Comprehensive Ethereum Price Prediction: Analyzing Future Trends And Market Dynamics

Table of Contents

Current Market Conditions and Ethereum's Position

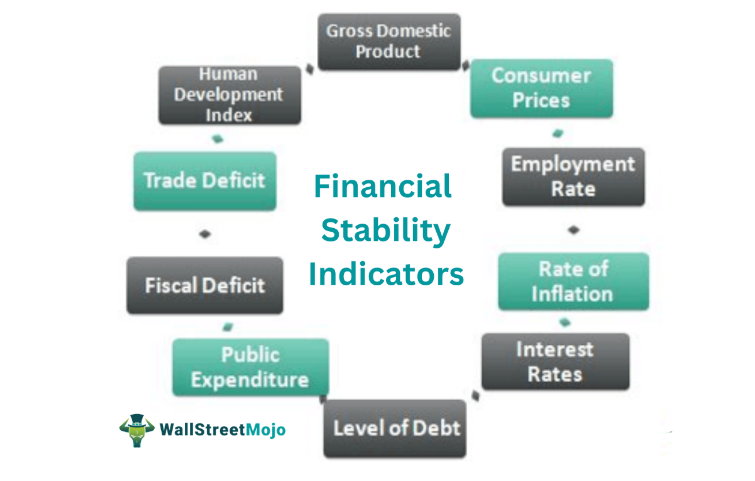

The cryptocurrency market is currently experiencing a period of relative consolidation after a significant bull run. Overall sentiment is cautiously optimistic, with investors monitoring macroeconomic factors like inflation and interest rates. Bitcoin's price movements continue to significantly influence the altcoin market, including Ethereum. A strong Bitcoin price often correlates with positive movement in ETH, while a Bitcoin downturn can trigger a sell-off in altcoins.

- Bitcoin's Influence: Bitcoin's price acts as a bellwether for the entire crypto market. Positive Bitcoin price action often boosts investor confidence, leading to increased investment in altcoins like Ethereum.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies remains a significant uncertainty. Varying regulations across different jurisdictions can impact investor confidence and trading activity, ultimately affecting ETH's price.

- Market Capitalization and Dominance: Ethereum's market capitalization provides a measure of its overall value. Its relative dominance within the cryptocurrency market indicates its strength compared to other cryptocurrencies. A rise in market dominance suggests strong investor confidence in Ethereum.

- Trading Volume and Liquidity: High trading volume and liquidity indicate a robust and active market for ETH, contributing to price stability and facilitating easier buying and selling.

Technological Advancements and Ethereum 2.0

The ongoing development and implementation of Ethereum 2.0 (ETH2) is a pivotal factor in shaping Ethereum's future price. ETH2 represents a significant upgrade to the Ethereum network, addressing scalability and energy consumption challenges.

- Proof-of-Stake (PoS): The shift from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism drastically reduces energy consumption and enhances network security. This is a major positive for the environment and the long-term sustainability of the network.

- Sharding: Sharding, a key component of ETH2, improves scalability by dividing the network into smaller, more manageable shards. This enhancement significantly increases transaction throughput and reduces transaction fees.

- Ecosystem Growth: The successful implementation of ETH2 is expected to attract more developers and users to the Ethereum ecosystem, further bolstering its value and utility. This increased adoption could lead to higher demand and subsequently, a higher ETH price.

- Price Implications of ETH2: The successful transition to ETH2 is widely considered bullish for ETH's price. Improved scalability, reduced fees, and increased network security are all expected to drive increased demand and potentially higher prices.

Adoption and Development in the DeFi Ecosystem

Ethereum plays a dominant role in the Decentralized Finance (DeFi) ecosystem. A large portion of DeFi applications are built on the Ethereum blockchain, leveraging its security and smart contract capabilities.

- DeFi Growth: The rapid growth of DeFi applications built on Ethereum has significantly increased demand for ETH. Users need ETH to interact with many DeFi protocols, creating a strong demand for the asset.

- Impact on ETH Demand: The increasing adoption of DeFi applications directly impacts the demand for ETH. As more users participate in DeFi activities, the demand for ETH as a transactional asset and for staking increases.

- ETH Staking and DeFi: Many DeFi protocols offer staking rewards for ETH, creating a further incentive to hold and stake ETH. This increased staking activity reduces the circulating supply of ETH, potentially pushing up prices.

- DeFi Risks and ETH Price: While the DeFi ecosystem offers significant opportunities, it also presents risks. Security vulnerabilities or market crashes within DeFi could negatively impact investor sentiment and, consequently, ETH's price.

Factors Influencing Ethereum Price Prediction (Bullish and Bearish Scenarios)

Predicting Ethereum's price involves analyzing a range of factors, both positive and negative. A balanced perspective considers both bullish and bearish scenarios.

- Bullish Factors:

- Increased institutional adoption of ETH by large financial institutions.

- Continued growth and innovation within the DeFi ecosystem.

- Successful and complete transition to Ethereum 2.0.

- Positive regulatory developments that clarify the legal framework for cryptocurrencies.

- Bearish Factors:

- Increased competition from emerging layer-1 blockchains offering faster and cheaper transactions.

- Regulatory uncertainty and potential crackdowns on cryptocurrencies.

- Security vulnerabilities or exploits within the Ethereum network.

- Major market corrections driven by macroeconomic factors or overall investor sentiment.

Analyzing Historical Price Data and Trend Analysis

Predicting Ethereum's price involves utilizing both technical and fundamental analysis. Technical analysis involves studying historical price charts and patterns to identify potential trends, using indicators like moving averages, Relative Strength Index (RSI), and MACD. Fundamental analysis focuses on assessing the underlying value of Ethereum, considering factors like technological advancements, adoption rates, and market capitalization.

- Technical Indicators: Technical indicators help identify potential support and resistance levels, momentum shifts, and overbought/oversold conditions. However, they should be used in conjunction with fundamental analysis.

- Historical Price Patterns: Studying historical price patterns can help identify recurring trends or cycles, but past performance is not necessarily indicative of future results.

- Charts and Graphs: Visual representations of price data, such as candlestick charts and line graphs, are crucial for understanding price trends and identifying potential patterns.

- Limitations of Prediction Models: It's important to acknowledge the inherent limitations of any price prediction model. Cryptocurrency markets are highly volatile and susceptible to unpredictable events.

Conclusion

This comprehensive analysis of Ethereum's price prediction has explored current market conditions, technological advancements, DeFi adoption, and key influencing factors. Both bullish and bearish scenarios have been considered, highlighting the complexities involved in forecasting cryptocurrency prices. While precise Ethereum price predictions remain speculative, a thorough understanding of these dynamics is crucial for informed decision-making.

Call to Action: Stay informed on the latest developments in the Ethereum ecosystem to make well-informed decisions about your Ethereum investments. Continue researching and learning about Ethereum price prediction to navigate the volatile cryptocurrency market successfully. Further analysis of Ethereum price prediction, incorporating real-time data and evolving market conditions, is recommended.

Taiwan Dollar Surge Implications For Economic Restructuring

Taiwan Dollar Surge Implications For Economic Restructuring

New Trailer For Stephen Kings The Long Walk Adaptation

New Trailer For Stephen Kings The Long Walk Adaptation

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

Psl 10 Ticket Sales Open Today

Psl 10 Ticket Sales Open Today

Analyzing Potential Ps 5 And Ps 4 Game Reveals In The March 2025 Nintendo Direct

Analyzing Potential Ps 5 And Ps 4 Game Reveals In The March 2025 Nintendo Direct