Apple Stock: Navigating The Pre-Q2 Earnings Uncertainty

Table of Contents

Analyzing Apple's Recent Performance and Market Trends

Headline Keyword: Apple Stock Performance Analysis

Apple's recent performance has been a mixed bag, reflecting broader macroeconomic trends and intense competition. Analyzing this performance is key to forming realistic expectations for the upcoming Q2 earnings.

- iPhone sales: While iPhone sales remain a significant revenue driver for Apple, growth has slowed in recent quarters compared to previous years. This slowdown is partly attributed to factors like global inflation and supply chain disruptions impacting consumer spending. Keywords: iPhone sales, Apple revenue, consumer spending.

- Macbook sales: The Mac segment has also seen fluctuations, with sales impacted by the global chip shortage and increased competition. Analyzing market share trends against competitors like Microsoft is crucial. Keywords: Macbook sales, market share, Microsoft competition.

- Apple Services revenue: Apple's Services segment continues to be a strong performer, demonstrating consistent growth driven by subscriptions like iCloud, Apple Music, and Apple TV+. This diversification provides a degree of resilience against fluctuations in hardware sales. Keywords: Apple Services revenue, subscription revenue, diversification.

- Competitor analysis: Samsung and Google remain key competitors across various product categories, constantly innovating and challenging Apple's market dominance. Analyzing their strategies and market share gains provides valuable context for understanding Apple's position. Keywords: market share, competitor analysis, Samsung, Google.

- Macroeconomic factors: Inflation, supply chain disruptions, and softening consumer confidence pose significant challenges to Apple's growth prospects. These macroeconomic headwinds need to be considered when predicting Q2 earnings. Keywords: inflation, supply chain, consumer confidence.

Key Strengths: Strong brand loyalty, diversified revenue streams (Services), robust ecosystem.

Key Weaknesses: Dependence on global supply chains, vulnerability to macroeconomic fluctuations, intense competition.

Q2 Earnings Predictions for Apple Stock

Headline Keyword: Q2 Earnings Predictions for Apple Stock

Predicting Apple's Q2 earnings requires a careful consideration of both positive and negative influences.

- Potential positive impacts: The launch of new products (if any) can significantly boost sales and investor confidence. Continued strong demand for existing iPhones and MacBooks would also positively impact earnings. Expansion into new markets could further fuel growth. Keywords: new product launch, product demand, market expansion.

- Potential negative impacts: A global economic slowdown could dampen consumer spending, impacting sales across Apple's product lines. Ongoing component shortages could constrain production and limit supply. Geopolitical uncertainties, such as international conflicts or trade disputes, could also disrupt supply chains or impact consumer demand. Keywords: economic slowdown, component shortage, geopolitical risk.

- Analyst predictions: Reputable sources like the Wall Street Journal and Bloomberg offer analyst predictions and consensus forecasts for Apple's Q2 earnings. It's crucial to review multiple sources and understand the range of opinions to avoid bias. Keywords: analyst predictions, earnings forecast, Wall Street Journal, Bloomberg.

Key factors influencing Q2 earnings: Global economic conditions, consumer spending patterns, supply chain stability, new product success, and competitive landscape.

Managing Apple Stock Risk

Headline Keyword: Managing Apple Stock Risk

Navigating the uncertainty surrounding Apple stock requires a robust risk management strategy.

- Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is a cornerstone of sound risk management. This reduces the impact of any single investment's underperformance. Keywords: portfolio diversification, risk management, asset allocation.

- Hedging strategies (for experienced investors): Options trading and other hedging strategies can be employed by experienced investors to mitigate potential losses. However, these strategies carry their own complexities and risks. Keywords: options trading, hedging strategies, derivative instruments.

- Due diligence: Thorough due diligence is essential before making any investment decision. This includes conducting independent research, analyzing financial statements, and understanding the company's business model and competitive landscape. Keywords: due diligence, fundamental analysis, technical analysis.

Prudent investment approaches during uncertainty: Maintain a long-term perspective, diversify your portfolio, conduct thorough research, and only invest what you can afford to lose.

Conclusion: Making Informed Decisions about Apple Stock

The upcoming Q2 earnings report for Apple will significantly impact Apple stock's performance. Several factors, including macroeconomic conditions, competitive pressures, and the success of new products, will influence these results. Careful analysis of these factors and the implementation of a sound risk management strategy are crucial for navigating this period of uncertainty. Remember to conduct thorough research, consider your risk tolerance, and make informed decisions regarding your investment in Apple stock. For further resources on Apple stock investment strategies, explore reputable financial news websites and consult with a qualified financial advisor. Understanding the nuances of Apple stock and its potential future performance, especially in light of the impending Q2 Earnings, is key to successful investing.

Featured Posts

-

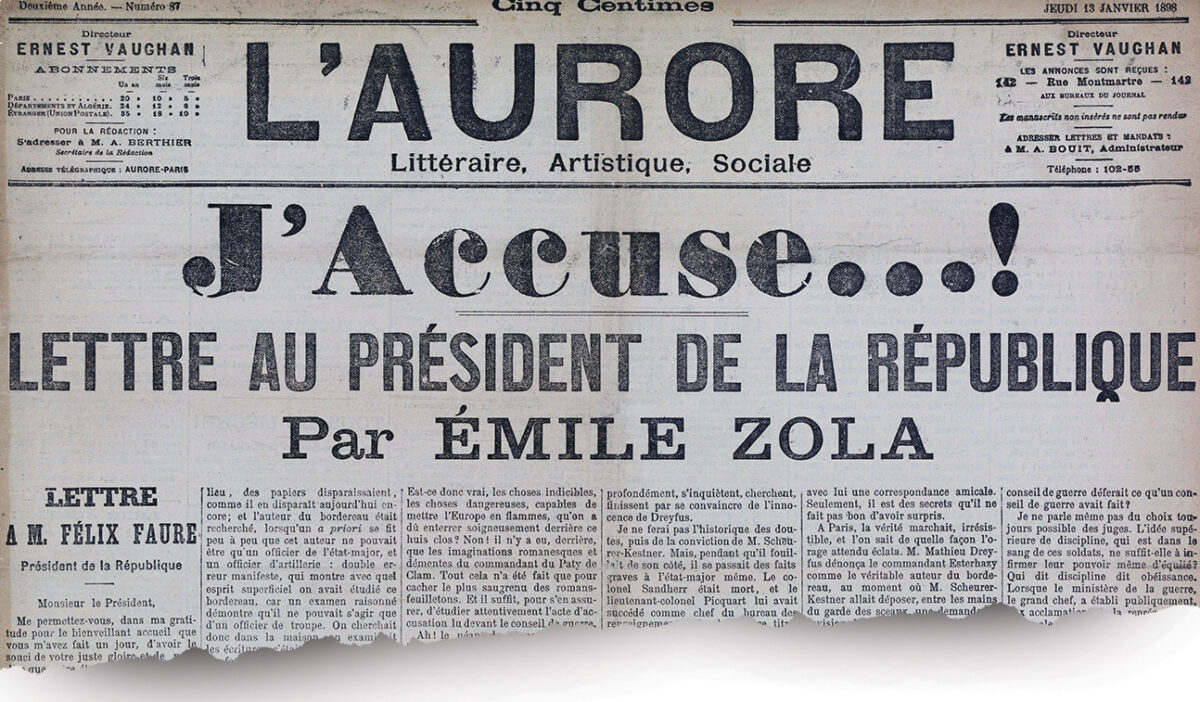

French Lawmakers Push For Dreyfus Promotion 130 Years On

May 24, 2025

French Lawmakers Push For Dreyfus Promotion 130 Years On

May 24, 2025 -

Evroviziya Kde E Konchita Vurst Sega

May 24, 2025

Evroviziya Kde E Konchita Vurst Sega

May 24, 2025 -

Gear Essentials For Ferrari Owners And Enthusiasts A Comprehensive Guide

May 24, 2025

Gear Essentials For Ferrari Owners And Enthusiasts A Comprehensive Guide

May 24, 2025 -

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025 -

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Investments

May 24, 2025

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Investments

May 24, 2025

Latest Posts

-

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025 -

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025 -

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025