DAX Soars: Frankfurt Equities Open Higher, Record High In Sight

Table of Contents

Factors Contributing to the DAX Surge

Several interconnected factors are contributing to the impressive rise of the DAX, the benchmark index of the Frankfurt Stock Exchange, also known as the German Stock Market.

Strong Corporate Earnings

Robust earnings reports from leading German companies across various sectors are a major driver of the DAX's upward trajectory. These positive results showcase the strength and resilience of the German economy. The positive sentiment stemming from these reports has significantly boosted investor confidence and propelled stock prices higher.

- Volkswagen: Exceeded profit expectations for Q3, driven by strong demand for electric vehicles and continued success in its core automotive business. This success story is a great example of how positive corporate performance directly impacts the DAX.

- Siemens: Announced a strong order backlog, indicating robust future growth prospects for the industrial giant. This positive outlook has reassured investors and contributes to the overall positive sentiment around the DAX.

- SAP: Provided positive guidance for the upcoming quarters, fueling investor optimism about the future performance of this leading software company. Their forecast demonstrates confidence in the wider technological sector and boosts investor confidence in the German Stock Market.

- Other Key Players: Beyond these examples, strong performances from other major players in sectors such as pharmaceuticals, chemicals, and consumer goods also contributed to the positive market sentiment.

Positive Economic Data

Encouraging economic indicators for Germany are further bolstering the DAX's climb. Positive data points reinforce investor belief in the country's economic health and future growth potential. This positive outlook translates directly into higher valuations for German equities.

- Stronger-than-expected GDP growth in Q3: Germany's economy demonstrated resilience in the third quarter, exceeding initial forecasts and demonstrating the strength of the German economy. This positive growth fuels investor confidence in the German stock market.

- Decreasing unemployment figures: The persistently low unemployment rate indicates a healthy labor market and strong consumer spending power. This positive indicator contributes significantly to a positive economic outlook.

- Positive consumer confidence index: Rising consumer confidence suggests increased spending and investment, contributing to a virtuous cycle of economic growth and strengthening the DAX.

Global Market Sentiment

The positive momentum in the DAX is not isolated but reflects a broader, more positive global market sentiment. Favorable global developments are further fueling the upward trend.

- Positive developments in the US stock market: Strong performance in US equities often has a positive spillover effect on other major global markets, including the DAX. This correlation shows the interconnected nature of global finance.

- Easing global inflation concerns: Reduced inflation pressures ease concerns about monetary policy tightening and provide a more supportive environment for equity investments, boosting investor confidence in the DAX.

- Increased investor appetite for risk: A general increase in risk appetite among investors leads to greater capital flowing into equities, including those listed on the Frankfurt Stock Exchange. This increased appetite is a key driver of the current DAX rise.

Implications of the DAX's Rise

The DAX's impressive rise has significant implications for investors and the wider German economy.

Impact on Investors

The DAX's upward trajectory presents both opportunities and challenges for investors in the German stock market.

- Opportunities for increased returns: The current positive trend presents significant potential for capital appreciation for investors with exposure to German equities. The DAX's rise presents opportunities for significant returns.

- Potential for increased volatility: While the trend is positive, investors should be aware of the potential for increased market volatility, especially as the index approaches record highs. Smart investment strategies are crucial for managing risk.

- Importance of diversification: Diversification remains crucial to mitigate risk. Investors should carefully consider their investment strategy and risk tolerance when investing in the German stock market.

Wider Economic Effects

A strong DAX has far-reaching consequences for the German economy.

- Increased business investment: Higher equity valuations stimulate business investment, fueling economic expansion and job creation. The rise of the DAX can lead to increased investments across various sectors.

- Job creation: Economic growth stemming from a strong DAX often translates into increased job creation and a strengthening labor market. This positive impact is a key benefit of the DAX's success.

- Strengthened Euro: A robust DAX can strengthen the Euro, benefiting international trade and investment in the German economy. A stronger Euro is beneficial for various aspects of the German economy.

Conclusion

The DAX's remarkable surge is a result of several converging positive factors, encompassing strong corporate earnings, favorable economic data, and a positive global market sentiment. This upward trend offers exciting opportunities but also necessitates a cautious approach for investors. Understanding the dynamics of the DAX and the German stock market is crucial for making informed investment decisions.

Call to Action: Stay informed about the DAX's performance and its potential impact on your investment strategy. Monitor the DAX index closely for further updates and potential record highs. Understanding the fluctuations of the DAX and other German equities is crucial for navigating the dynamic German stock market.

Featured Posts

-

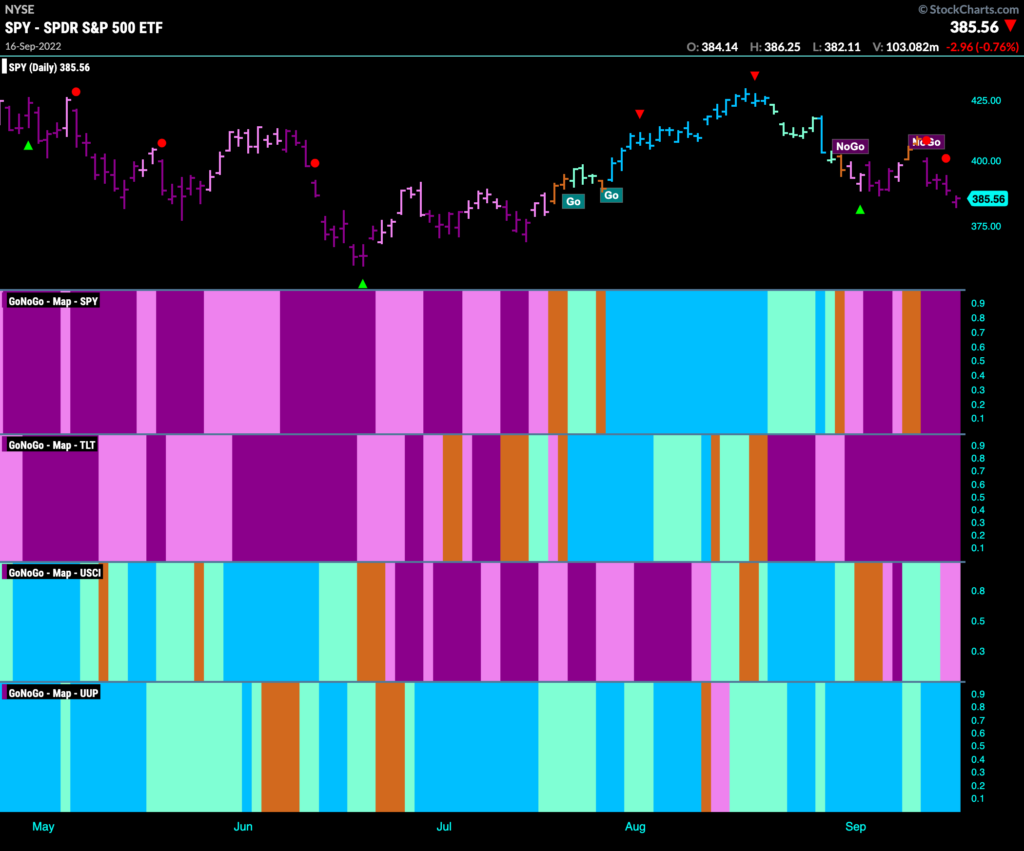

The 2027 French Election Will Bardellas Leadership Bring Change

May 24, 2025

The 2027 French Election Will Bardellas Leadership Bring Change

May 24, 2025 -

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025 -

Menya Vela Kakaya To Sila Dokumentalniy Film Posvyaschenniy 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025

Menya Vela Kakaya To Sila Dokumentalniy Film Posvyaschenniy 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025 -

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025 -

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Latest Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

Demnas Influence Reshaping Guccis Identity And Brand Image

May 24, 2025

Demnas Influence Reshaping Guccis Identity And Brand Image

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025 -

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025

Demna Gvasalias First Gucci Collection Review And Analysis

May 24, 2025