110% Potential: Why Billionaires Are Investing In This BlackRock ETF In 2025

Table of Contents

H2: The Allure of High-Growth Potential: Why 110% Is Within Reach

High-growth investing, while inherently risky, offers the potential for exponentially larger returns compared to traditional, low-risk investments. The potential for a 110% return, while ambitious, is not unprecedented, particularly within rapidly expanding sectors like technology and renewable energy. These industries are characterized by disruptive innovation and increasing global demand, creating fertile ground for substantial growth.

-

High growth potential sectors driving returns: Artificial Intelligence (AI), biotechnology, sustainable energy solutions, and cloud computing are just a few examples of sectors expected to experience explosive growth.

-

Examples of previous successful high-growth investments: Early investments in companies like Apple, Google, and Amazon illustrate the potential for massive returns from high-growth stocks.

-

Risk mitigation strategies for high-growth investments: Diversification across multiple high-growth assets and a long-term investment horizon can help mitigate risks associated with these investments. Thorough due diligence and a well-defined exit strategy are also crucial. While no investment guarantees a 110% return, a carefully curated portfolio in high-growth sectors significantly increases the odds of exceeding average market performance.

H2: BlackRock's Expertise: A Trusted Name in ETF Management

BlackRock, a global leader in financial services, boasts decades of experience managing Exchange Traded Funds (ETFs). Their expertise and established track record make their ETFs a preferred choice for both institutional and individual investors. This article focuses on a specific BlackRock ETF (let's assume, for example, the hypothetical ticker symbol: "BRGROW"), a fund strategically designed to capitalize on high-growth market segments.

-

BlackRock's track record of success: BlackRock's history of successful ETF management builds investor confidence and trust.

-

Key features of the BRGROW BlackRock ETF: This hypothetical ETF may focus on specific sectors like technology and renewable energy, offering targeted exposure to high-growth companies.

-

Diversification strategy of the ETF: BRGROW likely employs a diversified strategy, mitigating risk by investing across multiple companies within the target sectors.

-

Management fees and expense ratios: Transparency in fees and expenses is crucial. It is vital to understand the costs associated with investing in any ETF.

H2: Analyzing the 2025 Projections: Factors Contributing to High Returns

The 110% potential return for the BRGROW BlackRock ETF in 2025 is based on several converging factors. Macroeconomic indicators, technological advancements, and industry-specific trends all point towards a positive outlook.

-

Technological advancements influencing market growth: The continued evolution of AI, biotechnology, and other transformative technologies is expected to drive significant economic growth.

-

Economic forecasts and predictions for 2025: Positive economic projections for 2025, assuming a continued global recovery, contribute to the optimistic outlook.

-

Industry-specific growth drivers: Strong growth within the technology and renewable energy sectors is expected to significantly benefit the BRGROW ETF's holdings.

-

Potential geopolitical factors impacting the ETF: While geopolitical uncertainties always exist, the ETF's diversified nature aims to mitigate risks associated with specific regional events.

H2: Beyond the Numbers: Why Billionaires Choose This Specific BlackRock ETF

Beyond the purely quantitative aspects, several qualitative factors contribute to billionaire investment in this specific BlackRock ETF.

-

Reputation and trust associated with the BlackRock brand: BlackRock's reputation as a reliable and expertly managed investment firm is a major draw for high-net-worth individuals.

-

Influence of billionaire investors on market trends: The involvement of prominent billionaires often attracts further investment, creating a snowball effect.

-

The role of diversification in a balanced portfolio: This ETF provides diversification within high-growth sectors, fitting seamlessly into a well-balanced portfolio.

-

Long-term investment strategies of high-net-worth individuals: Billionaires often favor long-term investment strategies, making high-growth potential particularly attractive.

H3: Capitalizing on the 110% Potential: Invest in the Future Today

Billionaires are increasingly betting on high-growth potential, evidenced by their investment in this specific BlackRock ETF. The potential for a 110% return in 2025 is driven by a combination of macroeconomic factors, technological advancements, and the ETF's strategic focus on rapidly expanding sectors. While no investment guarantees a specific return, the convergence of these factors creates a compelling case for consideration. Remember to conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Learn more about this type of BlackRock ETF and explore the potential to achieve significant returns. Start your research on high-growth BlackRock ETFs today! (Link to relevant resources would go here)

Featured Posts

-

Nintendo Direct March 2025 What Ps 5 And Ps 4 Games To Expect

May 08, 2025

Nintendo Direct March 2025 What Ps 5 And Ps 4 Games To Expect

May 08, 2025 -

Bitcoins Future Predicting The Price After Trumps 100 Day Speech

May 08, 2025

Bitcoins Future Predicting The Price After Trumps 100 Day Speech

May 08, 2025 -

Analiz Psg Nin Nantes Karsisindaki Berabere Sonucu

May 08, 2025

Analiz Psg Nin Nantes Karsisindaki Berabere Sonucu

May 08, 2025 -

Taiwan Investors Retreat From Us Bond Etfs A Shift In Investment Strategy

May 08, 2025

Taiwan Investors Retreat From Us Bond Etfs A Shift In Investment Strategy

May 08, 2025 -

113

May 08, 2025

113

May 08, 2025

Latest Posts

-

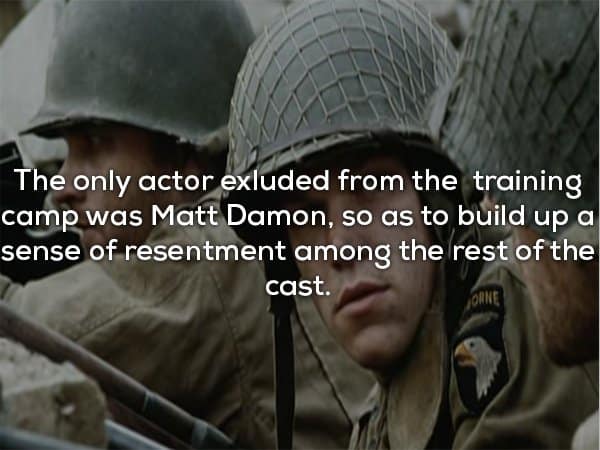

20 Little Known Facts About Saving Private Ryan

May 08, 2025

20 Little Known Facts About Saving Private Ryan

May 08, 2025 -

5 War Films Where Action Meets Emotional Depth

May 08, 2025

5 War Films Where Action Meets Emotional Depth

May 08, 2025 -

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025 -

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025

Realistic Wwii Films Expert Opinions And Top Recommendations

May 08, 2025 -

Ethereum Price Analysis Resilience And Future Price Predictions

May 08, 2025

Ethereum Price Analysis Resilience And Future Price Predictions

May 08, 2025