AT&T Reveals Extreme Cost Implications Of Broadcom's VMware Deal

Table of Contents

AT&T's Public Statement and Financial Concerns

AT&T has publicly voiced serious concerns regarding the substantial cost increases associated with VMware products following Broadcom's acquisition. The telecommunications giant hasn't shied away from expressing its anxieties about the impact on its budget and overall profitability. Their statements highlight a significant shift in VMware's pricing model, directly impacting AT&T's operational costs.

- Specific Cost Increases: AT&T reports significant percentage increases (exact figures remain undisclosed publicly but are rumored to be in the double digits) across various VMware products, including vSphere, vSAN, and NSX.

- Budgetary Impact: These cost increases are substantial enough to significantly impact AT&T's operational budget. The company is now facing the challenge of absorbing these unexpected expenses or finding ways to mitigate them. This could lead to adjustments in other areas of their spending or potentially affect their bottom line.

- Executive Quotes (Hypothetical, pending actual quotes from AT&T): "The price increases from Broadcom post-VMware acquisition are simply unsustainable for a company of our size. We are actively exploring alternative solutions." – Hypothetical quote from an AT&T executive.

Broadcom's Pricing Strategy and its Impact on the Telecom Sector

Broadcom's post-acquisition pricing strategy appears to be focused on maximizing profits and consolidating market share. This aggressive approach raises concerns about potential monopolistic practices, as VMware holds a dominant position in the virtualization market.

-

Monopolistic Concerns: The lack of robust competition in the virtualization space after the acquisition leaves many telecom companies, like AT&T, with limited alternatives. This could lead to reduced innovation and potentially stifle competition within the broader technology sector.

-

Impact on Other Telecom Companies: AT&T is not alone in facing these increased costs. Other major telecommunications companies, including Verizon, T-Mobile, and Comcast, are likely experiencing similar pricing pressures.

- Other Affected Telecom Companies:

- Verizon

- T-Mobile

- Comcast

- Many smaller regional providers

- Other Affected Telecom Companies:

The Future of Enterprise Software Pricing

The Broadcom-VMware deal has significant implications for the future of enterprise software pricing. The aggressive pricing strategy employed post-acquisition could set a concerning precedent for other large software vendors.

-

Increased Prices Across the Board: The deal could embolden other software giants to pursue similar price increases, potentially driving up costs for businesses across various sectors.

-

Reduced Competition and Innovation: A lack of competition often leads to reduced innovation and slower development of new features. This could leave businesses reliant on VMware with fewer options and potentially less incentive for improvement in the software itself.

-

Alternative Software Solutions: Companies are actively searching for alternatives. Open-source solutions and competitors like Citrix and Nutanix are gaining traction as businesses seek to avoid steep price increases.

- Potential Alternatives:

- OpenStack

- Kubernetes

- Citrix

- Nutanix

- Potential Alternatives:

Regulatory Scrutiny and Potential Antitrust Concerns

The acquisition has drawn significant regulatory scrutiny, raising concerns about potential antitrust violations. Several regulatory bodies are likely to investigate Broadcom's pricing practices and the overall impact on market competition.

-

Potential Antitrust Investigations: Investigations from the U.S. Department of Justice (DOJ), the Federal Trade Commission (FTC), and potentially international regulatory bodies are likely to follow.

-

Legal Challenges: Broadcom may face legal challenges from businesses and individuals who believe the price increases are unfair or anti-competitive.

- Relevant Regulatory Bodies:

- U.S. Department of Justice (DOJ)

- Federal Trade Commission (FTC)

- European Union (EU) competition authorities

- Relevant Regulatory Bodies:

Conclusion: Understanding the Long-Term Effects of Broadcom's VMware Deal on AT&T and Beyond

The Broadcom acquisition of VMware has undeniably created significant cost implications for AT&T and the broader telecommunications industry. The aggressive pricing strategy adopted by Broadcom post-acquisition raises concerns about monopolistic practices, reduced innovation, and a potential upward trend in enterprise software pricing across the board. The long-term effects remain uncertain, but regulatory scrutiny and the search for alternative solutions are likely to shape the future of this sector. Stay informed about the ongoing impact of Broadcom's VMware acquisition. Understanding the AT&T reveals extreme cost implications of Broadcom's VMware deal is crucial for navigating the evolving landscape of enterprise software pricing and planning for potential future cost increases within your own organization.

Featured Posts

-

New Ddg Song Takes Aim At Halle Bailey Dont Take My Son

May 06, 2025

New Ddg Song Takes Aim At Halle Bailey Dont Take My Son

May 06, 2025 -

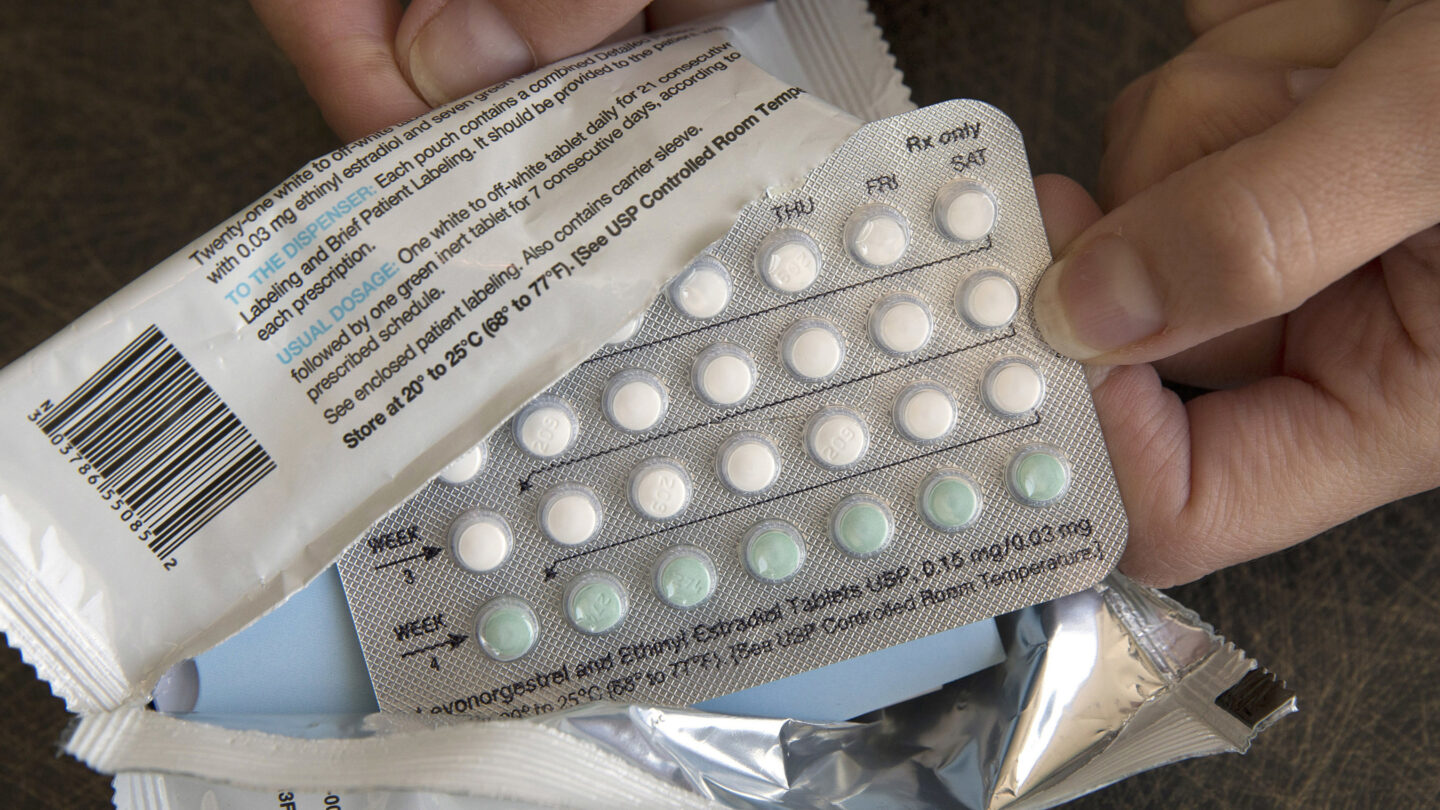

Access To Birth Control The Over The Counter Revolution After Roe

May 06, 2025

Access To Birth Control The Over The Counter Revolution After Roe

May 06, 2025 -

Federal Investigation Exposes Massive Office365 Hack Millions Lost

May 06, 2025

Federal Investigation Exposes Massive Office365 Hack Millions Lost

May 06, 2025 -

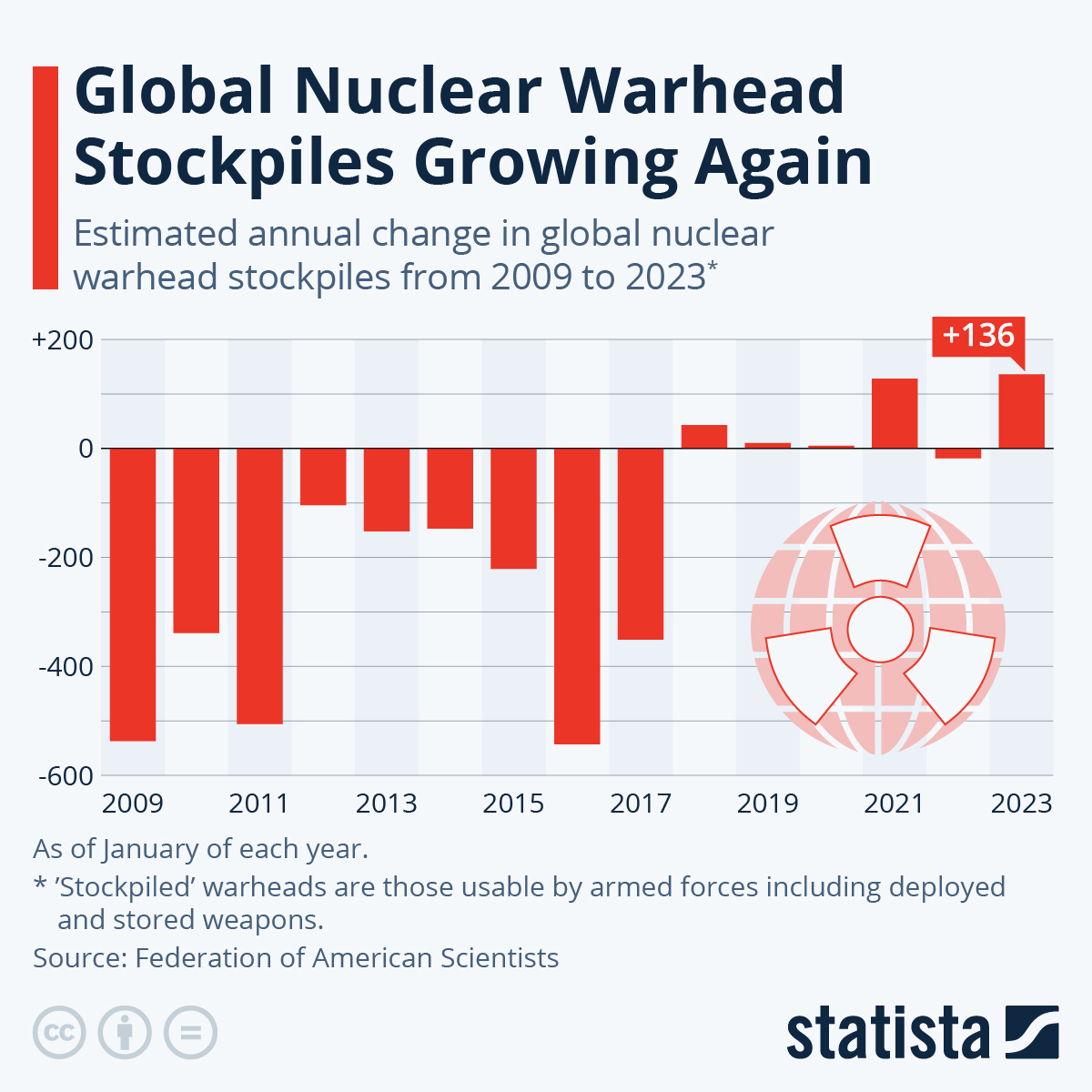

Russias Putin Avoiding Nuclear Weapons In Ukraine Conflict

May 06, 2025

Russias Putin Avoiding Nuclear Weapons In Ukraine Conflict

May 06, 2025 -

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025

Latest Posts

-

Rather Be Alone Exploring The Collaboration Between Leon Thomas And Halle Bailey

May 06, 2025

Rather Be Alone Exploring The Collaboration Between Leon Thomas And Halle Bailey

May 06, 2025 -

Leon Thomas And Halle Baileys Rather Be Alone A Deeper Look

May 06, 2025

Leon Thomas And Halle Baileys Rather Be Alone A Deeper Look

May 06, 2025 -

The Take My Son Controversy Ddgs Diss Track And Halle Bailey

May 06, 2025

The Take My Son Controversy Ddgs Diss Track And Halle Bailey

May 06, 2025 -

New Ddg Song Takes Aim At Halle Bailey Dont Take My Son

May 06, 2025

New Ddg Song Takes Aim At Halle Bailey Dont Take My Son

May 06, 2025 -

Ddg Releases Take My Son Aimed At Halle Bailey Full Song Analysis

May 06, 2025

Ddg Releases Take My Son Aimed At Halle Bailey Full Song Analysis

May 06, 2025