XRP (Ripple) Investment: Assessing The Risks And Rewards For Your Future

Table of Contents

Understanding XRP and its Technology

What is XRP and how does it differ from other cryptocurrencies?

XRP is a cryptocurrency designed to facilitate fast and low-cost cross-border payments through RippleNet, Ripple's payment network. Unlike Bitcoin, which uses a proof-of-work consensus mechanism, or Ethereum, which employs proof-of-stake, XRP uses a unique consensus mechanism designed for speed and efficiency. This allows for significantly faster transaction speeds and lower transaction fees compared to many other cryptocurrencies.

- XRP's Function: XRP acts as a bridge currency, facilitating the exchange of different fiat currencies and cryptocurrencies on RippleNet.

- Key Differences:

- Bitcoin: Primarily a store of value, slower transactions, higher fees.

- Ethereum: Primarily a platform for decentralized applications (dApps), slower transactions than XRP, variable fees.

- XRP: Focused on fast, low-cost cross-border payments, utilizes a unique consensus mechanism for speed and efficiency.

- Advantages: XRP's speed and low transaction fees are significant advantages, particularly for institutional investors needing to process large volumes of international transactions quickly and cost-effectively. These factors are key to its potential for widespread adoption. Keywords: XRP technology, RippleNet, cross-border payments, cryptocurrency comparison, transaction speed, transaction fees.

The Ripple Ecosystem and its Partnerships

Ripple has forged partnerships with numerous major financial institutions globally, integrating XRP into their payment infrastructure. These partnerships are crucial for XRP's adoption and potential price appreciation. The more institutions use RippleNet and XRP, the greater the demand and potential for growth.

- Key Partnerships: Ripple boasts partnerships with major banks and payment providers worldwide, enabling faster and cheaper international payments. Specific examples (which will need updating as partnerships evolve) should be mentioned here.

- Impact of Partnerships: These partnerships significantly increase XRP's legitimacy and adoption rate among institutional investors. This institutional backing is a key driver of market capitalization and price.

- Significant Developments: Any recent announcements regarding new partnerships or technological advancements within the Ripple ecosystem should be detailed here to show the ongoing evolution and potential. Keywords: Ripple partnerships, financial institutions, adoption rate, market capitalization, institutional investors.

Assessing the Risks of XRP Investment

The SEC Lawsuit and its Implications

The ongoing SEC lawsuit against Ripple Labs is a significant risk factor for XRP investors. The SEC alleges that XRP is an unregistered security, potentially leading to severe consequences if the SEC prevails.

- Potential Outcomes: A negative ruling could significantly impact XRP's price and its future prospects. It could lead to delisting from exchanges or restrictions on trading.

- Legal Arguments: Both sides present strong legal arguments, making the outcome uncertain. Understanding these arguments is crucial for assessing the risk.

- Regulatory Uncertainty: The outcome of this lawsuit will significantly influence the regulatory landscape for cryptocurrencies, impacting XRP's long-term viability. Keywords: SEC lawsuit, Ripple legal battle, regulatory uncertainty, legal risks, investment risk.

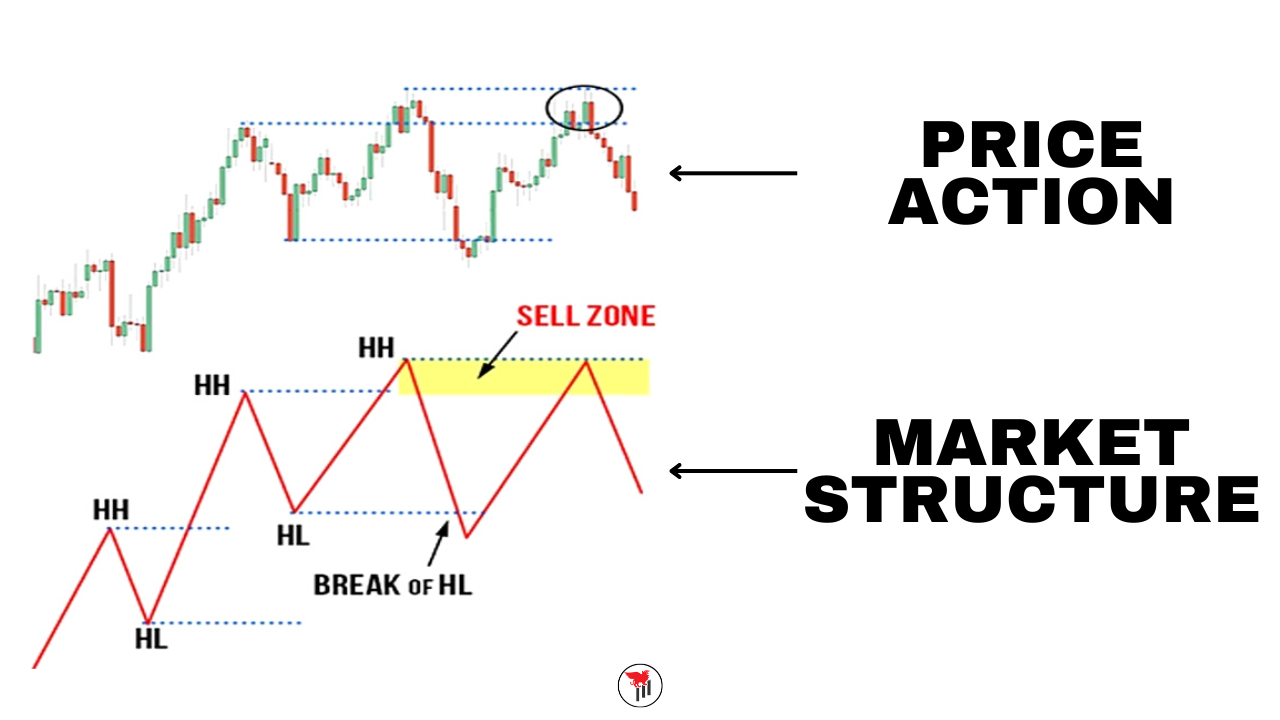

Volatility and Market Sentiment

The cryptocurrency market is inherently volatile, and XRP is no exception. Its price is heavily influenced by market sentiment, news events (including the SEC lawsuit), and overall market trends.

- Price Fluctuations: XRP's price can experience significant swings in short periods, making it a risky investment for those with low risk tolerance.

- Influencing Factors: News regarding Ripple partnerships, technological advancements, and regulatory developments can all significantly impact XRP's price.

- Risk Management: Diversifying your investment portfolio and only investing what you can afford to lose is crucial. Keywords: cryptocurrency volatility, market sentiment, price prediction, risk management, portfolio diversification.

Technological and Competitive Risks

XRP faces technological and competitive risks that could impact its long-term success. Advancements in blockchain technology and the emergence of rival payment systems pose challenges.

- Technological Disruption: New blockchain technologies might offer superior solutions for cross-border payments, rendering XRP obsolete.

- Competitive Landscape: The emergence of other cryptocurrencies and payment systems focused on similar applications presents significant competition. Keywords: technological disruption, competitive advantage, blockchain technology, emerging technologies.

Potential Rewards of XRP Investment

Growth Potential and Future Adoption

Despite the risks, XRP holds significant growth potential, especially if the SEC lawsuit is resolved favorably and adoption by financial institutions increases.

- Increased Adoption: Widespread adoption by banks and payment processors could significantly drive up demand and price appreciation.

- Future Price Appreciation: Various scenarios, such as a positive SEC ruling or increased market demand, could lead to substantial returns on investment.

- Long-Term Investment: XRP is considered by some to be a long-term investment, but this carries inherent risk. Keywords: price appreciation, return on investment, long-term investment, future potential, market adoption.

Passive Income Opportunities (Staking, Lending)

Some platforms offer opportunities to earn passive income by staking or lending XRP. However, these strategies also involve risks.

- Staking Rewards: Staking your XRP on certain platforms can generate passive income through rewards.

- Lending Platforms: Lending your XRP can also provide returns, but choose reputable platforms carefully.

- Risks: Risks include platform security breaches, smart contract vulnerabilities, and potential loss of principal. Keywords: staking rewards, lending platforms, passive income, yield farming, DeFi.

Conclusion

Investing in XRP (Ripple) presents a unique blend of potential rewards and substantial risks. While its technology offers a compelling solution for cross-border payments, the ongoing SEC lawsuit casts a significant shadow over its future. Before making any investment decisions, thoroughly understand the technological intricacies of XRP, the legal battles it faces, and the inherent volatility of the cryptocurrency market. Carefully weigh the potential rewards against the considerable risks and diversify your portfolio accordingly. Remember, thorough research and a well-defined risk tolerance strategy are crucial before committing to an XRP (Ripple) investment. Conduct your own due diligence and consult a financial advisor before making any investment decisions related to XRP.

Featured Posts

-

The White Lotus Season 3 Kennys Voice Actor Revealed

May 07, 2025

The White Lotus Season 3 Kennys Voice Actor Revealed

May 07, 2025 -

El Futuro De Simone Biles Los Angeles 2028 En La Balanza

May 07, 2025

El Futuro De Simone Biles Los Angeles 2028 En La Balanza

May 07, 2025 -

Ovechkin And Kasparaitis Unlikely Training Duo Spotted In Florida

May 07, 2025

Ovechkin And Kasparaitis Unlikely Training Duo Spotted In Florida

May 07, 2025 -

A24s Latest Horror Movie The End Of Jenna Ortegas Five Year Dominance

May 07, 2025

A24s Latest Horror Movie The End Of Jenna Ortegas Five Year Dominance

May 07, 2025 -

The Implications Of Trumps 100 Tariff On International Movie Production

May 07, 2025

The Implications Of Trumps 100 Tariff On International Movie Production

May 07, 2025

Latest Posts

-

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025

Understanding Ethereums Price A Comprehensive Analysis Of Market Factors And Future Trends

May 08, 2025 -

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025

Ethereums Price Trajectory A Deep Dive Into Market Dynamics And Future Predictions

May 08, 2025 -

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025

Predicting The Future Of Ethereum A Comprehensive Price Forecast

May 08, 2025 -

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025

Ethereum Price Prediction 2024 And Beyond A Comprehensive Analysis

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025