Tim Cook's Tariff Warning Triggers Apple Stock Sell-Off

Table of Contents

Cook's Tariff Warning and its Implications

Tim Cook's warning highlighted the escalating impact of tariffs on Apple's manufacturing and supply chain. His statement underscored the increasing challenges Apple faces in managing production costs and maintaining its global competitiveness. While the exact quotes may vary depending on the specific interview or statement, the core message consistently revolved around the significant financial burden imposed by tariff increases.

- Direct Quote (Example): "The escalating tariffs are a significant concern for Apple, impacting our manufacturing costs and potentially affecting our ability to deliver the same level of value to our customers." (This would be replaced with an actual quote if available)

- Specific Tariff Increases: The warning focused on the increased tariffs imposed on various components sourced from China and other affected regions. These tariffs specifically impacted key components used in iPhones, iPads, and other Apple products.

- Countries Affected: China, being a major manufacturing hub for Apple, was most significantly affected. However, tariffs on components sourced from other countries also added to the overall cost burden.

- Impact on Manufacturing and Supply Chain: The increased tariffs disrupt Apple's carefully optimized supply chain. Higher import duties translate to increased production costs, potentially jeopardizing profit margins and forcing Apple to reconsider its manufacturing strategy.

Market Reaction: Apple Stock Sell-Off Analysis

The market reacted swiftly and negatively to Cook's tariff warning. The announcement triggered a substantial Apple stock sell-off, sending ripples through the broader tech sector.

- Percentage Drop in Apple Stock Price: The stock price experienced a considerable percentage drop (insert actual percentage here if available) in the immediate aftermath of the announcement.

- Trading Volume Changes: Trading volume significantly increased, indicating heightened investor activity and a flurry of buy and sell orders.

- Analyst Reactions and Predictions: Financial analysts offered a range of reactions, with some predicting a continued downturn and others suggesting a potential recovery depending on Apple's strategic response and the future trajectory of tariff policies.

- Comparison to Previous Market Reactions: This Apple stock sell-off can be compared to previous market reactions to tariff-related news, showing a similar pattern of negative investor sentiment in response to uncertainty and increased costs.

Impact on Consumers: Price Increases and Product Availability

The increased tariffs are unlikely to remain solely absorbed by Apple. The resulting higher production costs will likely translate to higher prices for consumers, impacting affordability and potentially dampening demand.

- Increased Tariffs & Higher Consumer Prices: The simple economics of supply and demand dictate that increased manufacturing costs will inevitably be passed on to the consumer through higher prices for Apple products.

- Impact on Consumer Demand: Higher prices could lead to reduced consumer demand, particularly in price-sensitive markets.

- Apple's Mitigation Strategies: Apple may attempt to mitigate price increases by absorbing some of the added costs initially, exploring more cost-effective manufacturing processes, or optimizing its product mix.

- Potential Product Shortages: In some instances, depending on the severity of the supply chain disruptions, consumers may experience temporary shortages of certain Apple products.

Long-Term Outlook: Apple's Strategic Response and Future Predictions

Apple is likely to employ a multi-pronged approach to navigate this challenging situation. Their response will be crucial in shaping the long-term outlook for the company and its stock.

- Diversification of Manufacturing Locations: Apple might accelerate its efforts to diversify its manufacturing base, reducing reliance on any single region, particularly China.

- Lobbying Efforts: Apple will likely engage in lobbying efforts to influence tariff policy, advocating for changes that benefit its business operations.

- Alternative Sourcing Strategies: The company might explore alternative sourcing strategies for components, seeking suppliers in regions with more favorable tariff conditions.

- Long-Term Stock Performance Predictions: The long-term impact on Apple's stock performance remains uncertain. Analysts' predictions vary, depending on the success of Apple's strategic responses and the overall global economic climate.

- Expert Opinions: Financial analysts' opinions will continue to shape investor sentiment, providing guidance on the potential trajectory of Apple's stock price.

Conclusion

Tim Cook's tariff warning has undoubtedly triggered a significant Apple stock sell-off, raising concerns about the company's profitability and the potential for higher consumer prices. The impact on Apple's intricate supply chain is substantial, demanding immediate strategic adjustments to mitigate financial losses. While the long-term implications remain uncertain, analysts are closely monitoring the situation, assessing Apple's capacity to overcome these challenges. Understanding the dynamics of this Apple stock sell-off is crucial for informed investment decisions.

Call to Action: Stay informed about the evolving situation surrounding Apple's response to tariffs and their impact on the Apple stock market. Continue to follow updates on the "Apple Stock Sell-Off" for the latest news and analysis. Consider consulting with a financial advisor before making any investment decisions related to Apple stock or any other stock influenced by tariff changes.

Featured Posts

-

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro Blossoms

May 25, 2025

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro Blossoms

May 25, 2025 -

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025 -

Crystal Palace Target Kyle Walker Peters On A Bosman

May 25, 2025

Crystal Palace Target Kyle Walker Peters On A Bosman

May 25, 2025 -

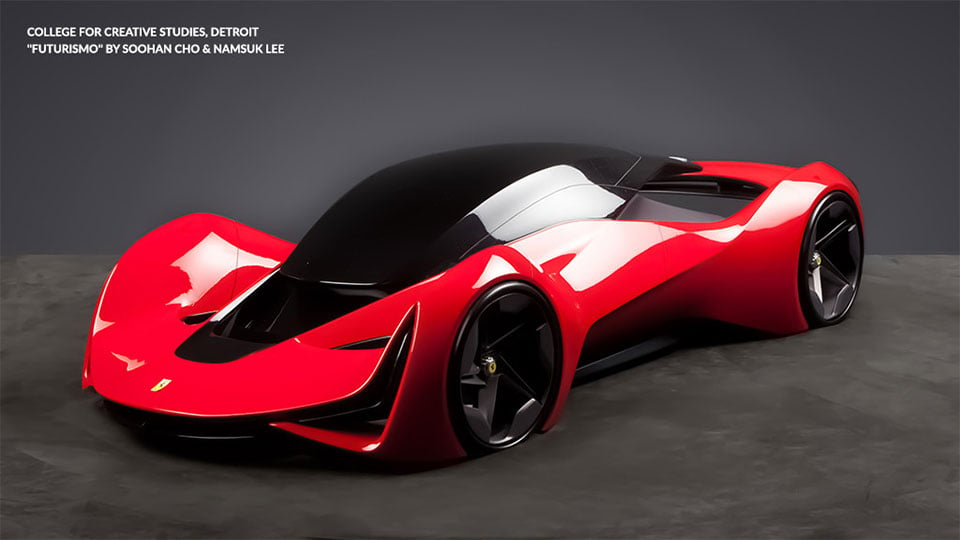

Ferrari Challenge A High Octane Weekend In South Florida

May 25, 2025

Ferrari Challenge A High Octane Weekend In South Florida

May 25, 2025 -

Prezzi Abbigliamento Usa Impatto Dazi Sulla Moda

May 25, 2025

Prezzi Abbigliamento Usa Impatto Dazi Sulla Moda

May 25, 2025

Latest Posts

-

Analysis Trumps Decision On The Proposed Nippon U S Steel Merger

May 25, 2025

Analysis Trumps Decision On The Proposed Nippon U S Steel Merger

May 25, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Urban Change

May 25, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Urban Change

May 25, 2025 -

U S Japan Steel Industry Reshaped Trumps Endorsement Of Nippon U S Deal

May 25, 2025

U S Japan Steel Industry Reshaped Trumps Endorsement Of Nippon U S Deal

May 25, 2025 -

Black Lives Matter Plaza From Dedication To Dismantling

May 25, 2025

Black Lives Matter Plaza From Dedication To Dismantling

May 25, 2025 -

The Trump Administration And The Nippon U S Steel Merger A Comprehensive Overview

May 25, 2025

The Trump Administration And The Nippon U S Steel Merger A Comprehensive Overview

May 25, 2025