Ethereum Price Analysis: Resilience And Future Price Predictions

Current Ethereum Price and Market Sentiment

As of [Insert Current Date and Time], the Ethereum price is approximately $[Insert Current Ethereum Price]. This represents a [Percentage Change] change compared to [Reference Point, e.g., yesterday, last week, last month]. Market sentiment towards Ethereum currently appears to be [Bullish/Bearish/Neutral - justify with current news and trends]. This sentiment is influenced by several recent events.

- Recent Price Fluctuations: The recent drop/rise in Ethereum price can be attributed to [Specific reason, e.g., regulatory uncertainty in a specific country, a major DeFi hack, a significant technological upgrade announcement]. This highlights the inherent volatility of the cryptocurrency market and the importance of careful risk management.

- Trading Volume and Market Capitalization: The current 24-hour trading volume is approximately $[Insert Trading Volume], while Ethereum's market capitalization stands at approximately $[Insert Market Cap]. This indicates [Interpretation of the data, e.g., high trading activity suggesting strong investor interest, low volume suggesting market consolidation]. Ethereum's market dominance currently sits at approximately [Percentage]%.

- Bitcoin's Influence: As with most altcoins, Ethereum's price is often correlated with Bitcoin's price. Recent movements in Bitcoin's price have [Explain the correlation – e.g., positively impacted Ethereum's price, negatively impacted Ethereum's price, had little effect]. This correlation underscores the interconnected nature of the cryptocurrency market.

- Chart Analysis: [Insert a relevant chart showing Ethereum's price performance over a specific period, clearly labeled and sourced]. This chart visually represents the key price trends and fluctuations discussed above.

Factors Influencing Ethereum's Price

Several key factors significantly impact Ethereum's price. Understanding these factors is crucial for predicting future price movements and making informed investment decisions.

Technological Advancements

Ethereum's ongoing development plays a pivotal role in its price.

- Ethereum 2.0: The rollout of Ethereum 2.0, with its shift to a proof-of-stake consensus mechanism, is expected to significantly improve scalability, security, and energy efficiency. This upgrade is a major catalyst for positive price action.

- Scalability Solutions: Layer-2 scaling solutions, such as Optimism, Arbitrum, and Polygon, are addressing Ethereum's scalability challenges, allowing for faster and cheaper transactions. This enhanced usability attracts more users and applications.

- DeFi and NFTs: The explosive growth of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) built on the Ethereum blockchain has driven significant demand for ETH, boosting its price.

Regulatory Landscape

The regulatory environment significantly impacts cryptocurrency prices, including Ethereum.

- Government Policies: Varying regulatory approaches across different countries influence investor confidence and market participation. Stringent regulations can stifle growth, while supportive policies can foster innovation.

- Regulatory Uncertainty: Uncertainty surrounding future regulations creates volatility. Clear and consistent regulatory frameworks are needed to promote long-term growth and stability.

- Potential Risks and Opportunities: Regulatory developments, both positive and negative, can lead to significant price swings. Staying informed about regulatory changes is paramount for Ethereum investors.

Adoption and Use Cases

The expanding adoption of Ethereum across various sectors fuels price appreciation.

- Growing Adoption: Ethereum's use cases continue to expand into finance, supply chain management, gaming, and other industries, driving increasing demand.

- Institutional Investment: The entry of institutional investors into the cryptocurrency market, including Ethereum, adds further legitimacy and boosts price.

- Developer Activity and Network Growth: A thriving developer community and consistent network growth are positive indicators of Ethereum's long-term viability and potential for price appreciation.

Ethereum Price Predictions

Predicting cryptocurrency prices is inherently challenging, but analyzing various perspectives can offer potential insights. Several reputable analysts and platforms offer price predictions, but it's crucial to remember these are estimations, not guarantees.

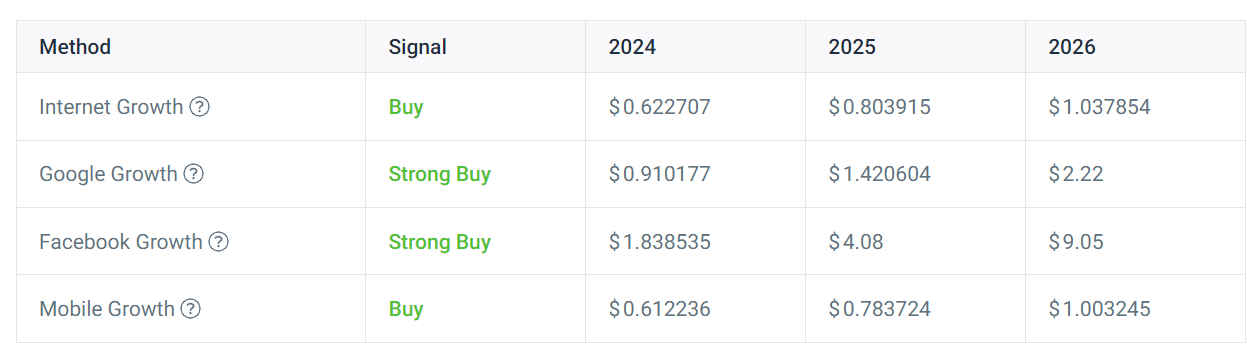

- Short-Term Predictions (Next 6 Months): Some analysts project a price range between $[Lower Bound] and $[Upper Bound] for Ethereum within the next six months. This prediction is based on [Reasons for the prediction].

- Mid-Term Predictions (Next 1-3 Years): Mid-term predictions vary widely, with some suggesting a potential price of $[Mid-Term Price Estimate], contingent upon [Factors influencing the prediction].

- Long-Term Predictions (Next 5+ Years): Long-term predictions are even more speculative. Some analysts envision a significantly higher price, potentially reaching $[Long-Term Price Estimate], driven by widespread adoption and technological advancements.

- Disclaimer: All price predictions are highly speculative and subject to market volatility. Past performance is not indicative of future results.

Risks and Opportunities for Ethereum Investors

Investing in Ethereum, like any cryptocurrency, involves both risks and opportunities.

Risks:

- Market Volatility: The cryptocurrency market is notoriously volatile, and Ethereum's price can experience significant fluctuations.

- Regulatory Uncertainty: Changes in regulations can negatively impact the price and accessibility of Ethereum.

- Security Risks: While Ethereum has improved its security, vulnerabilities remain a potential concern.

Opportunities:

- High Growth Potential: Ethereum's underlying technology and growing adoption suggest a high potential for long-term price appreciation.

- Exposure to a Thriving Ecosystem: Investing in Ethereum offers exposure to a rapidly expanding ecosystem of DeFi applications, NFTs, and other innovations.

- Significant Returns: Ethereum has historically delivered significant returns to early investors, although this is not guaranteed in the future.

Conclusion

This Ethereum price analysis highlights the resilience of Ethereum despite market fluctuations. Factors influencing its price include technological advancements like Ethereum 2.0, the evolving regulatory landscape, and the expanding adoption across various sectors. While price predictions are speculative, understanding these factors provides a more informed perspective. Remember that investing in cryptocurrencies involves significant risk. Stay informed about the latest developments affecting the Ethereum price and continue researching before making any investment decisions. Regularly check for updated Ethereum price analyses to stay ahead of the market.

Jayson Tatum On Steph Curry Post All Star Game Honesty

Jayson Tatum On Steph Curry Post All Star Game Honesty

Champions League Inter Milans Shock Win Against Bayern Munich

Champions League Inter Milans Shock Win Against Bayern Munich

Could Xrp Reach 5 By 2025 A Realistic Look At The Forecast

Could Xrp Reach 5 By 2025 A Realistic Look At The Forecast

Ligde Gerilim Psg Nantes La Berabere Kaldi

Ligde Gerilim Psg Nantes La Berabere Kaldi

Arsenal News Collymores Public Pressure Campaign Against Arteta

Arsenal News Collymores Public Pressure Campaign Against Arteta