Bitcoin's Future: Predicting The Price After Trump's 100-Day Speech

Table of Contents

Trump's Economic Policies and their Influence on Bitcoin

Trump's economic policies, characterized by deregulation and a focus on national interests, had significant implications for the cryptocurrency market and Bitcoin's future.

Impact of Regulatory Changes

The Trump administration's stance on cryptocurrency regulation remained somewhat ambiguous, leading to uncertainty within the market. Potential regulatory changes could have dramatically impacted Bitcoin's trajectory.

- Increased Regulation: Stricter regulations could stifle innovation and hinder Bitcoin adoption, potentially depressing its price. This could involve increased Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, impacting accessibility.

- Tax Implications: Changes in tax policies regarding cryptocurrency gains and losses could also significantly influence investor behavior and Bitcoin's price. Favorable tax treatment might stimulate investment, while unfavorable policies could deter it.

- Acceptance of Crypto as Legal Tender: While unlikely under the Trump administration, the possibility of the US government accepting Bitcoin as legal tender would have been hugely bullish for its price, driving widespread adoption.

These regulatory shifts, or lack thereof, directly influence Bitcoin regulation, cryptocurrency regulation, and the overall Trump administration cryptocurrency policy, impacting market confidence and Bitcoin adoption.

Effect on the US Dollar and Global Markets

Trump's policies significantly impacted the value of the US dollar. Since Bitcoin often acts as a safe haven asset during times of USD weakness, changes in the dollar's value could influence Bitcoin's price.

- Weakening USD: A weakening US dollar could increase demand for Bitcoin as investors seek alternative stores of value, potentially boosting its price.

- Strengthening USD: Conversely, a strengthening dollar could decrease demand for Bitcoin, leading to price depreciation.

- Global Market Volatility: Trump's policies created global market volatility. This uncertainty can drive investors towards Bitcoin as a hedge against traditional market risks, increasing its demand. This interplay between the USD value, global market volatility, and Bitcoin price correlation is complex and multifaceted.

Market Sentiment and Speculation Following the Speech

Trump's pronouncements always generated intense market speculation, directly impacting Bitcoin's price.

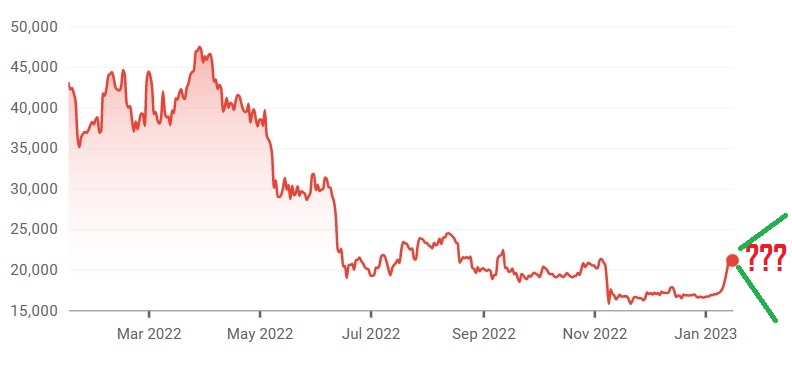

Immediate Reactions and Short-Term Volatility

The immediate market reaction to Trump's 100-day speech likely involved significant short-term volatility.

- Positive News: Positive comments about deregulation or economic growth could trigger a surge in Bitcoin's price due to increased investor optimism and speculation.

- Negative News: Conversely, negative comments about economic policy or increased regulatory scrutiny could lead to a sharp price drop as investors react to perceived risks.

- Fear and Greed: The cryptocurrency market is driven by fear and greed. Sudden price swings are often amplified by these emotional responses, making short-term price prediction extremely challenging. This highlights the importance of understanding Bitcoin volatility and market sentiment.

Long-Term Implications and Investor Confidence

The speech's long-term impact on Bitcoin's price depended heavily on its effect on investor confidence.

- Increased Confidence: Positive long-term economic prospects could boost investor confidence in Bitcoin, leading to sustained price appreciation.

- Decreased Confidence: Conversely, uncertainty and negative economic forecasts could erode confidence, leading to a prolonged price downturn.

- Long-Term Bitcoin Investment: Long-term Bitcoin investment strategies should consider these geopolitical factors alongside technological advancements and adoption rates. The long-term Bitcoin price forecast remains highly dependent on these interwoven factors.

Alternative Factors Influencing Bitcoin's Future Price

Besides Trump's speech, several other factors independently influence Bitcoin's price.

Technological Advancements

Developments within the Bitcoin network, such as the Lightning Network, significantly impact its usability and scalability.

- Lightning Network Adoption: Wider adoption of the Lightning Network could improve Bitcoin's transaction speed and reduce fees, making it more attractive to a wider range of users and potentially driving its price higher. This showcases the importance of Bitcoin technology in its long-term success.

- Scalability Improvements: Ongoing efforts to enhance Bitcoin's scalability address concerns about transaction processing times, which positively impacts user experience and potentially price.

Adoption Rates and Global Demand

The increasing global adoption of Bitcoin is a key driver of its price regardless of political events.

- Growing Institutional Investment: Increased investment from institutional investors (like large corporations and hedge funds) can significantly impact Bitcoin's market capitalization and price.

- Retail Adoption: Wider adoption among everyday users, fueled by increasing accessibility and understanding, continues to boost demand.

- Global Demand: Growing global demand for Bitcoin as a store of value and a means of payment helps sustain its price despite fluctuations in the short term. Understanding Bitcoin adoption and global demand is crucial to assessing its long-term viability.

Conclusion

Predicting Bitcoin's future after Trump's 100-day speech requires considering multiple interacting factors. While the speech undoubtedly had an impact, its influence needs to be weighed against technological advancements, global adoption rates, and broader economic trends. Positive regulatory changes could boost Bitcoin's price, while negative ones could lead to a downturn. The market's reaction to the speech's content, the USD’s value, and overall global market stability would influence both short-term volatility and long-term investor confidence. To make informed decisions regarding your Bitcoin investments, continue researching the future of Bitcoin after Trump's speech, paying close attention to Bitcoin price prediction post-speech analyses, and analyzing Bitcoin's future in the context of these multiple interacting forces.

Featured Posts

-

Watch Inter Vs Barcelona Live Uefa Champions League

May 08, 2025

Watch Inter Vs Barcelona Live Uefa Champions League

May 08, 2025 -

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025 -

Soulja Boy Found Liable 6 Million Verdict In Sexual Assault Case

May 08, 2025

Soulja Boy Found Liable 6 Million Verdict In Sexual Assault Case

May 08, 2025 -

Understanding The Bitcoin Rebound Risks And Opportunities

May 08, 2025

Understanding The Bitcoin Rebound Risks And Opportunities

May 08, 2025 -

Beat The Ps 5 Price Hike Your Guide To Finding A Console

May 08, 2025

Beat The Ps 5 Price Hike Your Guide To Finding A Console

May 08, 2025

Latest Posts

-

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025

Simsek Ten Kripto Para Piyasasina Kritik Uyari Yatirimcilar Dikkat

May 08, 2025 -

Brezilya Da Bitcoin Oedemelerinin Yasal Statuesue Ve Gelecegi

May 08, 2025

Brezilya Da Bitcoin Oedemelerinin Yasal Statuesue Ve Gelecegi

May 08, 2025 -

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025

Bakan Simsek In Kripto Varlik Kuruluslarina Uyarisi Riskler Ve Yeni Duezenlemeler

May 08, 2025 -

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025

Bitcoin Ile Maas Oedemesi Brezilya Nin Yeni Duezeni

May 08, 2025 -

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Detaylar Ve Etkileri

May 08, 2025

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Detaylar Ve Etkileri

May 08, 2025