XRP Price Poised For Record High Following Grayscale ETF SEC Review

The Grayscale ETF SEC Review and its Impact on XRP

The Grayscale ETF SEC review is arguably the most significant event impacting the cryptocurrency market right now. A favorable decision could usher in a new era of institutional investment in cryptocurrencies, boosting investor confidence and driving up demand. This positive sentiment would likely extend to altcoins like XRP, which have historically shown a strong correlation with Bitcoin's price movements. The successful resolution of the Ripple lawsuit further contributes to the positive momentum surrounding XRP.

- Increased Institutional Investment: ETF approval would open the floodgates for institutional investors, who have been hesitant to enter the market due to regulatory uncertainty. This influx of capital would dramatically increase liquidity and potentially drive up prices.

- Historical Price Performance: A review of XRP's price history reveals a clear upward trend following positive regulatory news and significant market events. A positive Grayscale ETF decision could trigger a similar reaction.

- Ripple Effect on Altcoins: A bullish market triggered by the Grayscale ETF approval is likely to have a positive ripple effect (pun intended!) on the entire altcoin market, benefiting XRP significantly.

- Bitcoin Correlation: XRP's price often mirrors Bitcoin's movements. A surge in Bitcoin's price following the Grayscale decision would likely pull XRP along for the ride.

Technical Analysis Suggests XRP Breakout is Imminent

While not financial advice, technical analysis of XRP charts paints a compelling picture. Several bullish indicators point towards an imminent price breakout. Increased trading volume coupled with specific chart patterns, such as potential head and shoulders or cup and handle formations, suggest a strong possibility of XRP breaking through significant resistance levels.

- Bullish Indicators: Key technical indicators, such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence), might display bullish signals, supporting the potential for a price surge.

- Price Movements and Volume: Recent price movements and a noticeable increase in trading volume could signal accumulating buying pressure.

- Resistance Levels: Identifying and monitoring potential resistance levels is crucial. A successful break above these levels would be a strong bullish signal for the XRP price prediction.

- Disclaimer: Investing in cryptocurrencies carries significant risk. This analysis is for informational purposes only and should not be considered financial advice.

Fundamental Factors Contributing to XRP's Potential Growth

Beyond the market sentiment surrounding the Grayscale ETF, XRP's inherent value proposition strengthens the case for its potential growth. Ripple's technology, particularly its On-Demand Liquidity (ODL) solution, offers a faster, cheaper, and more efficient way to facilitate cross-border payments. Growing adoption by financial institutions and strategic partnerships further solidify XRP's position in the market.

- Ripple Technology and ODL: Ripple's technology and its ODL solution provide a significant advantage over traditional payment systems, leading to increased efficiency and cost savings for financial institutions.

- Institutional Adoption: The increasing adoption of XRP by financial institutions demonstrates the growing recognition of its utility and potential.

- Market Capitalization and Growth: XRP's relatively low market capitalization compared to other cryptocurrencies presents a significant opportunity for future growth.

- Future Developments and Partnerships: Potential future developments and strategic partnerships could further enhance XRP's value proposition and drive demand.

Conclusion

The confluence of a potentially positive Grayscale ETF SEC review, encouraging technical analysis, and strong fundamental factors suggests a significant potential for XRP to reach new record highs. While the cryptocurrency market is inherently volatile, the current indicators point towards a bullish outlook for XRP. However, it's crucial to conduct thorough research and understand the inherent risks before making any investment decisions. Stay updated on XRP price predictions, learn more about XRP investments, and research XRP's potential to make informed decisions about your portfolio. The future of XRP looks bright, and this could be the breakout you've been waiting for.

Alex Carusos Playoff History Thunder Game 1 Victory

Alex Carusos Playoff History Thunder Game 1 Victory

Superiorite Geometrique Des Corneilles Elles Surpassent Meme Les Babouins

Superiorite Geometrique Des Corneilles Elles Surpassent Meme Les Babouins

Uber Vs Door Dash Lawsuit Alleges Anti Competitive Behavior

Uber Vs Door Dash Lawsuit Alleges Anti Competitive Behavior

Are Ps 5 Pro Sales Disappointing Compared To The Ps 4 Pro

Are Ps 5 Pro Sales Disappointing Compared To The Ps 4 Pro

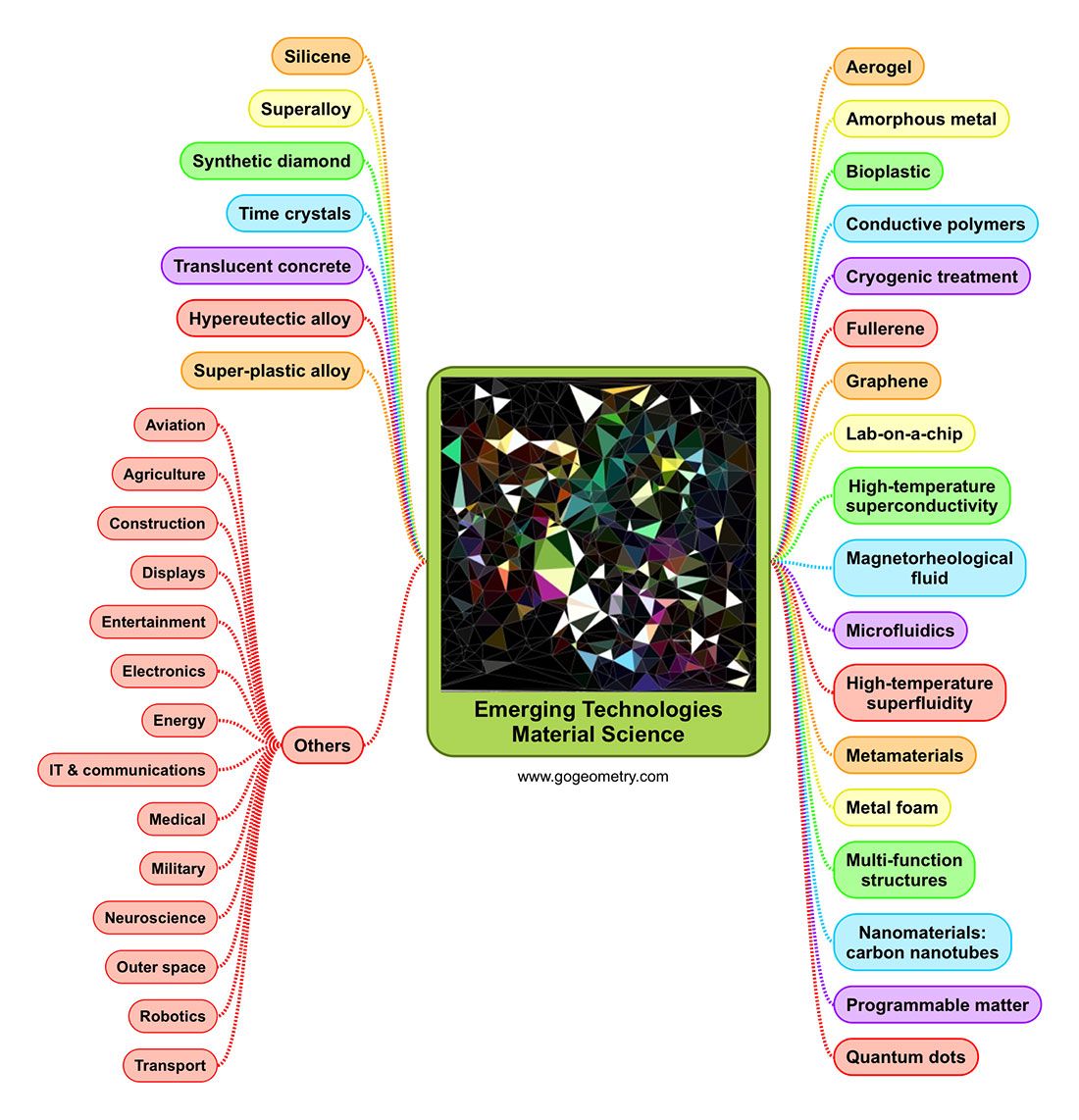

Investing In The Future A Map Of Emerging Business Hubs

Investing In The Future A Map Of Emerging Business Hubs