Trade War Fears Trigger 7% Plunge In Amsterdam Stock Market

Table of Contents

Causes of the Amsterdam Stock Market Plunge

Escalating Trade Tensions

The current market volatility is largely attributed to escalating trade tensions, primarily the ongoing US-China trade war and the complexities surrounding EU trade policies. These disputes create significant uncertainty for businesses, impacting investment decisions and leading to a sell-off in the Amsterdam Stock Market.

- Specific examples of trade policies impacting the Netherlands: Increased tariffs on Dutch agricultural exports to China, impacting the country's significant flower and dairy industries. Uncertainty surrounding Brexit continues to weigh heavily on Dutch businesses involved in trade with the UK.

- Sectors heavily impacted: The technology sector, heavily reliant on global supply chains, has been particularly hard hit. The manufacturing and agricultural sectors are also suffering from reduced export opportunities and increased input costs due to tariffs.

- Trade volume changes and economic forecasts: Preliminary data suggests a notable decline in trade volume between the Netherlands and key trading partners. Several economic forecasting agencies have revised their GDP growth predictions for the Netherlands downwards, citing trade war uncertainty as a primary factor.

Investor Sentiment and Market Psychology

Fear and uncertainty are powerful drivers of market behavior. Negative news headlines regarding escalating trade disputes fueled a wave of panic selling, contributing significantly to the Amsterdam Stock Market plunge.

- Negative news headlines and panic selling: Each new escalation in trade tensions, including announcements of new tariffs or trade restrictions, triggers immediate sell-offs as investors rush to reduce their exposure to risk.

- Reduced investor confidence: The uncertainty surrounding future trade policies makes it difficult for investors to make informed decisions. This erosion of confidence further exacerbates the market downturn.

- Speed and magnitude of the sell-off: The 7% drop in a single day reflects the rapid and intense nature of the sell-off, highlighting the market's sensitivity to trade war anxieties.

Global Economic Slowdown Concerns

The trade war is not an isolated incident; it's a significant contributor to growing concerns about a global economic slowdown. This broader economic context adds further pressure on the Amsterdam Stock Market.

- Trade war and global growth predictions: The IMF and other international organizations have already downgraded their global growth forecasts for 2024, largely due to the negative effects of the trade war.

- Ripple effects on other European markets: The Amsterdam Stock Market's decline is not isolated; similar downturns are being observed in other European markets, indicating a widespread impact of trade war anxieties.

- Expert opinions: Leading economists warn that prolonged trade tensions could lead to a more significant global recession, with severe consequences for the Netherlands and other economies heavily reliant on international trade.

Consequences of the 7% Drop in the Amsterdam Stock Market

Impact on Dutch Companies

The 7% drop in the Amsterdam Stock Market has immediate and potentially long-term consequences for listed Dutch businesses. Many companies are experiencing reduced valuations, impacting their ability to raise capital and invest in future growth.

- Companies significantly affected: Companies heavily reliant on exports or with significant operations in affected sectors (e.g., technology, agriculture) have seen the most significant stock price declines.

- Job security concerns and potential layoffs: As companies struggle with reduced revenues and profits, there are growing concerns about job security and potential layoffs across various sectors.

- Stock performance analysis: A detailed analysis of individual company stock performance reveals a clear correlation between exposure to international trade and the magnitude of stock price declines.

Implications for the Netherlands Economy

The decline in the Amsterdam Stock Market has broader implications for the Netherlands economy, potentially impacting GDP growth, consumer confidence, and overall economic stability.

- Impacts on GDP growth: The current market turmoil could lead to a contraction in economic activity and reduce overall GDP growth.

- Effect on consumer confidence and spending: Concerns about job security and economic uncertainty could lead to reduced consumer spending, further dampening economic growth.

- Government responses: The Dutch government may need to implement fiscal stimulus measures or other policies to mitigate the negative impact on the economy.

Global Market Ripple Effects

The Amsterdam Stock Market's decline is not isolated; it reflects the interconnectedness of global financial markets. The downturn has potential ripple effects on other major stock indices and global trade and investment.

- Correlations with other major stock indices: The Amsterdam Stock Market's performance is closely correlated with other major indices globally, indicating the widespread impact of trade war fears.

- Implications for international trade and investment: The uncertainty surrounding trade policies discourages international trade and investment, further hindering global economic growth.

- Comparative data: Comparing the performance of the Amsterdam Stock Market with other major indices reveals a pattern of widespread negative impact due to escalating trade tensions.

Conclusion

The 7% plunge in the Amsterdam Stock Market represents a significant consequence of escalating global trade war fears. The sharp decline highlights the vulnerability of even resilient economies to international trade uncertainty. The interconnectedness of global markets means that the consequences of this downturn extend beyond the Netherlands, impacting investor confidence, international trade, and overall global economic growth. The significant role played by investor sentiment and the broader economic slowdown further exacerbates the situation.

Call to Action: Stay informed about the evolving situation surrounding the trade war and its impact on the Amsterdam Stock Market and global markets. Monitor reputable financial news sources for updates and consider diversifying your investment portfolio to mitigate risk in times of economic uncertainty. Understanding the dynamics of the Amsterdam Stock Market is crucial for informed investing during these volatile times.

Featured Posts

-

Sean Penns Appearance Sparks Concern The Actor Makes Headline Grabbing Statements

May 25, 2025

Sean Penns Appearance Sparks Concern The Actor Makes Headline Grabbing Statements

May 25, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025 -

Apple Stock 200 Buy Point Before Reaching 254 Analyst Insight

May 25, 2025

Apple Stock 200 Buy Point Before Reaching 254 Analyst Insight

May 25, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 25, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 25, 2025 -

Avoid Memorial Day Travel Delays Best And Worst Flight Days 2025

May 25, 2025

Avoid Memorial Day Travel Delays Best And Worst Flight Days 2025

May 25, 2025

Latest Posts

-

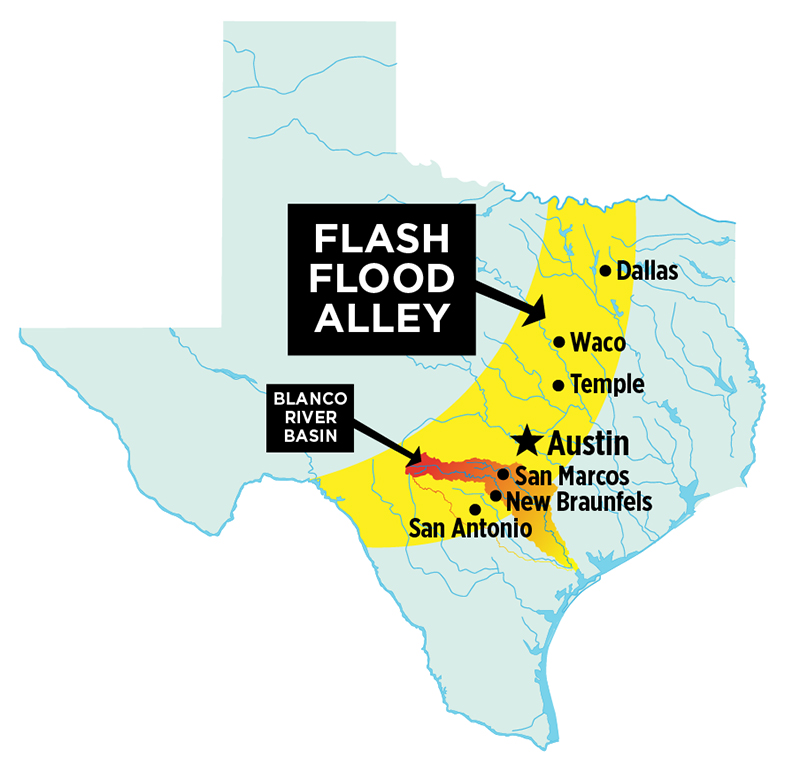

Preparing For Flash Floods A Guide To Flood Warnings And Emergency Response

May 25, 2025

Preparing For Flash Floods A Guide To Flood Warnings And Emergency Response

May 25, 2025 -

Is A Canada Post Strike Imminent The Customer Perspective

May 25, 2025

Is A Canada Post Strike Imminent The Customer Perspective

May 25, 2025 -

Texas Flash Flood Warning Urgent Alert For North Central Region

May 25, 2025

Texas Flash Flood Warning Urgent Alert For North Central Region

May 25, 2025 -

A Looming Canada Post Strike What Customers Need To Know

May 25, 2025

A Looming Canada Post Strike What Customers Need To Know

May 25, 2025 -

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025