XRP Price Surge: Grayscale ETF Filing Fuels Record High Hopes

Table of Contents

Grayscale's ETF Filing: The Catalyst for the XRP Price Surge

Grayscale's move to file for a spot Bitcoin ETF is being seen as a major catalyst for the current XRP price surge, even though it's not directly related to XRP itself. The impact is indirect but significant.

The Ripple Effect: Indirect Impacts on XRP

Grayscale's Bitcoin ETF application has created a ripple effect across the entire cryptocurrency market, positively impacting XRP.

- Increased regulatory clarity: A successful Bitcoin ETF application could signal a step towards increased regulatory clarity within the crypto space. This positive development could benefit all cryptocurrencies, including XRP, by reducing uncertainty and attracting more institutional investment.

- Institutional investment interest: A successful Bitcoin ETF would likely attract significant institutional investment into the crypto market. This influx of capital could spill over into other cryptocurrencies perceived as having strong fundamentals and potential, such as XRP. Many institutional investors seek diversification beyond Bitcoin.

- Improved market sentiment: Positive news surrounding Bitcoin often improves the overall sentiment within the crypto market. This increased confidence can lead to higher demand and price increases for other cryptocurrencies, including XRP. A bullish Bitcoin market typically helps lift the overall crypto tide.

Analyzing the Correlation (or Lack Thereof): Bitcoin's Influence on XRP

While Bitcoin and XRP prices aren't perfectly correlated, they are both influenced by overall market sentiment and regulatory changes. A successful Bitcoin ETF could still significantly influence XRP's value in several ways:

- Diversification within crypto portfolios: Institutional investors might allocate a portion of their ETF-based Bitcoin holdings into other crypto assets like XRP to diversify their portfolios and reduce risk.

- Independent factors affecting XRP price: It’s crucial to remember that XRP’s price is also driven by independent factors, including the ongoing legal battle with the SEC, Ripple's technological advancements, and the broader adoption of XRP by businesses and financial institutions. These factors can influence XRP's price regardless of Bitcoin's performance.

Technical Analysis: Charting the XRP Price Upswing

Analyzing XRP's price charts reveals a compelling upward trend fueled by the recent surge.

Key Resistance Levels: Breaking Through to New Highs

XRP's price needs to break through several key resistance levels to reach new all-time highs. These levels, typically identified through previous price peaks and psychological barriers ($1.00, $1.50, etc.), represent significant hurdles. Successful breaches of these levels would be strong bullish signals. (Note: Insert chart here if available showing key resistance levels.)

Trading Volume and Momentum: Signs of Strong Market Interest

The recent price surge is accompanied by a significant increase in trading volume, demonstrating strong market interest and participation. Higher volume often validates price movements, suggesting the current upward trend might be sustainable.

Indicators Suggesting Further Growth: Technical Signals

Several technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), might suggest further potential for upward momentum. However, it's crucial to remember that technical analysis is not foolproof and should be considered alongside fundamental analysis. These indicators provide signals, but not guarantees.

Ripple's Developments and Their Influence on XRP

Ripple's actions and advancements continue to influence XRP's price and overall market perception.

Technological Advancements: Improving the XRP Ledger

Ripple continues to improve the XRP Ledger (XRPL), focusing on scalability, efficiency, and enhanced functionality. These advancements can increase the attractiveness of XRP as a payment solution and potentially boost demand.

Partnerships and Adoption: Growing Acceptance of XRP

New partnerships and increased adoption of XRP by businesses and financial institutions are vital for its price appreciation. Positive news regarding increased usage of XRP in real-world transactions could fuel further price increases.

Ongoing Legal Battle: The SEC Lawsuit

The ongoing legal battle with the SEC remains a significant factor influencing XRP's price. A positive resolution to the lawsuit would likely have a tremendously positive impact on XRP's price, while a negative outcome could potentially depress it.

Conclusion: Navigating the XRP Price Surge

The recent XRP price surge, significantly fueled by Grayscale's Bitcoin ETF filing and positive market sentiment, presents both exciting opportunities and inherent risks. While the correlation between Bitcoin's success and XRP's performance isn't always direct, the overall improved market outlook and potential influx of institutional investment significantly impact XRP's trajectory. Further analysis of technical indicators and Ripple's ongoing developments is crucial for informed investment decisions. Stay informed about the latest developments in the crypto market and monitor the XRP price surge closely to make the most of this potentially lucrative opportunity. Remember to always conduct thorough research and consider your risk tolerance before investing in any cryptocurrency, including XRP. Understanding the factors driving this XRP price surge is crucial for successful navigation of the cryptocurrency market.

Featured Posts

-

Kara 100

May 07, 2025

Kara 100

May 07, 2025 -

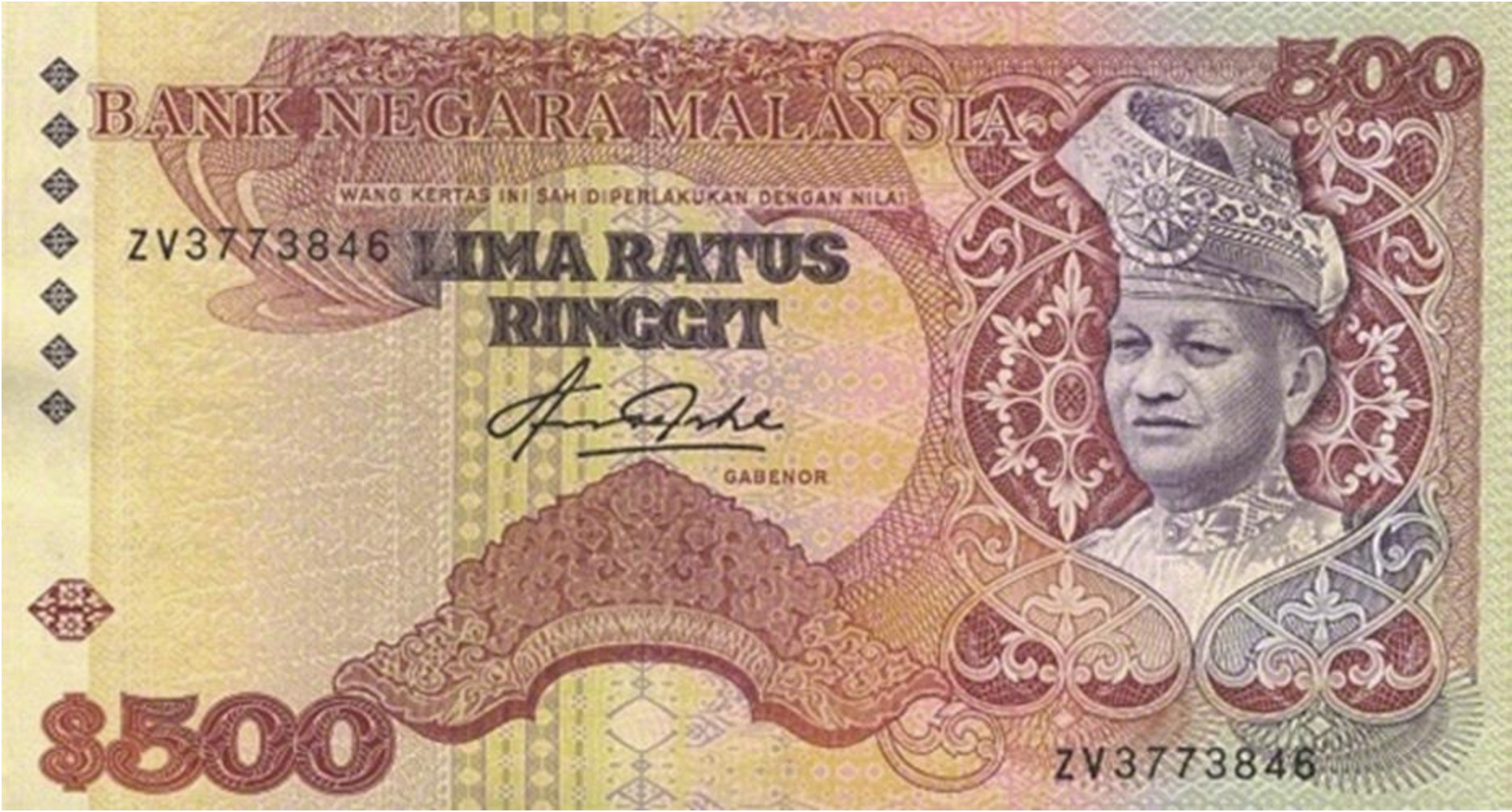

Malaysian Ringgit Myr Exchange Rate Front Loadings Impact On Export Businesses

May 07, 2025

Malaysian Ringgit Myr Exchange Rate Front Loadings Impact On Export Businesses

May 07, 2025 -

Analyzing John Wick Uncovering The Single True Iteration Of The Character

May 07, 2025

Analyzing John Wick Uncovering The Single True Iteration Of The Character

May 07, 2025 -

Utah Jazz Vs Houston Rockets Edwards And Conley Step Up In Goberts Absence

May 07, 2025

Utah Jazz Vs Houston Rockets Edwards And Conley Step Up In Goberts Absence

May 07, 2025 -

7 Hd

May 07, 2025

7 Hd

May 07, 2025

Latest Posts

-

Billions In Bitcoin And Ethereum Options Expire Market Volatility Expected

May 08, 2025

Billions In Bitcoin And Ethereum Options Expire Market Volatility Expected

May 08, 2025 -

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

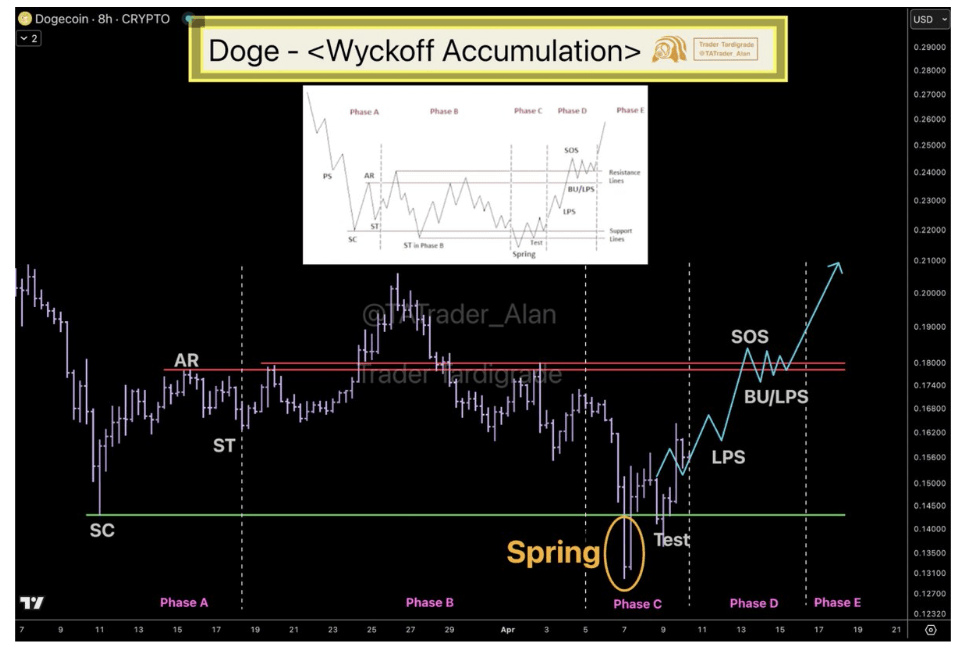

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025