AAPL Stock: Analysis Of Upcoming Price Levels

Table of Contents

- Analyzing Current Market Conditions & Their Impact on AAPL Stock

- Macroeconomic Factors

- Competitive Landscape

- Fundamental Analysis of Apple (AAPL): Assessing Intrinsic Value

- Financial Performance

- Product Innovation and Future Prospects

- Technical Analysis of AAPL Stock: Identifying Potential Price Levels

- Chart Patterns and Indicators

- Predicting Future Price Movements

- Conclusion

Analyzing Current Market Conditions & Their Impact on AAPL Stock

Several factors influence the current market environment and consequently, the AAPL stock price prediction. Understanding these is crucial for any AAPL stock investment strategy.

Macroeconomic Factors

Macroeconomic indicators significantly impact investor sentiment and overall market performance, directly affecting AAPL stock price prediction.

- Inflation's Impact on Consumer Spending: High inflation rates can reduce consumer discretionary spending, potentially affecting demand for Apple products, especially higher-priced items like iPhones and Macs. A decrease in consumer confidence can translate to lower AAPL stock prices.

- Interest Rate Hikes and Tech Stocks: Increased interest rates generally lead to a decrease in investment in riskier assets, like technology stocks. Higher borrowing costs can also impact Apple's expansion plans and future investments. This is a major factor to consider when formulating an AAPL stock price prediction.

- Global Economic Uncertainty: Geopolitical tensions and global economic uncertainty create market volatility, influencing investor behavior and impacting stock prices, including AAPL. Recessions or slowdowns in major economies can significantly affect Apple's sales and, consequently, its stock price.

Competitive Landscape

Apple faces stiff competition in various market segments. Analyzing the competitive landscape is vital for accurate AAPL stock price prediction.

- Samsung and Google's Android Dominance: Samsung and Google's Android operating system maintain a significant global market share, posing a continuous challenge to Apple's iOS ecosystem. New features and competitive pricing strategies from Android manufacturers constantly pressure Apple.

- Microsoft's Growing Cloud Presence: Microsoft's Azure cloud platform is a growing competitor to Apple's iCloud services. Increased competition in the cloud space could impact Apple's Services revenue, a key driver of its profitability.

- Innovative Technologies from Competitors: The rapid pace of technological innovation necessitates constant adaptation. Competitors' breakthroughs in areas like foldable phones, augmented reality, and artificial intelligence could directly affect AAPL's market share and future growth potential, impacting the AAPL stock price prediction.

Fundamental Analysis of Apple (AAPL): Assessing Intrinsic Value

A fundamental analysis of Apple's financial health and future prospects is essential for any AAPL stock price prediction.

Financial Performance

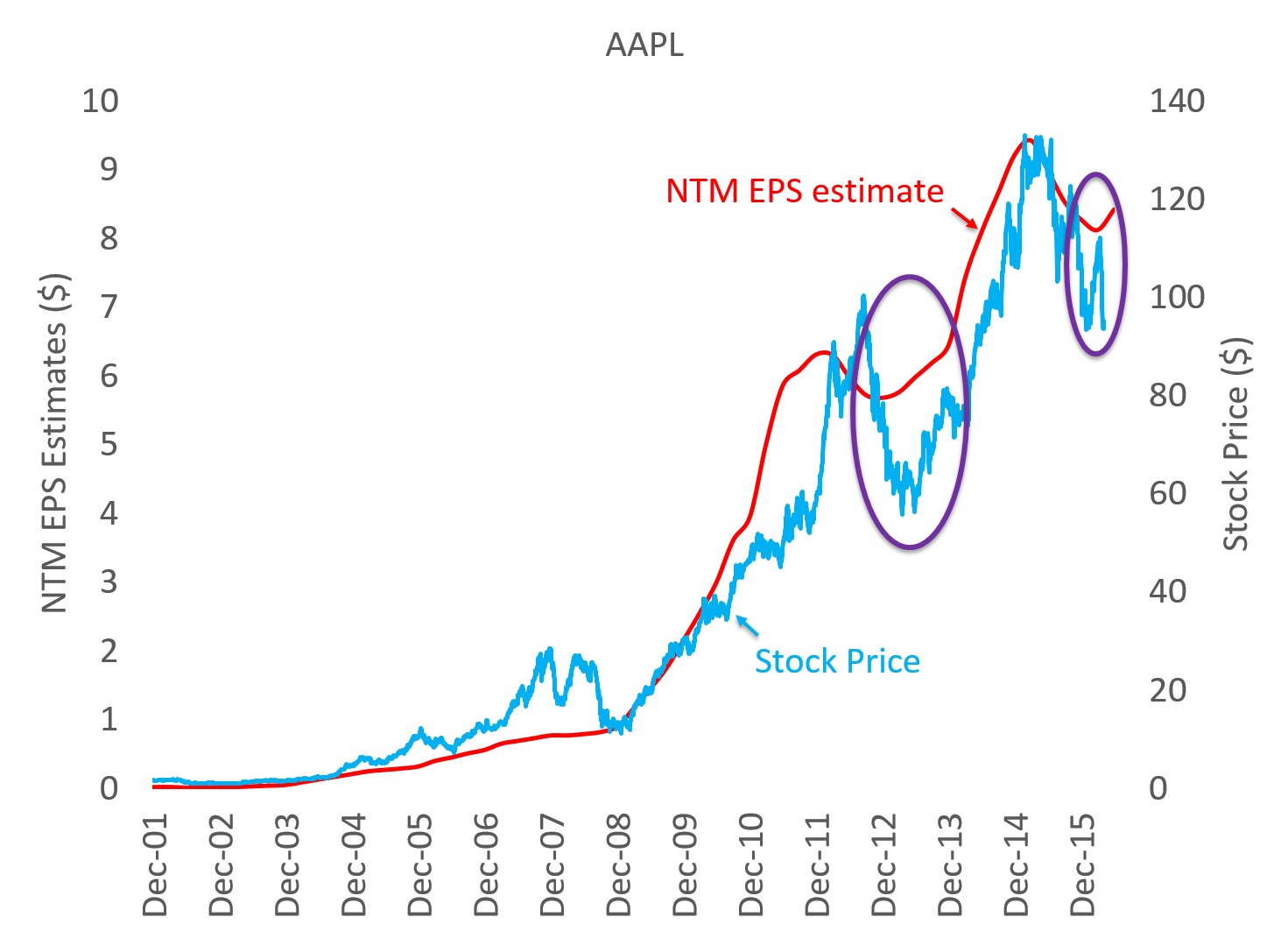

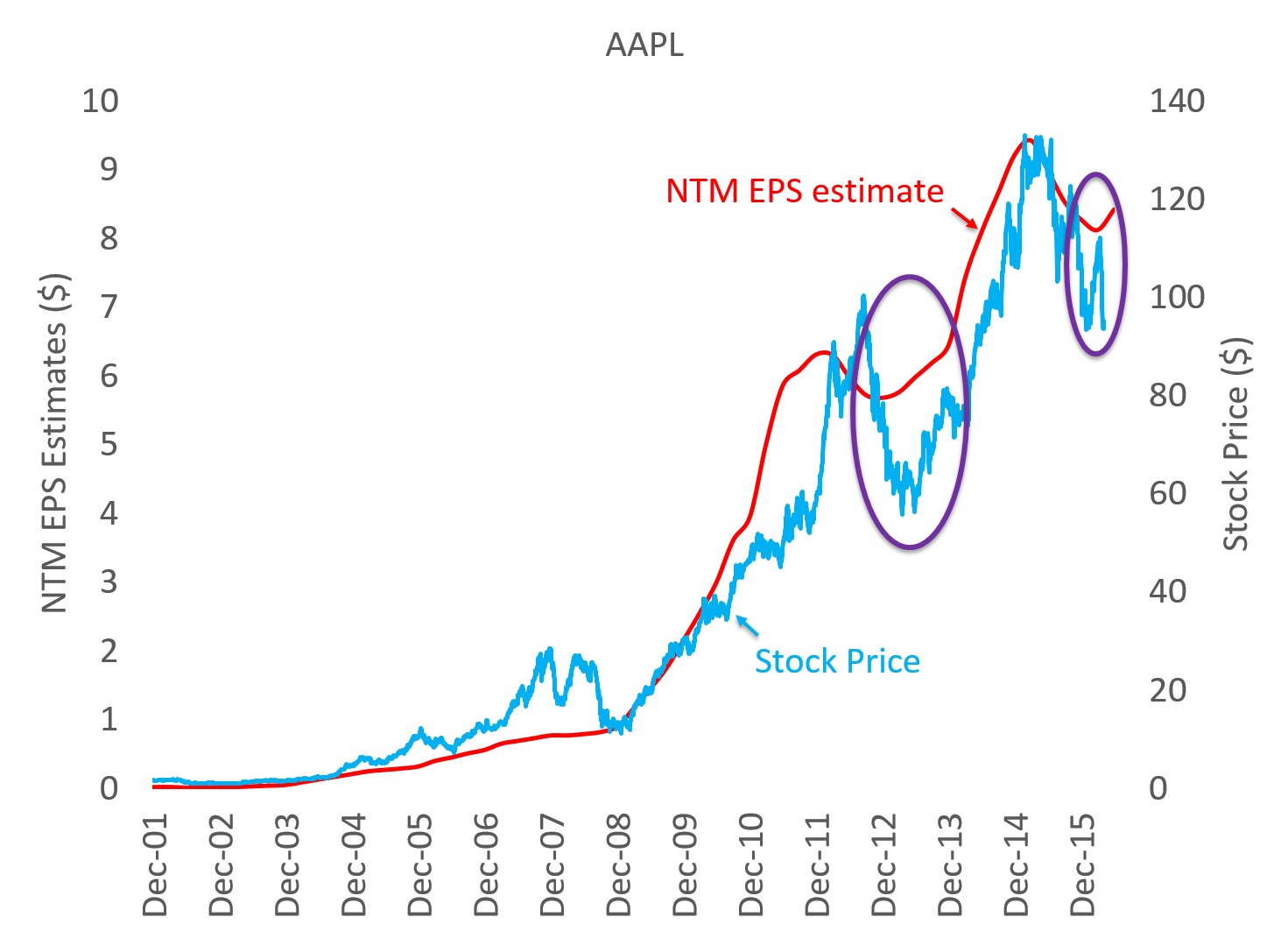

Examining Apple's financial statements provides crucial insights into its current financial health and future earnings potential.

- Revenue Growth Trends: Analyzing Apple's revenue growth over several quarters reveals its performance trajectory and identifies potential trends. Consistent revenue growth is usually a positive sign for the AAPL stock price.

- Key Performance Indicators (KPIs): Monitoring KPIs such as gross margin, operating margin, and return on equity allows investors to assess Apple's profitability and efficiency. Stronger KPIs generally support a higher AAPL stock price prediction.

- Debt Levels and Dividend Payouts: Apple's debt levels and dividend payout policies impact its financial flexibility and investor returns. A healthy balance sheet and consistent dividend payouts generally contribute positively to investor sentiment and AAPL stock valuation.

Product Innovation and Future Prospects

Apple's innovation capacity is a key driver of its long-term growth and the AAPL stock price prediction.

- Upcoming Product Releases: New iPhones, iPads, Macs, and Apple Watches, along with software updates and new services, significantly impact Apple's future revenue streams. Anticipated product launches and their market reception heavily influence AAPL stock price predictions.

- Subscription Services Growth: Apple's subscription services (Apple Music, Apple TV+, iCloud+) are increasingly important revenue streams. Their continued growth is crucial for the company's long-term financial health and positively impacts the AAPL stock price prediction.

- Technological Advancements: Apple's investment in research and development in areas like AI, AR/VR, and 5G technology will determine its competitiveness in the future, affecting the AAPL stock price.

Technical Analysis of AAPL Stock: Identifying Potential Price Levels

Technical analysis uses price charts and indicators to predict potential AAPL stock price levels.

Chart Patterns and Indicators

Technical indicators help identify potential support and resistance levels and predict future price movements.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations and help identify trends. Crossovers of moving averages can signal potential buy or sell signals.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): The MACD identifies momentum changes and potential trend reversals.

Predicting Future Price Movements

Based on technical analysis, potential short-term and long-term price ranges can be estimated. However, it's crucial to remember that these are just potential scenarios.

- Potential Price Targets: Based on current trends and indicators, we might see AAPL trading within a certain range (e.g., $150-$180 in the short term, $200-$250 in the long term). These are illustrative examples only and should not be considered financial advice.

- Timeframes for Predictions: Short-term predictions (weeks or months) are generally more susceptible to volatility than long-term predictions (years).

- Disclaimers: Technical analysis is not foolproof. External events and unforeseen circumstances can significantly impact stock prices, making accurate long-term predictions extremely difficult.

Conclusion

Predicting AAPL stock price levels involves analyzing macroeconomic conditions, Apple's fundamental strength, and technical indicators. While this analysis provides potential insights into future AAPL stock price movements, it’s crucial to remember that these are only potential scenarios. The AAPL stock price is influenced by numerous interacting factors, and precise prediction remains challenging.

While this analysis offers potential insights into AAPL stock price levels, remember to always conduct your own thorough research and consider seeking professional financial advice before investing in AAPL stock or any other security. Understanding the risks involved in AAPL stock investment is paramount.

Jymypaukku Muhii Tuukka Taponen F1 Autossa Jo Taenae Vuonna

Jymypaukku Muhii Tuukka Taponen F1 Autossa Jo Taenae Vuonna

Exclusive First Look At Tulsa King Season 2 Blu Ray With Sylvester Stallone

Exclusive First Look At Tulsa King Season 2 Blu Ray With Sylvester Stallone

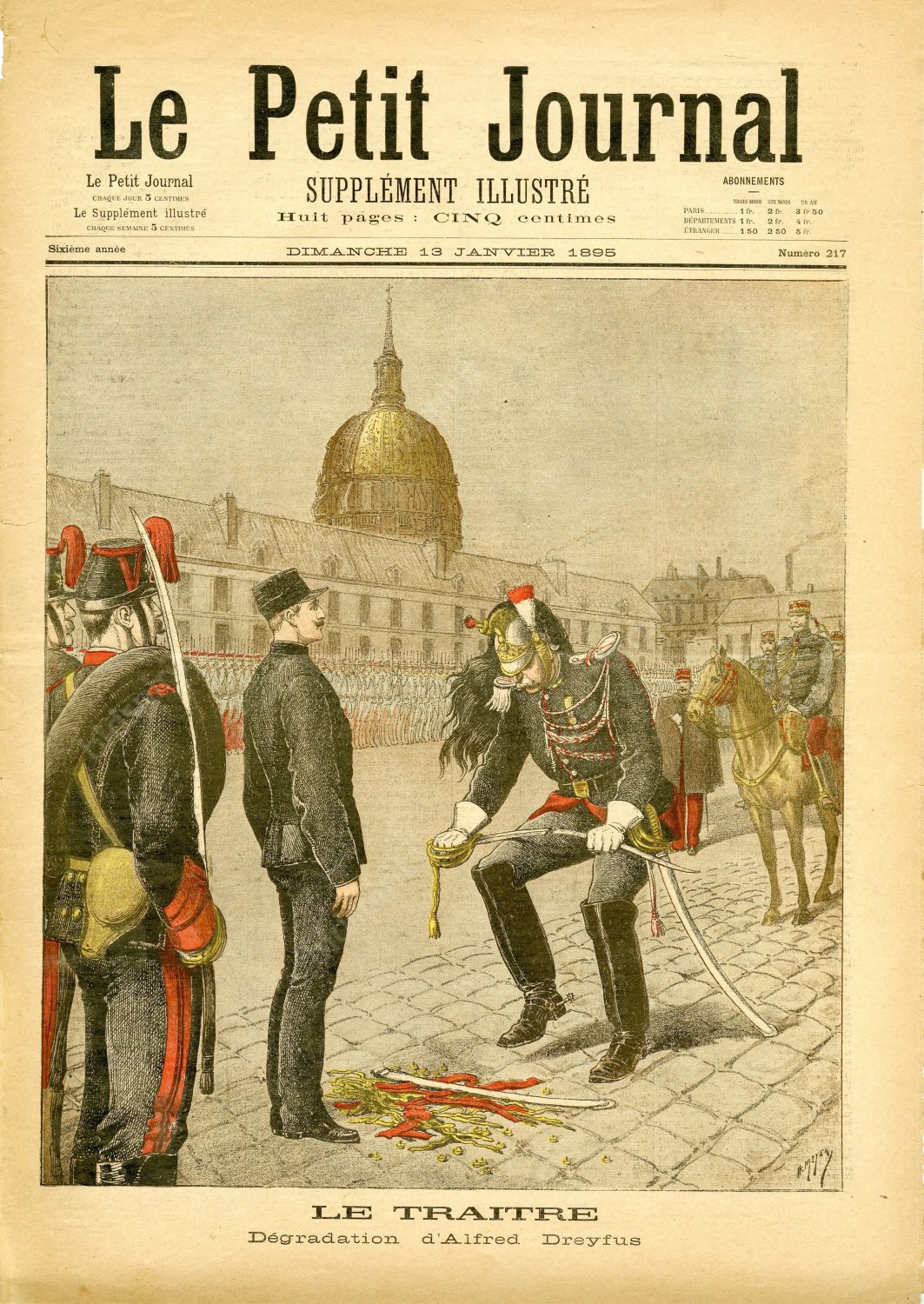

The Dreyfus Affair A Legacy Of Injustice And A Call For Redemption

The Dreyfus Affair A Legacy Of Injustice And A Call For Redemption

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

Retour De Ces Unveiled En Europe Les Technologies De Demain A Amsterdam

Retour De Ces Unveiled En Europe Les Technologies De Demain A Amsterdam