Amundi Dow Jones Industrial Average UCITS ETF: A NAV Deep Dive

Table of Contents

What is NAV and Why is it Important for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated by taking the total market value of all the stocks in the Dow Jones Industrial Average that the ETF holds, subtracting liabilities (like management fees), and dividing by the total number of outstanding ETF shares.

Monitoring the NAV is essential for several reasons:

-

Performance Evaluation: The NAV provides a clear picture of the ETF's performance, reflecting the actual value of the underlying investments. Tracking NAV changes over time allows investors to assess growth and identify periods of strong or weak performance.

-

Transparency: Regular NAV updates offer transparency, allowing investors to see the precise value of their holdings. This contrasts with market price, which can fluctuate throughout the trading day due to supply and demand.

-

Arbitrage Opportunities: Comparing the NAV to the market price of the ETF can reveal potential arbitrage opportunities. If the market price significantly deviates from the NAV, savvy investors might exploit these discrepancies for profit.

-

Key Points:

- NAV reflects the intrinsic value of the ETF's holdings.

- Regular NAV updates provide crucial transparency for investors.

- Comparing NAV to market price can highlight potential arbitrage opportunities.

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors significantly influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

-

Dow Jones Industrial Average Performance: The most significant factor is the performance of the underlying Dow Jones Industrial Average. Positive movement in the index directly translates to an increase in the ETF's NAV, and vice-versa. Individual stock performance within the index also plays a crucial role.

-

Currency Fluctuations: Since the Dow Jones Industrial Average is a US-based index, currency fluctuations between the US dollar and the investor's home currency can affect the NAV. This is particularly relevant for international investors.

-

Dividends and Distributions: Dividends paid by the companies within the Dow Jones Industrial Average are passed on to ETF shareholders. These distributions usually slightly decrease the NAV on the ex-dividend date, reflecting the payout.

-

Expense Ratios: The ETF's expense ratio, representing the annual management fees, gradually impacts the NAV over time. These fees are deducted from the assets under management, reducing the overall NAV.

-

Key Points:

- Changes in component stock prices directly affect the NAV.

- Currency hedging, if employed, can mitigate the impact of currency fluctuations on the NAV.

- Dividend payouts are reflected in a reduction of the NAV on the ex-dividend date.

- Management fees gradually erode the NAV over time.

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF's NAV Performance

Analyzing historical NAV data is crucial for understanding the ETF's performance. This involves:

-

Historical NAV Data Analysis: Examining past NAV data reveals trends, growth patterns, and volatility levels. This allows for a better understanding of the ETF's risk profile. Charts illustrating NAV performance over different timeframes are particularly useful.

-

Benchmarking: Comparing the Amundi Dow Jones Industrial Average UCITS ETF's NAV performance against other Dow Jones Industrial Average ETFs helps assess its relative efficiency and competitiveness. Factors like expense ratios and tracking error should be considered when making comparisons.

-

Performance Metrics: Key metrics such as the annual growth rate, standard deviation (a measure of volatility), and Sharpe ratio (risk-adjusted return) can provide a comprehensive picture of the ETF's NAV performance.

-

Key Points:

- Charts and graphs visualizing historical NAV performance are essential for analysis.

- Comparative analysis against competing Dow Jones Industrial Average ETFs provides valuable context.

- Risk-adjusted return metrics, like the Sharpe ratio, are vital for evaluating performance relative to risk.

Practical Implications and Investment Strategies

Understanding NAV data empowers investors to make informed decisions:

-

Buy/Sell Decisions: While not the sole determinant, NAV can inform buy/sell decisions. For example, a significant divergence between the market price and the NAV might signal an attractive entry point.

-

Maximizing Returns: Strategies like dollar-cost averaging, where regular investments are made regardless of NAV fluctuations, can help mitigate risk and potentially improve returns over the long term. Analyzing NAV trends can also help identify potential opportune moments for strategic investments.

-

Portfolio Diversification: The Amundi Dow Jones Industrial Average UCITS ETF should be considered as part of a diversified portfolio. Diversification across different asset classes and geographies is crucial for managing risk and achieving long-term investment goals.

-

Key Points:

- NAV analysis can inform buy/sell decisions, but it shouldn't be the only factor considered.

- Dollar-cost averaging can help manage risk and potentially enhance returns.

- Diversification is key for mitigating risk and achieving long-term investment goals.

Conclusion

This deep dive into the Amundi Dow Jones Industrial Average UCITS ETF's NAV has revealed its crucial role in understanding the ETF's performance and making informed investment decisions. Analyzing the factors influencing NAV, coupled with understanding historical performance, allows for more effective investment strategies. By leveraging this knowledge, investors can better assess the potential risks and rewards associated with this popular ETF.

Call to Action: For a more comprehensive understanding of the Amundi Dow Jones Industrial Average UCITS ETF and how its NAV can inform your investment choices, further research is recommended. Consider consulting with a financial advisor to determine if this ETF is suitable for your portfolio. Learn more about the intricacies of Amundi Dow Jones Industrial Average UCITS ETF NAV today!

Featured Posts

-

Trade War Fears Trigger 7 Plunge In Amsterdam Stock Market

May 25, 2025

Trade War Fears Trigger 7 Plunge In Amsterdam Stock Market

May 25, 2025 -

Ai And The Future Of Healthcare Key Findings From The Philips Future Health Index 2025

May 25, 2025

Ai And The Future Of Healthcare Key Findings From The Philips Future Health Index 2025

May 25, 2025 -

Best New R And B Songs This Week Leon Thomas And Flo Top The Charts

May 25, 2025

Best New R And B Songs This Week Leon Thomas And Flo Top The Charts

May 25, 2025 -

Change At The Top Guccis Supply Chain Leadership Transition

May 25, 2025

Change At The Top Guccis Supply Chain Leadership Transition

May 25, 2025 -

Frankfurt Stock Market Update Dax Climbs Record Within Reach

May 25, 2025

Frankfurt Stock Market Update Dax Climbs Record Within Reach

May 25, 2025

Latest Posts

-

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025 -

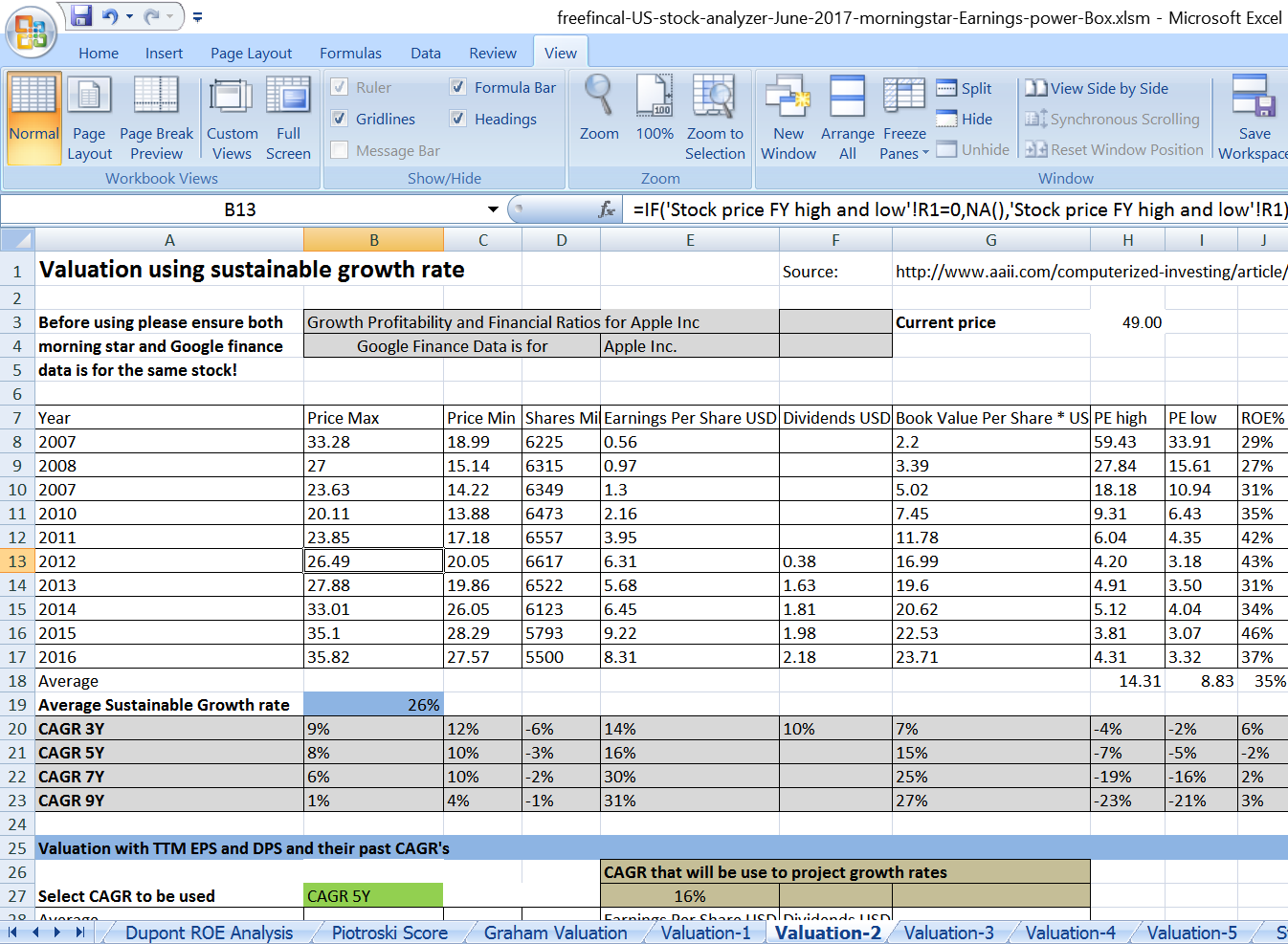

Apple Stock Investment Analysis Of Q2 Financial Results

May 25, 2025

Apple Stock Investment Analysis Of Q2 Financial Results

May 25, 2025 -

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 25, 2025

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 25, 2025 -

Collaboration And Growth The Future Of Bangladesh Europe Relations

May 25, 2025

Collaboration And Growth The Future Of Bangladesh Europe Relations

May 25, 2025 -

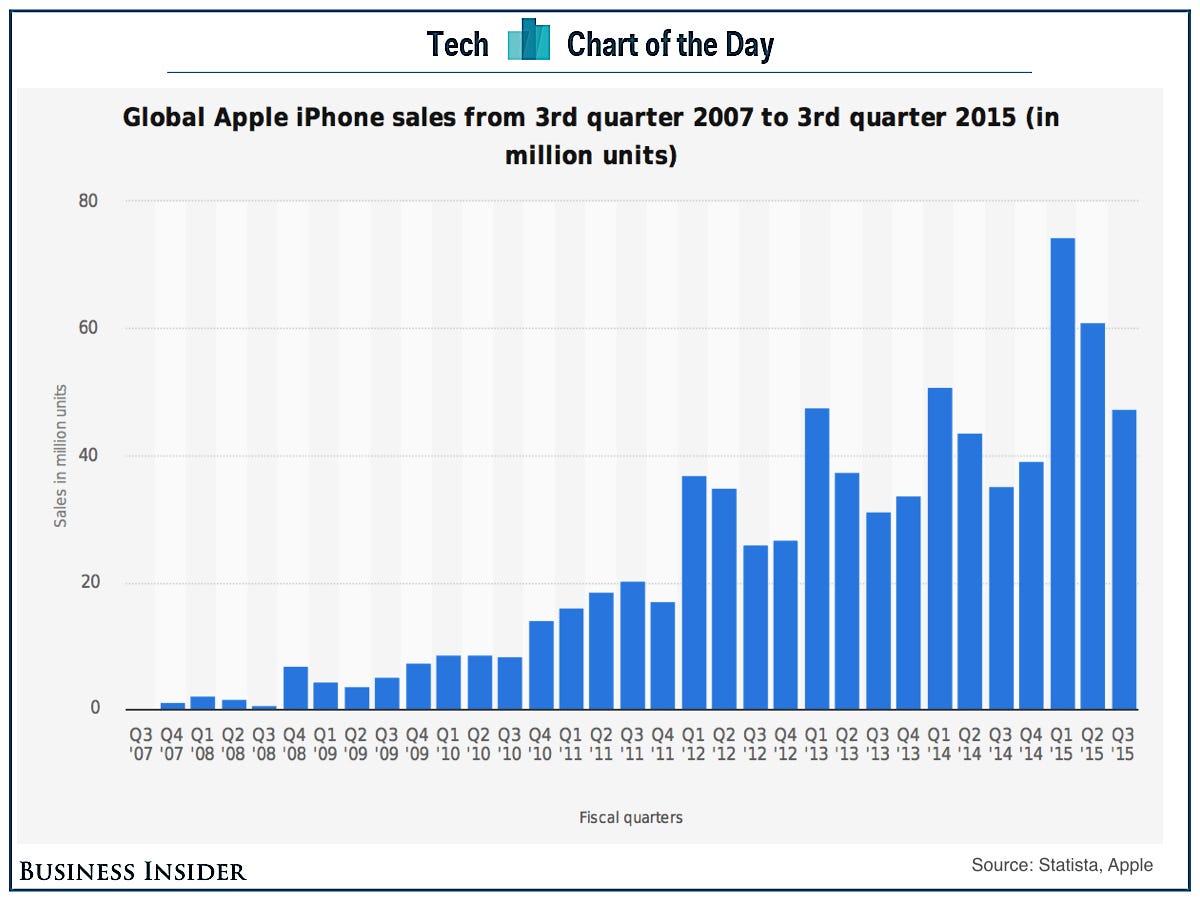

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales Fuel Growth

May 25, 2025