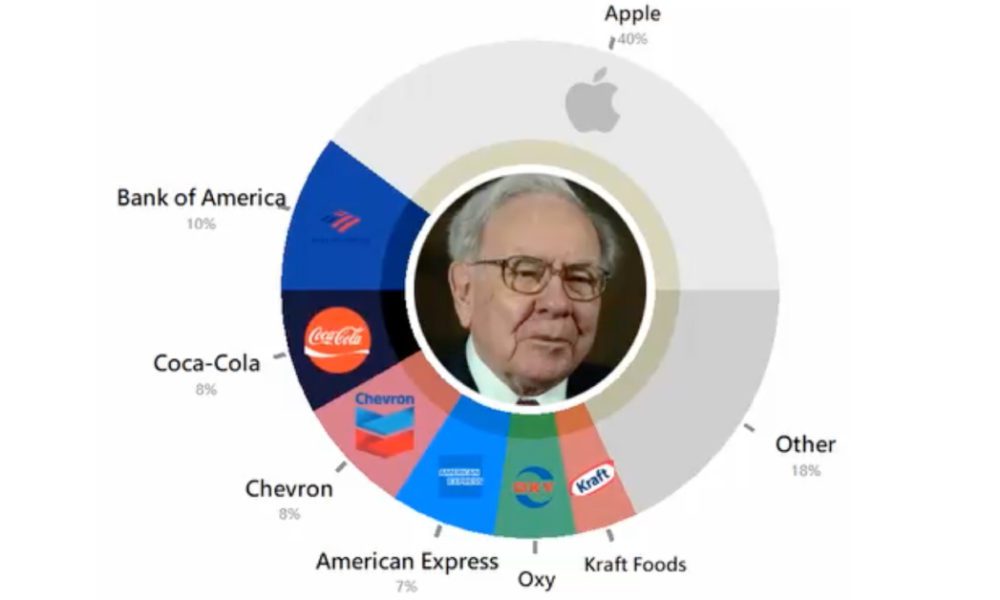

- Strong individual stock performance boosts the NAV; conversely, poor performance decreases it. The weighting of each company within the DJIA influences the impact of its individual performance on the overall index and, consequently, the ETF's NAV. A strong showing from a heavily weighted stock like Apple, for example, can significantly boost the NAV.

- Sector-specific trends (e.g., technology boom, energy slump) can significantly impact the DJIA and thus the ETF's NAV. Economic shifts and industry-specific events influence individual stock prices, creating sector-specific trends that ripple through the entire index.

- Macroeconomic factors influencing the overall market (interest rates, inflation, geopolitical events) have a considerable effect. Broader economic conditions heavily influence investor sentiment and market performance, directly impacting the DJIA and subsequently the ETF's NAV. High inflation, for example, often leads to increased interest rates, negatively impacting stock valuations.

Currency Exchange Rates (if applicable)

While the Amundi Dow Jones Industrial Average UCITS ETF is likely denominated in Euros (EUR), it's crucial to consider currency exchange rates if your base currency is different. For instance, investors holding the ETF in US Dollars (USD) will see the NAV fluctuate based on changes in the EUR/USD exchange rate.

- Fluctuations in the exchange rate between the ETF's base currency and the investor's currency will affect the NAV in the investor's currency. If the Euro strengthens against the dollar, the NAV (in USD) will decrease, and vice versa.

- Appreciation of the ETF's base currency against the investor's currency will reduce the NAV (in investor's currency). This is because the same number of Euros will buy fewer US Dollars.

- Hedging strategies can mitigate currency risk but might involve costs that affect the NAV. While hedging strategies can lessen currency fluctuations' impact, they usually come with fees that can slightly reduce the ETF's NAV.

ETF Expenses and Management Fees

The Amundi Dow Jones Industrial Average UCITS ETF, like any other investment vehicle, incurs expenses. These expenses, including management fees and operating expenses, directly impact the ETF's NAV. These fees are deducted from the ETF's assets, reducing the total value available for distribution amongst investors.

- Management fees and operating expenses are deducted from the ETF's assets, directly impacting the NAV. These costs are typically expressed as an expense ratio or Total Expense Ratio (TER).

- A higher expense ratio will result in a lower NAV compared to an ETF with a lower expense ratio. Therefore, comparing expense ratios is crucial when selecting an ETF.

- Investors should carefully consider the expense ratio when choosing an ETF. Lower expense ratios mean a larger portion of the investment returns goes directly to the investor.

Dividend Distributions

The constituent companies of the Dow Jones Industrial Average often pay dividends to their shareholders. These dividends are passed on to the ETF's investors, influencing the NAV.

- Dividend payouts from the underlying stocks reduce the NAV on the ex-dividend date. The NAV decreases because the ETF's assets are reduced by the amount of dividends paid out.

- Dividend reinvestment plans can offset the impact of dividend payouts on the NAV. Many ETFs offer dividend reinvestment options, which automatically reinvest the dividends back into the ETF, mitigating the immediate reduction in NAV.

Other Factors Affecting NAV

While the above factors are the most influential, other aspects can also subtly impact the Amundi Dow Jones Industrial Average UCITS ETF NAV.

- High trading volume can lead to minor discrepancies between the NAV and market price. Intense trading activity can create temporary price variations.

- Creation and redemption mechanisms help maintain the ETF's price close to its NAV. These mechanisms, involving authorized participants, help prevent significant deviations between the market price and the NAV.

- Market liquidity and supply/demand imbalances can temporarily affect the price, but generally shouldn’t significantly affect long-term NAV. Sudden changes in market sentiment can cause temporary price fluctuations, but the long-term NAV primarily reflects the underlying index's value.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV and the factors that influence its fluctuations is essential for successful investing. The performance of the Dow Jones Industrial Average, currency exchange rates (if applicable), expense ratios, dividend distributions, and market dynamics all play a role in shaping the ETF's NAV. By carefully considering these factors, investors can make more informed decisions and better manage their investment risks. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF NAV and monitor its fluctuations to develop optimal investment strategies.

Featured Posts

-

Glastonbury 2025 Lineup Olivia Rodrigo The 1975 And More Confirmed

May 24, 2025

Glastonbury 2025 Lineup Olivia Rodrigo The 1975 And More Confirmed

May 24, 2025 -

Finding Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025

Finding Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Frankfurt Equities Opening Dax Continues Record Breaking Rise

May 24, 2025

Frankfurt Equities Opening Dax Continues Record Breaking Rise

May 24, 2025 -

Dazi Trump L Effetto Sulle Azioni Nike E Lululemon

May 24, 2025

Dazi Trump L Effetto Sulle Azioni Nike E Lululemon

May 24, 2025 -

Country Escape Making The Move To Rural Living

May 24, 2025

Country Escape Making The Move To Rural Living

May 24, 2025

Latest Posts

-

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025 -

Ai

May 24, 2025

Ai

May 24, 2025 -

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Holdings A Post Buffett Analysis

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025