XRP Attempts Recovery Despite Derivatives Market Stagnation

Table of Contents

XRP Price Action and Recent Volatility

XRP's price has shown significant fluctuation in recent months. Understanding this volatility is key to assessing its recovery potential. Factors influencing XRP price include news events surrounding Ripple's ongoing legal battle with the SEC, overall market sentiment within the broader cryptocurrency space, and trading volume. Analyzing trading charts reveals periods of both bullish and bearish signals, impacting the market capitalization and creating uncertainty for investors.

- Examination of key support and resistance levels: Identifying these levels helps predict potential price movements. Breaks above resistance levels often signal bullish momentum, while drops below support levels can indicate bearish pressure.

- Analysis of recent price trends and their implications: Observing short-term trends (daily, weekly) alongside longer-term trends (monthly, yearly) provides a comprehensive understanding of XRP's price direction.

- Discussion of short-term and long-term price predictions (with appropriate disclaimers): While predicting cryptocurrency prices is inherently speculative, analyzing technical indicators and market sentiment can provide educated, albeit uncertain, projections. It's crucial to remember that these are not guarantees and involve substantial risk.

Stagnation in the XRP Derivatives Market

The XRP derivatives market, encompassing futures contracts and options trading, exhibits notable stagnation. This lack of significant activity raises concerns about the robustness and efficiency of the XRP market. Several factors contribute to this:

-

Regulatory uncertainty: The unclear regulatory landscape surrounding cryptocurrencies, particularly in the US, discourages institutional participation in derivatives markets. The ongoing Ripple lawsuit exacerbates this uncertainty.

-

Limited institutional participation: Institutional investors, often major players in derivatives markets, remain hesitant due to the legal and regulatory risks associated with XRP.

-

Overall risk profile of XRP: The inherent volatility of cryptocurrencies, coupled with the ongoing legal challenges, creates a high-risk profile, deterring some traders from engaging in XRP derivatives.

-

Comparison of XRP derivatives market activity to other major cryptocurrencies: A comparative analysis reveals that XRP's derivatives market activity lags significantly behind that of Bitcoin and Ethereum, highlighting its relative immaturity and lower liquidity.

-

Analysis of open interest and trading volume in XRP derivatives contracts: Low open interest (the total number of outstanding contracts) and trading volume indicate a lack of investor participation and confidence.

-

Discussion of the impact of low liquidity on price discovery and market efficiency: Thin liquidity can lead to exaggerated price swings and inefficient price discovery, making it harder for the market to accurately reflect the true value of XRP.

Ripple's Legal Battle and its Impact on XRP

The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price and market perception. The SEC's claim that XRP is an unregistered security casts a long shadow over the cryptocurrency's future.

- Summary of the key arguments presented by both sides in the lawsuit: Ripple argues that XRP is a currency, not a security, while the SEC contends that its sale constituted an unregistered securities offering.

- Assessment of the potential outcomes and their implications for XRP: A favorable ruling for Ripple could significantly boost XRP's price and attract institutional investors. An unfavorable outcome could severely damage XRP's value and prospects.

- Discussion of the impact of the lawsuit on investor confidence and market participation: The uncertainty surrounding the lawsuit has created a climate of hesitancy among investors, impacting trading volume and market liquidity.

The Role of Regulatory Clarity

Clearer regulatory frameworks are crucial for the growth of the XRP market, particularly the derivatives segment. Regulatory clarity would:

- Boost investor confidence: Well-defined rules would reduce uncertainty and attract institutional investors, increasing liquidity and trading volume in XRP derivatives.

- Encourage institutional adoption: Clear guidelines would enable institutional investors to confidently participate in the XRP market, fostering growth and stability.

- Improve market efficiency: A regulated market generally operates with greater transparency and efficiency, benefiting all participants.

Long-Term Prospects for XRP

Despite the current challenges, XRP's long-term prospects depend on several factors:

- XRP's role in RippleNet and its potential for cross-border payments: RippleNet's global reach and potential for streamlining cross-border payments represent a significant advantage for XRP. Increased adoption of RippleNet could drive demand for XRP.

- Discussion of potential future developments and technological advancements related to XRP: Future improvements to XRP's underlying technology and the development of new use cases could boost its value and appeal.

- Assessment of the overall risk-reward profile of XRP as a long-term investment: While the risks are substantial due to the ongoing legal battle and market volatility, the potential rewards, particularly if the lawsuit is resolved favorably and XRP gains wider adoption, could be significant.

Conclusion:

XRP's price recovery is hampered by the stagnation in the derivatives market and the ongoing Ripple lawsuit. While the potential for long-term growth exists based on RippleNet's potential and future technological advancements, the regulatory uncertainty remains a significant challenge. The outcome of the Ripple lawsuit will dramatically influence XRP's future. Stay informed about further developments related to XRP, conduct thorough research, and make informed investment decisions. Continue to monitor the XRP price and market activity closely for further insights. Remember that investing in cryptocurrencies like XRP involves significant risk.

Featured Posts

-

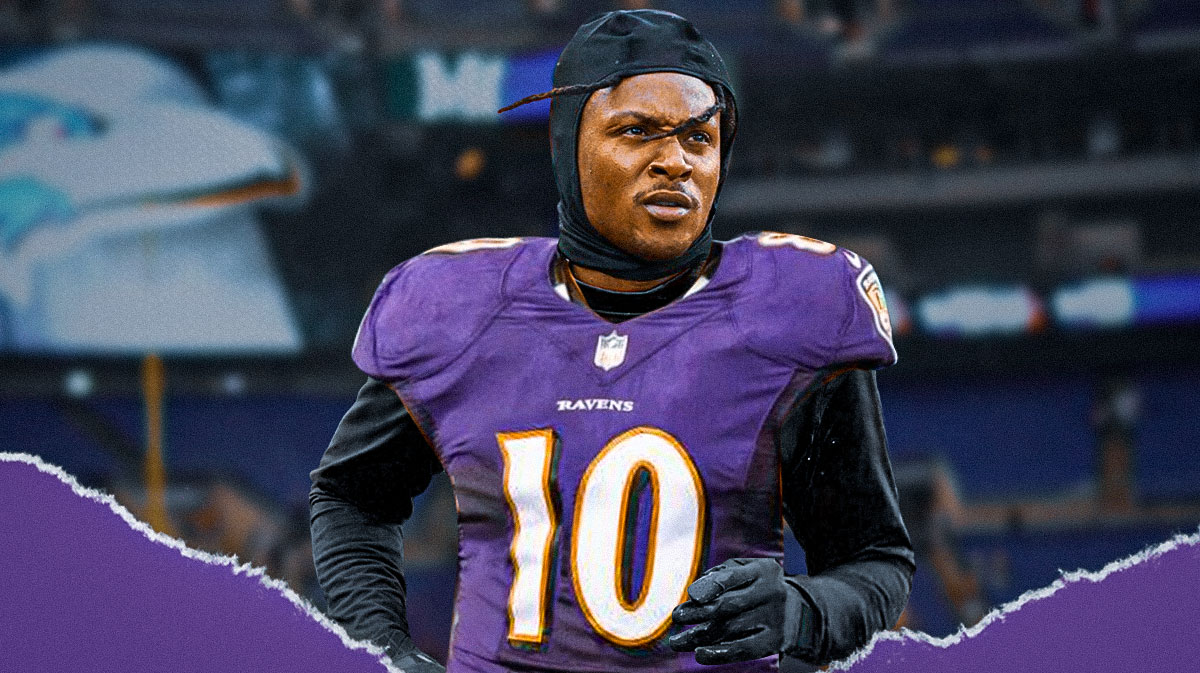

Ravens Bolster Receiving Corps With De Andre Hopkins Signing

May 08, 2025

Ravens Bolster Receiving Corps With De Andre Hopkins Signing

May 08, 2025 -

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025

Bitcoin In Son Durumu Guencel Degeri Ve Analizi

May 08, 2025 -

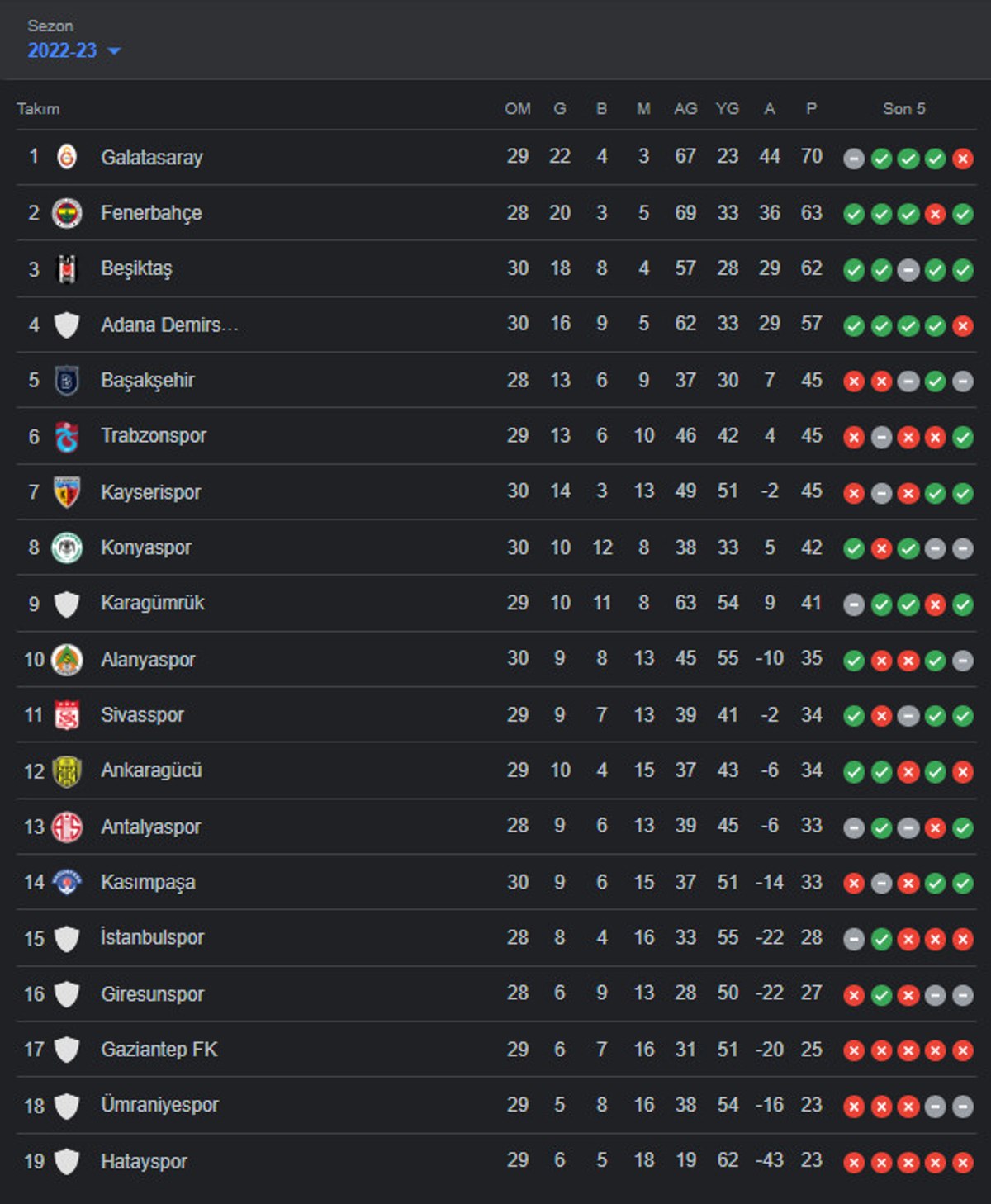

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025

Psg Ve Nantes Berabere Kaldi Ligde Puan Kaybi

May 08, 2025 -

Brookfields Opportunistic Approach Profiting From Market Disruptions

May 08, 2025

Brookfields Opportunistic Approach Profiting From Market Disruptions

May 08, 2025 -

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025

Navigating The Cryptosphere Why Reliable News Matters

May 08, 2025

Latest Posts

-

Jayson Tatums Personal Journey Grooming Confidence And Coach Essence

May 08, 2025

Jayson Tatums Personal Journey Grooming Confidence And Coach Essence

May 08, 2025 -

Jayson Tatum On Personal Grooming Confidence And A Full Circle Coaching Moment

May 08, 2025

Jayson Tatum On Personal Grooming Confidence And A Full Circle Coaching Moment

May 08, 2025 -

Reclaiming Unpaid Universal Credit Hardship Payments Your Rights

May 08, 2025

Reclaiming Unpaid Universal Credit Hardship Payments Your Rights

May 08, 2025 -

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025 -

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025