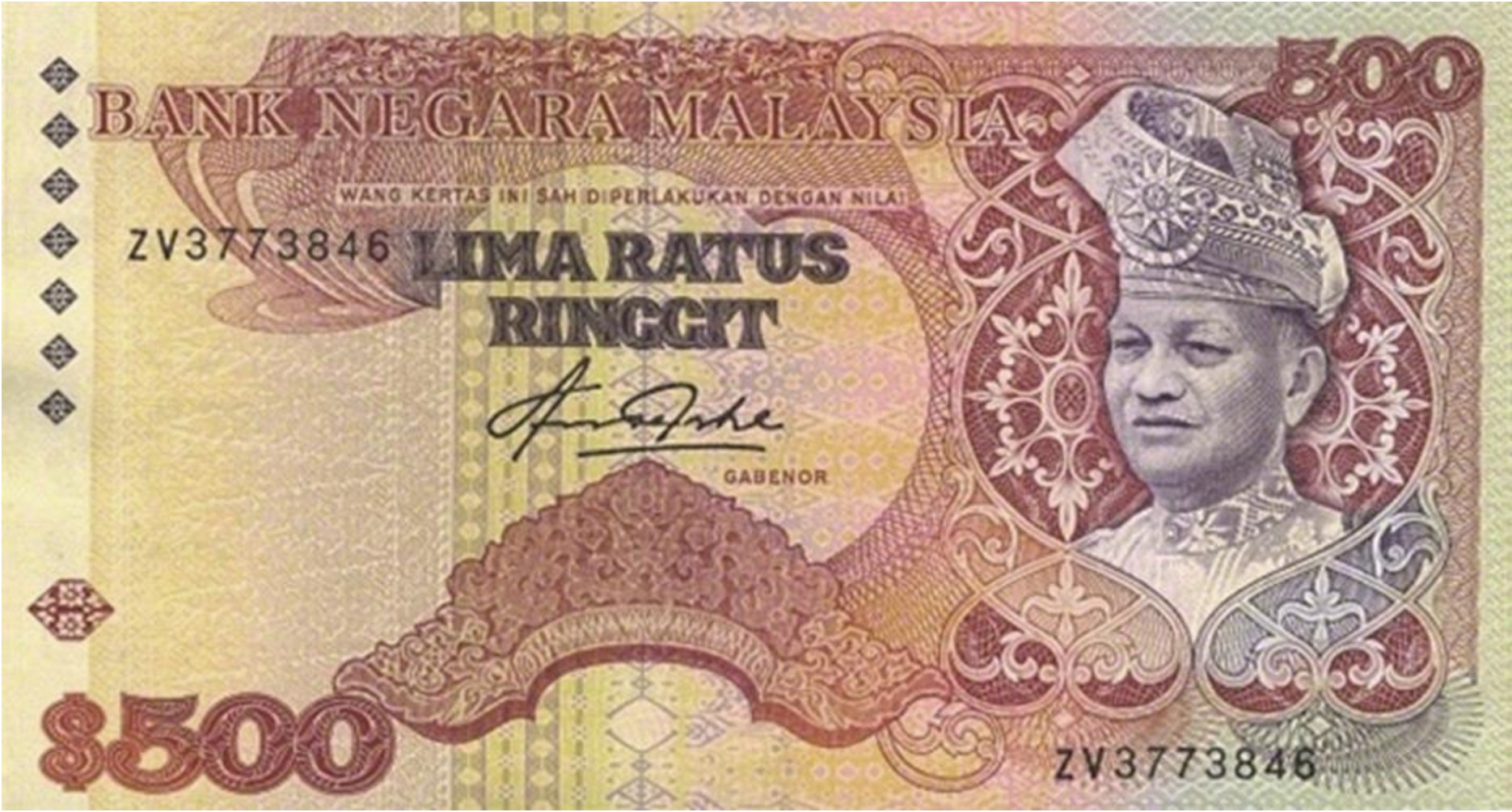

Malaysian Ringgit (MYR) Exchange Rate: Front-Loading's Impact On Export Businesses

Table of Contents

How MYR Exchange Rate Fluctuations Affect Export Businesses

The unpredictable nature of the MYR exchange rate presents considerable challenges for Malaysian exporters. Even slight shifts can have a profound impact on their bottom line.

Increased Uncertainty and Risk

Unforeseen MYR fluctuations introduce significant uncertainty and risk into export business operations. This volatility makes accurate financial forecasting incredibly difficult.

- Pricing Difficulties: Setting competitive export prices becomes a constant balancing act. A depreciating MYR might initially boost competitiveness, but rapid appreciation can quickly erode profit margins.

- Difficulty in Forecasting Profits: The inability to reliably predict future exchange rates makes budgeting and profit forecasting extremely challenging. This uncertainty hinders long-term planning and investment decisions.

- Potential Loss of Competitiveness: Significant MYR appreciation can make Malaysian exports less attractive in the international market, leading to a loss of market share to competitors from countries with more stable currencies.

For example, imagine a Malaysian exporter selling goods priced at USD 100. If the MYR appreciates from 4.2 MYR/USD to 4.0 MYR/USD, the exporter receives less MYR for each sale, impacting their profit margin. Conversely, a depreciation to 4.4 MYR/USD would increase the MYR received, but might also price the goods out of the competitive market if competitors do not adjust pricing.

Impact on Pricing Strategies

Exporters employ various pricing strategies to cope with MYR movements.

- Absorption of Losses: Some businesses absorb currency losses to maintain price competitiveness, impacting profit margins.

- Passing on Costs to Customers: Others pass on the increased costs to customers, potentially impacting sales volume.

- Hedging Strategies: Many exporters use hedging techniques to mitigate currency risk (discussed in the next section).

Determining the optimal pricing strategy requires a careful balance between competitiveness and profitability, considering factors like market demand, competitor pricing, and the MYR exchange rate forecast.

The Role of Hedging in Managing Currency Risk

Hedging is a vital tool for mitigating currency risk. Various methods exist, each with advantages and disadvantages.

- Forward Contracts: These contracts lock in a specific exchange rate for a future transaction, eliminating uncertainty. However, they can be costly if the actual exchange rate moves favorably.

- Options Contracts: These offer the right, but not the obligation, to buy or sell currency at a specific rate. They provide flexibility but are also more expensive than forward contracts.

- Currency Swaps: These involve exchanging principal and interest payments in different currencies, often used for larger transactions and long-term exposure management.

The choice of hedging technique depends on the exporter's risk tolerance, the size and timing of transactions, and the MYR exchange rate forecast.

Front-Loading: A Strategy for Managing MYR Exchange Rate Risk

Front-loading is a proactive strategy where exporters accelerate exports or adjust production schedules to take advantage of favorable exchange rates or mitigate anticipated losses.

What is Front-Loading in Export Business?

In the context of MYR-based exports, front-loading involves anticipating future exchange rate movements. If an exporter anticipates MYR depreciation, they might front-load their shipments to lock in a more favorable exchange rate before the depreciation occurs.

Benefits of Front-Loading for MYR-Based Exports

Front-loading offers several potential advantages:

- Locking in Favorable Exchange Rates: This secures better returns and protects against potential losses from future depreciation.

- Reducing Uncertainty: By mitigating exchange rate risk, businesses can improve their financial forecasting accuracy.

- Improving Profit Margins: By securing advantageous rates, companies can safeguard and potentially enhance their profit margins.

Potential Drawbacks and Risks of Front-Loading

Despite its benefits, front-loading carries risks:

- Inaccurate Exchange Rate Predictions: If the MYR exchange rate moves unexpectedly in a different direction, front-loading could lead to losses.

- Opportunity Costs: Front-loading might lead to missed opportunities if the exchange rate moves even more favorably later.

- Potential for Losses if Predictions are Wrong: Incorrect predictions about future exchange rate movements can significantly impact profitability.

Alternative Strategies for Managing MYR Exchange Rate Risk

While front-loading can be effective, other strategies can also help manage MYR exchange rate risk.

Diversification of Markets

Reducing reliance on a single export market can mitigate the impact of MYR fluctuations. By diversifying into multiple markets with different currencies, exporters reduce their overall currency risk.

Pricing Strategies

Dynamic pricing models that adjust to currency fluctuations can help maintain competitiveness. This requires close monitoring of the MYR exchange rate and competitor pricing.

Negotiating Contracts

Clearly defining currency clauses in export contracts is crucial. Contracts should specify which currency is used for payments and how exchange rate fluctuations will be handled.

Conclusion: Navigating the Malaysian Ringgit (MYR) Exchange Rate Landscape

The Malaysian Ringgit (MYR) exchange rate significantly impacts Malaysian export businesses. Fluctuations create uncertainty, affect pricing strategies, and pose risks to profitability. Front-loading offers a proactive approach to manage this risk by anticipating future exchange rate movements. However, it's essential to consider the potential drawbacks and incorporate alternative strategies such as market diversification, dynamic pricing, and careful contract negotiation. Proactive management of the MYR exchange rate is vital for the success of Malaysian exporters. Consider consulting with financial experts to develop a tailored currency risk management strategy to mitigate the impact of Malaysian Ringgit (MYR) exchange rate volatility on your export business. [Link to Currency Exchange Service] [Link to Financial Advisor]

Featured Posts

-

500 000 Pei Bill For Nhl 4 Nations Face Off Legislature Details

May 07, 2025

500 000 Pei Bill For Nhl 4 Nations Face Off Legislature Details

May 07, 2025 -

Onet Le Chateau Christophe Mali Cloture La Saison Musicale

May 07, 2025

Onet Le Chateau Christophe Mali Cloture La Saison Musicale

May 07, 2025 -

Jenna Ortegas Top Secret Movie Role With Glen Powell

May 07, 2025

Jenna Ortegas Top Secret Movie Role With Glen Powell

May 07, 2025 -

Xrp Price Surge Grayscale Etf Filing Fuels Record High Hopes

May 07, 2025

Xrp Price Surge Grayscale Etf Filing Fuels Record High Hopes

May 07, 2025 -

Vacances Au Lioran Profitez Du Village D One Le Chateau

May 07, 2025

Vacances Au Lioran Profitez Du Village D One Le Chateau

May 07, 2025

Latest Posts

-

March 29th Thunder Vs Pacers Complete Injury Update

May 08, 2025

March 29th Thunder Vs Pacers Complete Injury Update

May 08, 2025 -

March 7th Nba Game Thunder Vs Trail Blazers Time Tv And Streaming

May 08, 2025

March 7th Nba Game Thunder Vs Trail Blazers Time Tv And Streaming

May 08, 2025 -

March 7th Watch Thunder Vs Trail Blazers Live Game Time And Streaming Details

May 08, 2025

March 7th Watch Thunder Vs Trail Blazers Live Game Time And Streaming Details

May 08, 2025 -

How To Watch Oklahoma City Thunder Vs Houston Rockets Game Preview And Betting Tips

May 08, 2025

How To Watch Oklahoma City Thunder Vs Houston Rockets Game Preview And Betting Tips

May 08, 2025 -

How To Watch The Thunder Vs Trail Blazers Game On March 7th

May 08, 2025

How To Watch The Thunder Vs Trail Blazers Game On March 7th

May 08, 2025