XRP Price Prediction: After A 400% Increase, Where To Next?

Table of Contents

Analyzing the 400% XRP Price Increase: Causes and Implications

XRP's meteoric rise wasn't a spontaneous event; several key factors contributed to this significant price jump. Let's delve into the most impactful ones.

The Ripple vs. SEC Lawsuit's Impact

The long-running legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has profoundly impacted XRP's price. The recent positive developments in the case have significantly reduced the uncertainty surrounding the cryptocurrency.

- Positive court rulings: Favorable rulings have boosted investor confidence and created a more optimistic outlook for XRP's future.

- Reduced uncertainty: The clarity provided by the court proceedings has lessened the risk associated with investing in XRP.

- Implications for future price movements: The positive momentum generated by the lawsuit's progress suggests potential for further price appreciation. Keywords: Ripple lawsuit, SEC lawsuit, Ripple XRP, legal uncertainty, regulatory clarity.

Market Sentiment and Increased Adoption

Beyond the legal developments, a significant shift in market sentiment towards XRP has fueled its price increase. Growing investor confidence and increased adoption are key drivers.

- Increased trading volume: A surge in trading volume indicates growing interest and activity in the XRP market.

- Institutional investment: The involvement of institutional investors often signals a higher level of confidence and stability.

- Growing partnerships: Ripple's strategic partnerships with financial institutions worldwide contribute to the expanding utility and adoption of XRP.

- Onboarding of new users: New users entering the market further boost demand and contribute to price appreciation. Keywords: market sentiment, investor confidence, XRP adoption, trading volume, institutional investors.

Overall Crypto Market Conditions

While XRP's own developments are crucial, the broader cryptocurrency market also influences its performance.

- Correlation with Bitcoin's price: XRP, like many other cryptocurrencies, shows some correlation with Bitcoin's price movements.

- General market trends: Positive overall market trends typically benefit XRP, while bearish markets can lead to price declines.

- Impact of macroeconomic factors: Global economic events and factors like inflation and interest rates can also significantly influence the cryptocurrency market, including XRP. Keywords: crypto market, Bitcoin price, cryptocurrency market trends, macroeconomic factors.

XRP Price Prediction: Short-Term and Long-Term Outlook

Predicting cryptocurrency prices is inherently speculative, but by analyzing current trends and factors, we can offer potential scenarios.

Short-Term Price Predictions (Next 6 Months)

The short-term outlook for XRP remains cautiously optimistic. While volatility is expected, continued positive developments in the Ripple lawsuit and sustained market interest could push the price higher.

- Price targets: Based on technical analysis and current market conditions, a range of price targets can be considered, though it's crucial to remember these are estimates.

- Potential resistance levels: Identifying key price levels that could hinder further price increases is vital for managing expectations.

- Factors that could influence short-term price movement: News related to the Ripple lawsuit, overall market sentiment, and significant trading volume shifts are key factors to watch. Keywords: XRP price forecast, short-term prediction, technical analysis, price resistance, price support.

Long-Term Price Predictions (Next 1-5 Years)

The long-term prediction for XRP is more speculative but hinges on several key factors.

- Continued adoption: Widespread adoption by financial institutions and businesses is crucial for long-term growth.

- Regulatory developments: Clearer regulatory frameworks in various jurisdictions will positively impact investor confidence and price stability.

- Technological advancements: Continued innovation and improvements in Ripple's technology will enhance XRP's utility and appeal.

- Potential market capitalization: Reaching a higher market capitalization requires sustained growth and adoption. Keywords: long-term prediction, XRP future, market capitalization, technological innovation, regulatory landscape.

Risk Factors and Potential Downsides

It's crucial to acknowledge potential challenges that could negatively affect XRP's price.

- Regulatory uncertainty: Unfavorable regulatory decisions or increased scrutiny could dampen investor enthusiasm.

- Competition from other cryptocurrencies: The competitive landscape in the cryptocurrency market is fierce, with numerous altcoins vying for market share.

- Macroeconomic downturns: Global economic instability can negatively impact investor appetite for risky assets like cryptocurrencies. Keywords: XRP risk, investment risk, cryptocurrency risks, market volatility, regulatory risks.

Investing in XRP: Strategies and Considerations

Investing in XRP, like any cryptocurrency, carries inherent risks.

Risk Management and Diversification

Responsible investing is paramount.

- Don't invest more than you can afford to lose: This fundamental rule applies to all investments, especially high-risk assets like cryptocurrencies.

- Diversify your portfolio: Spreading your investments across various asset classes helps mitigate risk. Keywords: investment strategy, risk management, portfolio diversification, responsible investing.

Where to Buy XRP

Several reputable cryptocurrency exchanges offer XRP trading. Always conduct thorough research to choose a secure and regulated platform. (Note: We do not endorse any specific exchange.) Keywords: buy XRP, cryptocurrency exchange, trading platforms, secure exchanges.

Conclusion: The Future of XRP: Navigating the Post-Surge Landscape

XRP's recent 400% price increase is a testament to its resilience and potential, driven by positive developments in the Ripple lawsuit, increased adoption, and favorable market sentiment. While short-term price predictions are inherently uncertain, a cautiously optimistic outlook for the next six months seems plausible. The long-term outlook hinges on broader adoption, regulatory clarity, and technological advancements. However, it's vital to acknowledge the inherent risks associated with cryptocurrency investment. Remember to conduct thorough research before investing and stay informed about the latest developments in the XRP market. Stay tuned for updates on the XRP price, learn more about XRP price predictions, and make informed decisions about your XRP investment.

Featured Posts

-

Crypto Market Update Major Xrp Whale Makes 20 M Token Purchase

May 08, 2025

Crypto Market Update Major Xrp Whale Makes 20 M Token Purchase

May 08, 2025 -

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

May 08, 2025

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

May 08, 2025 -

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025 -

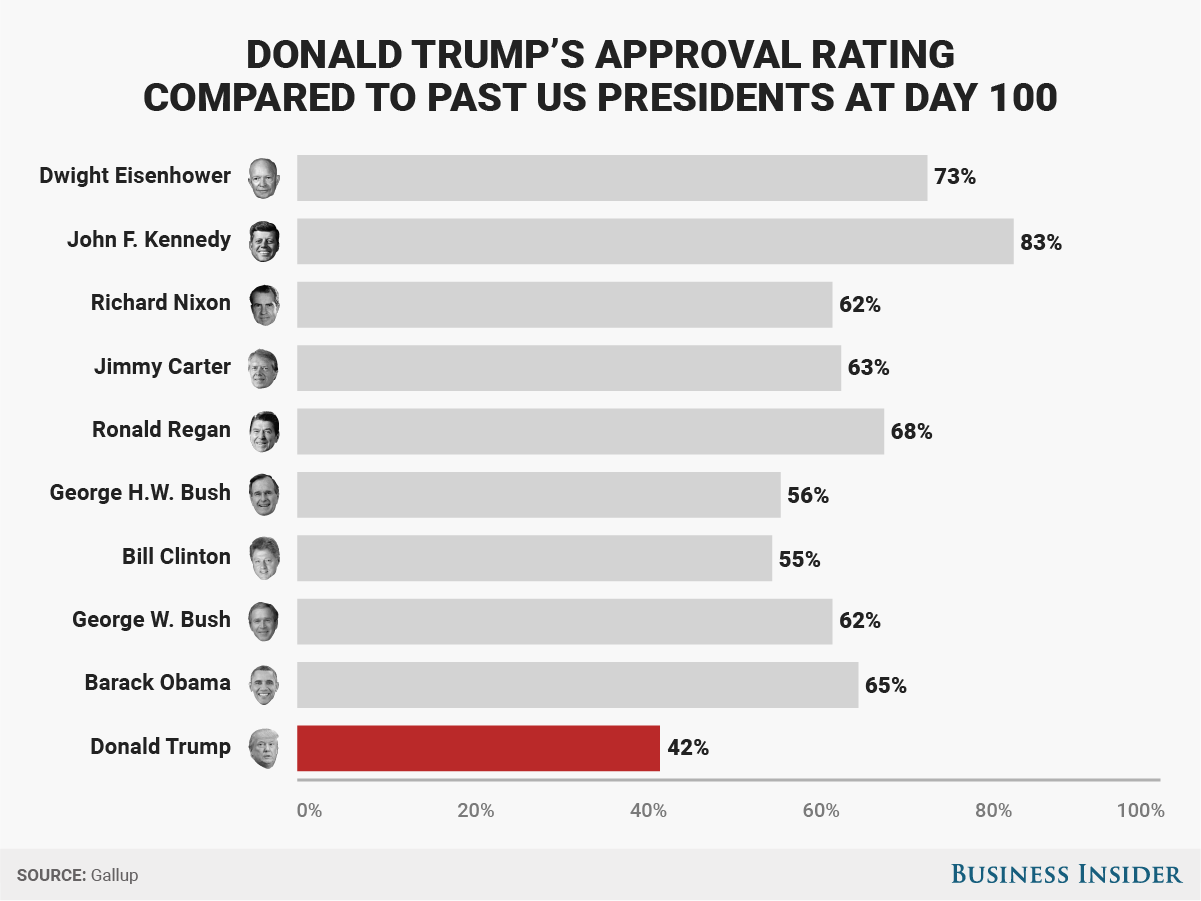

Trumps 100 Day Plan And Bitcoin A 100 000 Price Prediction Analysis

May 08, 2025

Trumps 100 Day Plan And Bitcoin A 100 000 Price Prediction Analysis

May 08, 2025 -

Ethereum Nears 2 700 Wyckoff Accumulation Signals Bullish Trend

May 08, 2025

Ethereum Nears 2 700 Wyckoff Accumulation Signals Bullish Trend

May 08, 2025

Latest Posts

-

Universal Credit Refund Dwp To Pay Back 5 Billion In April And May

May 08, 2025

Universal Credit Refund Dwp To Pay Back 5 Billion In April And May

May 08, 2025 -

Dwp Announces 3 Month Warning Before Benefit Cuts For 355 000 Claimants

May 08, 2025

Dwp Announces 3 Month Warning Before Benefit Cuts For 355 000 Claimants

May 08, 2025 -

Important Dwp Message Action Needed For 12 Benefit Payments

May 08, 2025

Important Dwp Message Action Needed For 12 Benefit Payments

May 08, 2025 -

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025 -

3 Month Warning 355 000 People Affected By Dwp Benefit Changes

May 08, 2025

3 Month Warning 355 000 People Affected By Dwp Benefit Changes

May 08, 2025