CoreWeave IPO: Listing Price Set At $40, Less Than Projected $51

Table of Contents

Reasons Behind the Lower-Than-Expected CoreWeave IPO Price

Several factors likely contributed to CoreWeave's IPO price being set at $40, rather than the initially projected $51.

Market Sentiment and Current Economic Conditions

The current IPO market reflects a cautious investor sentiment. Rising interest rates, persistent inflation, and a general economic slowdown have significantly impacted investor risk appetite. Many tech companies have seen their valuations decline, and several recent tech IPOs have underperformed expectations. This negative market sentiment undoubtedly played a role in the lower-than-anticipated CoreWeave IPO price.

- Negative investor sentiment towards tech stocks: The tech sector has experienced a period of correction, leading to decreased investor confidence in high-growth technology companies.

- Inflationary pressures impacting investor risk appetite: High inflation erodes purchasing power and increases the cost of borrowing, making investors more risk-averse.

- Recent underperformance of comparable tech IPOs: The poor performance of several recent tech IPOs has further dampened investor enthusiasm and contributed to a more conservative pricing strategy for CoreWeave.

CoreWeave's Financial Performance and Projections

While CoreWeave operates in a high-growth sector, its financial performance and projections likely influenced the pricing decision. A thorough analysis of CoreWeave's revenue growth, profitability, and market share is crucial to understanding the IPO pricing.

- Review of CoreWeave's revenue and profit margins: Investors scrutinize a company's financial statements to assess its profitability and growth trajectory. While CoreWeave's revenue may be growing, its profit margins might not have met initial expectations.

- Assessment of CoreWeave’s market position and competitive landscape: The cloud computing sector is highly competitive. CoreWeave's ability to compete with established giants like AWS, Azure, and Google Cloud will be a key factor influencing its long-term success and investor confidence.

- Analysis of CoreWeave’s future growth projections: Investors are heavily reliant on future growth projections to justify the IPO price. If CoreWeave's projected growth rates were deemed less optimistic, it could have led to a lower pricing.

Impact of Recent Market Volatility on IPO Pricing

The recent market volatility, characterized by fluctuating stock prices and economic uncertainty, undoubtedly influenced the CoreWeave IPO pricing. Investment banks, responsible for setting the IPO price, carefully assess market conditions and risk factors to determine a fair and attractive price.

- Impact of geopolitical events and economic uncertainty: Global events and economic uncertainty create an unpredictable market environment, influencing investor decisions and impacting IPO pricing.

- Role of underwriters in determining the offering price: Investment banks act as underwriters, balancing the company's desired price with the current market demand to ensure a successful IPO.

- Analysis of the risk factors outlined in the prospectus: The prospectus, a formal document outlining the investment risks, was carefully reviewed by underwriters and investors, influencing the final IPO price.

Implications of the $40 CoreWeave IPO Price

The $40 CoreWeave IPO price presents both opportunities and risks for potential investors.

Opportunities for Investors

The lower-than-expected IPO price could present an attractive entry point for long-term investors.

- Potential for higher returns due to undervaluation: If CoreWeave meets or exceeds future projections, the lower entry price could translate to significantly higher returns compared to the initially projected $51.

- Long-term growth opportunities in the cloud computing market: The cloud computing market remains a significant growth sector, offering long-term opportunities for companies like CoreWeave.

- Comparison to other undervalued tech stocks: Investors may compare CoreWeave's valuation to other undervalued tech stocks to assess its relative attractiveness.

Risks Associated with the CoreWeave IPO

Investing in a newly public company always involves risk.

- Risks associated with the cloud computing market: Competition in the cloud computing sector is fierce, with established players posing a significant challenge to new entrants.

- Competition from established players in the industry: CoreWeave will face intense competition from industry giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- Potential for lower-than-expected future performance: There's always a risk that CoreWeave's actual performance may fall short of its projected growth, potentially impacting stock value.

Conclusion

The CoreWeave IPO’s $40 listing price, considerably lower than the projected $51, reflects the current challenges in the tech market and investor sentiment. While this lower price offers potential opportunities for investors seeking long-term growth in the cloud computing sector, it's crucial to acknowledge the inherent risks. Thorough research and consultation with a financial advisor are essential before investing in the CoreWeave IPO or any other technology IPO. Remember to carefully consider your risk tolerance before investing in CoreWeave stock. Understanding the complexities of the CoreWeave IPO and the broader cloud computing market is paramount before making any investment decisions.

Featured Posts

-

Wordle 367 Solution Hints And Clues For March 17th

May 22, 2025

Wordle 367 Solution Hints And Clues For March 17th

May 22, 2025 -

Jim Cramers Lone Wolf Prediction Core Weave Crwv As The Ai Infrastructure Star

May 22, 2025

Jim Cramers Lone Wolf Prediction Core Weave Crwv As The Ai Infrastructure Star

May 22, 2025 -

Confronting The Love Monster Practical Strategies For Healthy Relationships

May 22, 2025

Confronting The Love Monster Practical Strategies For Healthy Relationships

May 22, 2025 -

Financial Constraints Effective Solutions For Budgetary Limitations

May 22, 2025

Financial Constraints Effective Solutions For Budgetary Limitations

May 22, 2025 -

Core Weave Inc Crwv Stock Drop On Thursday Reasons And Analysis

May 22, 2025

Core Weave Inc Crwv Stock Drop On Thursday Reasons And Analysis

May 22, 2025

Latest Posts

-

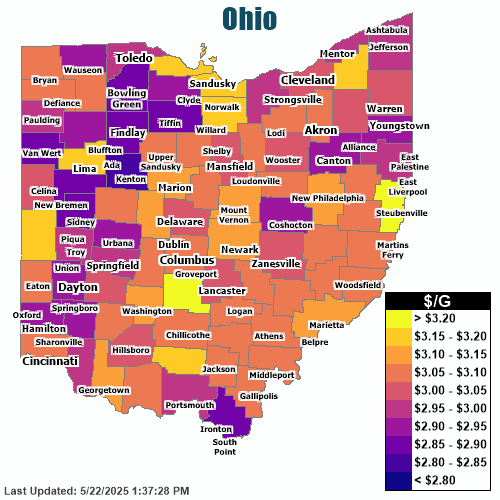

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025