XRP (Ripple): A High-Risk, High-Reward Investment Opportunity?

Table of Contents

Understanding XRP and its Technology

What is XRP?

XRP is a cryptocurrency native to the Ripple network, a real-time gross settlement system, currency exchange, and remittance network. Unlike Bitcoin or Ethereum, XRP's primary function is not to be a standalone currency but rather a bridge currency facilitating fast and low-cost transactions between different currencies. It acts as an intermediary, allowing for seamless conversion and transfer across various financial institutions.

RippleNet and its Advantages

RippleNet is Ripple's global network of financial institutions using its technology to send money across borders. Its advantages include significantly faster transaction speeds compared to traditional banking systems (often settling in seconds) and dramatically lower fees. This efficiency makes international payments more cost-effective for both businesses and individuals, a key factor driving its potential adoption.

Technological Advantages

XRP boasts several technological advantages over other cryptocurrencies:

- Transaction Speed: XRP transactions are processed significantly faster than Bitcoin or Ethereum, leading to quicker settlements and improved efficiency.

- Low Fees: Transaction fees for XRP are considerably lower, making it a more economical option for high-volume transactions.

- Scalability: The XRP Ledger is designed for high scalability, allowing it to handle a large number of transactions concurrently without significant performance degradation.

- Energy-efficient Consensus Mechanism: Unlike Bitcoin's energy-intensive proof-of-work consensus, XRP uses a less energy-consuming consensus mechanism, making it more environmentally friendly.

Key Features:

- Fast transaction speeds

- Low transaction fees

- Scalability for large transaction volumes

- Energy-efficient consensus mechanism

The Risks Associated with XRP Investment

Regulatory Uncertainty

The ongoing SEC lawsuit against Ripple Labs significantly impacts investor sentiment and the price of XRP. The legal uncertainty surrounding the case creates regulatory risks, potentially impacting future adoption and price stability. The outcome of the lawsuit remains uncertain, and a negative ruling could severely affect XRP's value. Investors need to carefully consider these "SEC lawsuit" risks and the inherent "legal uncertainty" surrounding the cryptocurrency.

Market Volatility

The cryptocurrency market is notoriously volatile, and XRP is no exception. Its price can experience dramatic swings in short periods, presenting considerable "market risk." Investors must be prepared for significant price fluctuations and potential losses. Past price volatility serves as a clear indicator of the risks involved.

Competition in the Fintech Space

XRP faces stiff "fintech competition" from other payment solutions and cryptocurrencies aiming to improve international transactions. Established players and emerging technologies in the cross-border payment market pose a challenge to XRP's market share and future growth.

Security Risks

Like all cryptocurrencies, XRP is susceptible to security risks. Exchange hacks and wallet vulnerabilities could lead to loss of funds. Investors should prioritize secure storage and exchange practices to mitigate these risks.

Potential Rewards of Investing in XRP

High Growth Potential

If XRP gains wider adoption by financial institutions and the SEC lawsuit is resolved favorably, its price could appreciate significantly. This presents a considerable "return on investment" potential. However, it's crucial to remember that past performance is not indicative of future results.

Adoption by Financial Institutions

Ripple has actively pursued partnerships with major financial institutions, and increased "institutional adoption" could drive significant price appreciation. Successful integration into existing financial systems could lead to widespread use and higher demand for XRP.

Expanding Use Cases

Beyond cross-border payments, XRP is exploring new "use cases," including potential applications in decentralized finance (DeFi) and other areas. Expanding into new sectors could boost demand and contribute to price growth.

Conclusion: XRP (Ripple): Weighing the Risks and Rewards

Investing in XRP (Ripple) presents a high-risk, high-reward scenario. While its technological advantages and potential for growth are compelling, the regulatory uncertainty, market volatility, and competition within the fintech space cannot be ignored. Thorough research and due diligence are essential before investing in XRP. Remember, never invest money you cannot afford to lose. While investing in XRP (Ripple) presents significant risks, the potential rewards are equally substantial. Conduct thorough research and carefully consider your risk tolerance before making any investment decisions related to XRP (Ripple). Learn more about XRP investment and explore the potential of XRP today.

Featured Posts

-

Who Wants To Be A Millionaire Celebrity Special The Biggest Wins And Biggest Losses

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special The Biggest Wins And Biggest Losses

May 07, 2025 -

Nowy Podcast Onetu I Newsweeka Stan Wyjatkowy Informacje Z Pierwszej Reki

May 07, 2025

Nowy Podcast Onetu I Newsweeka Stan Wyjatkowy Informacje Z Pierwszej Reki

May 07, 2025 -

Ripple Xrp And Sbi Holdings Shareholder Rewards Program Announced

May 07, 2025

Ripple Xrp And Sbi Holdings Shareholder Rewards Program Announced

May 07, 2025 -

Young And The Restless Spoilers Claires Pregnancy Summers Only Hope

May 07, 2025

Young And The Restless Spoilers Claires Pregnancy Summers Only Hope

May 07, 2025 -

The Jenna Ortega Face Change A Decade Older Or Just A New Look

May 07, 2025

The Jenna Ortega Face Change A Decade Older Or Just A New Look

May 07, 2025

Latest Posts

-

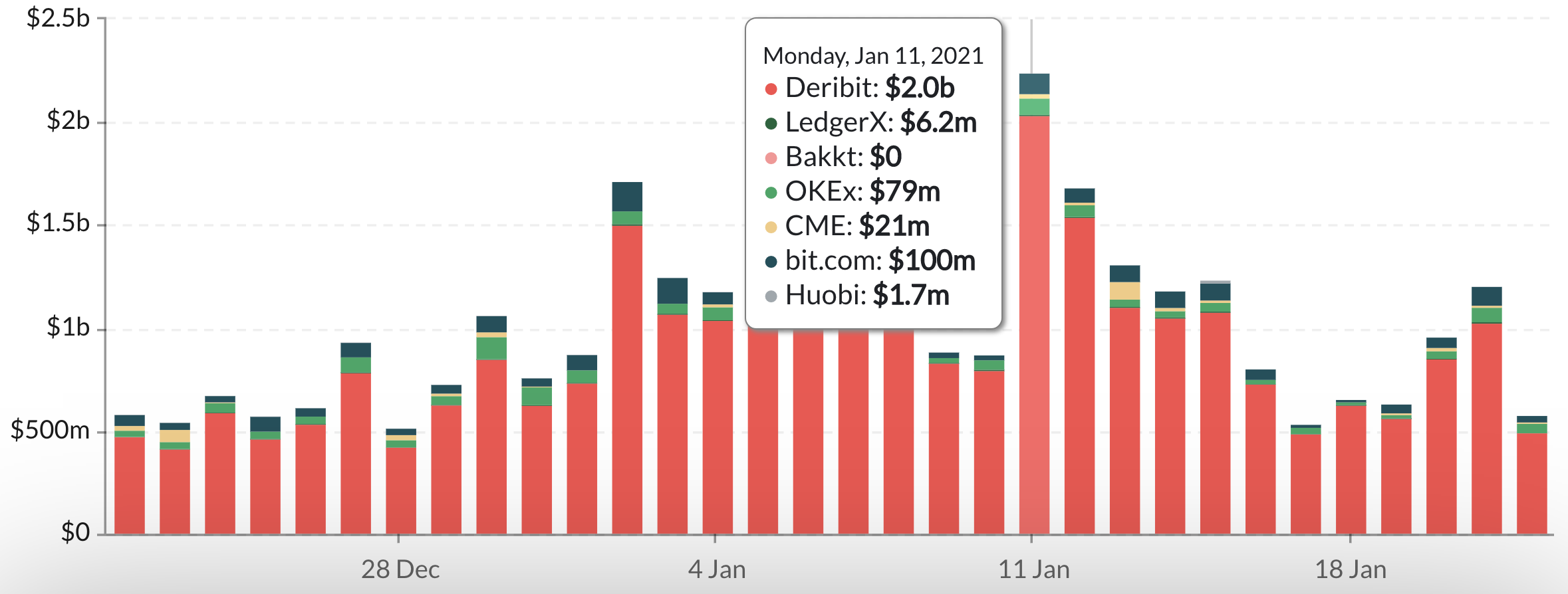

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions To Expire Impact On Market Volatility

May 08, 2025 -

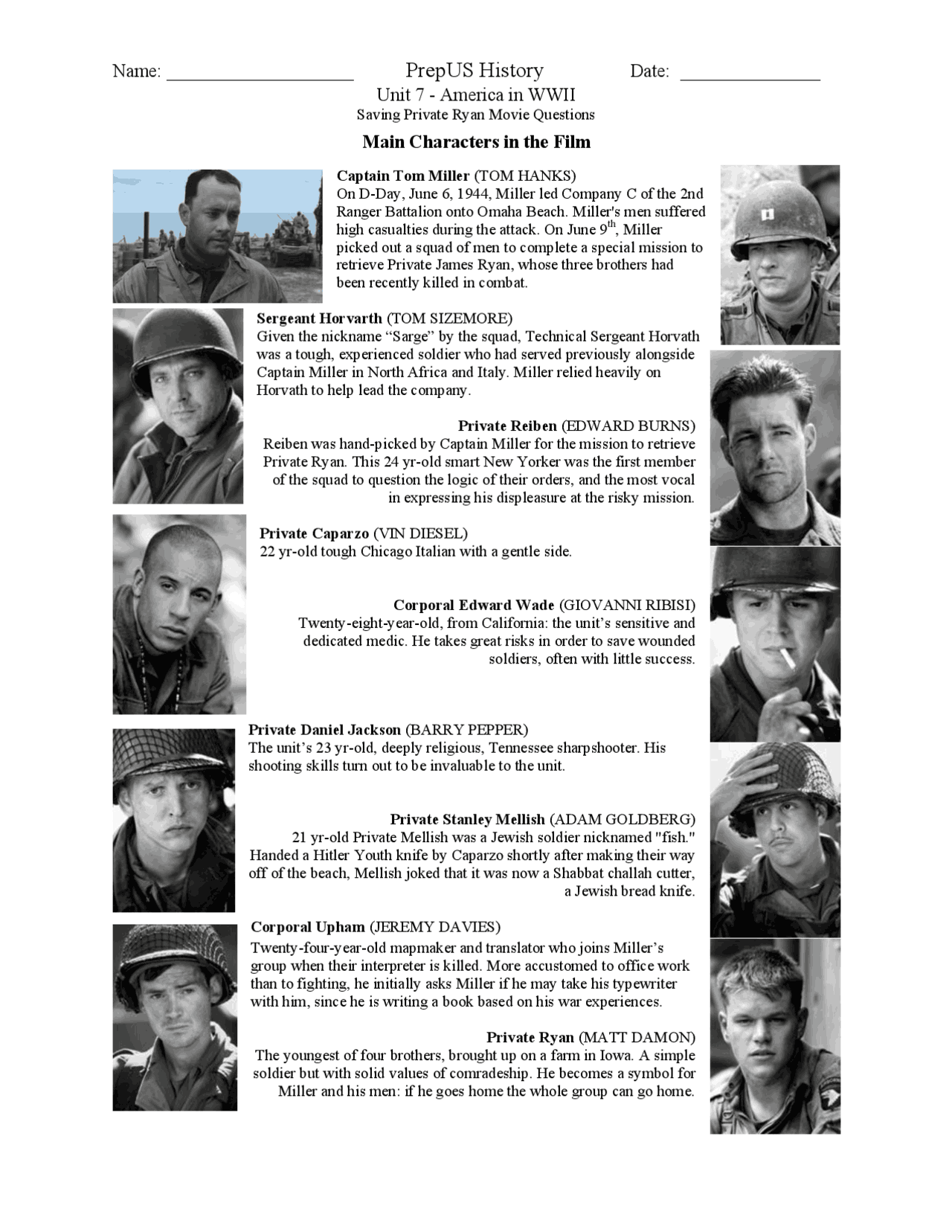

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025

A Lasting Impression Nathan Fillions Impact On Saving Private Ryan

May 08, 2025 -

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Market Volatility Ahead Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025

Saving Private Ryan Nathan Fillions Memorable Performance In A Short Scene

May 08, 2025 -

Nathan Fillions Three Minute Masterclass In Saving Private Ryan

May 08, 2025

Nathan Fillions Three Minute Masterclass In Saving Private Ryan

May 08, 2025