Will Australian Assets Rise After The Election? Expert Analysis

Table of Contents

Potential Impacts of the New Government's Economic Policies on Australian Assets

The new government's economic platform will significantly influence the performance of Australian assets. Key policy areas, particularly fiscal policy and its impact on interest rates, will have a ripple effect across various asset classes.

Fiscal Policy and its Effect on Property Prices

The government's planned spending and taxation policies will directly impact interest rates and borrowing costs, influencing the demand for residential and commercial property. Increased infrastructure spending, for example, could stimulate property values in targeted regions. Conversely, tax changes, such as adjustments to capital gains tax or negative gearing, could significantly affect investor activity in the property market.

- Increased infrastructure spending could boost property values in specific regions. Government investment in transport, utilities, and other infrastructure projects often leads to increased demand and higher prices in surrounding areas.

- Tax changes could affect investor activity. Changes to capital gains tax or stamp duty can influence the attractiveness of property investment for both domestic and foreign buyers.

- Interest rate hikes might cool down the market. Higher interest rates increase borrowing costs, potentially reducing the affordability of property and dampening demand. This could lead to a slowdown or even a correction in property prices.

Impact on the Australian Stock Market

The government's stance on regulations, business incentives, and superannuation will play a crucial role in shaping the Australian stock market's performance. Changes to corporate tax rates, for example, can directly influence company valuations and profitability, impacting investor sentiment.

- Changes to corporate tax rates could influence company valuations. Lower corporate tax rates can increase company profits and attract investment, potentially boosting stock market performance.

- Proposed reforms to superannuation could impact market performance. Changes to superannuation rules, such as contribution caps or investment options, can affect the flow of funds into the market and influence investor behaviour.

- Increased government investment in renewable energy could benefit specific sectors. A focus on green initiatives could drive investment and growth in renewable energy companies, leading to increased stock values in that sector.

The Role of Global Economic Factors

While domestic policies are crucial, global economic factors significantly influence Australian assets. Global inflation, interest rates, and supply chain disruptions all play a role. A global economic slowdown, for instance, could negatively impact Australian exports and investor confidence, leading to a downturn in asset values.

- Global economic slowdown could negatively impact Australian assets. Reduced global demand for Australian goods and services can affect economic growth and asset prices.

- Rising inflation worldwide could put pressure on Australian markets. Imported inflation can increase the cost of living and reduce consumer spending, potentially impacting asset valuations.

- Geopolitical instability can create uncertainty and volatility. Global events like wars or trade disputes can introduce uncertainty into the market, leading to increased volatility in asset prices.

Expert Opinions and Market Predictions

Leading economists and financial analysts offer diverse perspectives on the future of Australian assets. Some anticipate a modest rise in property prices driven by continued population growth and low interest rates (though potentially offset by rising inflation). Others foresee a more moderate outlook for the stock market, citing global uncertainties as a potential dampener.

- Summarized predictions from experts on property market trends: A range of predictions exist, from steady growth in specific areas to potential corrections in overheated markets.

- Outlined predictions for the stock market's performance: Experts foresee mixed results, with some sectors performing better than others depending on government policies and global conditions.

- Highlighted significant disagreements or uncertainties among experts: The overall consensus points to a period of uncertainty, with predictions varying based on different assumptions and interpretations of the economic landscape.

Strategies for Investors in the Current Climate

Navigating the post-election landscape requires a cautious yet proactive approach. Investors should consider diversifying their portfolios across different asset classes to mitigate risk. Thorough due diligence is crucial before making any investment decisions.

- Consider diversifying your investments across different asset classes. Don't put all your eggs in one basket. Diversification can help reduce risk and potentially increase returns.

- Conduct thorough due diligence before making any investment decisions. Research thoroughly before committing to any investment, considering the risks involved.

- Consult with a financial advisor to develop a personalized investment strategy. A financial advisor can provide tailored advice based on your individual circumstances and risk tolerance.

Conclusion

The future of Australian assets post-election is complex, depending on the interplay of domestic policies and global economic factors. Expert opinions vary, emphasizing the importance of careful consideration and diversification. While some sectors might experience growth, others may face challenges. Understanding the potential trajectory of Australian assets is crucial for making informed investment choices. Stay informed about economic developments and consult with financial professionals to develop a strategy that aligns with your risk tolerance and investment goals. Continue researching the outlook for Australian assets to make the best decisions for your portfolio and optimize your investment in Australian assets.

Featured Posts

-

The Dollars Descent Navigating Uncertainty In Asian Currency Trading

May 06, 2025

The Dollars Descent Navigating Uncertainty In Asian Currency Trading

May 06, 2025 -

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025 -

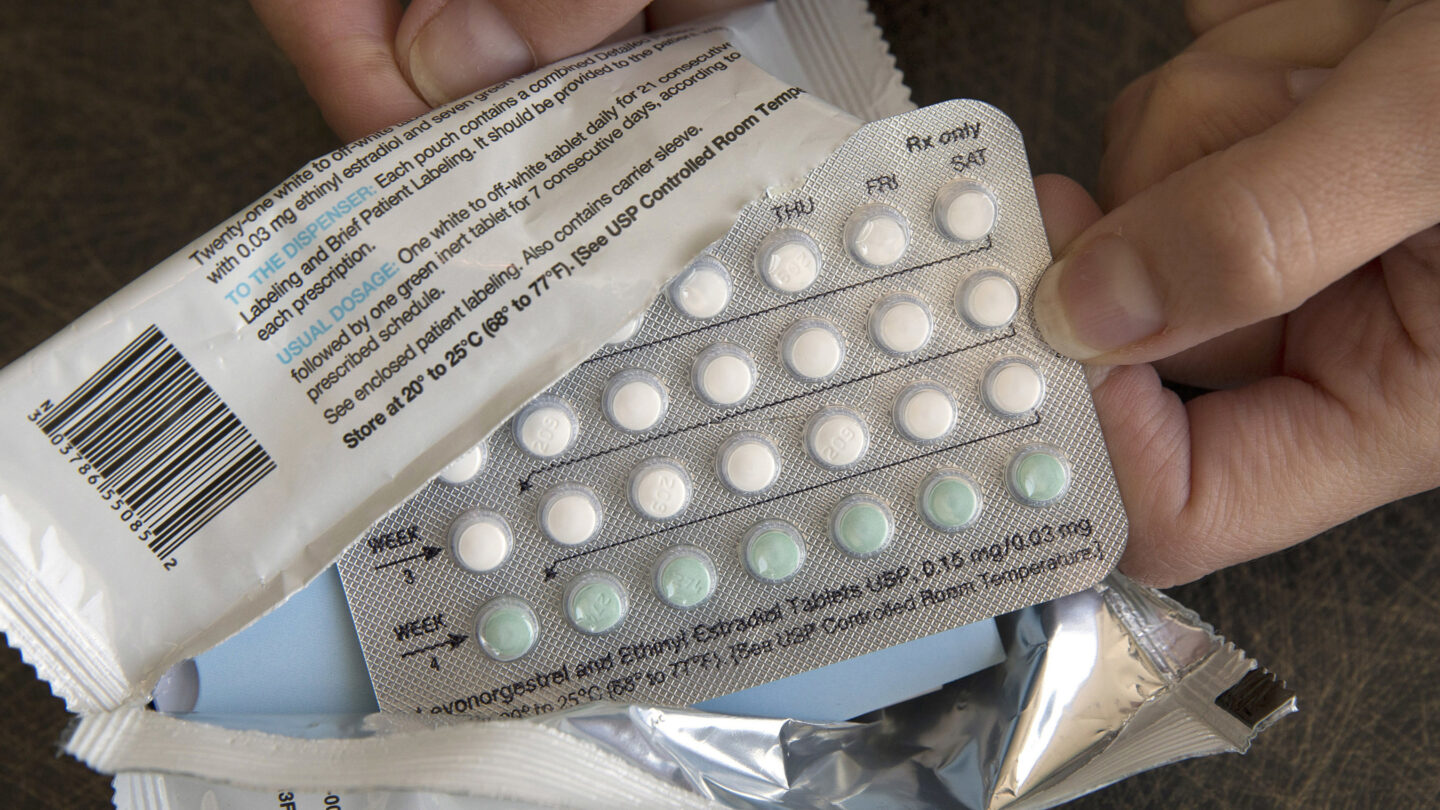

Access To Birth Control The Over The Counter Revolution After Roe

May 06, 2025

Access To Birth Control The Over The Counter Revolution After Roe

May 06, 2025 -

At And T Reveals Extreme Cost Implications Of Broadcoms V Mware Deal

May 06, 2025

At And T Reveals Extreme Cost Implications Of Broadcoms V Mware Deal

May 06, 2025 -

Massive Staffing Shortages Cause Major Newark Airport Delays

May 06, 2025

Massive Staffing Shortages Cause Major Newark Airport Delays

May 06, 2025

Latest Posts

-

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025 -

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025 -

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025