Apple Stock Investment: Analysis Of Q2 Financial Results

Table of Contents

Revenue Analysis: Deconstructing Apple's Q2 Earnings

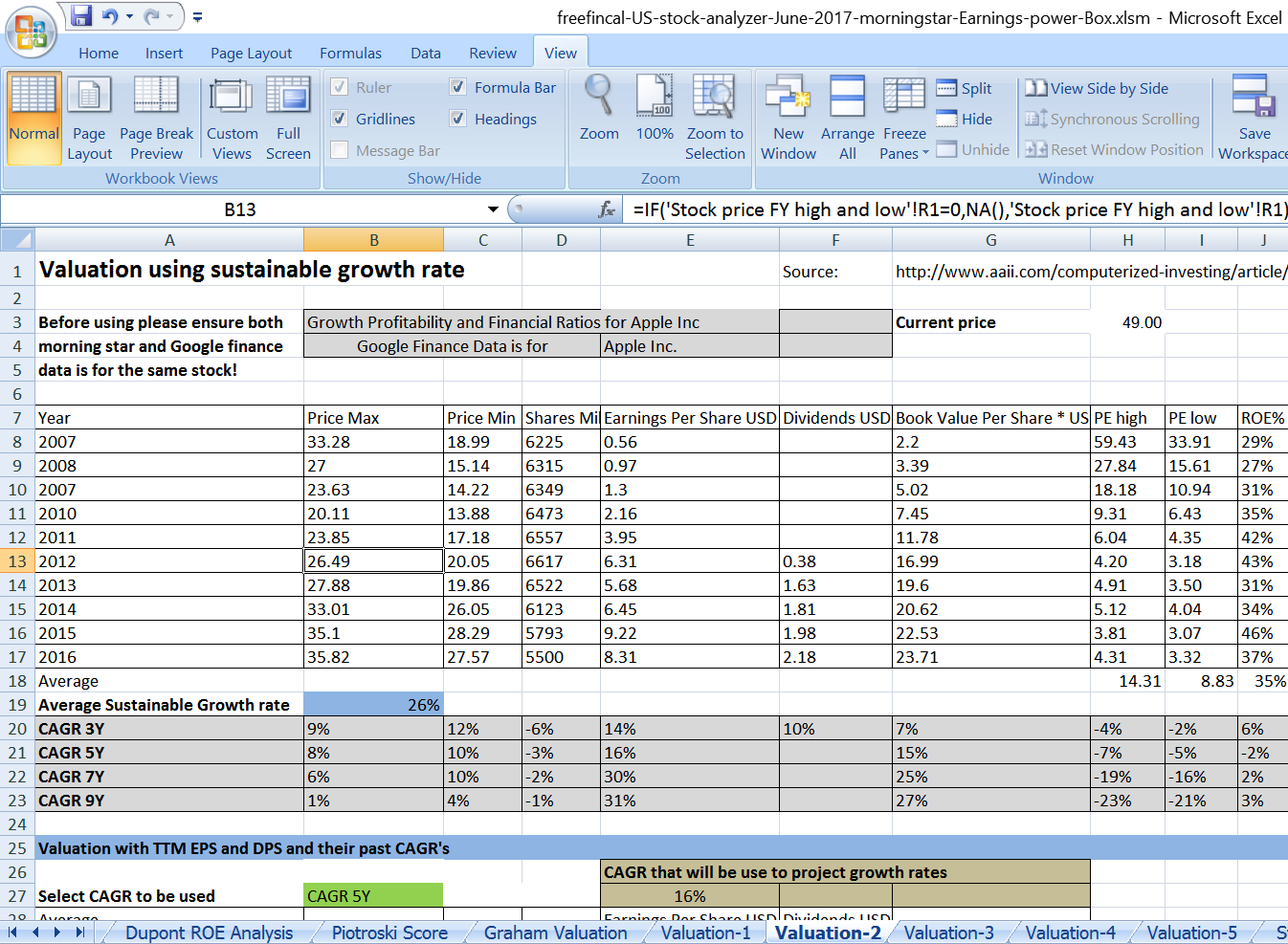

Apple's Q2 revenue is a key indicator of its overall financial health and a crucial factor in assessing Apple stock investment potential. Let's break down the performance across its major product categories:

-

Breakdown of revenue by product segment: Apple typically reports revenue from iPhone, Mac, iPad, Wearables, and Services. Analyzing the individual performance of each segment provides a nuanced understanding of market trends and consumer demand. For example, strong iPhone sales often signify overall consumer confidence in the tech sector. Conversely, a dip in Mac sales might indicate changing market preferences or economic headwinds.

-

Comparison to Q2 2023 revenue figures: Comparing Q2 2024 revenue to the same period in 2023 reveals growth or decline percentages. This year-over-year comparison is vital for understanding the trajectory of Apple's revenue streams and assessing the potential for future Apple stock growth. Significant variations from previous years need further investigation to identify underlying causes.

-

Impact of macroeconomic factors: Global economic conditions significantly influence Apple's revenue. Factors like inflation, currency fluctuations, and consumer spending habits directly impact demand for Apple products. Analyzing these macroeconomic factors provides context for interpreting the Q2 revenue figures and predicting future performance.

-

Significant surprises or unexpected trends: Sometimes, Apple's Q2 results reveal unexpected trends. Perhaps a particular product line outperforms expectations, or a region shows surprisingly strong growth. Identifying and analyzing these surprises is crucial for understanding the evolving market landscape and refining investment strategies.

-

Key geographic regions contributing to revenue: Apple's revenue isn't evenly distributed geographically. Analyzing which regions contributed most significantly to revenue highlights market penetration, growth opportunities, and potential risks associated with regional economic instability. Understanding these geographic patterns informs investment decisions and risk assessment.

Profitability and Margins: Assessing Apple's Financial Health

Analyzing Apple's profitability is crucial for evaluating the long-term viability of Apple stock investment. Key metrics include:

-

Gross profit margin, operating margin, and net income: These metrics provide insights into Apple's cost structure, pricing strategies, and overall efficiency. High profit margins typically indicate strong pricing power and efficient operations, positive indicators for Apple stock investment.

-

Comparison to previous quarters and Q2 2023: Tracking these profitability metrics over time allows for the identification of trends. Consistent growth is a positive sign, while declining margins may warrant further investigation into potential risks.

-

Changes in cost structure: Fluctuations in production costs, material prices, and labor expenses directly impact profitability. Understanding these changes is essential for predicting future profit margins and the potential impact on Apple stock.

-

Factors driving profitability: Effective pricing strategies, efficient cost management, and successful product innovation all contribute to Apple's high profitability. Analyzing these drivers helps investors understand the company's competitive advantage and its capacity for continued success.

-

Impact of supply chain issues: Global supply chain disruptions can negatively impact profitability. Understanding Apple's ability to navigate these challenges is crucial in assessing the long-term health of the business and its impact on Apple stock investment.

Future Outlook and Stock Implications: What's Next for AAPL?

Predicting the future price of Apple stock requires considering several factors:

-

Apple's future product roadmap: Apple's innovation pipeline is a key driver of future growth. Anticipated product launches, technological advancements, and service expansions can significantly influence future revenue and the value of Apple stock.

-

Competitive landscape and market share: The tech industry is highly competitive. Analyzing Apple's competitive positioning, its ability to maintain market share, and the potential threat from competitors is essential for projecting future performance.

-

Strategic initiatives and partnerships: Apple's strategic decisions, such as mergers, acquisitions, and partnerships, influence its future trajectory. Understanding these initiatives and their potential impact is crucial for assessing the long-term growth prospects of Apple stock.

-

Macroeconomic factors and their potential impact: Global economic trends continue to influence Apple's performance. Considering potential economic downturns, geopolitical risks, and regulatory changes is necessary for a realistic Apple stock forecast.

-

Reasoned outlook on the future price of Apple stock: Based on the analysis of revenue, profitability, and future prospects, investors can develop a reasoned outlook on the potential future price of Apple stock. This outlook should consider both the upside and downside risks associated with Apple stock investment.

Risks and Considerations for Apple Stock Investment

While Apple appears financially sound, investors must consider potential risks:

-

Market volatility and competition: The stock market is inherently volatile, and Apple stock is susceptible to market fluctuations. Increased competition from other tech companies could impact Apple's market share and profitability.

-

Negative impacts of geopolitical events or economic downturns: Global events and economic instability can significantly impact consumer spending and affect Apple's sales.

-

Regulatory changes or lawsuits: Apple faces potential regulatory scrutiny and legal challenges, which could negatively impact its financial performance and the value of Apple stock.

Conclusion

This analysis of Apple's Q2 financial results provides a comprehensive overview of the company's performance. We examined revenue streams, profitability, and the future outlook for Apple, offering insights into the potential of Apple stock investment. While Apple continues to demonstrate strong financial health, investors should carefully consider the risks before making any investment decisions.

Call to Action: Interested in learning more about incorporating Apple stock into your investment portfolio? Conduct thorough research and consult with a financial advisor before making any investment decisions related to Apple stock or any other stock. Stay informed about future Apple Q reports for a comprehensive understanding of the company’s performance and to inform your Apple stock investment strategy.

Featured Posts

-

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 25, 2025

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 25, 2025 -

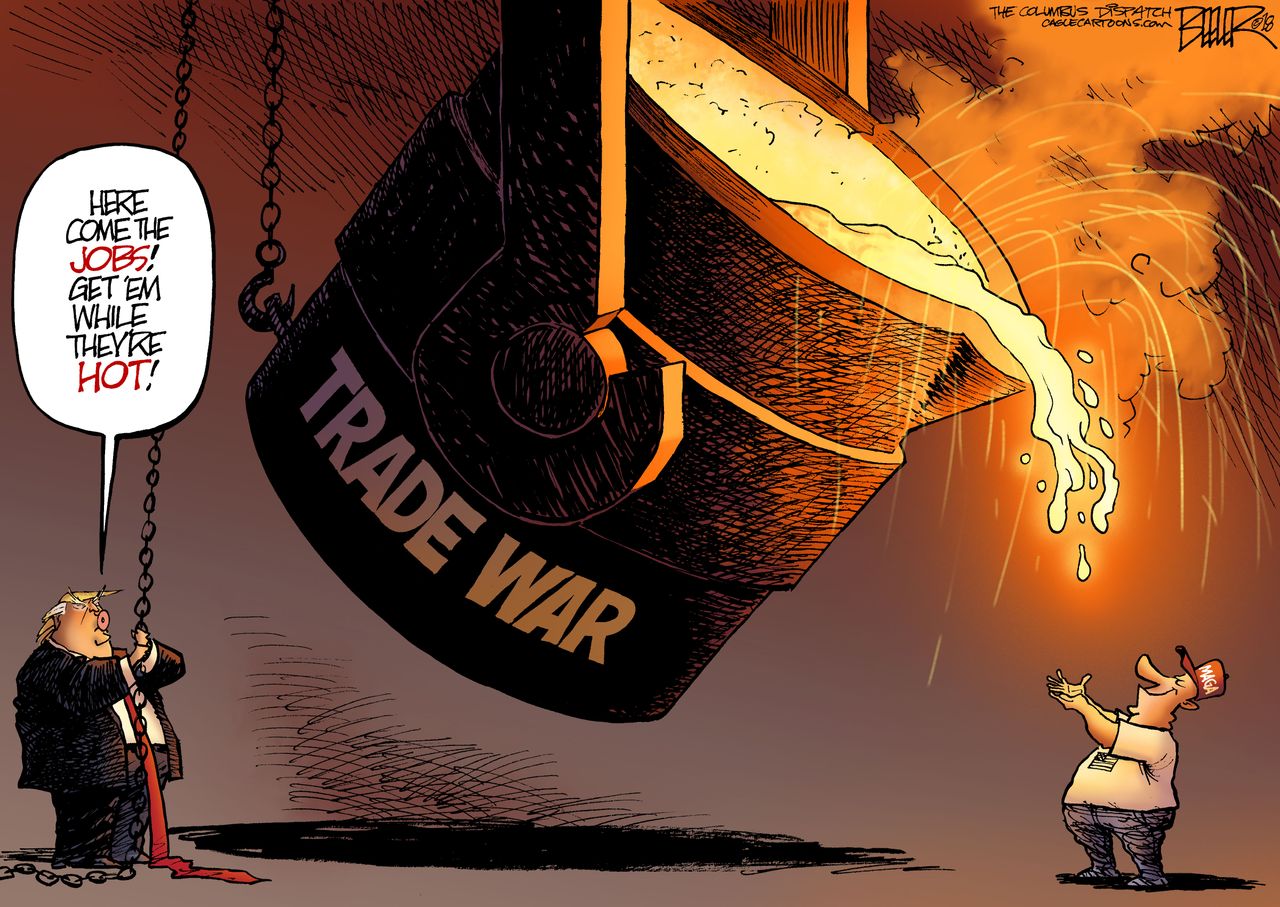

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025 -

Snl Afterparty Lady Gagas Romantic Arrival With Michael Polansky

May 25, 2025

Snl Afterparty Lady Gagas Romantic Arrival With Michael Polansky

May 25, 2025 -

Porsche 356 Zuffenhausen Riwayat Produksi Dan Warisan

May 25, 2025

Porsche 356 Zuffenhausen Riwayat Produksi Dan Warisan

May 25, 2025 -

80 Millio Forintert Extrak Ezt Kapta Ez A Porsche 911

May 25, 2025

80 Millio Forintert Extrak Ezt Kapta Ez A Porsche 911

May 25, 2025

Latest Posts

-

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025 -

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025 -

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025 -

Fathers Desperate Row For Sons 2 2 Million Treatment An Inspiring Story

May 25, 2025

Fathers Desperate Row For Sons 2 2 Million Treatment An Inspiring Story

May 25, 2025 -

Analysis Of A Sixth Century Vessel From Sutton Hoo Purpose And Contents Cremated Remains

May 25, 2025

Analysis Of A Sixth Century Vessel From Sutton Hoo Purpose And Contents Cremated Remains

May 25, 2025