Taiwan Investors Retreat From US Bond ETFs: A Shift In Investment Strategy

Table of Contents

Declining Returns and Rising Interest Rates in the US

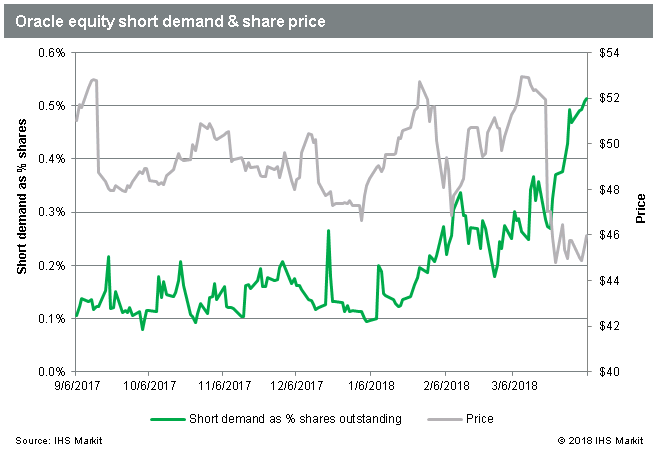

Rising US interest rates have significantly impacted the attractiveness of US bond ETFs for Taiwanese investors. The inverse relationship between interest rates and bond prices means that as the Federal Reserve raises interest rates to combat inflation, the value of existing bonds falls. This has directly affected the returns on US bond ETFs, making them less appealing compared to previous years.

- Impact of Rising Rates: Higher interest rates make newly issued bonds more attractive, leading to lower demand (and thus lower prices) for existing bonds held within ETFs.

- Return Comparison: Data comparing the performance of major US bond ETFs in 2022 to their performance in 2021 reveals a significant downturn in returns. For instance, [insert specific ETF example and data if available]. This decline has prompted many Taiwanese investors to reassess their bond holdings.

- Specific ETFs Affected: Several popular US bond ETFs, including those focused on government bonds, corporate bonds, and mortgage-backed securities, have experienced notable outflows of Taiwanese capital.

Geopolitical Risks and US-China Tensions

The increasingly complex geopolitical landscape, particularly the ongoing tensions between the US and China, plays a crucial role in influencing Taiwanese investment decisions. The perceived risk associated with US assets, fueled by trade wars and unpredictable political climates, is pushing investors towards perceived safer havens.

- US-China Relations: The escalating trade war and political uncertainties between the US and China have created a climate of uncertainty, prompting investors to seek diversification away from US-centric investments.

- Alternative Investment Havens: Taiwanese investors are increasingly exploring alternative investment havens, including those in other Asian markets, Europe, or even within Taiwan itself.

- Expert Opinion: [Insert quote from a financial expert on the impact of US-China relations on Taiwanese investment strategies]. This highlights the growing concerns among investors.

Diversification and Search for Higher Yields

The retreat from US bond ETFs is also driven by a broader desire for portfolio diversification and the search for higher yields. Taiwanese investors are actively seeking to reduce their exposure to any single market and explore opportunities with potentially higher returns.

- Portfolio Diversification: The focus is shifting towards a more diversified portfolio, including a wider range of asset classes and geographical locations.

- Higher Yield Alternatives: Emerging markets, particularly in Asia, are gaining traction as investors seek potentially higher returns compared to the relatively low yields offered by US bonds currently.

- Attractive Asset Classes: Real estate and private equity investments are becoming increasingly attractive to Taiwanese investors who are looking beyond traditional bond markets. [Include examples of specific regions or asset classes seeing increased interest].

Regulatory Changes and Tax Implications

Changes in both US and Taiwanese regulations related to investments in US bond ETFs have also influenced investment decisions. Tax implications and compliance requirements play a critical role in shaping investment strategies.

- US Regulatory Changes: [Mention specific regulatory changes in the US that might affect Taiwanese investors, citing relevant sources].

- Tax Implications: Changes to tax treaties or capital gains taxes in either the US or Taiwan can significantly affect the overall return on investment.

- Compliance Costs: Increased compliance costs associated with foreign investments might also contribute to the shift away from US bond ETFs.

Conclusion: Understanding the Shift in Taiwan's Investment Strategy Away From US Bond ETFs

The retreat of Taiwanese investors from US bond ETFs is a complex phenomenon driven by a confluence of factors. Rising US interest rates, geopolitical uncertainties, a desire for diversification and higher yields, and regulatory changes all contribute to this significant shift in investment strategy. This trend has significant implications for both Taiwanese investors and the global financial landscape. The future will likely see a continued diversification of Taiwanese investment portfolios, with a greater emphasis on emerging markets and alternative asset classes. Understanding the dynamics behind "Taiwan Investors Retreat From US Bond ETFs" is crucial for navigating the evolving global financial landscape. We encourage readers to delve deeper into the implications of this trend and consider consulting a financial advisor to review and adjust their own investment portfolios accordingly.

Featured Posts

-

Vesprem A Sobori Ps Zh Vo Ligata Na Shampionite

May 08, 2025

Vesprem A Sobori Ps Zh Vo Ligata Na Shampionite

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Unveiled

May 08, 2025 -

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025 -

Saturday Night Live And Counting Crows How A Single Performance Launched A Career

May 08, 2025

Saturday Night Live And Counting Crows How A Single Performance Launched A Career

May 08, 2025 -

Bitcoin Madenciliginin Sonu Mu Geliyor Karlilik Azalmasinin Nedenleri

May 08, 2025

Bitcoin Madenciliginin Sonu Mu Geliyor Karlilik Azalmasinin Nedenleri

May 08, 2025

Latest Posts

-

Ptt Personel Alim Tarihleri 2025 Kpss Ile Basvuru

May 08, 2025

Ptt Personel Alim Tarihleri 2025 Kpss Ile Basvuru

May 08, 2025 -

2025 Ptt Postane Alimlari Basvuru Tarihi Ve Detaylar

May 08, 2025

2025 Ptt Postane Alimlari Basvuru Tarihi Ve Detaylar

May 08, 2025 -

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar Ne Zaman

May 08, 2025

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar Ne Zaman

May 08, 2025 -

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Sartlari

May 08, 2025

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Sartlari

May 08, 2025 -

Psl 10 Ticket Sales Open Today

May 08, 2025

Psl 10 Ticket Sales Open Today

May 08, 2025